Methinkshe

-

Posts

578 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Methinkshe

-

-

Reading between the lines, the underlying complaint from recent post(er)s, is RH's repetition with the same view stated many times on numerous concurrent threads.

I can't speak for other posters but I am of the opinion that his balanced views bear repetition - they act as an antidote to excesses in either direction. And since such excess is freqently demonstrated, it is always useful, imo, to be brought back to balance.

But perhaps that's just me......

In any event, I very much appreciate RH's posts and have never found any repetitiveness irksome - rather it helps me to maintain a balanced view and not to be caught up by excess emotion in either direction.

-

Its just noise and drivel.

RH has infected this site by posting the same charts multiple times a day (why? what is the point?).

Its clueless ramblings.

I think many posters have just got fed up with this posters style the waffle covers up a distinct lack of knowledge.

There is no point coming here and having to wade thru this bilge just to find some common sense.

I'm sorry, but I have to strongly disagree with this.

RH is one of the posters that keeps me returning to this site.

His posts are always informative and balanced and his knowledge is wide-ranging. I am always glad that he is prepared to share it with those of us who are less knowledgeable.

What you consider "waffle" is, in fact, essential background information for any investor. I am always more than pleased to explore the wider view that RH so generously takes the time to present - it is only by so doing that one can get a sense of where we are at any particular point in time. He who refuses to learn from history etc...........

I have to say in all honesty that whereas I would miss RH's posts and would consider him a real loss to this board were he to leave, I wouldn't miss your posts - and that's just an observation, it is not intended as an insult.

Therefore, please exclude me from the "many posters" that you mention.

-

If you look at Jim Sinclair's site with its pictures of dogs with cheesy captions, you might be put off what Sinclair has to say - I expect some are but you have to swallow your prejudice and decide if what he says is credible or not.

If you have found the attitude of some of the pro-gold posters here to be unpleasant and use this as a guide to preserving (or not) your wealth, you may come to the wrong conclusion as to what you should do. Look at the numbers, look at the debt, look at the wealth production of the UK vs its consumption - look at the facts to guide your decisions!

No, I don't find the posts of those who are pro-gold unpleasant - at least, not in the main.

The thing is, I'm not prejudiced against gold per se; in fact, I am very open towards the idea of holding gold and even more so of holding silver.

But I find myself very put off by the "lift-boy" mentality that now prevails. What with gold-bugs and ads on tv and Ebay and the rest, I'm inclined to believe that we've got to the blow-off phase of a bubble.

Hence my refs to lift-boys and shoe-shine boys.

-

following on from Legatus

'R' posted a picture of the DJIA insinuating that it would crash in Feb ( he posted a relevant picture at the time, I remember it well), well today he is pointing towards this line from a link on his site:

the advice is: "wise investors would focus attention.. to/on 1937

(check out 1866 as well)"

"1937: 10/03/1937 (March 10 1937) Start of 2nd worst market crash of 20th century; Starting DJIA: 194.40; Ending DJIA: 98.95; Total loss: 49.1%; Total days: 386

1866: 05/1866 (April 1866) Market Crash (England, Italy) Suspension of Bank, Italy abandoned fixed parity"

this has been a looooong time coming imo & will show the stock market for what it is, its been running on lies for months now, pure lies.

TPTB in the US & UK (Europe as well) have been using QE funny money to buy stocks'n'shares using the the coporates to buy there own stuff (no links provided just experience, common sense & a whooooole lot of reading

) hence pumping the markets up & suckering back in.

) hence pumping the markets up & suckering back in.GOM

It may well be the case that the stock markets crash, if not next week then some time later this year.

But that doesn't equate, in my mind, to a necessary rise in the P o G.

The strange thing is, the more I read of your posts (and the posts of other gold-bugs) the less inclined I am to invest in gold. I am constantly reminded, by you and your ilk, of tulip mania and lift-boys!

