-

Posts

3,768 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by ziknik

-

-

I love the way RightMove is seen as a flawed survey on the way UP and gospel on the way DOWN.

Rightmove UP 3% today, London UP 5%.

-

I think sooner or later people will be thinking in terms of real (not nominal) falls.

I don't agree. Most people didn't work it out in the 70's. Why is it different this time?

In real terms with cpi at 5% and rpi at 3%, a nominal 0% is x?

...

'Real' can be calculated in many ways. C/RPI or gold or M4 or other money/credit supply measure.

I'll need the gold prices to work out the real value of 'x'

-

...

I guess you'd get a similar reaction if you told someone you think house prices could fall by 80% in the next couple of years. Maybe house prices wont fall by so much. But they could.

Yes, you would certainly get a dis-believing-type-reaction from me if you claimed houses would fall 80% in the next couple of years. BUT, I don't completely rule it out. It's not impossible I suppose. However, I think it is less likely than a 30% fall over the next 2/3 years

-

Some thought it was flawed by being "too optimistic".

...

Yes I agree. A negative RM index shows more than a positive one.

Just as an exercise, I compared RM's index (blue) with: 50%-Nationwide, 25%-Halifax & 25%-RM-Greater London

The composite was a rather good fix suggesting that RM simply has a heavier weighting towards London

Here's another comparison, which includes the H&N-Index (here, x 132% to make it comparable with Rightmove)

Are the Haliwide indexes time shifted on them charts?

-

UK mortgage lending slides to 10-year low

UK mortgage lending fell to a 10-year low of £11.4bn in August, further reinforcing fears that the recovery in the housing market is fading.

http://www.telegraph.co.uk/finance/economi...0-year-low.html

…

I believe* the CML data includes re-mortgaging and therefore it should come as no surprise that people don’t want to re-mortgage on less favourable terms.

The headline should read “People not dumb enough to pay more for the same thing”.

* I can’t check to be 100% certain atm.

-

Rightmove is the "delusion" index. It has it's uses. Now we have Rightmove index sinking fast and the RICS survey turning negative in the last few months. These are generally regarded as the leading indexes, while the lagging Halifax/Nationwide are levelling off quickly and will soon be flat YoY. The ship is definitely turning now.

RightMove is the ‘delusion’ index that ignores all the properties which have been on the market for more than 30 days.

If you were designing an index of asking prices, would you ignore most of the asking prices?

I accept it is an indicator of sentiment but nothing more than that. The Daily Mail is a better indicator of sentiment.

In my experience of buying a house last year, a lot of properties did not have a HIP. Now that the HIP law has been pulled, most of these properties are being re-listed as ‘new’. Considering all the price cuts over the past year, this will pull the RightMove index down without any change to the asking prices of ALL the properties on RightMove.

I accept your point about the RICS survey. This one is actually a reasonable piece of evidence.

BTW, Have you seen my RightMove survey? http://www.greenenergyinvestors.com/index....st&p=183870

-

...

So I held these things for a year or two, waiting for the market to rebound. They never did. Eventually I cut my losses and sold them for about 3.50 per share. Their price now? Seventy five pence. That's a fall of about 90% from their peak, not counting inflation. And when house prices begin crashing properly I can see lloy becoming just about worthless

...

Did you get any dividends payments in the 1/2 year(s) you held?

http://www.greenenergyinvestors.com/index.php?showtopic=6192

-

I love the way RightMove is seen as a flawed survey on the way UP and gospel on the way DOWN.

-

Are Kirsty, Phil & the Location team registered with the FSA to give investment advice?

They are clearly dishing out investment advice week after week but I can't find them on the FSA register.

Anyone know if they are breaking the law?

-

...

So, instead of waiting months and months for a 20% drop, why not try and get an immediate 12 - 15% drop ?

Given that they are selling one for a similar price, it makes sense to put in an offer just below stamp duty and allow theirs to sell at the same price.

Waiting for a 20% drop will mean theirs will drop 20% too so they’ve not got anything to gain by waiting.

Get it over and done with.

-

OFF TOPIC:

Does anyone know why/where Wren has gone?

24K news?No, Wren hasn't been on 24K for nearly 2 months

-

OFF TOPIC:

Does anyone know why/where Wren has gone?

-

I think mortgage rates will continue to go up at a slow pace. Like you say, there isn't a correlation any more. When the CB rate goes up it may be too late for 'homeowners' to obtain a decent mortage, if at all. The governments 'special liquidity scheme' ends in January I think. Don't know much about it but it may affect banks funding abilities. Anyone know more about this?

If things stay as they are now, the SLS can probably be closed as a lot of the dodgy assets have increased in price over the last 10 months.

-

Isn't it largely irrelevant what the CB rate is anyway? Mortgage and savings rates broadly decoupled a long time ago. If the Bond markets demand it, rates will rise irrespective of what the CBs do.

