-

Posts

112 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Goldilocks

-

-

Looking at the other website hpc and nearly fell off my chair when i saw this advertisement.

http://pagead2.googlesyndication.com/pagea...aMggT6h2UcEAN1g

Looks like Gold advertising approval

Here's the page it is being advertised on over at the new hyperinflation aware Hpc

http://www.housepricecrash.co.uk/forum/ind...showtopic=98640

-

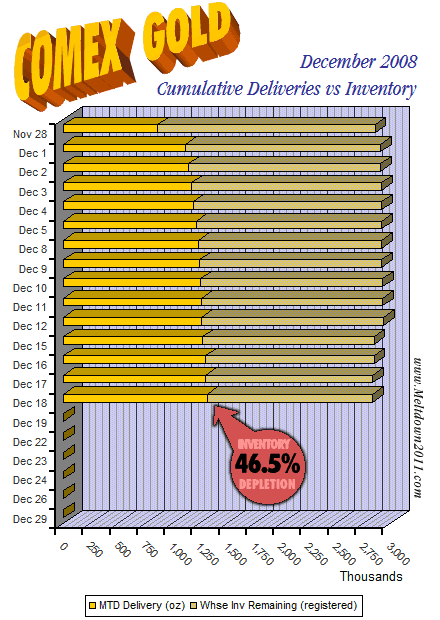

Is this correct?

Looks as if the Crimex will not be getting clean out of gold/silver by 31 December..

The Bernie madeoffs can carry on manipulating the paper metal prices for another couple of months or so.

-

Gold/silver are totally manipulated - by the PPT, central banks, FED, BOE - all acting in one general direction.

Charts are a waste of time in this environment. It is all POLITICS, nothing to do with fundamentals or supply and demand.

PPT investigating manipulation in the Silver market (crimex)

:lol:

:lol:  :lol:

:lol:

Its a bit like asking the SS concentration camp guards in the Nuremberg Trials did any of them killed any prisoners.

.

.quote Update 11/4/2008: Ted Butler has commented that he doubts this investigation will bear fruit. He says no investigation is needed; all the CFTC has to do is look at their own public reports to see evidence of manipulation.

And then I discovered this startling nugget of info: guess who’s on the President’s “Plunge Protection Team”–the very same team that’s behind the bank(s) that are used to manipulate the markets?

http://meltdown2011.wordpress.com/2008/09/...r-manipulation/

-

Whoops rumours

what would this do for physical gold/silver if they pay out in paper

I'm hoping the TSHTF ,doesn't happen before the gold silver ratio goes down

i wanting to converted my allocated silver (with serial nos paper silver) to physical delivery of gold from the Perth mint

i see also in the small print that if they can't supply physical metals they will pay out in paper WTF

Trader Dan

Comments On Comex Gold Contract Rumors

Author: Dan Yorcini

Dear Friends,

My inbox is being inundated with emails from many who are repeating claims made by some gold web sites that the Comex Gold contracts are now going to be settled as cash-only contracts in effect depriving buyers of the opportunity to take physical delivery of gold bullion.

I cannot verify these reports nor do I see anything from the exchange stating anything to this nature. As far as I can see, no changes whatsoever have been made to the Comex delivery process.

I have contacted the exchange to see if I can find any further information but let me state the following:

The NYMEX, through the CME, offers TWO CASH SETTLED GOLD CONTRACTS, one is ASIAN GOLD which is a 1,000 gram sized contract with a minimum tick size of $0.005 per gram. The second gold contract is the mini gold contract, which is 50.0 ounces in size and has a minimum tick fluctuation of $0.25. These and only these contracts are cash settled, not the full sized Comex gold contract. If there has indeed been a change in the specifications of that contract, I believe the exchange would have let it be known clearly. So far I see no evidence of that.

If I do find out that a change has been made, I will let it be known to the community of readers. For now, it is business as usual with that contract and buyers may take delivery of physical gold if they prefer.

Dan

-

Reply from Sonia Hellwig,

>>>>

Unfortunately we cannot switch back to the 7% in the UK now that we adopted the 17,5% rate. We are VAT registered in the UK and therefore apply the normal UK rate.

