-

Posts

102 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by ares

-

-

Which would see Euroland squealing like.... pigs.

More likely is some new problem erupts to send the Euro down, and the dollar back up. Vertigo anyone?

Indeed, I am a buyer of the dollar here.

-

Goldfinger, I think Prechter's point is more than Gold and the Euro are move in the same direction (I guess you could say that about lots of assets recently). Not that gold hasn't out performed Euro over the last 5 years.

I find Prechter's view outlandish in the targets he talks about in the stock market, but would gold correcting to say $650 (~50% from it's 1220 high) be that crazy?

-

No matter now, its hit a new all time high regardless of the 1023.50 or 1033.

Now the question becomes can it hold!

-

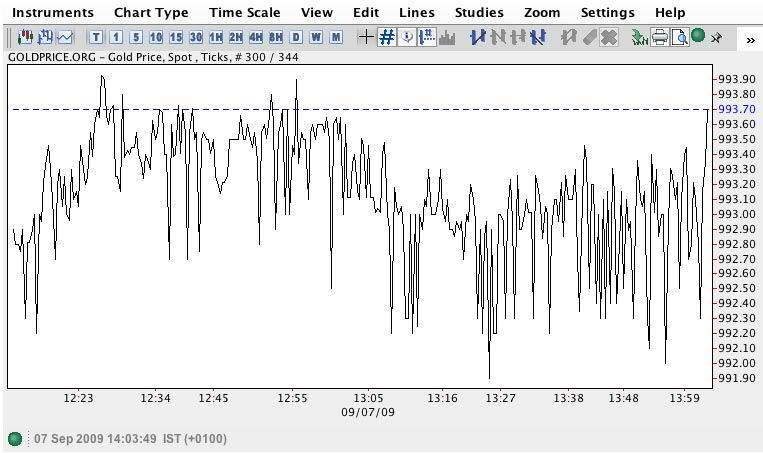

Gold is highly volatile today, it is almost like someone really wants to take it down but is being allowed. Check this graph which shows the tick movements in price, the price is moving 1% between each tick. I don't think it is normally like this.

It looks to me like it's in a very tight range, 991-993 so thats only ~0.2%, the graph looks very volatile due to the scale.

-

I agree, there is still not enough negative sentiment. However I don't get the sense we are looking at a huge downside risk (especially in Sterling)

Maybe a few more months of boredom before something gives.

-

Simply amazing day on the markets, quite a rush!

Looks like it hit 897 (dec 08) in Asia, I think a pull back to 850 would be ideal then we look to 900 proper.

This kind of action only makes the Miners look like the bargain of a life time!

-

Are we looking straight in the face of the birth of a wave 3 move here?

WAVE 1 = 250 -> 1030 +300%

WAVE 2 = 1030 -> 735 -28%

WAVE 3 = 735 -> 2000-3000? +300-500%??

Whats amazing is that the equities are still soooooo cheap in relation to the metal. HUI is up 13 XAU is up 10 only just out pacing the bullion!

-

From CoinInvestDirect.com

This item is not available for shipment to the selected Ship To country Great Britain until next calendar year. For 2008 we have reached the limit of VAT liable goods as per Article 34 of EC directive 2006/112/EC, VAT directive. Please chose a different Ship To country.

What a bloody pain in the ass, I was going to look at buying up a few thousand pounds worth of 1KG bars...

wonder If there is anyone I can get them sent to in euro land

-

Yeah, this hammering has really hurt. Over the last two years have consistently made most of the common mistakes, over leverage, selling low and buying high, not taking profits, playing with future (very bad idea!) etc but I had thought I was learning lessons and so losing a bit on the way was part of it.

But facing the latest sell off has really had my portfolio hit rock bottom, tried to call the bottom and took on a bit of leverage turned out trying to catch a falling knife is a bad idea, funny that

Expensive lessons... but valuable none the less. Still my 50% in physical G&S are not going anywhere, and I am young always time to make more money (I hope!) key will be trying to keep my family prepared for the coming times... maybe they can benefit from my lessons lol

Any of you guys suffered really bad losses, and how did you turn things around?

-

Has anyone here dealt with CoinInvestDirect.com, I am looking at there 1KG Heraeus silver bars currently at £300 which seems cheap considering you could probably turn around and sell them on ebay for going on 330-350 it seems, if anyone has brought from them did you experience any wait for the silver?

Does anyone have an opinion on the bars? or just any opinions on CoinInvestDirect?

-

[/url]

[/url]Looks like the $775-$780 is crucial level break that and maybe we test the old may 06 high

I have taken a little trade on the double long ETF here (DGP) with a tight stop.

UPDATE: Looks like we touched the 777 level again, and bounced who knows could just be a retest before a rally.

Though with the utter carnage in the PM stocks I can't say I really feel like things are going to turn around very quick, here hoping I am a good contrarian indicator.

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

Gold is already hit $1355!

So we're at the top end of your range, another day like this and we'll be at the bottom end.