-

Posts

1,725 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by FWIW

-

-

MUST Read here:

http://www.marketoracle.co.uk/Article15013.html

Quote:

Anyone who has studied prior secular bull markets knows that a 4 fold gain over ten years is not a bubble and is not anywhere a secular top, but "bubble" calls are everywhere in the mainstream financial community regarding Gold. First, they don't see it coming and say it can never happen and then they call "bubble" the second it does! I love it because Gold is still climbing a wall of worry. Yes, the short-term speculative froth is a little high, but long term (I am not a day trader), Gold has a long way to go regardless of what paperbugs think.

-

Hi Guys and Gals

At the risk of irritating some of you, I'd like to say that my take on all the recent action (global politics, economics, gold news, UK/sterling news, chart patterns...) leads me to a fairly strong suspicion that now would be a good time to lighten up on GBP gold holdings (not sell it all, just ease off a little) - IF you want to play that game at the edges whilst keeping a substantial core holding.

Replies with more that 5 swear words will be ignored :-)

It's always good to ease off a little now and again, if only to prove to yourself that you can sell gold and are not a

goldbugperma gold bull!However, if you think the GBP will escape some pain then I think you are wrong.

-

He's changed his tune - have you read Hot Commodities?

In that book he was luke warm on Gold saying the complete opposite of what that article says re mining exploration (i.e. everybody is at it)

That book is a few years old mind

I have the book right here in my hands - published in 2004:

He states on page 164:

Gold has been a favourite inflation hedge for some, and with the dollar likely to continue weakening over the next few years, I can see gold continuing to climb, which is why I own some. But you may do a whole lot better buying other commodities that will be making much more impressive moves. You should also be aware that the continual fascination with gold flies in the face of the realities of supply and demand.

On page 166:

The gold standard for gold prices among the goldbugs and other gold hopefuls was that 1980 historic high of $850. It is not a price we're likely to see soon - outside an economic collapse so awful that we will all be fighting one another to buy gold.

I don't see anything contradictory in what he said. When the facts change, then people also need to change! Sir Pixel8r posted a story regarding 400 oz Tungsten bars earlier on - maybe a story like that has changed Jim's mind.

Read the tungsten story here: http://news.goldseek.com/GoldSeek/1258049769.php note the year 2004 makes another appearance.

-

http://jsmineset.com/2009/11/11/the-battle-at-the-bridge/

The Battle At The Bridge

Posted: Nov 11 2009 By: Jim Sinclair Post Edited: November 11, 2009 at 2:21 pm

Filed under: General Editorial

Dear CIGAs,

The currency intervention, both real and oral, is a waste of time as the euro will trade well above the $1.50 level. This is not because it is worth it but it is another inverse to the US dollar which is headed considerably lower.

The mistake that governments always makes in its assumed omnipotence is that intervention, certainly at a key number like $1.50, is that when the market realizes it is over moving momentum goes ballistic on the upside. That renders all the talk, skewed figures and wasted intervention money as not only useless but contra-productive.

In a floating system governments should know they cannot not enforce currency parity rates.

Parity rates are fixed currency highs and lows from the Bretton Woods days.

All talking heads on this subject were gleams in the eyes of their parents back then, not even in diapers, but do claim expertise.

-

Well congratulation for repeating it

If jake wants to be ignorant and think i am stupid then so be it

I can always edit it out - just think twice before you post.

thanks!

-

I assume you have heard of platinum ********.

**** you

There is no need for that language here.

If you have to resort to that type of language to defend yourself, then you have already 'lost'.

-

Gold at $1115 keeps setting new records. Get ready for the pound slide next IMO.

From:

Fiat game gonna be flipped upside down.

-

I like that guy, Damon Vickers.

I think you will enjoy this one, fitkid.

From:

I must say that rubber duck video was excellent!

-

Pierre Lassonde on Bloomberg right now!

Basically he said gold is in a bull market and has 4-9 years left to run, he also said that gold production is flat and will be for at least 4 years or so.

Not a great interview as was very rushed. Bloomberg seemed to want to get onto the next segment which was all about Call of Duty 4...

I'm sure it's a great game, but FFS!

-

The production cost of gold has actually gone down a fair bit over the last year. A large part of the production cost is oil and as this has fallen from $148 to $35 they are saving a lot. A number of miners took out futures on oil while it was so cheap, locking in continued cheap production costs for themselves.

Have you got a list of these miners that did this?

They are very smart and I would use that info as a selection criteria!

-

Maybe the production cost does not matter all that much for a monetary asset that has an only very slowly changing above ground stock.

I'm glad that someone understands me!

Remember there is lots of gold in the oceans (and I don't just mean treasure!)