<<<<

Previously they were a mail order company based in Germany but now they are registered in UK

They are still cheaper 2-3 quid than Ebays silver coins even paying the 17.5% (we pay for banksters rate)

I ordered some maples today before they disappear of the shelves before the rush

Can i really expect 2-3 day delivery as quoted or is it longer?

-

-

-

They may be letting this one go to the wall?

Soon be posting nice rocket pics again this week

-

Listened to first hour and 3a, leaving the rest for when i'm in the car..

out of interest what did jim have to say to these people?

Quit whinging buy financials then

Been having a nosey on ebay folks and 1 kilo silver sold for 530 quid 2nd sept

1 kilo silver buy it now for 485 quid today

I oz krugger 475 quid today

better hurry up and get yourselfs some phyical while its still cheap.

-

I'm a little concerned about Clive Maund since I read about his connection with Garry North.

I'm also a bit worried about Jason Hommels delusions.

:lol:

:lol:  :lol:

:lol:

Maybe he once got a silver bar from the Perth mint with 666 stamped on it,and now they are the devils reincarnated.

:lol:

:lol: Visit my other website:

The Silver Stock Report

where I'm actively putting into practice

the Christian lessons regarding "honest weights and measures".

If the 666 mark of the beast is bad,

then God's .999 fine gold and silver is good.

Email me, Jason Hommel here:

bibleprophesy@yahoo.com

Why should you support a mininistry?

How to let God bless your ministry.

-

Apart from the fact that Perth Mint is mentioned in the article (and Goldmoney isn't), what makes you think Goldmoney is safer than Perth Mint? (This is a serious question as I use Goldmoney.)

If there's a way of seeing serial numbers with Goldmoney (or BullionVault for that matter), I don't know how... Perhaps someone can enlighten me?

Maybe the Perth Mint is sound after sending an email to my broker about the jason Hommels report (slagging the Perth Mint off) yesterday i got this response today. I for one am really reassured about this response and i will continue to hold my allocated Silver with them goldinvestments/Perth Mint.

Unfounded Allegations regarding Perth Mint Certificate Program

Further to recent articles containing unfounded rumours and allegations alleging that the Perth Mint does not have physical precious metals (especially silver) to back its storage programmes or to make deliveries we have received a few phone calls and emails from concerned clientele.

Both the Perth Mint and Gold Investments strongly refute these absolutely baseless allegations.

Firstly, it is important to remember that the Perth Mint is owned by the Government of Western Australia and is run within very strict and ethical guidelines. The Perth Mint does not and would not contravene the law and act in a manner which would embarrass its government owner. Indeed because it is government owned it has to be absolutely scrupulous in adhering to strict business procedures. For every ounce of precious metal that is sold to a client, the Perth Mint must buy a corresponding ounce in the marketplace. The Perth Mint is audited rigorously by the Auditor General of Western Australia as well as by internal auditors Price Waterhouse Coopers, to ensure that this policy is maintained at all times.

The Perth Mint holds full inventory confirmations on a quarterly basis as well as the comprehensive audits. The Perth Mint Depository programs are not permitted to, and do not, run short positions under any circumstances The Perth Mint does not lease metal out to mining or exploration companies and does not undertake precious metal derivative transactions.

The Mint shares concerns about pool and unallocated accounts where it cannot be established if the operator is backing its liabilities to investors. Gold Investments would advise investors to research and question any program or facility they are investing in.

The Perth Mint Certificate Program remains one of the world’s safest and securest ways of owning gold and silver offshore. All methods of investing in precious metals have pros and cons. However we are confident that the AAA rated government Perth Mint is the safest option when it comes to third party precious metal ownership.

This is because of the important and crucial distinctions pertaining to the Perth Mint:

· The Perth Mint is one of the oldest operating mints in the world, set up as it was in 1899. The Perth Mint is wholly owned by the Government of Western Australia and has been providing secure vault storage of precious metals since that time.

