-

Posts

349 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Ret45

-

-

Got to $936 tonight...and she is holding up well.

Let's wait for tomorrow to play out.

Steve - I feel something in the air as well - the TA is setup, and the 'news' seems to be a perfect fit.

is she holding up well on strong buying volume? otherwise she's just holding...who knows how well.

-

http://www.moneyweek.com/investment-advice...Money%2BMorning

Quote I Like:

Another possibility is gold. If you had invested $100,000 in bullion coins ten years ago, selling off 5% at the end of each year to provide you with cash, by now you would have gold worth more than $200,000. In the meantime, you would have enjoyed an income – usually tax-free – totalling more than $71,000.

If you had used that $100,000 instead as a 20% deposit on a UK property worth $500,000, you could have sold the property for over $1,000,000 after 10 years, netting a profit of $500,000. In the meantime, you would have enjoyed historically low interest rates and a rental income which would have exceeded your BTL mortgage.

-

As for trading silver for gold, someone mentioned the savings on storage costs but could there be an advantage in terms of capital gains too? I'm not sure how it's taxed when you're effectively bartering but I expect you'd be able to quote a price in your national currency. It's handy to be able to book a gain without having to be in cash for any period to show you're not "bed and breakfasting".

Weren't BV supposed to start selling silver on their site? Anyone hear any update on that?

-

There is a danger in reading too much into the gold price rises. Its all about the currency at the moment, specifically the game of chicken that the Fed is playing with the Bond market. As a euro holder, gold has seen small, steady, boring increases over the past few months.

-

should have just asked him where the dollar will be

gold is money - sometimes its good to hold excess money - when financial assets are overvalued

The majority of people do not accept your view that gold is money. Try buying a loaf of bread in Tesco with your gold. Gold has no intrinsic value, unlike oil or corn or sugar. Gold depends on people's acceptance of it as a store of value. Just like fiat.

-

Buffett's response to a question that came from an investment club of seventh and eighth graders who invest $1 million in fake money every year. This is the Grizzell Middle School Investment Club in Dublin, Ohio, and the question is, where do you think gold will be in five years and should that be a part of value investing?

BUFFETT: I have no views as to where it will be, but the one thing I can tell you is it won't do anything between now and then except look at you. Whereas, you know, Coca-Cola will be making money, and I think Wells Fargo will be making a lot of money and there will be a lot--and it's a lot--it's a lot better to have a goose that keeps laying eggs than a goose that just sits there and eats insurance and storage and a few things like that. The idea of digging something up out of the ground, you know, in South Africa or someplace and then transporting it to the United States and putting into the ground, you know, in the Federal Reserve of New York, does not strike me as a terrific asset.

-

Telegraph in full 'media interest' mode atm. Chinese public beginning to buy.

http://www.telegraph.co.uk/finance/finance...hard-times.html

that reminds me. Was talking to a very clued in Malaysian Chinese taxi driver in dublin the other (I knew he was clued in because he said has been buying physical gold for a about 10 years!). I asked him why he bought gold and he remarked that "Chinese people love gold".

1 billion chinese people + rising salaries in China/emergence of middle class = shortage in gold?

Maybe I should open a GM in China if James Turk already hasn't.

-

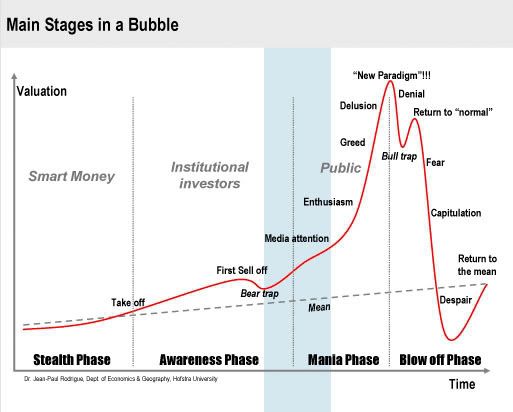

That corresponds quite nicely with the graph below and where I think we are, at the beginning of the media attention stage.

You might be on to something there Pixel8r. Of course putting a timeframe on it is the hard part - no one would have predicted that the property bubble would last so long.

Is there any way of graphing the demand for physical gold bars/coins that people take delivery of, or gold that goes into a nominated account like BV or GM? This would give us a better indication of how quickly gold becomes a mainstream investment. In the long term this is propably more significant than the COMEX spot price that we all follow.

Might be worth a separate thread - "Actual demand for physical"

-

I hate these articles. It means the GEI view is becoming mainstream. I'm much more interested in what the mavericks are thinking.

btw if you are a gold bug, do you think its a good idea seeking out (and posting) articles and information that reinforce your view?

-

I hope they are having a go at silver too. I’ve made a killing on the Dow and need to get it in to GM

BTW, GoldMoney process incoming money within a couple of hours. No more waiting around for days

i just bought a few coins, so price is certain to drop

have been waiting for a dip to buy for weeks now and it has just been going up. the way things are going, maybe we don't have the luxury of a lot of time before physical gold starts becoming hard to find. Cgnao has been the most accurate forecaster to date, bar none! That's a scary thought and the rational "things will eventually return to normal" part of me is fading fast!

-

POG just broke through €700 p/oz. For the first time. Ever.

