-

Posts

710 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Compounded

-

-

I'm still waiting for mine to arrive.

Ordered them over Christmas, but the guy at Weighton sent an email on the Wednesday before New Year saying he'd decided to wait until Monday the 4th to post them, with the excuse of the "pending bank holiday and weekend coming up".

He could have dispatched them on the Wed/Thurs before New Years Day, then maybe I'd have had them delivered on the Saturday.

So I get a delivery note on Tuesday because I was at work, and then it snowed and I couldn't go and collect them from the Post Office.

Arranged a redelivery for today (Saturday), checked the status on Royal Mail tracking system, which says they are "out for delivery", but nothing turned up today!

Have arranged for another redelivery for Tuesday, but I bet they won't arrive if there's more snow by then....

It's really annoying not knowing what's happened to my order!

Especially when it could have been dispatched a day or two earlier with a simple trip to the post office.

I had this with Chard - they were concerned that they would be pilfered from a RM depot when there are few staff around.

I got the impression they knew what they were talking about.

-

I haven't used them (yet) and they're presently out of stock of buffalos, but Sarnia Silver in in the Channel Islands will send you one of these for £14.50 including delivery to the UK. Not a bad deal when you'd be hard pressed to get a silver britannia from ebay for less than £20 delivered. They do lots of other coins and bars too.

The main disadvantage compared to the silver britannia is that the buffalo potentially has CGT payable upon sale (assuming you've used up your annual CGT limit, etc). All foreign silver coins have this disadvantage, of course.

There was a thread that mentioned Sarnia on here recently. Apparently the way they work is by sailing under the £18 VAT threshold per item coming from the Channel Islands. This means that if you order 10 coins, you'll get 10 envelopes.

As long as they can profitably send an ounce of silver plus postage for less than £18, they'll have a great business. Depending on who you believe, you may need to hurry

cheers

sjiff

I gave them a go - all arrived ok.

Prices are VAT free so bloody cheap I only bought 10 oz I cannot see this as a way to make substantial silver purchases but like ebay silver spoons it all helps.

-

Investing in gold for me is a way to protect my savings in uncertain times so I am definitely a buy and hold investor.

I am happy make small loss for the case of security.

However I must say I have been surprised by the rapidity of the rise in gold the last couple of months and wonder if it is sustainable.

I expected a much more gradual rise.

I am the same, I expect a gradual rise with increasing volatility, the rise in the last two months fits in with this expectation as would a £200 sudden plunge.

I do not think gold can become the dog of an investment it was in the 80's and 90's unless the financial system is fixed, I don to believe that to be possible if I am wrong and it does turn out the system is OK it would be a better outcome for me overall even though my investments would be halved or worse.

-

Maybe Bubb has a repeating pattern of getting out too early? He got out of UK property in 2001, 3 years before the property peak in gold and 6 years before the nominal peak. If he does the same with gold, he might lose out on another 500% gain or so.

“I made a fortune getting out too soon” J P Morgan

I found this one of his as well while looking for the above. Was JPM a bit confused, or hypocritical or thinking of someone else when he said this?

"Of all forms of tyranny the least attractive and the most vulgar is the tyranny of mere wealth, the tyranny of plutocracy” JPMorgan

-

Gold showing good bounce-back-ability at the week close - nearing $1120 again. Silver again struggling a bit at $17.4.

G-to-S ratio now 64.

That monthly dip in gold price around the 28th shows up well here. Look how a 22 dma (thats a month in workdays, right?) acts as this support. A buying op on this 28th (Fri 27th/Mon 30th) at around $1080 maybe ?

Bullish IMO a silver spike and crash at the end of a gold run is usual is it not?

-

From a traders viewpoint platinum has made some impressive moves at over 2000 to around 1000 and now 1300 and every chance it will be over 2000 before gold is.

In an economic recovery where there is less fear of collapse gold will fade in favour of stuff people require.

