-

Posts

1,421 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Errol

-

-

Trump needs to win or America is lost. Hillary is criminal ahd must not be allowed to hold office (of any kind).

-

Precious Metals Manipulation Worse Than Libor Scandal, German Regulator Says

It may be time to shift yet another conspiracy "theory" into the "fact" bin, thanks to Elke Koenig, the president of Germany's top financial regulator, Bafin, which apparently is not as corrupt, complicit and clueless as its US equivalent, and who said that in addition to currency rates, manipulation of precious metals "is worse than the Libor-rigging scandal."

-

If someone wants to sell me £50 an ounce gold I'm all for it.

-

Gold just another commodity? After 30,221 posts on this thread, this is still a topic on here?

No wonder I had to essentially stop posting at this joint!

It's similar to Hpc forum. You can have endless, circular debates about whether gold is a commodity/money/in a bubble etc. I've stopped bothering, tbh.

-

Doom did not come about as you expected.

You failed and now apparently you think that failure entitles you to respect?

Eh? The crash hasn't happened yet. It's coming. Why are you in such a hurry?

-

More interesting developments ...

Gold Bug Hedge Funds Collectively Report Over $183mm In New Call Option Positions On Miners

While mainstream news sources continue the war against gold and gold-related investments, three of the world’s top performing hedge fund managers have been busy at work building speculative gold positions during the first quarter. George Soros, John Paulson, and Steve Cohen, who in aggregate control over $60 billion dollars, have been aggressively buying the most speculative vehicles associated with gold: call options on gold mining stocks.

Bottom Line: While gold and gold mining equities in particular have become the world’s most hated investment, three of the top hedge fund managers of our generation are not only holding firm their previous gold holdings—but they are quietly accumulating tens of millions of dollars in call options on gold mining stocks.

-

So who is doing all the buying? Where is the physical going - China?

-

ETF outflows? People selling real, physical ounces or just paper? Are we talking about pallets of gold bricks here or just paper?

-

Excellent feature on recent gold moves on Newsnight. Max Keiser on top form!

-

Another excellent piece from Detlev Schlichter: Gold sell-off: There is only one question that matters

http://detlevschlich...n-that-matters/

I like this bit:

If the gold market knows that easy money is about to end, how come the other markets haven’t got the news yet? Do we really believe that stocks would be trading at or near all-time highs, the bonds of fiscally challenged nations and of small-fry corporations would be trading at record low yields, if the end of easy money was around the corner?

To justified the lofty valuations of these markets on fundamentals, one would have to assume that they no longer benefit from cheap money but instead have again become the efficient-market-hypothesis’ disinterested, objective, reliable, and forward-looking barometers of our economic future, and of a bright future indeed, in which apparently all our problems – cyclical, structural, fiscal, demographic- have now been solved, so that the central bankers can pack up the emergency tool kit and gold can be sent to the museum. – Well, good luck with that.

-

Another great article by Detlev Schichter (this time with a hefty section on ownership of gold etc):

Some personal thoughts on surviving the monetary meltdown

http://detlevschlichter.com/2012/11/some-personal-thoughts-on-surviving-the-monetary-meltdown/

My three favourite assets are, in no particular order, gold, gold and gold. After that, there may be silver, and after a long gap of nothing there could be – if one really stretches the imagination – certain equities or commercial real estate.

-

1968 memo from the BOE archives sent by the Bank of England to the Federal Reserve reveals that the Fed sent at least 172 bad delivery gold bars to London in the late 1960′s for safekeeping for the German Bundesbank as repayment for swaps.

The memo also indicates that the Bank of England was willing to keep the discovery private due to the fact that the gold was to be held for the Bundesbank

Exclusive: Bank Of England To The Fed: "No Indication Should, Of Course, Be Given To The Bundesbank..."

-

Ah, now we get the old 'alchemy' stories. lol.

-

Indeed.

And how many posting here one year ago would have predicted that? Or even considered that?

Erm, most of the posters on the gold thread?

