-

Posts

267 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Plastic Elastic

-

-

-

http://www.moneyweek.com/investments/property/uk/money-morning-dominic-frisby-buying-property-20600

That's a major problem in the UK with renting, as there seems to be a much higher turnover of property and liquidity of property than elsewhere in Europe.

LOL, first Merryn, now Frizzers.

Of course, Dom isn't stupid. I'm sure he's done his sums and worked out that it is cheaper to buy a house now than to rent, and by how much. He knows the risks ahead for the housing market as much as anyone, but at the end of the day he needs a place to live.

[...]

Now is not the time to be overstretching yourself to get onto the housing ladder/snake, but if you are in the fortunate position that you can afford to buy a nice place to live and not over-extend yourself then it is certainly a good time to be choosing this option and then to be making overpayments on your loan to insulate yourself somewhat from a shock event that force borrowing rates higher, and ultimately cut many years off your mortgage.

This is a lot about personal choice, and about balancing many factors!

Dominic has ridden the gold bull for a long time, and he's now getting much more house per ounce than he would have got a few years ago. Is he getting out at the top? Probably not! Has he made a decent profit (in terms of sq.ft. per ounce)? Probably yes!

If he has done his numbers properly and if he finds the right place then he could do worse than buying now!

I also agree completely that tenancy laws and culture are a nightmare in the UK. Moving house seven times in ten years sounds awful and is also quite a stretch on resources (contacting agents, visiting properties, moving, paperwork etc.) - I can think of a million things more valuable to spend my time on...

-

Yes, the size of the potential outfall is totally unclear at present. Greece is only a tremor, Italy lurking in the dark. Again, it is the old inflation-deflation debate, but hey, we have an Italian at the helm of the printing press.

Yes, I think the renting part could be tricky, and also if you lever up on fixed IR you better make sure you have a fixed (or at least non-decreasing) EUR-income too.

It is tricky. If they continue to inflate, this COULD be the sweet spot.

What I forgot is the demographic issue. Some (but not all) rural areas in Germany (not only the East) are experiencing a rapidly shrinking population. There was an article in Der Spiegel a few months ago on this. It also seems very difficult to attract doctors to rural areas. Again, choosing wisely location-wise might be the difficult bit here.

-

I think and somehow fear that the sweet spot for German property might have been reached.

(1) Interest rates are at an historic low. Depending on LTV and your occupation (lifetime state employee), there seem to be 30-fixes at 4%.

(2) Prices have been fairly stable over the past 5 years, and also before, there was not really a bubble like in the UK-PIIGS.

(3) But see the hockey stick at the end of the chart above? I fear that this is a first sign of a PIIGS-imported hyper-inflation. While they will see some asset deflation (Athens house prices minus 70% anyone?), I fear that the flood of money (ECB in hyper-drive) will

(i) keep IRs in Germany extremely low for the foreseeable future.

(ii) will make people who fear about their savings buy hard assets like houses (because they don't understand that gold would be better).

(4) The general economy is doing fine and supporting house prices at the moment. This might change, but how bad would it have to get to really have a proper impact on house prices?

This is a theory I have at the moment. This could be the sweet spot for German property. I wouldn't sell any (or at least: much) gold for it, but the time could be right to lever up. If house prices suffered some deflation in Germany too, it might come together with higher IRs and the effect on affordability could be muted.

I heard anecdotal evidence that Greeks were buying lots of properties in Hamburg but it could be that somebody was having me on

I also feel that German people are getting concerned about inflation, and, thus, are herding into property, and, as you say, it might not be the wisest step in all cases. Firstly, Germany will not be spared from all the outfall from the PIIGs desaster, thus rents and tenants may and probably will become less reliable. Secondly, German property is likely to become a prime target of financial repression - I think they will simply raise taxes and all sorts of other legal hurdles (environmental legislation etc.) by a lot. We are seeing that already. Thirdly, you are "immobile", as the German term implies. Of course, a lot of these arguments may not apply if you looked for a property to live in but if you look towards renting out you better choose wisely and in a good location I think.

I also feel that German people are getting concerned about inflation, and, thus, are herding into property, and, as you say, it might not be the wisest step in all cases. Firstly, Germany will not be spared from all the outfall from the PIIGs desaster, thus rents and tenants may and probably will become less reliable. Secondly, German property is likely to become a prime target of financial repression - I think they will simply raise taxes and all sorts of other legal hurdles (environmental legislation etc.) by a lot. We are seeing that already. Thirdly, you are "immobile", as the German term implies. Of course, a lot of these arguments may not apply if you looked for a property to live in but if you look towards renting out you better choose wisely and in a good location I think.I wouldn't be very keen to sell any gold for a property at this point.