Meanwhile, I've got a pair of shoes that need shining.......

-

As far as i knew central banks still settle in gold via the bank of international settlements

But most people on the planet dont see gold as money as far as i can see. Gold is instead like diamonds or pearls.

Most people will not take gold as money because they are unable to know it is gold, just as people are unlikely to take a diamond or a pearl because they cannot know if it is genuine. It is an impractical money unless it is made into recognised coins that can easily be passed to another person.

If you offer me gold and pay for my expenses to melt it down and have it tested we could probably trade however provided i took no risk for whatever happened to your gold while it was tested and i was still due payment regardless of the results of my test.

I watched a youtube video (can't remember what it was called or where I got the link from) about a reporter trying to sell to anyone on the street a 1oz Canadian Maple worth $1000.

No one would take it - not even for $20!

-

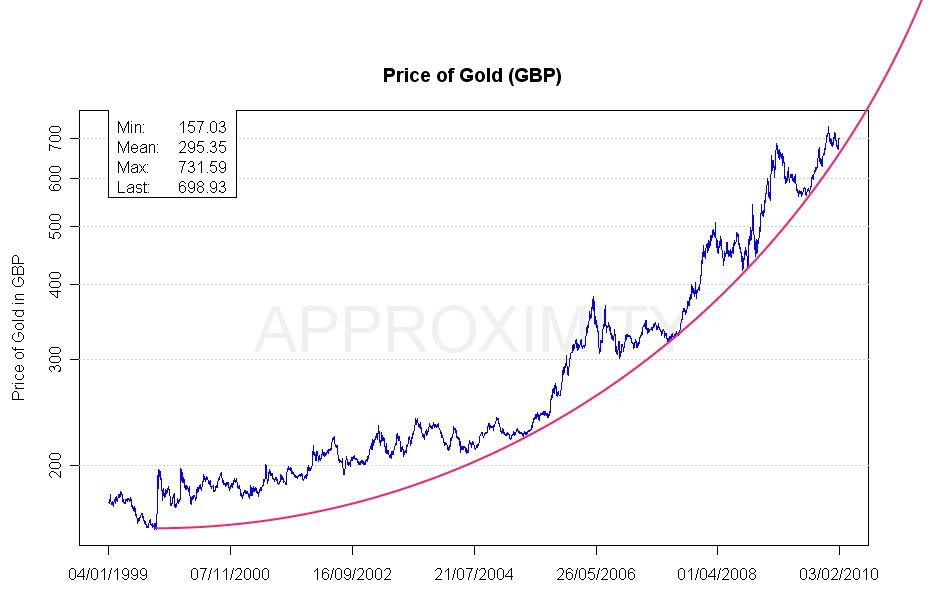

When hyperinflation occurs, the purchasing power of the currency ends up at zero. The exponential curve could be used for anything - not just gold. The actual increase in purchasing power of gold in the last few years is as a result of prescience of the few who are buying it while they are able.

Hyperinflation when it occurs is always very short lived - it is the final blow-out phase before the search for equilibrium results in an opposite move. And if the opposite move cannot be found then there is a self-destruct.

Within an oscillation there is an up and a down move.

Those that catch the up do well - unless they believe that the up will continue exponentially toward infinity.

The trick is to ride the up and bale out before the reverse swing.

The difficulty is to identify the tipping point.

The only certainty is that the tipping point and consequent reversal WILL occur.

I just think that gold has reached a tipping point and will reverse.

Psychologically, which is the more immediate/greater fear in the mind of an investor?

Immediate losses or losing out on potential gains?

My bet is that the immediate fear of losses due to a large correction will cause its own positive feedback loop downwards until equilibrium is reattained.

-

If you are assuming that the currency will have a stable purchasing power into the future, you would be right. The purchasing power of gold will probably go up somewhat - perhaps double what it is now. The exponential curve does not represent the purchasing power of gold only the amount of zeros in fiat needed to buy it. At some point, no amount of devalued currency will be accepted for gold (when the line is vertical) This does not mean that the purchasing power of gold is infinite, just that all faith has been lost in fiat. There are many historical examples of this. The collapse of the Soviet Union is recent and well worth reading up on.

