-

Posts

3,103 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by warpig

-

-

Thanks for the reply. Yes you can use the ratios to swap from one asset to another, but that doesn't guarantee you're getting the best price for either. What if when you sold your silver you stayed in cash and bought gold now, you'd be significantly better off than playing the gold:silver ratio. If you've been in precious metals for the last 3 years, you've suffered a significant loss of profits the same as the rest of us. If you look at the CCI since late 2011, the decline in commodities is unmistakable and yet to this day, I've barely seen it mentioned let alone discussed on any of the goldbug sites. It seems to me that gold-[bulls|bugs] refuse to accept gold can still act as a commodity, yet the last 3 years clearly prove this wrong.

My mistakes were believing gold would "only" act as a monetary asset since 200[7|8] and not having a full appreciation for money cycling in and out of asset classes depending where we were in the business cycle, I drew some wrong conclusions.

It's not that I don't believe there's manipulation, after all that's what the anonymous HFT bids and dark pools are, it's just I don't think long term market trends are surreptitiously manipulated, although in the short term everything is. I accept the impact of loose monetary policy, but this isn't manipulation, it's mismanagement. The London Gold Pool and gold leasing were open secrets and were clearly connected with the gold standard, so this was "different..." IMO.

I also don't believe in the hyper-inflation thesis anymore, so I "may" consider going to cash when gold peaks next. Clearly inflating the debt away isn't working and I am confident they won't try and push the string much harder, because they'll sacrifice the currency if they hyper-inflate. Having said that I reserve the right to change my mind as conditions change!

I'ii come clean and tell you that I don't think I personally made a mistake with silver, but I did swap it for gold at $49.20 in 2011, which you might consider a mistake, but I do not.

My swap bought me three times more gold than I would have otherwise obtained, if I had just bought gold with the cash instead of silver first.

The trick there imo was to buy something which screamed good value (silver), and bail out when the profits were good enough (3x in as many years).

As to my "mistake" with gold, well .... gold is at it's 2011 highs in Yen and Euros. It's also at new highs in Rubles. If you're Greek, you dont regret buying in 2011.

There but for the grace of god goes the UK. The GBP 'profit' on gold has not yet been good enough for me to consider swapping out of it. I think there's a blow-off coming, some massive catastrophe as the Central Banks are forced to let go of an unsustainable position (somewhat like the SNB was forced to let go, but for reasons of poor fiscal management, ultimate erosion of the USD as reserve currency [reversing this little uptrend weve seen])

Now, as for manipulation - what we have seen over the last 2 years in gold, I believe *is* largely manipulation.

Something is brewing, and it involves China and Russia.

Indian authorities have clearly particpated in that manipulation (either wittingly or unwittingly), at the expense of their people.

Now, I don't know if we had the Fed, the BoE or the SNB doing it, the Obama-bankster meeting the day before gold was slaughtered seems like a clue to me.

Gold behaved for 2 years like 'the red headed step-child'. It got beat for anything and everything.

There has clearly been stress in the physical market - because I personally have seen arbitrage opportunities between futures and spot gold which made $1/Oz for not holding gold.

Stress in the physical market comes from entities demanding delivery.

Futures prices can be whacked on margin.

There is your manipulation! - physical delivery on the cheap.

In December 2014, something changed. Gold began to rise with the USD rising.

The futures whacking slowed and is now more occasional (perhaps that's healthy speculation).

India is now easing its tax and import/export regulations, so they are coming back to the market.

China is apparently guzzling gold at a rate of 200 tonnes / month through Shanghai Gold Exchange.

My view: let's see whare this takes us. I'm not selling/swapping out until at least 100 Oz buys an average UK house (if that exists!).

(I already own my home, but I'm use the average home as a measure of value to help me decide when to swap)

As to what to swap to? - my ideal would be a mix of bonds and equities; whichever seems good value.

BUT the distortions in both those markets are so extreme at the moment it will be fun to see how that plays out from the sidelines.

I aim to buy either bonds or equities when the blood is on the streets for those markets.