· Western Australia is rated AAA by the US international credit rating agency, Standard and Poor's. While S&P have rightly been criticised in recent times, this is a bona fide and justified credit rating as Western Australia is one of Australia’s wealthiest states, with some of the largest concentrations of mineral and natural resource wealth in the world.

· All PMCP precious metals are insured (at The Perth Mint's expense) by Lloyds of London.

· The Perth Mint is operated by the Gold Corporation, a unique diversified Australian precious metals refinery and mint created by statute in 1987 and wholly owned by the Government of Western Australia.

· Investors have a private client relationship with The Perth Mint.

· Gold Corporation is the eleventh largest exporter in Western Australia and has a 40% interest in AGR Matthey, Australia’s only major gold refiner and one of the world’s largest refineries. Western Australia's goldfields are a major world source of world gold. The Perth Mint, through its interest in AGR Matthey, refines all of Australia’s mine output, together with gold produced in several neighboring countries, averaging over 400 tonnes of gold per annum. Gold Corporation is the official producer of Australia’s legal tender gold and silver bullion coins which are marketed to investors throughout the world. It also mints Australian commemorative or numismatic coins and produces collector coins on behalf of several overseas issuing authorities.

· PMCP clients have an overseas relationship with a Government Vault, Mint and Refinery and not a foreign bank. The Perth Mint is not a bank but a refinery and mint and has no exposure to the housing, derivative and credit markets.

Investors are right to be wary of pool accounts and unallocated accounts held with financial institutions that are exposed to the deteriorating credit and financial crisis. Some may be sound while others may not be. The Perth Mint is in no way exposed to the global financial crisis. Quite the opposite – given the nature of their business they are experiencing unprecedented levels of business and are as profitable as ever. Also, the natural resource boom makes Western Australia one of the safest regions in the world in which to invest one’s wealth.

It is important to remember that PMCP investors can convert from unallocated to allocated and take delivery at any time. For further information on this and the distinction between allocated and unallocated bullion in the PMCP please see http://www.perthmint.biz/investment/allocvsunalloc.aspx .

At the moment there is a delay of some 2 to 3 weeks on delivery of smaller silver coins and bars however 1 kilo bars and 1000 ounce bars are being regularly delivered from the refinery and will be allocated to clients in line with demand. If you have become concerned, then for peace of mind you could convert some of your unallocated holdings to allocated. If a client feels unsafe or exposed we would encourage them to sell their holding, go allocated or take delivery.

If customers have concerns regarding unallocated storage in the Perth Mint we advocate buying allocated Perth Mint certificates, storing in personal allocated accounts in VIA MAT Zurich and or taking possession of one's bullion (or a combination thereof as some will not feel comfortable taking possession of large quantities of bullion and others prefer to have their bullion stored in another jurisdiction ). We could not be any clearer and direct in our exhortations to present and potential clients that the present web-based criticism of the Perth Mint is wholly unsubstantiated and that the Perth Mint’s Depository products represent both value and safety for investors in these uncertain times.

Further confirmation of our firm stance regarding the importance of being certain regarding the ownership of your precious metals can be seen in articles done by Gold Investments’ executive director Mark O’Byrne and our US consultant Mike Clark:

http://www.goldassets.co.uk/articles/Stori...rnationally.htm

http://www.goldassets.co.uk/articles/Are_Y...d_Party_htm.htm

-

Anybody that wants to beat income tax should read about this case in USA, an employer paid his workers in gold for seven years and avoided paying the theifs (IRS) monies for their labour.

Of course the media didn't report the outcome of the trail.

I wonder would it work in the U.K.

IRS Suffers Staggering Defeat

Tax Questions Raised Regarding Gold and Silver Coins Used to Pay Wages

Around noon on Monday, September 17th, a Las Vegas federal jury returned its verdict refusing to convict nine defendants of any of the 161 federal tax crimes they had been charged with. The charges included income tax evasion, willful failure to file and conspiracy to evade taxes.

The four-month trial centered around the family businesses of Robert Kahre who paid numerous workers for their labor with circulating gold and silver U.S. coins, and did not report the wages. The payments took place over several years, allegedly totaling at least $114 million dollars.

