-

Posts

3,447 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Perishabull

-

-

[This move]...is very similar to the move that also happened across a weekend, back on 23 - 26th September 2011. On friday 23rd September 2011 Gold opened at 1739, sold off heavily, then sold off even more heavily on monday 26th September, trading as low as 1535 before rebounding sharply higher. That was a two day drop of $204 whereas across the 2 days this time it's been as much as $175.

Well it's now $205 down from the open on friday to the lowest point so far today.

Monster volume so far 512,000 GCM3 (June) contracts traded. This is the highest volume of trade in one day in the history of the gold futures market and we are only part of the way through the day.....

I think when all is said and done we may hear news about the wipe out of a hedge fund or two.

-

Gold futures;

Looking at this my first though was, "Paulson's dead"

So far this move - the drop on friday and the drop today...

...is very similar to the move that also happened across a weekend, back on 23 - 26th September 2011. On friday 23rd September 2011 Gold opened at 1739, sold off heavily, then sold off even more heavily on monday 26th September, trading as low as 1535 before rebounding sharply higher. That was a two day drop of $204 whereas across the 2 days this time it's been as much as $175.

Very strong volume coming in now for gold;

Intraday showing what looks like a V bottom;

-

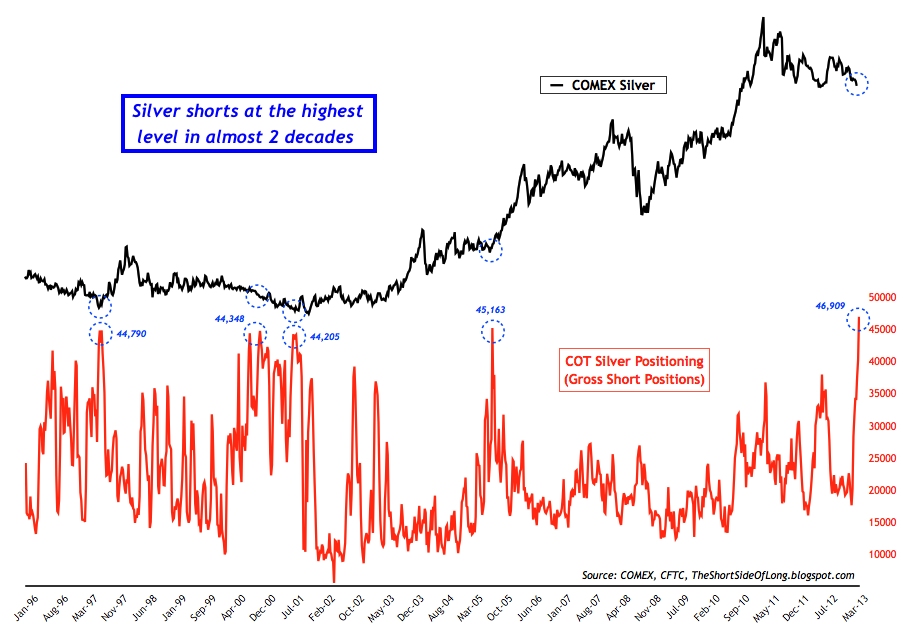

How low will silver have to go, to shake it self free of the Weak Hands ?

At what price will it really start to hurt the majority of weak hands?

Regards

ML

$23

I didn't expect to see this

-

Well I've reopened my story with silver having just made some small purchases;

Thank the lord I only nibbled.

Silver down 10% to $23.70

-

Looks like I was wrong about the $1430 level being significant.

-

So based on this I would be looking for gold to move down to $1430 and then be met with solid support.

Gold Futures (June)

Gold sold off further early this morning, with a very brief dip down to $1422 for a 5 min period. I've highlighted the $1432 level. So far volume by 9am today has been equal to an average days trade in the gold futures market. I would really have wanted to see much higher volume on that second move down to $1432....

The lowest trendline represents 3 standard deviations from the mean and is currently at $1432, so if gold were at that level today it would be 3 standard deviations from the average price over the last 5 years.

Referencing the above gold spiked through the lower 3 standard deviations line during it's move down to $1422. Measured this way we have seen an extreme in price.

-

aren't people also protected from a Cyprus event if their money is in the S&P?