-

Back in 2007 or so the production cost of gold was about 300 usd or less?

If the production cost of a house is 100000 today will it rise past the current updated production cost with inflation tomorrow?

I assume the producers are timing release of gold to the market at price peaks and storing it the rest of the time which you would guess most buisinesses would do in the circumstances and shorting the hell out of it the rest of the time if that is something that makes sense to them. When they get the price lower they release the shorts and sell into the rally.

And given the nature of the buisiness you can imagine they finance all manner of gold ramping propoganda web sites commentators and so forth.

The diamond cartels work a similar gig with the value of their minerals. You as customer buy high and you sell low.

But maybe i am wrong about the production cost of gold?

The production cost of gold is not something that I spend a lot of time thinking about. The market price is what concerns me.

If a gold producer wants to spend effort, time and money on finding and digging up gold only to keep it in a warehouse so that he can sell it later, then that is up to them. If they pay their employees in newly minted fiat money from the government so that they can both keep this jig going, then they all deserve whats coming to them.

Edit to add: entwine what Bubb says here to get a fuller picture of malinvestment: http://www.greenenergyinvestors.com/index....st&p=139845

-

The trend being that the commercials will keep going shorter and shorter until their game is up!

I think the commercials think that a gold making machine is just around the corner...if they only hang on a bit longer...I'm sure the hadron collider will be able to produce a spec of au.

-

http://www.myiris.com/newsCentre/storyShow...;secID=livenews

There seems to be no stopping for gold prices, due to weak dollar as it hovered near last week`s lifetime high above USD 1,100 after a weaker-than-expected US unemployment rate revived worries about the health of the global economy, reports Economic Times.

Gold has gained as much as 25.2% in 2009, driven by persistent weakness in the US currency.

Cash gold added USD 3.95 an ounce to USD 1,100.25 an ounce by 0306 GMT, having hit an intraday high of USD 1,100.40 - within striking distance of Friday`s record high of USD 1,100.90.

US gold futures for December delivery rose USD 5.0 an ounce to USD 1,100.7 an ounce after striking a record of USD 1,101.90 last week. Japan`s foreign reserves rose to a record high for the third straight month in October partly as rising gold prices inflated the value of its gold holdings.

Meanwhile, the International Monetary Fund (IMF) signaled that record low US interest rates are funding global carry trades and the dollar is still overvalued as concerns mount that new financial imbalances are forming.

US government figures released on Friday showed that the nation`s unemployment rate topped 10.2% in October, lifting expectations that the Fed will keep interest rates near zero well into next year, and thus pressuring the dollar.

The world`s largest gold-backed exchange-traded fund, SPDR Gold Trust, said its holdings stood at 1,108.344 tons as of Nov 6, unchanged from the previous business day. Noncommercial net long US gold futures positions fell 0.2% to 241,319 lots in the week to Nov. 3 from 241,777, a weekly report by the US Commodity Futures Trading Commission showed.

-

GOLD and COT data...

My eyeballs see this

Let's check and see how accurate that is...

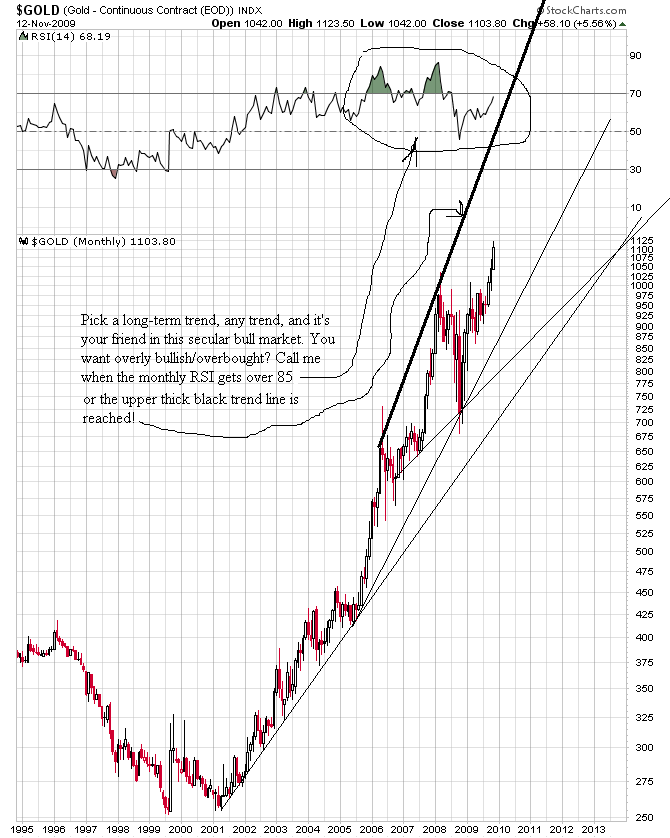

It works rather well ... Gold chart update

In contemplating what may come next, I make a comparison with the gold breakout in 2005/6,

and I see that gold ran higher (by over $200?) after the Commercial shorts had hit its maximum - was this short-covering?