On September 20, 2007, three days after the federal trial's dramatic conclusion, the Las Vegas Review Journal, reportedly under a degree of public pressure, ran its first (and last) story about the outcome of the trial. To this day, with exception of the single article by the Review Journal, no major media entity has published a news story regarding the outcome of this important federal criminal tax case.

The censorship of this important news story is, unfortunately, not unexpected given the continuing, worldwide onslaught against the U.S. "dollar" -- specifically the Federal Reserve variety, and the ever growing numbers of Federal Reserve Notes required to trade for an actual ounce of silver, gold, oil, or for that matter, anything.

In short, this failed prosecution has coalesced and exposed truths our Government desperately needs to hide from the People: the truth about our money, the truth about our (privately-owned) central bank, and the truth about the fraudulent nature of the operation and enforcement of the federal income tax system.

According to defense attorney Joel Hansen, who represented co-defendant Alex Loglia, the primary "willfulness" defense was that the defendants believed they had no legal obligation to withhold, pay income taxes or report anything to the government because, in part, the nominal (i.e., face value) of the gold and silver coins is so small as to fall beneath the reporting thresholds set by the Internal Revenue Code.

-

apologies if this has already been posted

i am still waiting for my 20 x 100oz bars

http://www.silverstockreport.com/2008/perth.html

Perth Mint and Kitco Scheme Exposed

(What's going on here?!)

Silver Stock Report

by Jason Hommel, March 26, 2008

Yesterday, I got into a bit of trouble by writing that the NorthWest Territorial mint was bankrupt, which they are not (consider this a second retraction). The NorthWest Territorial mint only has a risk of bankruptcy since they have so much silver owed to them by their suppliers, and those risks concern me in light of shortages of silver reported everywhere, and their long delivery times.

What is going on with Perth and Kitco is very unfortunate, since the Perth Mint is reportedly one of the largest bullion dealers in all of Asia, and Kitco has the largest presence on the internet, ranking number two in the search terms for silver and gold, just behind wikipedia.

So I have to choose my words carefully regarding the Perth Mint & Kitco. Perhaps the words of Jesus and Andrew Jackson are appropriate to quote in this context:

"You are a den of vipers. I intend to rout you out and by the Eternal God I will rout you out. If the people only understood the rank injustice of our money and banking system, there would be a revolution before morning." --Andrew Jackson, 1828

Matthew 23:33 "You snakes! You brood of vipers! How will you escape being condemned to hell? 34 Therefore I am sending you prophets and wise men and teachers. Some of them you will kill and crucify; others you will flog in your synagogues and pursue from town to town.

You know who Jesus and Andrew Jackson were addressing? The moneylenders who offer to hold your money for you!

Since I advocate that you hold your own bullion yourself, I've wondered if the business practices of Kitco gave them a bias to rarely ever publish my articles, even though I was an advertiser for years, and my articles appeared far more regularly at gold-eagle.com and goldseek.com. I think I finally figured it out, and it's time for me to finally burn my bridge to kitco; as I don't need them anyway, and stopped advertising with them a while ago.

Kitco is a partner in a bullion certificate scheme with the Perth Mint, and also offers a pool account like Perth Mint does.

https://online.kitco.com/pmcp/

I believe, but cannnot prove, that Kitco is short of bullion owed to their own customers in their pool account, and this would explain why they publish the anti-gold articles that they do. If you own precious metal in a pool account or certificate form with anyone, Kitco, Perth, Monex, Goldline, any Major Bank or Brokerage, or anyone else, I think you would be wise to cash out, and get real silver somewhere else, even if you have to pay extra fees to do so.

Here are my five witnesses in my case against the Perth Mint (Kitco is implicated only by association, as they advertise the Perth certificates.)

The testimony of the people below go to show that you cannot trust silver certificates, nor can you trust allocated silver storage, nor can you trust government guarantees. (Trusting government guarantees for bullion is the most absurd thing I can think of, since governments are the ones who are printing money which competes with the demand for silver as money!)

