-

Posts

638 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by ologhai

-

-

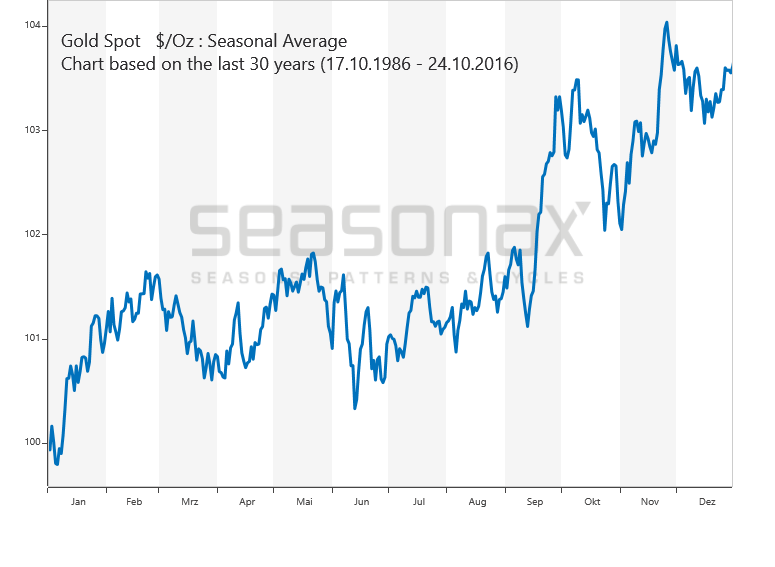

Here's a 40 year seasonal chart, which shows the best time is now.

I thought it might be useful to be able to see the 'wrap around' of the first six months copied onto the end of the year. So, just in case anyone else will find it useful:

If one were a trader, this 'wrap around' makes it particularly clear that on average, one should stock up in August and sell up at the end of February (the change in price between the end of Feb and Aug is rather dwarfed by what had been the 'usual' growth from Aug to Feb).

-

If it presses ahead with its plans, nearly 20 per cent of existing borrowers may be unable to remortgage without reducing their debt significantly, funds available to borrowers overall could be reduced a further 10 per cent, and the self-employed may be prevented from taking that first step on the property ladder.

Why would that be? I would've thought that most reputable lenders would take the word (albeit written) from an accountant about the state of the self-employed person's income/profit.

-

I'm curious:- Anyone one know why he hits 'enter' halfway (Harveway?) through a sentence?

My guess would be that the text of the blog is composed in some separate editing tool (not directly on the blogging website), then copy-and-pasted into a text-editing box on the blogging website in order to publish it... and somewhere between one and the other, 'soft' linebreaks (i.e. word-wrap linebreaks generated by the editing tool because of its window width) are being converted to 'hard' linebreaks. The explanation needn't be exactly this, but it has the feeling of being something along these lines, especially as the erroneous linebreaks occur after roughly the same number of characters: they don't have the appearance of being randomly placed.

Or perhaps, as DrBubb suggests, he's a nutter. You choose which explanation you prefer...

-

Hello all,

Ignoring the bile, there's really not much to add to the further comments Mrs.XXX posted from the email I sent her. Augmentum has a client which is RIT, a publicly traded investment trust. Like the WGC, Augmentum is now a minority shareholder in BullionVault. Paul remains CEO and the major shareholder, and there's no change whatsoever to your property rights or our terms (we'd be legally bound, as users know, to give 30 days' notice anyway). The custodian remains ViaMat, and the Daily Audit continues to prove your unique ownership each day. Raising capital was a long way from urgent, as our 2009 accounts show, but it's always useful in a fast-growing business, especially when it brings with it Augmentum's e-commerce expertise and the WGC's global marketing clout.

Whatever your prejudices or politics, the Rothschild name also has a long association with gold bullion, all of which makes for stronger sales, deeper markets and more active users. So I am genuinely sorry, and can only wish you the best, if the tomfoolery that passes for "gold analysis" on the web makes you view this fantastic news as part of the cabal's grand plan. Because you'll be leaving the world's most secure, transparent and cost-effective route to defending your savings with gold, and just when private wealth looks set to need it most, too.