I should be pleased but am reminded that I bought gold as a hedge in case everything else turned to crap.

Looks like its crapville.

tada - 100th post!

-

ha ha ha....... I meant short term......

Its really difficult to say at the moment. I took profits and closed an IAMGOLD position yesterday because I thought that gold would dip today, but of course its done the opposite. I am torn between thinking that gold will now take its usual dip before climbing again, and on the other hand thinking that this rise in pog is starting to gain real momentum. Maybe go in 30% of what you intended to buy?

-

I'm ready to buy more goldbut cant decide if its going up or down! I mean significantly. You think the escallating bad news will make the pice of platinum and palladium lower? They fell lower but seem to have risen slightly. Did they fall too far and have now leveled at a realisitic level? Im trying to be patient and wait for an obvious buy.

I think gold is going up.

Over a 2-3 year timeframe.

-

said by a guy who's avatar says 'pot o gold'

I think you want it ALL for yourself & your trying to put us all off.

It's MY precious!

Well, like a lot a lot of people on this site I do think that gold is a good store of value. But I am wary of 'experts', and some people on this site, who seem to think that gold will rocket in value and the pog will stay high forever. Knowing that gold is a good buy is the easy bit, recognising the signal to sell will be the real challenge. No doubt the same people who came to the btl game at the 11th hour will also rush to gold just as its peaking. Maybe I should register a GoldPriceCrash site now before someone else does.

-

Gold and Silver in 2009 by James Turk - http://news.goldseek.com/JamesTurk/1230583965.php

You'll like this!

hmm, a guy who sells gold for a living is predicting is that the price of gold will rise will in value. I also think the price in gold will rise, but i don't think that articles by people with a vested interest have much value. Will James Turk be writing articles when he thinks that the price of gold has peaked? Estate agents predicted that the price of property would increase, and for a long time they were correct too.

-

Looking at buying some physical. For gold coins, my local dealer sells at spot price + 10% - is this competitive or can I get better value.

-

Also trying to decide whether to buy more gold at the moment. Bought some on BV back in September during the dip. I am euroland so pog has remained fairly static for the last month or so. I had planned to buy when the price dipped again but no sign of that happening. I intend to hold my gold. Have some cash in the bank but not sure whether to keep it there in case i want to take a chunk off the mortgage - mortgage is at about 2 times gross salary and its on an ECB tracker of about 3.2%. Job is very secure.

Any advice? - I suppose the obvious answer is to buy a certain amount every month, but I think I would get caught up in trying to time my purchase every month. Re the 10% guide - is that 10% of gross assets, including your house, or 10% of liquid assets?

-

pog in euro is actually not doing much at moment thanks to the steep $ devaluation. I have hedged by spreadbetting on EUR rise against USD and that is doing much better then my gold right now.

-

I am hoping for one more big dip in gold before the end of the year, so I can buy more, but think that it may not happen.

I think in six months time we will realise, with hindsight, that the huge premium on physical coins over spot price, which developed in October 2008 was the signal that confirmed a fundamental shift to gold.

i bought gold for the fist time during the big dip in September, since then it has more than held up in euro despite all the market turmoil. I bought as an insurance - the 10% approach. But am now happy to increase that if the price dips again.

-

This is a great article and a must read:

It seemed to be just another cheerleader article on commodities, with a lot of conjecture about inflation. I don't understand the basis for speculating that we are halfway through a bull run on commodities and there is another 15 years left to go. Why not five years, or ten, or fifty. What in particular is going to trigger the end of a bull run in 2023?

-

Spot Gold up $20 in as many minutes on IGINDEX

-

Gold now at ALL TIME HIGH in EURO.

-

Question - how do the gold coin dealers pay for the coins? At spot price on the day they purchase them? I was thinking that if that was the case, and I was a gold dealer, and I thought that prices were going down, I would not stock up on gold coins, becuase they will be cheaper next week and I would make a huge loss. So why not reduce your stock to the bear minimum and say there is a shortage to keep people buying?

Dealers make a profit on each sale, so why would they turn away customers? There is no need to keep people buying, there are more buyers than sellers now, plain and simple. We keep tossing it back and forth on this site, but maybe the most obvious answers are best. Gold is one of the few practical stores of wealth, in times of financial crisis its value will increase.

-

I think we need to step back a little and look at what is actually happening here.

1. In the past week physical gold has gone from being in plentiful supply to, at times, practically out of stock. When is the last time that happened?

2. BV has posted a warning that the market is very thin and it is trading on wide margins. When is the last time that happened?

3. Gold as a safe haven is now being discussed in the mainstream media, on chatshows and by people on the bus. When is the last time that happened?

4. Gold spot price this week came close to year high in EURO, and very high in STG. Price for coins is at year high.

So what does all this mean? We know that there are a myriad of factors influencing the spot price of gold, and gold is a manipulated commodity. So prices will fluctuate depending on those factors. But one thing is for certain, when gold becomes scarce its value will rise. I think the talk of waiting for the dip to buy is irrelevant, the shortages we saw this week may become the norm. And at the rate that things are unfolding, and with the growing shortages, there is a real risk of being caught out. You have been warned.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

At these prices I'm afraid to buy more gold.

But I'm also afraid not to buy more gold.

So I'm buying silver with my crappy euro