=============

Date: Thu, 28 Feb 2008 18:52:05

Subject: Re: Silver Stock Report: How to Get Into Silver, for Billionaires

S Tabikh wrote:

Jason,

Ive just ordered $20k worth of Silver 100oz bullion from the Perth Mint and have to wait upto 6 months for delivery for such a small order. Goes to show the lack of Silver avaliable.

Regards,

Shafic

=============

Date: Thu, 28 Feb 2008 15:07:40

Subject: Re: How to get into Silver for Billionaires

peter wrote:

Hi Jason,

Thanks for sending me your latest email, I'm always interested in hearing your opinion of the current state of the Silver market.

I was rather alarmed, however, to read the story of the gentleman you mentioned who had 10,000 ozs of allocated Silver stored on his behalf by a "AAA rated,... guaranteed " mint which "services the Asian market" ...I assume you are unable to publicly identify the mint concerned for legal and other reasons, but I would greatly appreciate it if you could inform me privately of same. IE: Is it the Perth Mint?

The reason I ask, as you can probably guess, is that my own situation is almost identical to the one mentioned in your article (which listed difficulty getting allocated silver which took 6 months) and you have now further aroused my suspicions about the alleged security of allocated storage of precious metals. In addition, I have also met with an un co-operative attitude when making enquiries about taking delivery of my Silver, so again there are further parallels with your story.

I hope you can take a moment from your busy schedule to share this information with me as obviously, its vitally important to my future financial security -just a simple 'yes' or 'no' in answer to my query above would suffice, no need to elaborate.

Thanks again for your time and I wish you every success in spreading the Story of Silver to the world.

Regards,

Peter

Jason: YES! I was alluding to the Perth Mint, but I didn't have enough testomony at the time to name them publically, but now the truth comes out! Get your silver. Travel to their location, and get it, and haul it away, as soon as possible. (They might not have it!)

=============

3/19/2008 9:20 PM

Jason,

Just placed another order with Perth Mint, they are out of stock on everything, however there waiting period is no longer 6 months (Im guessing they received alot of complaints) its now 6-8 weeks.

Just got off the phone with them, they have no bullion in stock, its all on backorder, the official excuse is that it takes along time to make the bars and everyone wants them, could be viiewed as a good thing knowing demand is high, but I personaly dont like waiting 6-8 weeks for delivery.

I contacted several other dealers in Sydney, only 1 out of 5 has stock...... Everyone has back orders with PM which is the distributor.

Regards,

S

=============

In the March 26th Midas report, from lemetropolecafe.com (a site I subscribe to, and highly recommend):

G'day Bill

The shortage of silver is becoming acute in Australia. I phoned my supplier (THE major in my state) this morning, to confirm the developing situation re supply and he has confirmed that he cant get silver until May. He has always had ample stocks on hand, with my son or myself able to walk in and transact on a cash and carry basis.

NOT ANY MORE!!! He can't get a price from his supplier whom I assume is the Perth Mint or the Australian Bullion Co, as these are the bars that I have received from him. He only does Open Book orders where he will take your order but will not be able to price the metal until he is assured of a delivery price from his suppliers. Mid April is when he expects to be able to price an order. He said he has knowledge of a Perth Mint customer who has his money tied up in their Unallocated Pool Account, using Silver Certificates. Taking the advice of various "hold it in your hot little hands" advocates (such as yourself, Ted Butler and Jason Hommel etc,) he tried to redeem his certificates and have his holdings transferred into an Allocated Account.

The Perth Mint has advised him that they WILL NOT buy his certificates from him and WILL NOT allocate physical silver to him. They will however ALLOW him to swap them for gold. They will only do this by slugging him on the spreads. They slug him on their buy back price for silver and then whack him for their mark up on gold. He apparently is a man on the edge as my dealer feels that he is close to topping himself over the issue. Must be on Margin. I wonder if the Perth Mint is so broke that they can't pay him. Apparently they are backed by the full faith and credit of the Western Australian Govt. Yeah Right!