The S&P seems to be where TPTB want you to have your money, isn't buying/holding gold now just pissing into the wind?

I see Cyprus as a signal of a general trend where property rights and the rule of law are gradually being eroded. Cyprus is good example but if things get really bad capital controls could come into play in other countries. That would have been unthinkable many years ago, so who knows, down the line governments could raid other types of private property/assets, pension holdings, brokerage accounts. Some of those types of assets where there are plenty of records showing who holds what etc.

Do you think buying gold is pissing into the wind? Do you think it's finished now?

-

what motivation is there to buy gold if people perceive their capital will be protected and they can get yield in stocks?

Cyprus

-

-

-

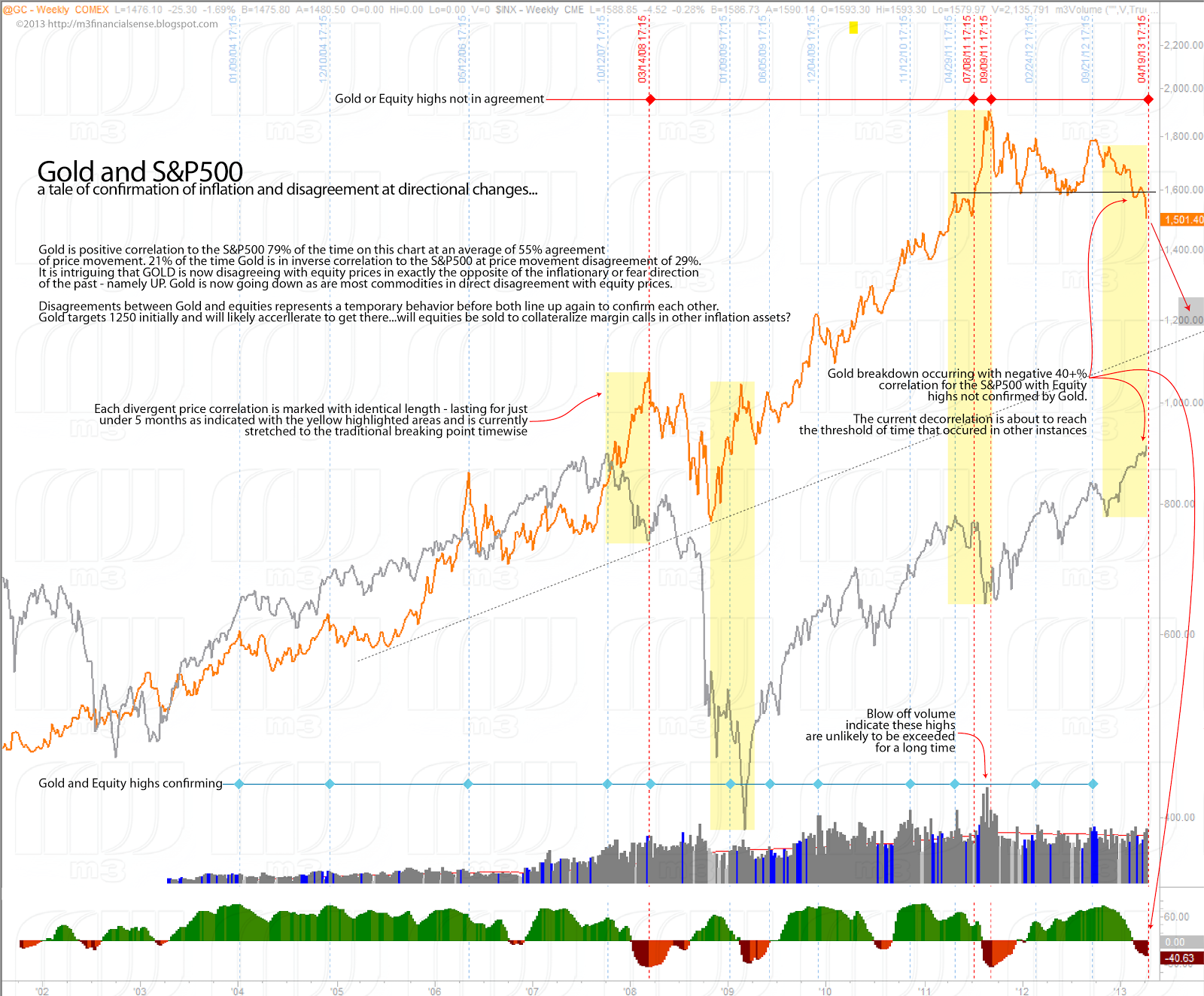

Different perspectives on gold;

Volume profile and Linear Regression

3 year continuous futures with volume profile;

The light blue shown on this chart is volume profile. That is showing the volume of trade at each price level (as opposed to volume of trade per day shown at the bottom). The horizontal line emerging from the light blue and running the whole way accross the chart shows the price level over the last 3 years where most volume transacted - $1661.60.