Still, I'll confess - it is nice to feature on David Icke's website at last!

http://www.davidicke.com/headlines/35432-l...o-bullionvault-

Best wishes,

Adrian

Adrian Ash

Head of Research

BullionVault.com

Perhaps a central issue here is that the kind of people who have bought physical (even at a distance) over recent years are precisely the kind of folks who like things kept simple. They have (I suspect) mostly bought gold to remove many of the question marks associated with other investments, and to try to get out of the way of those who can mess with their money. It feels as if we're still well in advance of any gold mania (whether or not one is to come), so gold buyers thus far are probably more suspicious and more cautious people than most. For gold buyers, change is something to be wary of.

BV's apparent simplicity (and being relatively question-mark free) might explain why it's done pretty well, and (sadly, from the point of view of at least some customers) become interesting to other parties.

I hope that those still in majority control of BV remind any such interested parties that they became interested in BV because of what BV already is. I would suggest the possibility that trying to 'improve' what BV is might not work out as intended.

-

Have you tried negotiating a Rental Cut Recently?

Show this chart to your landlord

================================

This is not positive for BTL Landlords

RENTAL INDEX

Rent Index: 580.287 / calculated from 5,477 tenancies - at 23 Jun 2010 02:09

Why do you think showing this chart will help renters? Doesn't it just show that rents haven't changed really over the last couple of years (at least nominally)?

-

Before I transferred funds to BV some years ago, I did enough research into the company to satisfy myself that it was a sound proposition with honourable people in control. Edit: Now that there is a new element involved, it would require me to do similar time consuming research - I prefer not to do so.

Thanks for your thoughts!

While I'm typing a reply -- if George Osborne announces an increase in the CGT rate (and perhaps a reduction in the allowance), will the PoG plummet tomorrow? Any thoughts, folks?

-

I do not have much left at BV but what I have, will be coming out in the near future.

What's the thinking behind this?

-

You'd be surprised how little space you need for a tonne of gold. After all, it is only about 85 London Good Delivery Bars and they're not very big. Could fit it all in a suitcase in your attic. Now, where's your $50m?

I struggle to lift my largest suitcase when it's just full of clothes and stuff!

And, unless you have especially strong joists up in your attic, it wouldn't be long before the suitcase would end up in your cellar without you having to lift a finger!

-

I was just reading a short piece about Brazil in MoneyWeek.

"Brazil 'won't be immune'," it says, "to a renewed slide in global growth, says Morgan Stanley. That would be bad news for commodities, which are also threatened by a Chinese slowdown."

Further, in an item about copper:

"Then there's China, the biggest user of [copper]. Demand will soften as the government keep trying to reign in growth."

Is there a general downward trend in commodity prices incoming, and what do folks imagine the effect on silver will be?

-

BV's gold chart doesn't seem to have 'woken up' since the weekend. Is anyone else seeing this, or is it just me?

-

I suppose the opposite of a smackdown is a... smackup?

-

I think I'm gaining another pet topic. Analysing the use of words, and paradigms re money/currency/gold etc.

[...]

2. Gold is money, and so can't have a "price", because it can only be "priced" by itself. In fact it buys other things, it being money, including fiat currencies.

Or, just for the fun of the analysis:

2. Gold is money, so it can only be 'priced' in terms of everything else?

Maybe.

-

I think I'm gaining another pet topic. Analysing the use of words, and paradigms re money/currency/gold etc.

[...]

2. Gold is money, and so can't have a "price", because it can only be "priced" by itself. In fact it buys other things, it being money, including fiat currencies.

Or, just for the fun of the analysis:

2. Gold is money, so it can only be 'priced' in terms of everything else?

Maybe.

-

Another way of trying to measure the peakiness and troughiness of gold occurred to me yesterday.

I thought it might be interesting to plot the increase in the price of gold as steady growth over the top of its actual price movements. Assuming that this has any validity at all, then peakiness could be seen by most/all of the price of gold plot being below the steady growth plot, and the other way around for troughiness.

In retrospect, I'm not sure this approach really adds much information that the idea of plotting the ratio of the price of gold over the 200 DMA, but I thought it might be worth a try.

Here is a chart of the PoG from the start of 2007 to yesterday (blue), with steady growth (red), 200 DMA (green) and the PoG/200 DMA ratio (white):

As you can see from the chart, if my interpretation of the steady growth line (as explained above) is true, there is still some addition upside yet to come as the steady growth line comes in below the three previous extremes of peakiness.