And in 2004 $850 was nowhere to be seen anytime soon

It seems if:

1. you are certain of economic collapse then trade wholely with gold

2. If you are optimistic of economic recovery then trade mainly with something that is required.

IMO If you are certain of economic collapse you should not trade but should aquire gold, silver and anything that can be bartered.

MUST Read here:http://www.marketoracle.co.uk/Article15013.html

Quote:

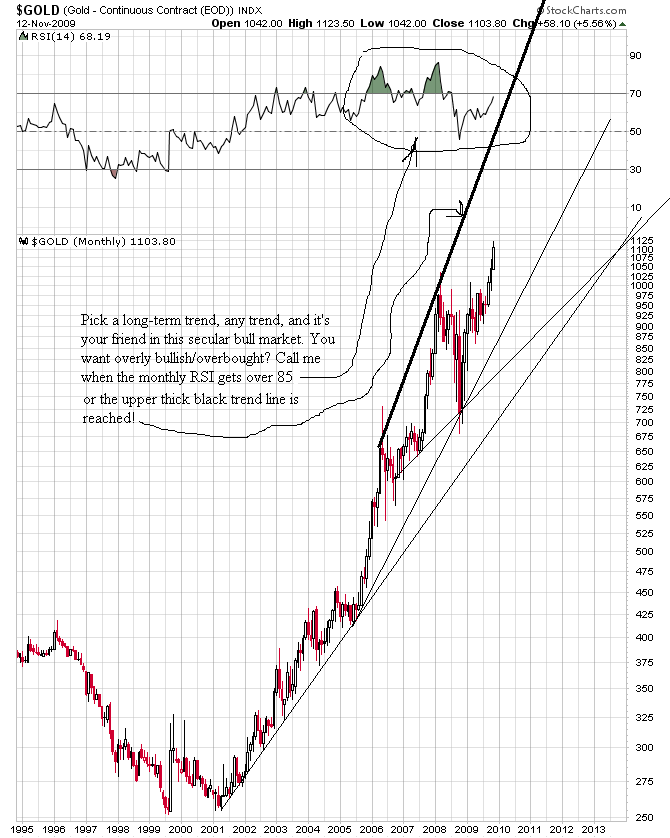

Anyone who has studied prior secular bull markets knows that a 4 fold gain over ten years is not a bubble and is not anywhere a secular top, but "bubble" calls are everywhere in the mainstream financial community regarding Gold. First, they don't see it coming and say it can never happen and then they call "bubble" the second it does! I love it because Gold is still climbing a wall of worry. Yes, the short-term speculative froth is a little high, but long term (I am not a day trader), Gold has a long way to go regardless of what paperbugs think.

The 2000 low in the gold price was an extreme low and was IMO caused primarily by the new rising economic powers unlike those in the past choosing to accumulate American debt instead of gold. The fourfold increase in value has got gold to more or less the value it should be in normal times; IMO it is still a screaming buy if you believe your fiat currency will fail.

-

AHA that would take the thinking of a cool,calm collected physical gold investor.A rare commodity it would seem.

When We Have Gold We Are in Fear, When We Have None We Are in Danger - English Proverb

-

This is what Jim Willie thinks of GLD and SLV:

He thinks a systemic banking failure is approaching.

Well worth a read IMO especially if you are tempted to believe the green shoots fairytale.

-

What springs to mind is the Shiller income chart.

Irrational Exuberance - loads of data from Robert Shiller book

http://www.irrationalexuberance.com/

Including PE of S&P500, which is also available here: http://www.multpl.com/

Is that what you mean?

Thanks, this stuff is not easy to find.

I am a newbie to this but my interpretation of these data:-

1. earnings have collapsed by about 90% but dividends have not been reduced by anything like that amount.

2. The quoted P/E average does not show this collapse because it is averaged over 10 years

3. Dividend yield has more than doubled since 2000 but is still lower than at the 1929 minimum

Irrational Exuberance seems and understatement.