The volume profile shows the amount of trade at each price level over the last 3 years. So at $1450 you can see the volume of trade was very low indeed (just below the blue line beneath 'LESS TRADE', and as you look at higher prices, the volume has steadily increased at each price level.

Gold has recently sold off very sharply from around $1550 to $1476.10 where it sits now. So as the price moved lower and lower from $1550 to $1476.10, the price moved deeper into price levels where trade volume was less and less. That may partly explain why the move lower was so sharp, certainly if there was some manipluation it's clear from this chart that the price would be particularly vulnerable at the $1550 level.

So I would certainly expect to see gold move down and through $1450 (trade volume historically low at that level)

You can see below the 'SOLID TRADE BELOW HERE' line there is a sizeable and consistent block of volume. in other words there was a lot of gold traded between $1430 and $1350.

So based on this I would be looking for gold to move down to $1430 and then be met with solid support.

This next chart is 5 year and shows the 'air pocket' in terms of lack of volume more clearly.

At the left axis of the chart just above the blue line there is very little volume. This very low volume region is $1450 to $1500.

This 5 year chart shows gold (in log) with Linear Regression lines

These help to provide longer term context (see explanation below). The lowest trendline represents 3 standard deviations from the mean and is currently at $1432, so if gold were at that level today it would be 3 standard deviations from the average price over the last 5 years. Over any period price can only exceed 3 standard deviations for 0.3% of the period covered. You can see that when gold topped in 2011 it spent very little time above the upper 3 standard deviation line.

Interestingly looking at it from this perspective confirms the analysis of the volume profile aspect (that price could go to $1430 but then be met with very strong buying).

Of course by its very nature Linear Regression is constantly moving, albeit it's slower over longer periods like this, but what this does show is that we are nearing an extreme.

The channel lines are Linear Regression channel trendlines. These section off price action to show extremes in price action. When the price is at the far upper or lower line it can be said to be 3 standard deviations from the mean price covering the period concerned. What I've also set it to show is the 95.4% line, 2 standard deviations from the mean price. So if price is at the upper or lower 95.4% line you can say it's at a price extreme that has only been seen 4.6% of the time during the period covered, two standard deviations from the mean price.

I also show the 68.3% lines, that's those lines closer to the median line of the channel. The reason for this is because I want to section of the trend channel in the same way as a bell curve distribution, so that I can easily see areas where the price is 1, 2 or 3 standard deviations from the mean price.

-

An old interview of mine reported by a blogger recently:

http://www.tonytoppi...rek-technology/

I wanted to say it earlier, but I didn't find the occasion …

BTW, this new published book seems interesting:

https://www.springer...8-1-4614-5622-3

This was brought up in a circle of interested guys to similar topics and someone commented that is not so useful in his opinion, but I'd like to take a look at it later.

That interview link doesn't work but I found another - http://www.starpod.us/2006/09/30/starstream-research-interviews-iranian-physicist-mohammad-mansouryar/#.UWnAGz7E2Ac

-

Hi Mansouryar, what do you make of this? (A story on RT)

http://rt.com/news/i...prediction-692/

"Iranian ‘time machine’ can ‘predict’ oil prices and wars

An Iranian inventor claims to have created a ‘time machine’ that can predict a person’s future. He boasts that the device is relatively cheap, but says he has not built one yet because he fears that the Chinese will steal his idea.

Ali Razeghi, 27, has submitted his invention to the state-run Centre for Strategic Inventions for registration.

The device is called “The Aryayek Time Traveling Machine,” FARS news agency reported. Razeghi said he worked on his creation for the last 10 years, resulting in a desktop-computer-sized machine that can "predict five to eight years of the future life of any individual, with 98 percent accuracy."