-

There is this one: http://www.hypoport.de/hpx-hedonic.html

Thanks, this one is new to me! Apparently, the index encompasses around 10% of all property transactions in Germany.

-

http://www.pmm-partners.co.uk/funds.html

Its not bad and it'll probably be okay given the valuations of Berlin property vs elsewhere and, say, Germany leaves the Eurozone...

Wouldnt mind re-allocating a portion however

Well, that would be interesting to know too, so thanks for looking into it. However, there is a currency risk (if these are not EUR mortgages from British banks). I was asking for the inter-Eurozone case. But anyhow, what you mentioned would be interesting to know too. It might tell us something about the connectivity of these markets.

GF, I only found this one. I know there are others as well but I can't find anything at the moment.

Edit: I guess this isn't based on, say, investing a UK mortgage into German property either. Even so, there is definitely some flow of foreign money in German property. Also, there were also American REITs that bought up former public property in Dresden, for example. I read about this a few years back, well before the crisis hit. A foreign investor may also buy shares of TAG Immobilien, for example, and related shares.

Whether all this is enough to have a serious impact on prices I do not know. Plus, as you are well aware, there aren't really any house price indices in Germany.

-

[...]

The buying fee can be made back in less than one day by buying at the right time. I often buy at PM fix around options expiry time each month and the fee is often made up before the end of the day is up. [...]

That is a very interesting piece of information I was actually not aware of, so many thanks for that!

Are these the dates you are looking at? It appears that they are not concurrent with stock option expiry dates.

-

-

[...]A drop of almost 50% in Silver prices (without them calling a top near $50, as I and others did)...

Dave Morgan did. So did Bob Moriarty (321gold). They have certainly risen in my estimation by doing so.

On the other hand I'd like to point out that it seems a bit strange to me when you label certain things as 'cultish', given the threads you post on various conspiracies and New Age ideas.

-

AFAIR, Bubble Pricker did a thread on something similar to this many years back. I think he even set up a fund to buy property in Germany for BTL.

I think there are a number of investment vehicles that were created to enable British people to buy German property. I'll have a look and see if I can find some information.

That's probably not what you meant though, GF.

-

Performing that action is deflationary, isn't it? I smell a rat

Performing that action is deflationary, isn't it? I smell a ratWell spotted! That's just another piece in the puzzle of sophisticated disinformation, probably spread by the Illuminati.

-

gold looks a safer bet to me..

[...]

Make sure you ask the captain to put passengers carrying bullion in cabins on different sides of the ship. You don't want them all on one side like that one.

This is precisely the problem with all these 'Port Out, Starboard Home' people

-

If Hitler has been hiding out in Ecuador all this time and recently decided to sell his PMs, could this be a top?

One could argue he'd be nearly 123 years of age by now. Then again, don't they say a cat has seven lives?

-

[...] How silly will I feel if it's at $2500 in Sep and I've already sold most of it.

IF the price is really going to be at $2500 in September (let's face it: nobody knows) then you will likely have sold into a rising trend, and you're average selling price will be between $2500 and what it is now. Not exactly the top but not bad either I'd say.

But I guess my focus should be on achieving my main goal.

I fully agree.

-

I have a question. Say you had a pile of gold accumulated over the past 5 years, and you know you need to sell 70% of it by Sep 2012. Not selling isn't an option - need the cash to buy a farm out in the hills (not in the UK I migt add).

Would you sell now, or wait until summer?

If you definitely need to be out of 70% of your position why not sell a little bit each month? I'd probably go for selling a definite amount of gold each month rather than selling for a definite amount of money each month. Thus, you probably won't be hitting the top between then and now, but you will also avoid the risk of having to sell at the bottom.

Obviously you could also look at seasonality factors, technical analysis and so on but selling gradually might be the most convenient option, especially if you sit on profits anyway.

-

Looking at GLD for gold volume is as if you asked someone like Lindsay Lohan about the state of general business affairs in Hollywood, and then you based your whole investment strategy on it. Oh gee...

Volume of GLD is rather associated with the weak hands that trade in and out of gold. I think it can give information on the short term price movement but has little to do with the long term trend. All in my humble opinion, of course.

-

http://www.pmm-partners.co.uk/funds.html

Its not bad and it'll probably be okay given the valuations of Berlin property vs elsewhere and, say, Germany leaves the Eurozone...

Wouldnt mind re-allocating a portion however

Thanks for that, I will look into it!

-

At last, might be able to offload my Berlin investment fund then..

May I ask what sort of investment fund you are talking about? I might be interested...

-

Ah, but think of all those gazillion holes of debt that has a claim on all those gazillions of "Janus-faced" money.

