springer

-

Posts

67 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by springer

-

-

Gold at £721. Is that a new all time high?

-

Special offer on 1oz Britannia coins at Weighton

2003 1oz Gold BRITANNIA - Helmeted Design - LAST BATCH

If anyone is interested.

Thankyou CJ am down that way this weekend - might just pop in.

-

Hi Springer

If you are UK-based, is now really the best time to do this WRT exchange rates? How about averaging in over the summer doldrums?

Just my opinion, as always do you own research

Thanks Diet Cola,

I'm a complete pension virgin so I am learning as I go. I was assuming I would have to transfer all funds in one go, I have not done enough research yet and am still waiting to hear back from Scottish Equitable if I can make the transfer at all. But averaging in seems a good idea.

-

In case anyone else is interested - Berkley Burke (not goldmoney) are the company that provide the gold Sipp. It is allocated physical metal and the same vaults as GM are used for storage.

Thanks again chrisct, you've made my day!

-

Thanks chrisct. That is excellent news, I already have an account with GM and like them very much. I would be very happy having a SIPP with them, didn't even occur to me that they might do this.

-

Can anyone help? I want to transfer my small personal pension, which I've had for 10 years now,out of stocks and shares and into precious metals (physical if poss). Can anyone point me in the direction of an investment co that will do this? I'm not having alot of luck on google.

-

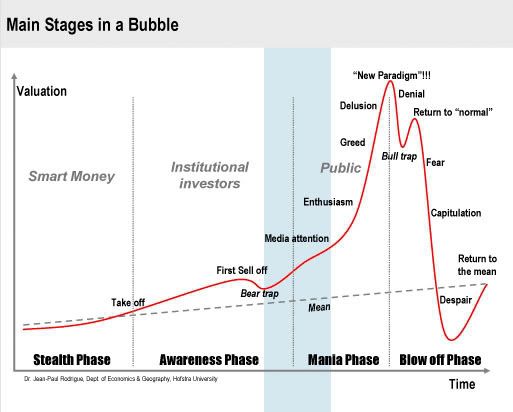

That corresponds quite nicely with the graph below and where I think we are, at the beginning of the media attention stage.

Wow -I hope so, if you're right that's some mountain ahead of us! A mania phase in gold would be very nice thankyou!

-

Maybe it is getting more mainstream - just logged onto my email and front page of www.orange.co.uk is talking up gold!

-

I have managed to gently persuade a few friends now to look into gold. I have passed on what I have learned from this website (thanks guys) and opened the idea to them that there are possibly dire consequences to follow this 'credit crunch' as they are still calling it. I have passed on goldmoney's website to them, told them how easy it is to use and all I can do now is hope they follow through.

It is quite difficult to do cos you want to frighten them enough to make them start doing a bit of research whilst not being considered a doommonger.

I try to lightheartedly slip gold into the conversation if it is at all possible even to the plumber who was whining about his shares! You never know it might just prompt them to get off their backsides and do abit of DD. Just trying to do my bit

-

I think the US stock markters open 9:30 - EST which is 2:30pm in good old blighty

But I think the New York Nymex gold starts at 1:30pm?

You thinking that if it doesn't get to $1000 by the US opening it will not happen?

EDIT: From the nymex web site http://www.nymex.com/GC_spec.aspx

Comex Gold

Trading Hours (All times are New York time)

Open outcry trading is conducted from 8:20 AM until 1:30 PM.

Electronic trading is conducted via the CME Globex® trading platform from 6:00 PM Sundays through 5:15 PM Fridays, Eastern Time, with a 45-minute break each day between 5:15 PM and 6:00 PM.

Thankyou dst for that comprehensive answer. No I'm not thinkinking that. I don't see anything but apalling news day after day and am gobsmacked at the lagg in POG to be honest. I can't deny I am not anticipating anything other than a rocket surge in the upward direction! But when - I just know.

-

What time do the american markets open again? I forget.

-

£664/per oz is this not a new high in sterling?

-

double post

-

Has anyone heard of an auction website called swoopo? The last 5gm gold(Degussa feingold 999.99) bar sold for £7.21 apparently. There must be a catch, there is always a catch!!!

-

-

GOM - it was supposed to be a picture of rocket!

-

That's definitely dandelion!

Great idea though, gave me a laugh on a monday morning!

Great idea though, gave me a laugh on a monday morning!

-

Cheers, yours and goldfingers comments very welcome. The fix does feel to be the way to go.

edit: ps. which provider did you go with and why (if not lowest rate) if you don't mind me asking?