-

I have calculated performance since 1999 and it matches this graph almost exactly $1000 would have become $3703

I would like to calculate the return if I had stayed with the dow however I am finding it difficult to find historic dividend return figures infact all I have found after a good half hour of googling is a quote "Dividends on the Dow fell from 3.94% to 1.47% in the period 1990 to the peak at 1999" A 1.47% return does seem to be very poor it suggests that at that time for many if not most stock market pension funds charges would consume all the income generated by the share portfolio; I am not surprised it is a figure that is not well publisized.

Does anyone know where I can get historic yearly dividend return figures for the dow?, historic dividend return figures for ftse indexes as well would be brilliant.

I have done the calculation with assumed dividend return figures but it would be nice to have actual figures.

$1000 becomes

1.5% - $849

2% - $897

3% - $997

4% - $1106

5% - $1223

-

GOM, I guess I don't quite understand what you mean by "nothing else just St George". I think the backs of my Sovs all look like this. I have no shield designs.

Victorias, yes, there is the older queen and the younger one. Just like the Elizabethians. If I'm not wrong there might be more than two different ages, but I don't care too much anyway about how old that gold is.

Victorias, yes, there is the older queen and the younger one. Just like the Elizabethians. If I'm not wrong there might be more than two different ages, but I don't care too much anyway about how old that gold is.

There are three Victoria heads, young, jubilee and old and I think four QE2 heads.

The george and the dragon tail is also used on victorian and pre victorian crowns - these are large coins nearly one oz silver.

The beauty of the design is much more apparent on these than on the small sov.

-

As predicted by Dr B (?) and others, GBP is falling as fast/faster than Gold.

All of which totally validates the do not wait for a dip if you are holding GBP approach.

You could of course convert to USD and then to gold later but this is a big risk for someone who does not have a core position yet.

+1

-

Sovereigns are by far the best IMO

No GCT

Proper historic coin at bullion prices

Recognized the world over

Not too big - important if prices go up substantially as they may well do if fiat money implodes.

-

It could come to a bimetallic standard anyway. In general, if gold was reintroduced as the global currency, my guess would be that the price of silver would become less volatile.

If China wants to surprise everyone, they'll give silver a much more prominent role in their currency strategy.

Because the silver stockpile has been largely used up by industry I suspect there is not enough mined silver in existance now for silver to be used as the loose change money in a traditional bimetallic monetary system.

Perhaps silver is too useful to be used as money

-

Maybe teaching the kids about gold should be left until they're a bit older.

No way Jose - the more they know now the more they will be prepared - they will afterall be the ones who have to sort out this paper money debt mess.

-

“What is fascinating is the extent to which gold still holds reign over the financial system as the ultimate source of payment,” Greenspan said.

Fascinating that nobody wants to play his game anymore? Not particularly.

I think it's an important statement and will be seen as such - maybe not yet.

Anyway I am saving in gold if gold does go parabolic it will be risky then what is there as a safe saving medium?

Has anyone any suggestions?

-

I'll take another drop right now. Please.

Especially in sterling.

+1

-

That's the one. Thanks very much.

------------------------------------------------------------------------------

An interesting quote from a historical novel about QE1.

So is this the Gresham of Gresham's Law?

Link (about a possible overnight dollar devaluation):

I think so:-

http://en.wikipedia.org/wiki/Gresham%27s_law

According to the economist George Selgin in his paper "Gresham's Law":

As for Gresham himself, he observed "that good and bad coin cannot circulate together" in a letter written to Queen Elizabeth on the occasion of her accession in 1558. The statement was part of Gresham's explanation for the "unexampled state of badness" England's coinage had been left in following the "Great Debasements" of Henry VIII and Edward VI, which reduced the metallic value of English silver coins to a small fraction of what that value had been at the time of Henry VII. It was owing to these debasements, Gresham observed to the Queen, that "all your fine gold was convayed out of this your realm."[3]

Gresham made his observations of good and bad money while in the service of Queen Elizabeth, with respect only to the observed poor quality of the British coinage. The previous monarchs, Henry VIII and Edward VI, had forced the people to accept debased coinage by means of their legal tender laws. Gresham also made his comparison of good and bad money where the precious metal in the money was the same. He did not compare silver to gold, or gold to paper.