Gold will have its day. Silver too, likely.

-

Conspiracy theories haven't been able to predict the price of gold for the last 3 years. I'm really pissed off with myself for not seeing the top in 2011 and I'm prepared to admit a lot of what I described as sinister shadows controlling the gold market, was actually a lack of knowledge and putting too much "faith" in others. I'm of the opinion that unless we work out where we all went wrong in 2011, we're likely to make the same mistake at the next peak.

Doesn't that worry you?

sorry mate, but lolz. -

It absolutely isn't reflected in the price and you should be concerned.

Nah, not in the least bit worried about the political risk.

And it's already reflected in the price so that's even better for investors like myself who regard that risk as being negligible.

-

I agree, silver rose about 14% compared to gold which rose about 9% since the beginning of the year, margins are expected to rise as the price rises. Isn't it about time we stopped seeing conspiracy in absolutely everything..?

-

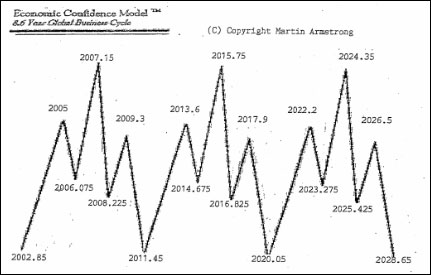

I agree, I've been an idiot too. It's now clear to me commodities are in a significant bear market and since 2011, gold has been acting as a commodity not as the money of last resort. I think it's very healthy to acknowledge your mistakes or you're bound to repeat them. The dollar is going to rally much higher from here and it could push gold down in dollars to $680, in Martin Armstrong's own words, "This is the extreme target we have to respect is possible." He believes gold won't resume it's bull market until 2016, I believe he's said Q1 in the past. However it should then rally until 2020. He says this is all about the dollar and it's the process of repatriating the dollars that will cause the system to fall apart.

I suppose it should also be said, this doesn't necessarily reflect the price of gold/silver in local non dollar currencies. As the dollar strengthens, presumably other currencies are in decline which will cushion gold/silver. Non of this is what I want to hear either, but I can't help but feel it's going to come true.

The gold bugs have been complete idiots for the last 3 years. I include myself in this.

No doubt the bottom will fall out of the recovery at some point, but if you held gold you are sitting on very substantial losses. Don't even mention silver.

Where's the bottom? here? $1000? $800? No one has a clue at the moment. All that we know is that the price is falling and continues to go lower.

-

This chart paints a clearer picture IMO.

warpig talked about an interesting indicator to monitor for confirmation of the change in gold direction on 24knews today, the CCI index. Looking like it is about to confirm it breakout with a test at around 504

-

Pixel8r spotted this today, see if you can spot Brown's bottom.