Stow it or blow it is the right call from you et al, and I thank you dearly for the advice, as I was once a Perth Mint PAPER silver certificate holder.

=============

5:24 AM, March 26th

Hi Jason,

just wanted to let you know about recent dealing with Perth Mint.

As I have been following your emails now for some time I recently decided to buy silver at Perth Mint in the form of the PMCP (Perth Mint Certificate Program).

Talking with a person in their Treasury Department I opted for Unallocated silver with the view of changing that to Allocated or pick up at a later stage.

After your email "If you don't hold it, you don't own it" I sent an email saying when I wished to pick it up, giving about 4 weeks notice that I was told I needed to give.

Still have had no reply after a phone call and another email.

Wondering if you have had any similar emails from anyone else regarding Perth Mint?

God bless,

Graeme.

=============

=============

I've been thinking more about how people who are afraid of risks, and who don't want to pay the costs of storing their own silver, tend to trust promises of men rather than the provision of God. The Great Harlot of Revelation 17-18, I believe, refers to moneylenders who lend to the kings of the earth to control them; and this is harlotry because the Harlot will trust the kings of the earth for security rather than the King of Kings, Jesus Christ.

So, now, I wonder how much different it is to trust having someone else hold your silver for you; is that an act of spiritual harlotry as well? Do these people who put their trust in the Perth Mint, guaranteed by a "king", the government of Australia, get what they deserve? The kings are said to turn on the harlot to destroy her, and I wonder if the Perth Mint not giving out silver that was paid for is like a preview of that prophecy. You judge.

As for me, I've long decided to choose to be responsible for taking dominion over God's provision of silver that He has entrusted to me to care for, and I'll accept and take the risks of holding it myself, and I'll trust in God that things will work out ok without man's insurance.

I know that if I have wealth, then I must also have the wealth to guard it, as that is a basic undeniable truth.

If you have a small amount of silver, get a lock box. If you have more, get a floor safe. If more, get a large gun safe. If more, get several gun safes. If more, build a vault. If more, build a warehouse.

According to God, if you are Christians, you are Kings and Priests, and so, I try to act like it; taking possession and guarding my silver with my own safes, and preaching that others do the same.

Revelation 5:10 And hast made us unto our God kings and priests: and we shall reign on the earth.

The united States is supposed to be a nation of sovereigns, kings, the people are the kings.

Act like a King. Get your silver.

Act like a Priest. Tell other people to get their silver.

http://find-your-local-coin-shop.com/

Sincerely,

Jason Hommel

www.silverstockreport.com

www.miningpedia.com

Fook!

I have a allocated silver certificate (with serial no's of the bars)

for the Perth mint,

for the Perth mint,I don't like what i'm reading in the above report, but i never intended to take delivery to the U.k. too costly and capital gains etc.

I was intending to change over to over to Goldmoney and hold Silver there when my years holding fees were up in the Perth Mint storage programme.

I sent Ted Butler an Email on the Jason Hommels above report ,prevouly Ted has written as long as you have the serial no's you are protected! But then wern't Merrill Lynch bank charging for allocated gold,which they didn't have?

-

Jim sinclair seems to have upgraded is gold forcast,and is talking loadsa thousands

This could be it.

Meanwhile gold and silver getting smackdown time, and the dollar surges,what a joke bankers must need more time to steal.

This weekend’s meeting of four heads of central banks communicates the size of the OTC derivative disaster. It is a system that is broken. A bailout will require the printing of trillions of dollars worth of monetary stimulation making Bernanke’s helicopter drop look like chump change.

The dollar number of pending derivative bankruptcies is the size of the mountain of garbage paper issued by just those who are to be bailed out. That number is greater than the total world economies.

There simply isn’t enough money in the world for central banks to buy up the mountain of worthless paper sold by those who need bailouts; all of which made fortunes for their directors, officers and key people.

Because of the unthinkable size of the problem it is impossible to construct a Resurrection Trust to buy all these worthless and never to be anything but worthless items.

Should any item surface to do this it will destroy all the National currency of the central banks that participate.