I'm not convinced that the base-line measure against which a parabolic rise is measured is very important. It may have a short term importance (Weimar germany, for instance) but the correction toward balance will always be the over-riding driving force.

-

Machine guns, tinned food and a log cabin in the hills ?

Lol!

Sorry, perhaps I shouldn't laugh, but this one-liner drew an instant chuckle for its brevity and perceptiveness.

-

Prechter is a fool if he thinks the Dow at 1,000 or anywhere near is possible.

He is nuts the whole system would implode everyone would be bankrupt pension funds, insurance companies, banks govts etc.

Guess what would be the only thing worth holding in that scenario - it has no liabilities has been used as currency for 99.99% of the last five thousand years.

Its a paper bubble not a gold bubble, everyone is using paper promises, when everyone is using and talking about gold then I'll concede it is a bubble.

If Prechter thinks he can just swan in and buy physical gold at $300 an oz he is delusional.

He is one stopped clock who will never be right.

The physical and paper gold and silver markets are disconnecting big time right now physical gold is in strong hands that is how bull markets work.

I don't get the impression that Prechter is trying to buy gold at $300/oz. I think he's just telling what he sees - a bit like I am attempting to do.

Prechter does it from a financial background and I do it from a background of 5 decades of keen observation of people, the natural world, psychology etc.

My observations and experience lead me to believe that Prechter is correct in his forecast - simply because I "feel in my bones" (shorthand for some kind of sub-conscious distillation of knowledge and experience) the constant tug toward balance.

Gold is NOT going to go parabolic - the equal and opposite reaction that attends all systems will click in before that.

-

LOL money printing isn't part of nature - politicians and central bankers can make anything go exponential.

Markets are"part of nature" inasmuch as they reflect the actions of people.

Markets always seek balance - they don't like parabolas and always correct. If that were not the case then the POG would by now be in the £millions/oz!

I just see these moves more as oscillations (as per the graph I linked) than one way parabolic moves toward infinity, and with a constant search for equilibrium.

As RH and I touched upon in another thread (or maybe it was this one - can't remember) the search for balance underpins all existence with wild swings in one direction compensated by excessive swings in the opposite direction until momentum declines and a position nearer to balance is achieved - think of a pendulum.

I think this 10+ year bull run in gold may have a little further to go but not much - I expect to see an equal and opposite move in the not too distant future.

I think Prechter is right.

-

The cartel appear to be determined to give themselves the opportunity to clear some shorts before the CFTC position limits possibly come into play. It will be interesting to see how JP Morgan's silver positions change during this takedown.

I get the feeling we will soon be back in backwardation and physical metals will be in very short supply.

Just to remind everyone of the longterm picture

Predictions of exponential growth always makes me feel uncomfortable. Positive feedback loops are inherently unstable and nature abhors instability and always seems to self-correct at the blow-out phase.

I think the graph to be found on Page 35 here: Unexpected Behaviors in Higher- more accurately represents real world systems.

Graph of Sustained Oscillations

Sorry, I cannot copy it to here - don't know how to.

.

-

$1,101 gotta keep it on topic.

Still testing the underside...

Let's see if it bounces back through 1125 before we dismiss this correction. There could still be more downside to come......

-

Its all very strange.

Maybe someone reading this:

So long as Fiat money is easier to create than gold

Thought you were alluding to being some master forger?

Cos last time I checked its much easier for me to add gold to the gold supply (go to some river and siv it out) than it is for me to print £ notes.

"siv"???

Lol!

Did you read that Willem Buiter article I linked.

I found it very interesting.

Edited to add:

Re "siv"...

Perhaps that was a very clever reference to SIVs and nothing to do with them there mesh thingies....!