Yes, the two lines lines need to align again!

I'm still not clear whether that's going to happen through a collapse of debt and money supply, a rapid decrease in value of monetary units or (at best) a slow and orderly decline...

-

Yes. That's why so many are herded to invest in "certificates" and other derivatives - usually these are just empty paper promises, because there just isn't enough real wealth to go around at these prices.

When the paper shufflers wake up, it will be over. I watch Bubb as an one of my indicators. There seems to be no immediate danger yet (for the sleepers to awaken, I mean), but I would continue to accumulate.

Precisely!!

This graph totally contravenes and undermines the entire idea of selling useless bits of paper from A to B, and then A buying it back from B a little while later.

There will be a point where this particular piece of music stops playing. The emperor doesn't wear any clothes!

I totally agree we are not there yet, and I also hope anything that is creating genuine wealth has not been destroyed by then! Every day I go to work I can see the effects of an asset stripping exercise carried out at my work place.

-

Some interesting gold/economy charts. Provided as is - not trying to start an argument. Make of them what you will (I like the last 3 in particular).

Taken from http://www.zerohedge.com/news/guest-post-gold-still-answer-investors

[...]

[...]

I find this one truly and particularly shocking!!

GAZILLIONS of liquidity sloshing around in the system desperately looking for MORE YIELD, MORE MONEY, MORE RETURN, and nowhere near enough real goods or industry there to deliver it!!

Not that we didn't know it but it's no surprise that in the last few decades we have seen one asset and stockmarket bubble after the other, more and more environmental devastation, longer and longer working hours, more and more ludicrous financial instruments, a greater and greater wealth gap in many countries and so on and so on...

I think it's not too far-fetched to claim that the world is indeed drowning in liquidity and useless paper!

-

With giold it's all relative. A couple of years ago 1000 seemed expensive, was a difficult buy for many... and 1600 looked a bit fantastical. Presently, with gold already having spiked to 1900, 1600 looks relatively cheap. With the long term trend in mind {"TA"; trend analsis] it's very likely that gold will spike through 2000 next year with new support around 1800/ 1900.

A lot is about the relative buying power of gold, hence the need for charts Gold vs. Dow, Gold vs. Houses, Gold vs. Brew etc etc

From what I've seen recently in all these charts, IMHO gold isn't cheap anymore but it isn't terribly expensive yet either. IMHO that means it will go higher! All of the fundamental drivers of the gold price are still in place, and I don't see any of the root causes of the current mess being tackled.

Of course, if any person doesn't have any gold at this stage, they should clearly still buy!

-

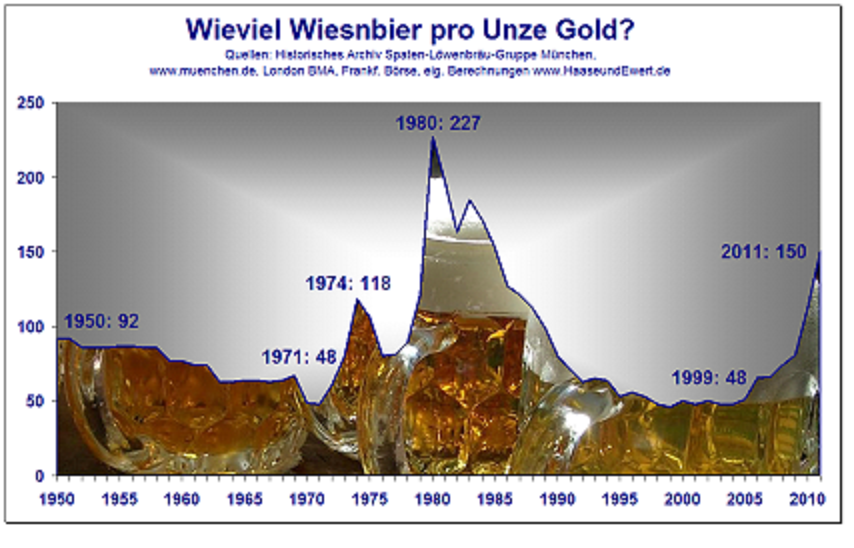

Appeared in this article (in German): CLICK

Very nice graph here (courtesy of Daniel Haase (Haase & Ewert)! It shows the gold price in units of Munich Oktoberfest beers.

I would say gold is definitely not cheap anymore but it's still some distance away from the 1980 top. As of today (€1240 per tr.oz. / €9 per Mass beer) we sit at a ratio of 138.

-

What degree of leverage is there in Paulson's gold investments?

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

I'm sure with that sort of predictive powers you'll be more than welcome on the Fringe Forum