The question for me is: how much of a real rate rise is needed before mortgage rates would be pushed up?

You'd need total panic in the bond market to cause the price of SVR mortgages to go up.

Bond prices are normally linked to fixed rate mortgages, rising bond prices lead to rising fixed rate mortgages (for new customers) fairly quickly and directly.

-

...

I think it works this way? Basically the point I'm making is that a rise from a low level should theoretically have more of a disproportionate impact than the same rise from a higher foundation.

Yes that's right. It tells us that the first base rate rise will be 0.1% or 0.05%.

Anyone expecting a 0.25% rise (50% increase) is living in dream land.

-

...

If he gets in excess of £420k then I have made a big mistake selling in summer 2007.

The reality is that the funds from my sale haven't made that much either for me to be able to stand up to my wife and say it has been worth living out of boxes for a few years!!

You made your decision to sell using the best information available at the time and you were probably right to do so.

You couldn’t have known the scale of fiscal stimulus and the slashing of interest rates. Even the people who predicted interest rate falls have been surprised at the way they’ve been kept down while inflation is (and forecast to be) over the BofEs target.

If I was you, I would forget about the old house. You cannot change the present situation and you probably cannot learn anything from it either.

Instead, I would have a good review of my investment choices, pick out successes & failures and examine the reasons for success & failure. Judge whether success or failure will be realised on your existing investments. There’s a lot more to be gained from this exercise and it will help you going forwards.

I’m someone will come along in a bit and mention the horrific crash that’s coming round the corner. The truth is it might not come for some time yet so you have to work hard and make your investments outperform housing whether HPI is positive or negative.

-

That's great to know. Thanks.

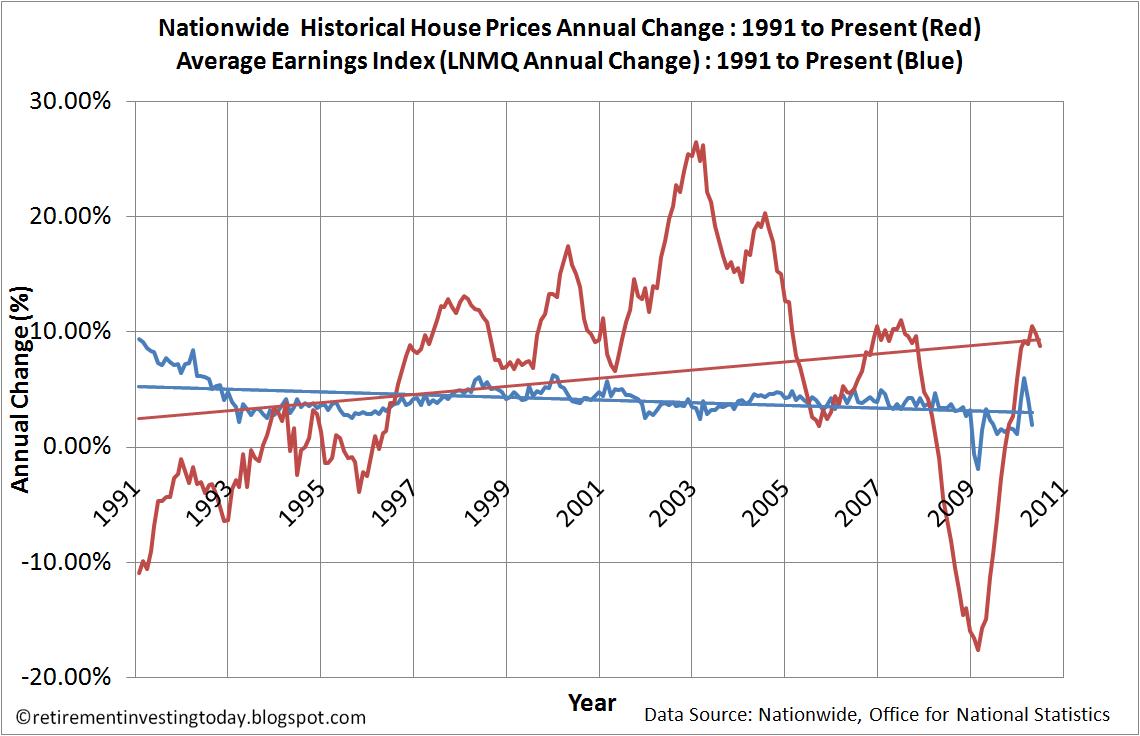

Yes I'm watching the rate of growth slowing with interest. LNMM for April '10 up only 0.5% with RPI at that time sitting at 5.3%. Everyone please take a pay cut in real inflation adjusted terms...

While checking I noticed AEI is going to be scrapped. You might want to pick out a new measure and start updating your charts.