The man, who has 179 other inventions under his belt, eyes governmental applications for his prediction device with uses both civilian and military.

"Naturally a government that can see five years into the future would be able to prepare itself for challenges that might destabilize it," he explained. "As such we expect to market this invention among states as well as individuals once we reach a mass-production stage."

Razeghi also claimed to have beaten competitors working on similar devices: “The Americans are trying to make this invention by spending millions of dollars on it where I have already achieved it by a fraction of the cost."

He added that he is concerned about industrial espionage, as other nations will be eager to learn his secrets. "The reason that we are not launching our prototype at this stage is that the Chinese will steal the idea and produce it in millions overnight," he said.

The news has intruguied the English-language media. However, as the story went viral, the Fars news story became unavaliable as the link now shows an error page.

Predicting the future, even on relatively narrow issues, is a notoriously complex task. It usually requires creating an accurate computer model of a system that takes into account numerous factors, and often requires plenty of computational power. Predicting a future event in its entirety is virtually impossible with existing technology."

-

Panic Selling Hits Gold

Trader Dan's Market Views

Friday, April 12, 2013

"It is too early to call this as a final washout day but it has the makings of one. Thus far volume is running about 3-4 times its normal size! It might be in the range of over 300K by the time this session is over.The emotions are off the chart as FEAR and PANIC are on full display..."

Yes the volume aspect was very suspect. The last time volume in gold was at this level was 26th September 2011, when price crashed down to $1535, before recovering to $1630 that day.

-

Now this is beginning to make sense:

(Mario Draghi, ex-Goldman: http://en.wikipedia....ki/Mario_Draghi )

Draghi was then vice chairman and managing director of Goldman Sachs International and a member of the firm-wide management committee (2002–2005).[6]

and pieced together with this:

http://www.zerohedge...ilout-shortfall

Mario Draghi Orders Cyprus To Sell Gold To Cover Bailout "Shortfall"

...13.9 tons, of its central bank gold. Today, we learn that this demand came from none other than the head of the ECB Mario Draghi. Bloomberg reports: "European Central Bank President Mario Draghi said the profits of any gold sales by the Cypriot central bank must be used to cover losses it may sustain from emergency loans to Cypriot commercial banks."

That's just ridiculous isn't it.

-

-

Better shorting Goldman and going long gold.

-

Sentiment very low indeed.

-

-

Perhaps if we see a charge into gold it will start with the Japanese, the BoJ seems intent on destroying the Yen.

-

My god, how I laughed when I read this - not at the misfortune of the people involved but just the sheer black comedy of the situation which has been completely missed by the Daily Mail.

"The Alzheimer's gran 'betrayed by her bank': Widow, 80, faces losing home after being handed a £470,000 mortgage she couldn’t repay

Irene Rose Hearn, then 74, was granted a £470,000 interest-only mortgage

She was only able to afford it with the help of her son Rodger

Her Alzheimer's set in just three years after she got the mortgage

Santander has now applied to repossess the home of the widow

A bank has applied to repossess the home of an 80-year-old Alzheimer’s sufferer after giving her a mortgage she could not hope to repay.

Just seven months before the credit crunch struck, Irene Rose Hearn, then 74, was allowed to take out a £470,000 interest-only five-year mortgage by the Abbey National.

Experts say it would be ‘virtually impossible’ for Mrs Hearn to take out such a loan in today’s more prudent lending climate.

Mrs Hearn, a widow with 13 grandchildren, had been hoping to repay the loan by selling the house because, at the time, property prices were rising and the economy was booming.

But the financial crisis means she is unable to pay it back by selling up as the £675,000 house has plunged £200,000 in value. She is now facing a court battle to keep the family home.

In 2006, three years before her family say her Alzheimer’s set in, Mrs Hearn, a retired property developer, agreed to pay a monthly mortgage bill of £493 even though she could afford it only with help from her son Rodger, 58.

But when this deal ended, she was put on a new repayment loan arrangement by Santander, which took over Abbey, and was told she had to pay £4,219 a month.

Unable to make the repayments on her £594-a-month pension, she fell into debt and was taken to court by the bank, which won a repossession order on the house, which her son arranged to have built for her.