Nothing would surprise me. Gold could just as easily drop to $500 as rise to $2000. The central banks are working to cap it below $1650.

-

Right now gold and silver are not trending, they are consolidating and winding up before they begin another move. I can argue the reasons for a move either way

http://jessescrossroadscafe.blogspot.co.uk/2012/04/gold-daily-and-silver-weekly-charts_19.html

-

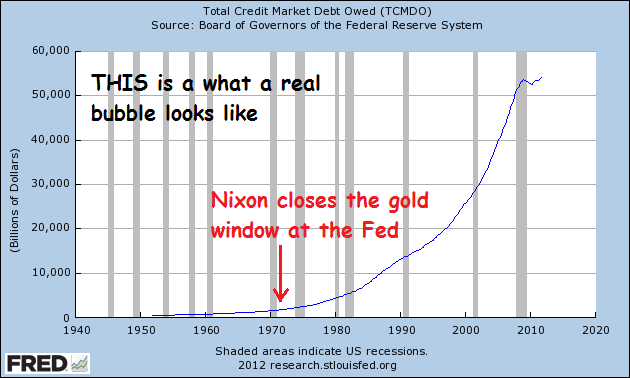

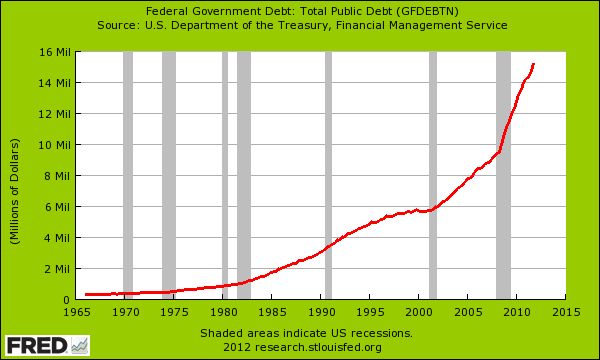

Note the debt is now going up again and at all time highs.

-

Just reading 'The Golden Revolution' by John Butler -

A great read and provides some good ideas about how the coming gold standard might work.

Amazon.co.uk link - http://www.amazon.co.uk/The-Golden-Revolution-Prepare-Standard/dp/1118136489

-

Richard Russell - Crime, Chaos, Collapse & Skyrocketing Gold

With continued turmoil in global markets, the Godfather of newsletter writers, Richard Russell, issued some ominous warnings and gave some strong advice to investors in his latest commentary: “Save some cash, load up with gold and silver, and be patient. Get ready for a crime wave -- a large segment of the population will do ‘whatever it has to’ in order to obtain food. Hungry men and women can be desperate and lawless.”

Worrying

Pretty much in the Jim Sinclair line of thought. Both are correct.

-

Gold Moves Sharply Higher For No Particular Reason Yet Seen - Remarkable Divergence

http://jessescrossroadscafe.blogspot.co.uk/2012/04/gold-moves-sharply-higher-for-no.html

-

Chart suspiciously starts rising after Nixon closes the gold window ... hmmm ...

-

Having said that I personally believe that the market is manipulated

Great piece on the manipulation. It's certainly taking place - I don't think anyone can deny it now - http://www.zerohedge.com/news/paul-mylchreest-presents-various-visual-case-studies-gold-price-manipulation

Report is a great 50+ page read.

-

-

Latest Maund updated - http://www.clivemaund.com/gmu.php?art_id=68&date=2012-04-01

-

Very good report on the manipulation of the Gold price - http://www.zerohedge.com/news/paul-mylchreest-presents-various-visual-case-studies-gold-price-manipulation

The need for such concerted and blatant manipulation of gold, the arch-nemesis of the current over-leveraged world monetary system, suggests that the integrity of the latter is not just fragile, but arguably fraudulent. Understating the situation, it’s high time to be more than a little “concerned”, if you aren’t already.

The Most important election in US History?

in Acore Public Forum: tinyurl.com/Acore-Public

Posted

The Presidential debates will finish Hillary. There's no getting away. She will have to debate Trump live, one on one.