rpitwood

-

Posts

57 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by rpitwood

-

-

We've got a new all time high in Silver in GBP today. Over the previous £21.65 as I type.

-

Thanks, so it's £21.61 = $35.18 as I post. Only a few hours to go, at this rate.

-

Does anyone know the All-time high silver price in sterling?

I have worked out $49.45 in March 1980 @ £1=$2.32 = £21.26.

I had to guess the exchange rate, but I think we've beaten that now.

-

I was in Amsterdam last weekend and bought as a birthday present to myself a 1929 2 1/2 guilder coin from a dealer for 14 euros. He told me it was 945/1000 silver and it weighs 25g, but when I got home the internet tells me it's only 720/1000. He got the weight right though.

Don't trust coin dealers on Nieuwezijds Vorburgwal

-

I would be interested in one or some. What are you suggesting? Thanks for the tip.

I'm merely passing on a tip - get in touch with them if you're interested. I guess there'd be P&P charges if you don't want to go to the shop in Birmingham. The point is he doesn't bother advertising them because he thinks there's no market, so you need to ask.

-

I went to the MoneyShow on Saturday, which had been preceded by a convenient fall in the price of silver.

I was comparing the price of CID who I knew were going to be there with their 100kg gold mapleleaf - the size of a pizza.

There was another company I'd not heard of before, bullionbars.eu. aka Atkinsons the Jewellers. He was not as competitively priced, as he was selling Umicore 100g bars of silver. He talked about his margins, and I said what a shame it was I couldn't buy second-hand stuff, because of the VAT only being levied on his profit margin, rather than on the full value.

He thus presented me with a 10oz Johnson Matthey bar for which I paid £174. Beat that!

He said it was worth getting in touch if I wanted to buy more, so I will. I'm sharing this news with you guys as my needs are modest.

-

"CME confirmed silver margins raised"

Can someone please explain what this actually means?

Thanks!

-

Copy silver or a copy of a $20 coin?

http://cgi.ebay.co.uk/1TROY-OZ-FINE-SILVER...60#ht_500wt_949

22 mins, £12.40 + £1.50pp

Bingo. £16. Yay for me.

-

I would guess fake coin real silver, the seller has other silver for sale so they must know what the real thing looks and feels like. If it isn't they're telling blatant porkies and a paypal claim should be successful.

Good point. Thanks. I bet the description puts people off

-

Copy silver or a copy of a $20 coin?

http://cgi.ebay.co.uk/1TROY-OZ-FINE-SILVER...60#ht_500wt_949

22 mins, £12.40 + £1.50pp

-

That's a big difference between rounds and coins, surely an oz of silver is an oz of silver regardless what form it's presented. Does the premium come about because of a coins legal tender status or is it down to something else?

At present, when selling on, coins undeniably attract a premium over rounds, but I wonder whether this will always be the case.

JL

I have read countless threads on sites like goldismoney2 arguing for coins v rounds and I could sum them up as follows: Rounds are cheaper, coins are more recognisable if tshtf.

Anyway I came to the conclusion that there is no right answer, so I buy any silver that is at the right price, except for the religious stuff. Variety is nice.

I only managed to buy 1 ounce on Friday - I wanted £100-worth, and I'm checking once or twice a day.

-

2011 1oz Silver Britannia in stock at Weighton Coin.

Link for 10pcs @ £23.80/each:

http://www.weightoncoin.co.uk/coins/index....roducts_id=2046

20pc and 50pc bundles also in stock. Only 500pcs available from November 15th.

Going fast...!

From e-mail earlier

Yes but it's still £23.80 an ounce, when spot is £15.50. That's a huge difference.

I bought a first majestic round off Sarnia on Friday for £17.99, arrived today. Keep looking they are there sometimes.

-

Are you sure its made from silver, the replica coin?

Crowns tend to be overpriced. I have been buying 50% half crowns for a bargain price recently from some guy I know of. I will be back to buying pre 1947 again on ebay soon and pre 1920 if the price is right.

Received today and my gamble paid off - it weighs, looks and sounds like pure silver.

Is buying 50% silver coins worth it? I read elsewhere about US silver half-dollars from 1965-1968. They are only 40% silver so if you were to sell them for smelting they would cost so much to process it makes them worth rather less than the value of the silver within them. Since reading that I've stuck to sterling silver UK coins, 90% US coins and occasional francs and guilders 80%+

-

I won a 1-ounce silver round yesterday for £17 inc p&p

I tend to go for unusual searches, and relying on buyers / sellers not always knowing what they've got. This one I found by searching for 'Troy'

http://cgi.ebay.co.uk/USA-Modern-Replica-S...=item3f04038dde

I've also started looking at old (Victorian and older) crowns now that I can't use Sarnia and CI silver bullion.

I have sold my PHAG having made nearly 20% profit since July when I bought it. Hoping for a dip towards the end of the year so I can buy it back.

-

Here's an ambivalent article on silver:

http://www.timeslive.co.za/business/articl...-in-the-picture

I found it at http://www.silverbearcafe.com/private/09.10/onaroll.html

According to Virtual Metals, the physical market for industrial silver will remain in oversupply for the rest of this decade...

With spot silver at the $20/oz door this is probably not the time to be buying physical silver at premium prices.

v.

Virtual Metals forecasts demand that will steadily erode the industrial demand/supply surplus coming from new technologies - photovoltaics, solar mirrors, medical, textile, radio frequency identification, water purification and food hygiene are a few Virtual Metals pinpoints. They are slated to absorb as much as a quarter of all industrial silver by the end of this decade.I've looked on Virtual metals website but haven't found the source yet. It looks like a good site for GEI-type stuff. I don't think I've seen anyone refer to it before.

-

Fiat currencies. Don't you just love them

http://www.telegraph.co.uk/finance/persona...currencies.html

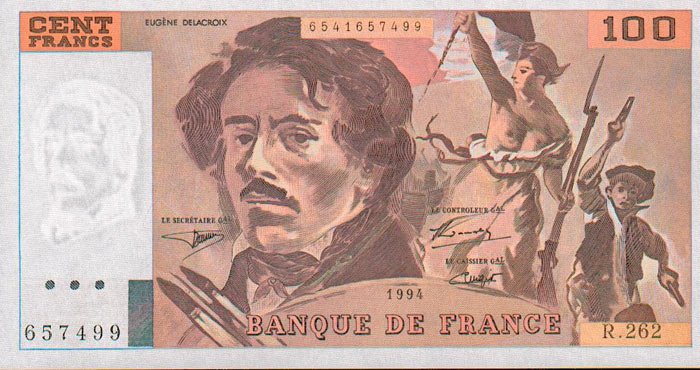

Don't like any of them. My favourites are still the French franc notes form the 1980's. The head on the front is in reverse on the back, and there is a work of art. And bare breasts.

-

Wow. That's great.

Not exactly a discrete investment, is it?

Very discrete, perhaps not too discreet.

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

Yep - see Goldfinger's chart about a page ago. At about $2.40 to the £