I would be interested to hear any comments, particularly on whether plotting this actually adds any information (or even a perspective) on the movements of the PoG.

-

Thanks Ologhai.

Could you email a copy of your spreadsheet to me?

My address is thomas.e.shaw@hotmail.co.uk

Thanks.

I'd rather not do that as the spreadsheet contains quite a bit of personal information in addition to just raw data and formulae.

I could come up with a new spreadsheet containing just the non-personal bits, but that would take a little time -- time that I don't have at the moment.

Alternatively, if there are specific questions you have on how to calculate particular things, I could just field those questions?

-

The generally accepted "best practice" echoed on the gold threads 12+ months ago, was don't trade your gold, it isn't necessary. This was illustrated by various metaphores such as, "why would you try and trade an insurance policy." I am concerned new members haven't read the older gold threads and may be lead to be believe trading gold is the generally accepted norm and it isn't. To some degree the `goldbugs` have lost their voice on this thread and sometimes there is post after post of trading talk and it would be quite easy for new members to draw an unbalanced conclusion. There are many of us who are still staunch believers that trading gold is akin to `picking up pennies in front of a steam roller` and you are very likely to end up with far fewer ounces trying to trade this volatility. This rationale is not so rational IMO, especially as we enter the final phase of this crisis.

In combination, our posts have hopefully straightened out much of the possibility of misleading any 'newcomers' and have summarised the two 'sides'!

Incidentally, perhaps we get more 'trader' chatter because there's the potential for them to have more to discuss? By definition, there aren't multiple approaches to choosing not to sell and re-buy gold? (I don't know whether you'd agree.)

Perhaps this leaves the 'holders' less to say, making more room for them spend time alleging that the 'traders' are fools!

-

I think the allure of a quick paper profit can be strong - but if thought through, how can that profit be stored? Professional and semi-professional traders here believe they can anticipate movements and make a profit - some (lucky) will and some (unlucky) will not but those who just hold will preserve their purchasing power - and will probably increase it into the future - they will also not have the extreme stress associated with high stakes gambling - although some people are born gamblers and love it.

I don't know why those of you with a 'hold-only' approach to gold feel the need to keep taking pot-shots at the others, sometimes in a not-so-pleasant way.

There is a rationale behind selling and re-buying gold, not to take a 'quick paper profit', but to try to end up with more gold, i.e. trying to make our money go that bit further.

Both parties (for the most part I think) want to protect their money from the devaluation of fiat -- to 'preserve their purchasing power' -- so we're not so different. It's not like one party is especially noble and upstanding, while the others are low-lives just in it for a quick buck.

Sometimes, people who trade some of their gold will lose out due to their action, but sometimes, those who hold-only will lose by their inaction. So what? Don't be so insecure that you have to keep trying to convert everyone to The Right Way. Speaking for myself, if I wanted that kind of thing, I'd go to church!

I don't see why this artificial division between people who are MUCH more similar than they are different should keep coming up.

-

I get sterling gold data from 24hgold.com

http://www.24hgold.com/english/interactive...lecom=valelivre

However, it only provides 200dma as a line on a chart and does not give a figure for 200dma which is therefore open to error from reading the chart and trying to estimate the 200dma.

Ologhai,

Where do you get your sterling gold 200dma figures from?

I don't -- I work it out (or, rather, the spreadsheet does) from the raw gold-price data. I've set the spreadsheet up to generate (and display as charts) moving averages, the PoG/200DMA ratio and Bollinger Bands, both for USD and GBP (although I never got around to doing it for EUR -- although in theory I could because I do paste the EUR PoG into the spreadsheet as well).

I get my raw data (for gold and silver) from the London Bullion Market Association website.

If you use a spreadsheet and you want a few tips for formulae, let me know.

-

Question - Was the 1.37 in Feb 09 in gold $ or sterling gold? If sterling, I will double check my numbers. I have this at 1.34

According to my spreadsheet, the ratio peaked on 20-Feb-09. The 200DMA was £502.42 and the PoG was (PM Fix) £690.35 -- a ratio of 1.374 or so. (I actually sold on 19-Feb when the ratio was 1.365.)

-

I vaguely recalled trying to make a gold-price prediction last year in response to a 'predict the top' post, and just went looking for it to see how wrong I was turning out to be.