Skipton - apparently they are a pretty safe provider that is not too embroiled in this mess, I didnt check this myself though , just took a friends(FA) word for it. Also I can make 10% capital repayments each year. It was extremely easy , they didnt even check our salary/value of house etc etc (worrying

eric would not like that!) Very low LTV though.

eric would not like that!) Very low LTV though. -

I have a mortgage which tracks the BoE base rate (not libor) and as such have been pleased to bide my time in the short term to take advantage of the lowered interest rate and will be happy to do so until they hit at least 3.5%. What do folks think about the medium to long term prospects for 'official' central rates and the prospect of potentially having a mortgage with close to zero interest? Is this likely/probable? Of course I'd like to have no debt but that is not possible right now and it is not practical for me to re-mortgage to a long term fixed at the moment. I totally accept what is likely to happen to rates in the real market. I have been thinking about re-mortgaging to a long term fixed, but these are more closely linked to libor are they not so am in two minds given my current link to BoE base.

Last week I fixed my mortgage at 5.6% for 7 years. I think that IR's could well go down in the short term but I was not interested in saving a few quid now and risk getting caught out later! I did wonder whether I had done the right thing and was especially nervous last fri when electronic money was flying through the system. I was glued to the tv/computer and online banking hoping the system didnt implode that day!

However, having done it I am feeling extremely relaxed, knowing exactly what is what for the next 7 yrs. AND 5.6% is still historically low.

hope this helps

Springer

-

I am very interested to know more about Argentina and in particular the first 2/3 weeks of the crisis. Can anyone point me to any links or even better anecdotal information. I am trying to gage how quickly panic spread through to the people in the streets and just how fast hyperinflation can take hold.

Thanks,

Springer

-

I know that I should have checked to see if there has been any change to the HMRC advice since I last bothered to look and there has. I have added the legal bits and bobs to the Buying Investment Coins thread http://www.greenenergyinvestors.com/index....ost&p=49276

Basically the £5K limit for a single transaction and a £10K limit for yearly transactions still exist before the dealer needs to take your details if you want physical and there is a €15,000 limit on both single and yearly for funds or other investment vehicles where delivery may not be necessary.

The Gold Team has been replaced with the Financial Services (VAT & IPT) Team, so I rung them up and asked what the requirements were and they didn’t have a clue which way was up but it wouldn’t surprise me if gold continues to increase in price then they will start to look at the records.

Wow thanks id5. That really helps. I would love to buy a few coins to diversify my 'protection' but I think I would start to really scare myself if I did that, I dont want to give weight to my fears. This financial shit storm that is due is going to be horrific and the fallout from it could be worse than anyone believes possible - I so hope we are all wrong.

In the mean time, I'll keep the larder fully stocked and get those hens I've been meaning to have for a few years now. The veg patch is coming on nicely.

-

In the UK if you purchase more than £5,000 in one financial calendar year from a dealer then that dealer must inform the HMRC Gold Team of the purchase but the problem is that they no longer exist and haven’t for quite a few years.

Dealers are required to record any transaction that could possibly deemed as ‘money laundering’, there are various guidelines produced by various government department but effectively if you pay for something in cash above £500 then they like some form of ID. If the transaction is paid for by a card then there is automatically some form of identification, ditto bank transfer etc but this does not stop them from asking.

If the SHTF then first you will be limited to the amounts that you can transfer between banks and get out of the ATM’s. Buyers will be limited to the amount of cash that they can give you as well. If it gets worse than that then you may lose part or all of the debt that the bank owes you and that includes ETF’s as well. If you are able to get your hands on any of the debt then it will be in very small amounts and a long time after the SHTF.

Thankyou all for your replies. This is indeed what I had read. It seems that my worries are unfounded then as my bullion was not delivered to me and also that the HMRC seem to be no longer in existence. Thankyou for clarifying that.

-

I am not sure what flag you are referring to, however the Capital Gains Tax limit is about £9.2k.. after which your profits from any rises in Gold, Silver etc are liable for tax.. Some of the UK coins are legel tender and therefore exempt.. however they do attract a premium over bullion prices

Thanks for the reply Matt,

I'm obviously confused then. I thought I had read somewhere that if you purchase more than 1K of gold in a year you get automatically registered with someone( cant remember who). Maybe it is the CGT that I was thinking of then .

-

sorry if my previous post is in the wrong place - I 'm not too good at this yet! Feel free to move , I dont know how!

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

I agree with Methinkshe 100%.