-

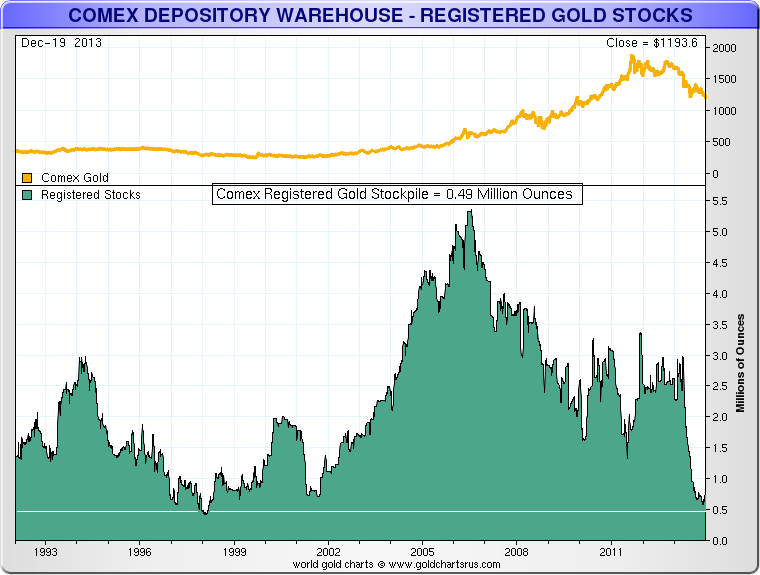

Fundamentally there's every reason to be a permabull in gold, but that doesn't reflect the real world. People don't always make the right logical decisions, there are other influences. Having said that, what perplexes me is how the price can decline for 2 years and yet inventory levels are so low. I think it shows the gold market doesn't reflect the underlying commodity any more, it's more about the wallstreet casino than hedging genuine production and that sort of mentality is exactly what put the financial world in it's current predicament.

The western economies must go back to manufacturing, where real things have real value. Trading is just educated gambling, it's distorting all of the markets everywhere. I think history will look back at precisely now and label western governments naive for sending all of the western gold east, in exchange for paper promises that we all know are going up in smoke. Countries were invaded for gold in times gone by and now we vilify gold in a brazen effort to promote fiat currencies. What madness...

BTW - I think the (double) bottom is in.

Sure wish I had better... Underestimating the banksters and too much reading of KWN, maybe!

-

We'll see what happens, but I'd rather know it's a possibility and mentally prepare to sit and wait longer.

-

Latest from MA's blog:

QUESTION: Dear Sir,

are the following figures still valid. Will Gold fall to USD 950 per Ounce or is it more likely to build the low in the optimum range?

Thank you for the great audio-interview and your support of the little guy!

T

ANSWER: Yes. The timing is 2014 as the optimal target. However, we could see a cycle inversion pushing the sideways to lower trend into its final low in 2015 and then rally as the ECM declines. This will be laid out in the coming report. But it is ALWAYS a question ofTIME and PRICE. Keep in mind that NOTHING trades in a vacuum. This is like a ballet and every step and every dancer has to be in their place to pull off the great performance.

As far as the low is concern, the price can be between 1050 and 850. It is more WHEN the price is reached rather than the express actual number. BOTH have to be achieved. If we saw $950 tomorrow, sorry, that would not be the low because the time is not right.

-

This is an interesting chart.

-

Full circle...

I've just reread it and I think I agree with his closing sentiment:

I believe any sort of SUSTAINED RALLY in the price of gold will not occur until either CONFIDENCE in the ability of the monetary masters is shattered or rattled, or INFLATION EXPECTATIONS begin to arise.QEIII has been slated to end mid 2014, is gold going to trend lower until then?

Also, that momentum - HFT, algos sure helped push that along. A manipulation, if you like.

Guess I'm paraphrasing Trader Dan and Stewart Thomson, in the main...

http://traderdannorcini.blogspot.com/2013/12/qe-is-not-producing-inflation-here-in-us.html

Get the regular bit from ST here: http://www.321gold.com

-

I should have refreshed the page before I replied to Jake. Yes I guess that's mainly it, but why didn't we see it coming? We should have IMO...

The ramp up in gold price to 2011 was QE/inflation expectation related. When it was seen that the printy supply wasn't splashing around but was being contained by the banks and used for profiting/speculation on (so inflating) the stock markets, others money tagged that way. And, like DrB said - momentum... I don't think it was lots of people seeing the 'light' and gold as a monetary asset (with a currency crisis coming) and then dropping that in 2011 to just see it as only a commodity again... This year, banister/corrupt politician meddling to cripple the gold markets in India (and China for some time) has also had it's effect. Maybe next year will see the restrictions dropped in India and cost-push inflation start to show more... See what Japan gets busy with.

-

Hi Jake,

Good to see you too. Are you still in Japan? I just took a look at gold in JPY, I'm surprised it's come off the boil, I assumed it would still be at all time highs. I assume you sold at the top...

I really like your theory, although I've always thought shale oil/tar sands was a negative EROI, but perhaps I'm wrong on this. I know it's heavily dependent on low IR's, perhaps there are other influencing factors.