Here's my post in the Gold thread of the time (dated 2 Dec).

To quote:

"Gold will go more or less sideways for about a month (although, it may be pretty choppy, so it won't feel like sideways necessarily), then there'll be another jump early in the new year, then a slower climb up to a local top around the end of Q1 -- at which point, I would expect to see £850/oz (I was going to say £900 knowing that what seems like 'wild prices' now can seem almost normal when they arrive, e.g. how wild did $1200-before-year-end seem a couple of weeks ago?). In dollars, it'll be more like $1400 or so by then."

My time estimates were pretty hopeless (at least two months too soon), but I wonder how well the peak numbers will turn out to be.

-

Clearly what you want to avoid is to average in now. I would be averaging out now as in sterling terms gold is approximately 1.24 x its 200 day moving average. At every peak in gold prices in this gold bull sterling gold has peaked at about 1.28. So yes there is abit more upside, but there is also alot of downside. We are also coming in to the summer doldrums where my guess is gold will fall back to its 200 day moving average. That is the time to reverse the dumper truck and invest heavily.

I am planning on selling half my gold stash at 1.28 x 200 day moving average which i think will be at the end of May beginning of June. It won't go much higher. I will then buy back in over the summer near 200 day ma level.

Right or wrong, that almost precisely sums up my position, and (currently at least) my intended strategy.

As I've said before, this is essentially what I did starting back in Feb '09 when gold was looking decidedly peaky. (According to my spreadsheet, the 200DMA ratio was around 1.37 then!) I started averaging back in, in retrospect probably starting a little too early, when the ratio was 1.10 (Apr '09) and had completed buying back in with a ratio of 0.98 (Aug '09). (As said elsewhere, this also allowed me to benefit from some CGT allowance.

Even if folks are not open to the idea of trading (i.e. selling) any of their stash, keeping an eye on this ratio could help point out when to start averaging in more or less aggressively.

Whenever it's looking peaky, some will say that there's no stopping it now. One day they may be correct. Today might be that day. But, if it turns out like it most often does, now doesn't seem all that likely to be a good time to be buying particularly stridently (although Gordon Brown might disagree!

).

). -

The chances of a Lib-Dem/Labour coalition seemed high. Gold went up.

Gordon is seen packing holdalls into his Jag behind Downing Street and rumours abound that talks between the Conservatives and Lib-Dems are going well and there'll be an announcement today. Gold can now fall again...

-

Look at gold over the last 5 years and the sensible approach feels like buy and hold. I sold some when it looked toppy at euro 27,200 but now look at it!

And? Your anecdote doesn't change the principle behind my post, does it?

Here's another anecdote (for what little it's worth): I sold half of my gold in Feb '09 for around £685, then bought back in from May to Aug '09, finally buying the last lot at around £565. Since then (as we've seen), it's risen in value to over £800, thus permitting me (as it turns out) to benefit from even more gain that by just holding. I don't know whether my gut feeling will produce similar results in the future, but I'm open to the possibility (and principle) of selling/re-buying gold, and not simply repeatedly asserting that holding is The Only Way.

I say again, isn't the goal simply to try to increase value by as much as you can?

-

This is not a Gold rally...It's the paper stuff you once called money collapsing!

You take your profit then what...prey it goes back down?

Don't you think there's some sense (in principle at least) of selling some gold when it looks peaky and then buying back more gold when it's looking... erm... troughy?

Some people seem to be of the opinion that it's utterly crazy to sell any gold ever presumably because it might continue upwards (with many a 'on your own head be it'), but isn't that the exact mirror of deciding not to sell some gold and it goes downwards? It's possible to 'lose out' either way -- selling/trading or holding.

To my mind, the ultimately idea is simply to make more 'money' or more 'value' (where that may be to end up with more gold). What's your goal?

Only if you simply love gold and you want to keep it and stroke it and polish it does it never make sense to sell any.

To come at it from another angle: due to its volatility, when gold rises from, say, 1000 to 1200, if you could straighten out the saw-tooth way it got to 1200 by trading some of the volatility, it's grown by much more than just 20%.

If you had a 'more often right than wrong' approach (or even just a knack) of trading some of that volatility to your advantage, why wouldn't you?

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

By the way, is the implication of this chart that, on average, the price of gold has risen at around 9% per year for the last 40 years?