That may happen again, and if it does, Gold may not be done yet.

But if the Commercials are not forced to cover, then Gold could be done at/near $1100.

An interesting golden battleground, we are in now.

Nice work Bubb! Any chance you could repeat with Silver?

Should be crystal clear to people that following the so called 'smart' money, without analysis such as yours, is a fools errand. However, saying that I still would not sell any physical gold/silver in this economic environment!

-

Arise SIR Pixel8r you have been duly knighted for your dedication in your search for the truth in gold and then delivering that message to the masses.!!!!

+100

-

Interview with Pierre Lassonde (Ex CEO of Newmont Mining) by Eric King

He explains that investment has now overtaken jewellery as the primary demand for gold. Previously it was 80% jewellery, 10% industrial & 10% investment, now there is over 50% investment demand. He talks about how important the recent Indian buying of gold is, saying central banks will now be net buyers rather than sellers. Also that the Dow/Gold ratio is going to 1:1, but is unsure as to what price that will be, it depends on how much money the CB's print.

http://kingworldnews.com/kingworldnews/Bro...e_Lassonde.html

Pixel - everyone of your posts is top

dollargold!Thanks for posting that - I seem to skip over audio interviews but I am grateful that I had a chance to listen to Pierre.

-

Kerr [he never reads this thread right?] the anti-goldbug.

Ouch my lip!

I think you mean Perma Gold Bear!

-

I like the way he describes his channels as fractal, maybe been taking a bit too much LSD lately

Maybe he doesn't know how to spell

equaldistanceequidistantequally spaced apart channels?Calling them Fractal in nature sounds so important!

Anyway, that gold one is much better than his recent Silver one where he predicts with great gusto that Silver will be going to $2.50 an oz!!!!!

-

The indians obviously don't think the fundamentals aren't justified and they are not known for being a frivolous nation.

Is it only me that thinks Roubini has become irrelevant? I used to read a lot of his stuff but now a days I can't even be asred to get passed the headline!

I think he is nore interested in becoming a celebrity...expect him in the jungle soon!

-

1100 just taken

I calculate that it took 26 days of Gold Bull effort to get from $1000 to $1100.

In comparison it takes the Treasury and Congress 15 days of effort to go from $250bn to $350bn.

Got Gold?

ref from http://en.wikipedia.org/wiki/Troubled_Asset_Relief_Program

The initial $250 billion can be increased to $350 billion upon the President’s certification to Congress that such an increase is necessary. The remaining $350 billion may be released to the Treasury upon a written report to Congress from the Treasury with details of its plan for the money. Congress then has 15 days to vote to disapprove the increase before the money will be automatically released.

-

Why all this ganging up on RH?

He (and everyone) should be allowed to post whatever he likes, so long as it is not rude nor insulting (which he never is!!!).

Heck... if people don't like his content or expressed views/arguments, then just discard or ignore his posts. Please don't start telling him or others what style of post/reasoning is acceptable.

I am not ganging up against anyone!

I thank RH for answering my direct question - it helps me understand what he is saying if i understand what a certain term means (to him).

RH - rather than use the derogatory term gold 'bug', would you consider using Perma Gold Bulls? I think this definition would aid respectful debate.

This will be my last post on this 'bug' issue - as I say I can go back to biting my lip.

Regards,

fwiw

-

No, I realize you opinions re. hyper,inf',defl',etc differ - I said:

IE all of this you posted:

Is any one asking you to have the same opinion? It's the quality of opinion that sets the quality of the forum.

I don't think you'll find ST fits with most definitions of a Gold Bug - if you look into what he actually says. You seem to be actively trying to tar people with your (mocking) 'gold bug' brush...

I agree RH seems to use the Gold Bug label a hell of a lot. Does seem at times that the 'gold bug' phrase is thrown around as a subtle attack to put gold investors down. I usually bite my lip when I read this, but I must agree with Mr P on this particular point.

RH - could you let me know your actual definition/meaning of a gold bug?

Most on this site are Gold Investors. I myself am a gold bull. I don't know anyone who would call themseleves a gold bug.

-

Yet, price unchanged in GBP. Still £660.

Sometimes I wonder: Did the British Empire really collapse? We seem to have more lives than a cat!

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Well that made me smile!

Thanks!