Yes that's the irony, nothing's changed, in fact that's not true, everything's magnitudes worse! I can appreciate the world's chasing yield, but I never thought it would have this much of a detrimental effect on gold. Adding further insult to injury, western inventory's going down whilst eastern demand seems to be higher than ever... can that be right? Surely only a lack of demand or a glut in supply can cause a lower equilibrium!

Whilst I was hunting around your oil theory earlier I can across this -

The QE Pump StopsIn June 2011, the QE pump which had been keeping commodity and equity markets inflated and correlated stopped, and price levels began to decline. Consumer demand – as opposed to financial demand – for commodities had also been affected not only by high prices, but by reduced demand from developed nations for finished goods. In September 2011, more than $9bn of index fund money pulled out of the markets for the safe haven of T-bills.What happened as a result was that the regular rolling over of oil leases, and the free dollar funding for producers of their oil inventory ceased. So the leased oil returned to the ownership of the producers, while the dollars returned to the ownership of the funds.Since the ‘repurchases’ were no longer occurring, the forward oil price fell below the current price, and this ‘backwardation’ was misinterpreted by market traders and speculators. They believed that the backwardation was – as it usually is - a sign that current demand was high and increasing relative to forward demand, whereas in this false market the current demand is unchanged but the forward demand is decreasing.I thought the timing was interesting, so I wanted to remind myself of the dates of different iterations of QE.QE II ended in June 2011 (Buy $600B of Treasury securities < Q3 2011)

Operation Twist - 21/09/11 - Buy $400B long dated bonds (6-->30YRS) + sell short dated bonds < 3YRS - This strengthened USD20/06/12 - Added $267BQE III was announced 13/09/2012 - $40B/month MBS12/12/2012 - increased to $85B/month MBSIf you look at the end date of QEII, the duration of operation twist and the start of QE III against a gold chart, it looks to me like it's caused stark behavioral changes as far as gold investors are concerned. I appreciate it hasn't happened in isolation, there are of course many other influencing factors like oil, the velocity of money, European fragmentation etc... etc... but it's hard to ignore those dates on those charts...

Why would QEII encourage people to buy gold and QEIII encourage people to buy equities..?

Warpig, if you take Chris Martensons thesis re oil energy as driver of finance, the oil shale/shale oil/sands/etc...seem to have given a much needed shot in the arm-for a while-to our way of financing the future.

Oil Drum packed in. Detlev packed in. Orlov picked in...all around the time of Barisheffs 10k gold book! Puplava changed tunes. Russell too.

But anyway I think it's all about having a bit more room to run thanks to a few drops more of oil.

Nothing else has changed really. In fact except for QE induced fixes, everything is worse. Except we don't realise it yet.

Nice to see you btw! -

Of course.

Does anyone think China will partially back the remnimbi with gold?

-

Exactly.

Very interesting....

Flip that Upside Down for Gold:

2011.45 to 2013.60 was the Bearish period !

-

Interesting... (6-10/2) 8 years for the top of the mania in gold is inline with Martin Armstrong's ECM, but as he said he expects healthy gains in gold up until that point. I was hoping to drop out around 2016 assuming MA's ECM holds true, but this of course all hinges on what's happening...

So with that article in mind, why did investors decide gold should be considered more of a commodity rather than a monetary asset at the end of 2011? What changed?

-

Whilst true and if we trust the current price, then supply must still have been greater than demand. Do you know anyone that predicted the current 2 year decline DrBubb?

-

I broadly agree it's "stored" in certain financial and consumer asset classes, but I still can't help but wonder if there's something else we've missed. Martin Armstrong has a 2014 metals report coming out early next year and whilst it isn't cheap, I'm tempted to buy it given he was the only one who nailed this correction AFAIK. It would appear he has an insight in to the gold market.

Yes that sounds about right, as the rich get richer and the poor get poorer, high earners are spending their `winnings` on high end items and inflating high end asset prices. Sounds like you got a bargain!

The money velocity might be low if the new money goes directly into the equity/bond markets and stays there?