-

Oh I am sorry I got the wrong end of the stick yes I agree I think I can name at least one.

Ssshh.

If I say I love paper will I get rehabilitated?

When I mentioned that I thought it might be possible that some forums are filling up with paid paper pushers masquerading as gold lovers who always tell you to wait until it has fallen in price to nearly zero - I obviously didn't mean it.

There thats better.

Gold having a strong day silver having an even better day.

Hey, C.J.,

Look, I don't think there is any point in your getting paranoid.

I haven't a clue who reported your post, but it is possible that it had more to do with your allegations of trolling than your derogatory references to paper money.

Either way, so what?

I like to read your posts - I like to read everyone's posts - so why bother so long as you can continue to post?

Just ignore it.....

...and keep posting.

All the best and I hope your strategy works for you in the long run.

As you may have discerned from my posts, I'm still undecided re gold, at least, anything above a diversification style 10% of portfolio.

But I'm open to being convinced - which is why I like to read both pro and anti gold-bug posts.

So just keep posting......!

Edit: diversifaction???!!! Good lord, my typing gets worse by the day! Substitute diversification.

-

My post above has been reported and I have been warned again!!

Well, I assure you it wasn't me even though your post was a response to mine. I had no problem with it.

-

does GM forward buy?

I dunno. But it would make sense from their perspective to forward buy on the dips in anticipation of orders if the trend is upwards, wouldn't it? However, such a tactic would not be so clever if the POG reversed to a down trend. An enforced 3 month max for holding cash would limit any losses and also generally encourage full investment for fear of running out of time.

How can we be sure given how lax Jersey financial reporting laws are?You tell me!

-

I believe it has something to do with GM being based in Jersey, British Channel Islands. I think it was caught up in the recent international moves to further regulate outlying areas where it was thought tax evasion and money laundering was taking place. That's the official story as far as I know, others might be able to fill you in on more detail. I thought it was odd at the time, and it did seem like a change in "terms and conditions". I am now using BV to hold dollar funds.

Hmm, so you don't think it's a ploy on the part of GM to share any losses that might occur if they forward buy physical to meet potential orders and then get caught in a big down move?

So long as they can keep people fully invested in gold, then POG corrections are shared. If everyone can move freely in and out without any restrictions, GM is left holding the baby in the event of a long term correction.

-

You can sell anytime. But the problem is that at GM they have a new rule whereby you can not sit on cash for more than three months. This new rule/ regulation put me under pressure to sell dollars and buy bullion. I think GM is still good for those who want to buy and hold... but for those wanting to transfer between bullion and cash from time to time, BV is the better option.

If I remember correctly, you posted that GM said that this new rule had to do with regulations outside their control.

Is that true? If so, why not the same at BV?

If not true, why would GM want to make it difficult to stay in cash?

Or am I just being unnecessarily suspicious?

-

I found the following article by Willem Buiter very thought-provoking.

Gold - a six thousand year-old bubble

Here is a an excerpt from the article but it's worth reading the whole.

Because to a reasonable first approximation gold has no intrinsic value as a consumption good or a producer good, it is an example of what I call a fiat (physical) commodity. You will be familiar with fiat currency. Unlike what Wikipedia says on the subject, the essence of fiat money is not that it is money declared by a government to be legal tender. It need not derive its value from the government demanding it in payment of taxes or insisting it should be accepted within the national jurisdiction in settlement of debt. Instead the defining property of fiat money is that it has no intrinsic value and derives any value it has only from the shared belief by a sufficient number of economic actors that it has that value.The “let it be done” literal meaning of the Latin ‘fiat’ should be taken in the third sense given by the Online Dictionary: 1. official sanction; authoritative permission; 2. an arbitrary order or decree; 3. Chiefly literary any command, decision, or act of will that brings something about.

The act of will in question is the collective attribution of value to something without intrinsic value. Being declared legal tender by a government may help achieving that status, but it is neither necessary nor sufficient.