The family are challenging the court decision, but may lose the detached four-bedroom house in the exclusive area of Lilliput in Poole, Dorset, near the millionaires’ playground of Sandbanks.

Her son, also a property developer, said: ‘This is appalling behaviour by a bank. Santander messed up by giving her the wrong mortgage and are now saying they want their money back.

Irene was granted the mortgage by the Abbey National just three years before her Alzheimer's set in

‘So they forced a mortgage on her that she simply could not afford so that they could repossess the house and get some of their money back.

How could any bank force a ten-year repayment mortgage on an 80-year-old? It’s madness to think she could afford to pay £4,000-a-month. She’s retired.’

The heartbreaking case comes just before a damning investigation by the Financial Services Authority (FSA) is expected to reveal the full scale of the interest-only mortgage scandal, which some experts fear could be the next mis-selling debacle.

Around 40 per cent of homeowners who have a mortgage have an interest-only loan, which means they only pay the interest every month, but not a penny of the actual loan.

In recent months, some of Britain’s biggest mortgage lenders, such as the Nationwide, Co-Op, HSBC, RBS, have all stopped selling these controversial types of mortgage.

Santander now insists on a 50per cent deposit to secure an interest-only loan" etc etc

http://www.dailymail...dn-t-repay.html

This sounds like a flip gone wrong.

-

Well I've reopened my story with silver having just made some small purchases;

I've been out of the silver market since 22nd September 2011, I had previously sold half right at the top and bought puts, closed the puts within a few days at $35 and held onto the other half of my silver holdings. Then from 21st to 22nd September 2011 silver went from $40 to $36 - 10% down in one day, I immediately realised that that was it for silver for some time and sold the other half.

I originally bought in September 2008 at about $11 then a further purchase in August 2010 at $18 (I think it was) so clearly that worked out rather well. It's nearly 2 years since that top at the end of April 2011, I think silver has had enough time to consolidate, gold too. More to the point I'm bullish on gold and the miners have been absolutely crushed again reflecting the abysmal sentiment in the precious metals sector. Sentiment on the dollar is too bullish right now.

-

Stock/Bond ratio;

www.sentimentrader.com

-

Gold sentiment;

www.sentimentrader.com

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Possibly the Cyprus gold being dumped on the market.

http://blogs.telegra...-gold-reserves/AEP's Telegraph article;

Excerpt;

"EMU plot curdles as creditors seize Cyprus gold reserves

First they purloin the savings and bank deposits in Laiki and the Bank of Cyprus, including the working funds of the University of Cyprus, and thousands of small firms hanging on by their fingertips.

Then they seize three quarters of the country’s gold reserves, making it ever harder for Cyprus to extricate itself from EMU at a later date.

The people of Cyprus first learned about this from a Reuters leak of the working documents for the Eurogroup meeting on Friday.

It is tucked away in clause 29. "Sale of excess gold reserves: The Cypriot authorities have committed to sell the excess amount of gold reserves owned by the Republic. This is estimated to generate one-off revenues to the state of €400m via an extraordinary payout of central bank profits."

This seemed to catch the central bank by surprise. Officials said they knew nothing about it. So who in fact made this decision?

Cypriots are learning what it means to be a member of monetary union when things go badly wrong. The crisis costs have suddenly jumped from €17bn to €23bn, and the burden of finding an extra €6bn will fall on Cyprus alone.

The government expects the economy to contract 13pc this year as full austerity bites. Megan Greene from Maverick Intelligence fears it could be a lot worse.

She says the crisis has reached the point where it would be “less painful” for Cyprus to seek an “amicable divorce” from the eurozone and break free.

Quite so, and while we’re at it, lets seek an amicable divorce for everybody, for Portugal, for Ireland, for Spain, for Italy, and above all for Germany, since they are all being damaged in different ways by the infernal Project. All are victims of their elites."

The last sentence is chilling.

Remember Gordon Brown's atrocious telegraphing to the market of the impending sale of UK's gold? Perhaps this is either a mass exodus before Cyprus gold is sold (I hope not) or it has perhaps just been unceremoniously dumped on the market like an unwanted rag. If that's what's happened it's a very unsophisticated way to sell into the market. It that's what they've done then they clearly are very desperate, and that it's quite concerning because perhaps there is something very serious going on behind the scenes right now.