As a collector of art and coins myself, I can tell you that the 'bubble' is only at the very top of the market. The lower echelons are still very affordable; as an example I bought a painting last month whch sold in late 1987 at Sotheby's for three times what I paid.

-

Yes when potential inflation becomes kinetic inflation, the financial landscape will look very different.

Inflation is currently "stored" in currencies, bonds and equities markets. At some point when these bubbles pop it will leak out and find its way into commodities and general consumer prices, and at that point the SHTF.

-

I accept the velocity of money is very low, but bubbles are still appearing in other asset classes. Look at equities, London property, yachts, fine wines or art, fine art has doubled in 6 months. So there is a lot of money sloshing around, it's just the love affair with gold ended. It seems nonsensical to me, everyone has such a short term mentality... I don't understand the mindset that would have someone sell their gold and buy fine art. Collectibles are notoriously bad at retaining value in a financial crisis.

I think the MV plunge is the cause of the gold price drop. The perception of inflation is low because of it.

I think also the Fed and the USGOV are responsible for that drop. I think it happens when people and corporations' appetite for loans diminish, they hoard cash, see little value in bonds or equities and are unsure about the future. Also, corporations may hoard cash overseas (e.g. apple inc.) for tax reasons.

I think personally, usually gold does do well in deflations, but you have to admit that if there is a significant inflation in cost-push terms (prices) from here, like in the 70's?? then there will be no mining activity at all unless the gold price rises!

We could be in for a 70's-style ride. Bubb's charts seem to show it is possible. Dr B., I liked the a-b-c-d-e-f-g-h-i-j-k analysis! Very interesting.

Goldfinger always said these moves were often self-similar.

-

This seems to fit in with the charts I've posted above. It feels like there is light at the end of the tunnel now.

GOLD, A familiar pattern?

I think so - just look at it !

Of particular similarity is:

+ Waves c-d-e-f : "the box", where d and f are about the same level+ Wave-f : is the "mid-correction peak" !+ Wave-g : holds above the c and e lows+ Wave-h : the "last gasp" rally+ Wave-i : the slide into: The Low at "i"+ Wave-j : a small rally+ Wave-k : Retest Low (higher than i)========If this pattern is repeating, Gold is now on/near the Retest Low -

Thanks for the reply. I've just realised I wrote something interesting above - "especially considering everything was falling apart?", perhaps that's it, it "was" falling apart and now it isn't, gold is certainly a hedge against uncertainty. I'm not sure what's changed in terms of the Euro's stability, but there's very little reported anymore and I don't recall anything being fixed... Do you see the declining velocity of money as a symptom or the cause?

Martin Armstrong has stated all markets are gamed in the short term, but you can't influence the long term trend. The longer this continues, the more I've come around to his point of view.

I think Dan Norcini has hit the nail on the head here:

http://traderdannorcini.blogspot.ca/2013/12/qe-is-not-producing-inflation-here-in-us.html

Money velocity is at multi-decade lows

of course, for my money, he discounts the daily weird price smackdowns as normal, which I feel they are not.

-

So what did the gold [bugs|bulls] overlook? I have to say I didn't expect a 2 year decline in gold and silver and even now it's hard to appreciate why this happened. Martin Armstrong predicted a 19 month decline, but I'm still at a loss as to why. Now I appreciate everyone's chasing yield, but what was wrong with chasing capital gains, especially considering everything was falling apart? What caused the fundamental switch? Does anyone have any credible ideas? It's not as if anything appears to have changed, but clearly something underneath the surface has... Anyway, a couple of charts to ponder, both of which hint gold is just about to complete a huge double bottom IMO, although MA believes there's still a small amount further to fall from here, $900 being the absolute possible bottom IIRC.

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

Controlling the price of gold was part of the plan, it wasn't a conspiracy, it was an open secret.

Yes at some point the game stops, it doesn't go on for a generation or even another decade, the system will collapse under it's own weight. They know they can't fix it, the best they can do is stall for time. Hyperinflating the currency would cause more problems than it solves, they won't do it.