Gold is very close therefore to the stone money of the Isle of Yap. This stone money, known as Rai, consists of large doughnut-shaped, carved disks, consisting usually of calcite, that can be up to 4 m (12 ft) in diameter, although most are much smaller. Apparently, the total stock of Rai cannot be augmented any further. It also depreciates very slowly. This intrinsically useless form of money in the Isle of Yap is in all essential respects equivalent to gold today in the wider world. Another example would be pet rocks, as long as the rock in question is rare and costly to get into its final shape.

Gold has become a fiat commodity or a fiat commodity currency, just as the US $, the euro, the pound sterling and the yen (and a couple of hundred other currencies) are fiat paper currencies. The main differences between them are that gold is very costly to produce, while the production of additional paper money has an extremely low marginal cost. If we count the deposits of commercial banks with the central banks, which together with currency in circulation make up the monetary base, as fiat money, then the incremental cost of fiat base money creation is zero.

It is controversial and has attracted quite a few indignant comments which are also worth reading, imo.

I'm not saying I agree or disagree, only that I find the article thought-provoking. And I have to admit that I'm still wary of gold as a hedge against either inflation or deflation and even against a crisis although I can see the value of holding 10% of one's wealth in gold or silver. But I cannot quite put my finger on the cause of my disquiet.

I suppose it would depend on how deep a crisis became; gold as a store of wealth is very much a construct of society thus if society breaks down, one wonders whether gold would retain any value.

I was thinking of Zimbabwe and Mugabe's land grab (white owned farms) and was reminded of communism and similar land grabs. It seems to me that the ultimate store of value is productive land together with breeding herds of livestock, a comprehensive seed-bank, and availability of human labour, plus essential tools, to farm that land. Which is why, perhaps, totalitarian states always make a land grab and not a gold grab.

All other forms of wealth, including gold, are essentially derivatives of this ultimate store of wealth - the means of survival.

And I wonder whether, in a crisis, any amount of gold could tempt a landowner (farmer) to sell his land.

-

If there was five empty disabled bays, and you only needed one but someone undeserving had parked in a disabled bay as it was conveinient, as it was raining or late at night, would you still be vocal in questioning them or think of the bigger picture?

Of course not! Rules are there to grease society, not to terrorise it! But that takes discernment on the part of every individual and we seem to be lacking that these days. The spirit not the letter of the law is what is most important.

Let me put the boot on the other foot....

I have a disabled parking badge so could, in practice, use it even if I did not have my disabled daughter with me - and I have seen this occur many times - even though it is against the law.

However, I choose from conscience, not threat of penalty, to limit my use of the disabled parking badge only to those occasions when I really need it - that is, when I have my disabled daughter with me.

I am all too aware of the difficulties that I have experienced when forced to use a normal parking bay because all disabled bays have been taken to ever want to inflict that on another for purely selfish reasons.

.

-

Can't you grass them up for a couple of hundred quid now?

EDIT: I actually thought before that not many poeple would go down that route, but given the problems we are in financially I can see many more porple going down this route. Maybe leading to more social disturbances

I find the whole concept of "grassing-up" reprehensible, and when the government offers money to those prepared to inform on their neighbours, I am reminded of the GDR and other totalitarian states.

Surely, the better thing to do is to approach the man who is cheating and confront him - is it not?

I am always irked by those who park in disabled parking bays without any need. I know they are located nice and close to the shop entrance but it is not that which makes them essential to me when I take my disabled daughter shopping. It is the extra width which allows one to manipulate a non-standing, non-walking person from car seat to wheel-chair that I need - and in a normal-sized parking bay, this is simply not available. Therefore, when I see the underserving parking in disabled bays, I am very vocal in my questioning of them!! What I refuse to do is "grass them up". That way lies an informer society where the only winner is the state and no-one is able to trust his neighbour - divide and conquer - we all become slaves of the state rather than the state serving us.