-

That's the one. Thanks very much.

------------------------------------------------------------------------------

An interesting quote from a historical novel about QE1.

So is this the Gresham of Gresham's Law?

Link (about a possible overnight dollar devaluation):

I think so:-

http://en.wikipedia.org/wiki/Gresham%27s_law

According to the economist George Selgin in his paper "Gresham's Law":

As for Gresham himself, he observed "that good and bad coin cannot circulate together" in a letter written to Queen Elizabeth on the occasion of her accession in 1558. The statement was part of Gresham's explanation for the "unexampled state of badness" England's coinage had been left in following the "Great Debasements" of Henry VIII and Edward VI, which reduced the metallic value of English silver coins to a small fraction of what that value had been at the time of Henry VII. It was owing to these debasements, Gresham observed to the Queen, that "all your fine gold was convayed out of this your realm."[3]

Gresham made his observations of good and bad money while in the service of Queen Elizabeth, with respect only to the observed poor quality of the British coinage. The previous monarchs, Henry VIII and Edward VI, had forced the people to accept debased coinage by means of their legal tender laws. Gresham also made his comparison of good and bad money where the precious metal in the money was the same. He did not compare silver to gold, or gold to paper.

-

I think everyone one should own some gold if they don't have any.

+1

Some more observations...and some pre-flight checks...Candlesticks - check

Cup & handle - check

Bounce off lower median line - check

Highest close in 14 days - check

Closes over 38.2% Fib retracement - check

Means big smackdown is probably due soon if you think the market is manipulated.

-

I didn't know that mish liked gold...

http://globaleconomicanalysis.blogspot.com...at-does-it.html

Jetstram

Gold over time holds value but gains purchasing power in deflationary periods and loses purchasing power in inflationary periods this has happened over and over again throughout centuries , the only exception is the 1970's inflation when gold rebounded after being manipulated lower by the great western powers in the London gold pool price supression scheme.

Mish is a deflationist I think he knows history shows deflation is good for gold - he says gold may lose dollar value in his predicted deflation but will gain purchasing power.

Hyperinflation - anyting of value is better than money - in that situation gold is best but it may be so good the government requisitions it.

-

I'd like to publicly thank CGNAO, GoldFinger, Bubb and all the other great posters on GEI that have given me the history, courage and conviction to 'understand' gold. Well at best as my little brain can cope with!

I wasn't even alive when we went off a gold standard on 15th August 1971.

[

+1

except I was alive then though do not remember Nixon leaving the gold standard- I do remember people were much more worried about the financial mess the uk was in the 70's than they are now and people were genuinely worried.

There was a Labour government in the 70's that had spent too much that is almost a repeat but the worry that existed then of some sort of economic collapse looming is not present now .

-

Leverage is often silly and indeed rash.

Holding gold is historically about as conservative and unrash as it's possible to be and even if its a loser - its just about the only thing thats guaranteed to hold some value.

-

I must say, everyone on here is getting remarkably relaxed about smack-downs these days. Time was when a good $25 smack-down of an afternoon would bring out several posters in a panic. Or have such folk simply given up out of nervous tension?

I have got used to it - understand the fundamentals and wait - gold certainly takes it's time.

I think the real point is the alternative mainstream saving media are rubbish.

And the only other way is by being clever and swapping from from one fashionable asset to the other earlier than the crowd; thats difficult even with Dr Bubb giving his not inconsiderable investing experience for nothing.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Confiscation means they make you sell at an official cheap price, which is not very different to giving you the real price with some special tax on the "windfall"

Virtually all my gold is in my goldmoney SIPP pension; I wonder what they will do with gold in pensions?