The Average Earnings Index (AEI) is an indicator of how fast earnings are growing in Great Britain. It is no longer the lead measure of short term changes in earnings, having been replaced by the Average Weekly Earnings Statistic in January 2010.The Average Earnings Index will be discontinued after September 2010.EDIT Link

-

Hi ziknik

LNMQ is the seasonally adjusted Average Earnings Index (AEI) measure. The non seasonally adjusted index is LNMM. I used to always use this index however it has some wild rides. Looking at the months since January '10 it went -0.44%, 4.95%, 7.80% and then 0.51%.

I am pretty sure it includes bonuses and I personally am assuming this when conducting my analysis. It is based on information obtained form the ONS Monthly Wages and Salary Survey (MWSS). If you look up details of this survey it collects total gross pay from individual firms, as well as total bonus payments and any pay award arrears. The reason I'm not 100% sure is this statement on the ONS website "The AEI is based on information obtained from ONS’ Monthly Wages and Salary Survey.". It's the word based that is a little ambiguous IMO but maybe I'm just paranoid.

Here's the 2 links that are relavent so you can get it straight from the horses mouth.

http://www.statistics.gov.uk/about/data/gu...siness/mwss.asp

I've double checked. It does include bonuses.

AEI: Whole economy SA inc bonus: Index 2000=100: GBSeasonally adjusted2000 = 100Industry: 01-93Updated on 18/ 6/2010I am surprised to see the rate of growth reducing, -

Does LMNQ exclude bonuses?

-

(This is actually a very bearish story if you pick through it)

U.K. house prices edge higher in May: RICS

...

The RICS survey found a net balance of 22% of surveyors reported a rise rather than a fall in house prices in May, up from 17% in April.

...

http://www.marketwatch.com/story/uk-house-...nk=MW_news_stmp

-

House price inflation back to 10%, government says

Annual house price inflation is back in double-digits, according to government figures.

The Department for Communities and Local Government (DCLG) said prices in April were 10.1% higher than a year ago.

...

-

-

Errr... Please do excuse me. I am still learning. Seemed like a big deal since Gordon Brown's removal of mortgage interest costs in 2003 is often cited as a stoking of HPI, as it caused base interest rates* to remain artifically low, according to the "other" site.

*appreciate these are not the same as the "real" rates you cite above. Still learning.

Gordon didn’t remove mortgage interest from the inflation target… they were never included in the first place. Historically, the BofE/Treasury used RPIx (that’s RPI excluding mortgages)

Including mortgage interest in price inflation target causes a positive feedback loop.

Interest rates increase => mortgage prices increase => increase in RPI => interest rate increase.

The same is true the other way round

Interest rates decrease => mortgage prices decrease => decrease in RPI => interest rate decrease.

Gordon replaced the RPIx target with CPI…. And TBH, I don’t know if this is as big an issue as people make out.

As for holding down rates – globalisation held down rates more than Gordon could have. It was the cheap goods from China (etc) that held down our C/RPI

EDIT: there’s a lot more to this that I haven’t really touched upon for simplicity. I’m sure someone will fill in some of the missing bits later.

-

I know the question wasn't directed to me but I hope you don't mind if i put in my tuppence worth.

Everyones' input is most welcome

I think we are going to see the standard of living drop for an extended period although admittedly perhaps not for 25 years. This drop in standard of living will involve higher prices for essentials relative to your income. We are already seeing paycuts and pay freezes while I saw someone post (Wanderer?) inflation is at 4.4%. During this period there will an enormous squeeze on peoples finances with much less money available to service debt. This puts massive downward pressure on house prices at least for the next couple of years especially when priced in gold.Once wages start to rise again in real terms (inflation adjusted) that will be the time to at least consider buying.

So yes over a 25 year span it may get inflated away but it will be far from painless particularly during the initial phases where wages are going down and inflation up.

I agree with what you have written. Things will be tough for many people..... however, this could lead to interest rates being held low and anyone with a disposable incomes may sail through the though years.

In any case, you have to live somewhere and I hope everyone is sufficiently insulated from the potential of rent increases

EDIT: It's also worth remembering that prices are actually increasing at present.

UK House prices: News & Views

in NEWS Commentary, 2021 & Beyond

Posted

Yes, I agree. I say the Right Move survey is not meaningful every time I comment on it.

I do accept it as a useful indicator of sentiment (more so on the way down), but nothing more than that.

I’m aware that September/October is a usually an UP month, but we are also seeing YoY gains from 2009 to 2010. This YoY has grown in October when compare to September.

As you know, YoY takes out all the normal seasonality so it’s not enough to use seasonals as an excuse to knock down the indicated sentiment.

From your table:

Sep 2009 £223,996

Sep 2010 £ 229,767

=2.6% YoY

Oct 2009 £ 230,184

Oct 2010 £236,849

=2.9% YoY