-

It sounds very impressive but then it would to me not having any knowledge in the field or industry. It does look like a patent for a wonder drug is in the making, I particularly like the fact that it prevents the virus from infecting the cell compared with the competitors products which are a cure rather than a prevention. An ounce of prevention being better than a pound of cure. The fact that their "product" (is that the right word?) may be able to be customised to whatever virus the receipient is likely to be exposed to is..... well, like you said a possible trip to pluto for this stock.

Feet firmly on the ground though, without being able to calculate an R2R ratio it's purely a speculative punt to me with a small amount of money (a lot less than allallans recommendation)I can afford to lose. If it doubles my moneyt I'll probably take half out for a risk free investment.

Wave 4's or iv in this case tend to retrace 38.2% so we "may" have (hopefully)seen the last low for this stock for some time. Drilling down on the lower time frames would confirm this (if we are in an impulsive wave) IMO.

I was all prepared to take a small punt on this ($1000) but decided first to consult my daughter-in-law who is a bio-chemical research scientist - most recently in stem-cell technology. As such she is very much in touch with everything bio-scientific and especially with the value (or otherwise) of any particular patent - she has been very involved in seeking patents in her specific field of endeavour.

She was distinctly unimpressed.

I have asked her if, from the kindness of her heart, she could put down in bullet points her disquiet that she relayed to me over the phone. She has convinced me that it is not a worthwhile investment, not the least because the company founders appear to be awarding themselves million dollar salaries while seeking additional funding from the markets. She is also unimpressed by the patent held.

Anyway, I do not want to misrepresent her (or to impugn NanoViricides) so I shall post more if she is kind enough to give me a written account of her disquiet which I asked of her whilst admitting it was a total imposition requested only so as to warn you good folk.

Meanwhile, her concluding advice was:

If you want to invest in a pharma you'd be better off investing in Astra Zeneca and if you want to make a speculative bet, buy a lottery ticket.

-

Silver is money.

There is a beauty in these images - for me it's a bit like the hypnotic beauty of a swaying cobra.

-

Has anyone read this? If so, what do you think? Further, would anyone be kind enough to precis it in terms that are understandable to a complete dummy?

It doesn't sound good to me. Although what I do take from it is, buy silver now (physical only) because the price could explode any minute. Or have I read that wrong?

Is the Price of World Silver the Result of Legitimate Market Discovery

It's quite a long article but here's an excerpt.

It seems to me that there may be real stress in the wholesale physical silver market. All the factors I look at, including flows into ETFs, the shorting of SLV, the decline in COMEX silver inventories, the strong retail and institutional investment demand in silver, the now growing world industrial demand, etc., suggest tightness and the potential for a silver shortage like never before. This, in essence, is the real silver story. In spite of a large and growing concentrated short position, the price of silver suggests that it is the manipulation that is under stress. At some point, a physical silver shortage will destroy any amount of paper short selling. We may be very close to that point.When the silver shortage hits, the price will explode. On this, there is no question. Industrial users, at the very first sign of delay in silver shipments, will immediately buy or try to buy more silver than they normally buy, in order to protect against future operation-interrupting delays. This is just human nature. The world has never experienced a true silver shortage ever, so the price impact is clearly unknown. I’ll try not to overstate how high I think the price will go in a true silver shortage and how quickly it will occur, so that I don’t sound too extreme. But the price move will give new meaning to “high” and “fast.”

.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

...................and still I haven't bought any gold!

I'm either the last of the idiots on GEI or the first of the sane!

And I know without waiting for a reply which category most are going to put me in.

And still I cannot put my finger on why I am so reluctant to buy gold.

Something, somewhere doesn't add up.

But I'll keep listening to the gold-bugs and gold-buyers in the hope that one of these days the penny will drop or I'll work out why I have been so reluctant to allow the penny to drop.

Either way, thanks for all the input.