If there were an attempt to construct such an entity with the cooperation of the USA, the US dollar would go much lower than .5200. Gold would go to many thousands of US dollars.

Anyone who last week assumed the problem was over and we would be improving from there on out is simply nuts.

-

The time has come to exit all financial institutions and take yourself off the grid.

I already have done and have the bear minimum in the bank, 99.5% protected.

-

Destroy the world's largest, most powerful economy so the US can be "integrated" with other nations in the western hemisphere - but do it slowly, so nobody can point the finger at one particular Fed action and go lynch the bastards.

Bernanke's thesis was on the Great Depression

he is obviously the elite's placeman to take the usa down...

btw they assaisnated eliot spitzer quite brutally

http://www.youtube.com/watch?v=GMo7T9t0Gzk

you won't hear anything about his sub-prime battles in the mainstream press

this all leads me to believe that the sub prime and resulting financial implosion we are all witnessing has been planned from the get go...

Was that gorgie boy giving the rent boy that visited

the white house 200 times a kiss/hugs

the white house 200 times a kiss/hugsIt looks like the guy Eliot Spitzer got politicly assassinated alright,he's a lucky man he didn't go to Dallas or he would have got shot in the head?

"French Societe Generale claimed that 15 tons of gold, worth $500 million, which they had given to Goldaş to sell at the Istanbul Gold Market, has gone missing"

Rouge trader and now this Bullsh*t

:lol:

:lol:  :lol: probally the gold got dropped from the benanke's helicopter 's

:lol: probally the gold got dropped from the benanke's helicopter 's -

Bernanke's own home down 260K in value

"'Even though he's the Fed chairman, he's going to get hit"

Fed Chairman Ben Bernanke's Capitol Hill home is slipping in value and may soon be worth less than he paid for it. An economist quoted by Bloomberg estimates Bernanke's house has lost $260,000 in value.

:lol:

:lol:  :lol:

:lol: -

I'm not selling my gold/silver i don't care even if gold drops down to 2cents or silver 1 cent.

what a great gift the elite is giving away with cheap prices, i'll sell when the central banks stop pumping money into the stocks,currency's,banks, fiddling the employment figures when the trade deficit is at zero, the likes of the usa/uk start making stuff instead of service industry's, and they start cutting back of big government.

Its all a goldilocks economy the governments are hiding the real mess!

As Jim Sinclair says if you can't stomach the volatility $100 down swings and up swings get out.

"this is it"

-

0pps double post

edit typo

-

I think you will find coininvestdirect.com are cheaper and they dont seem to be bothered about documents. Thay are based in Germany I think.

Thanks for the reply,i'm sure he'll go this way 2morrow ,what a bargain he's getting with today's smack down.

-

Look who's getting into commodities in a bigger way.

And they most be shorting gold today to help exceed expectations on profits as well.

I think this is another bear-trap from Goldman Sachs.

I would think they got the nod and wink to smack gold down form their ex chaiman in the fed.

NEW YORK, March 18 (Reuters) - Goldman Sachs Group Inc (GS.N: Quote, Profile, Research) boosted its commodity trading activities dramatically last quarter, while shrinking its exposure in equities, according to its earnings statement Tuesday.

The shift into surging commodities markets and away from the relatively soft stock markets helped the top Wall Street investment bank exceed expectations for its first-quarter revenues, it said.

http://www.reuters.com/article/fundsFundsN...817900320080318

-

Right my friend looked at the etfs and Perth Mint ,he has decided to dip his toes in and buy physical coins,like kruggers about 20k it total for now , was suggesting coininvestdirect.com but would they ask for id crap for been over the official 5k limit or spread it around Bairds,Chards,ATS and so on to keep the greedy tax abusers and collectors from been nosey.

I know people here have used them and recommenced them as trustworthy etc..

Tee,hee

Replying to myself again, My friend is going to buy tonight some coins, i think he is a real lucky B*stard getting the bargain with the nice Easter sales and huge reductions on the spot gold price today.

Seems that the coininvestdirect are the cheapest place to do business.

-

Right my friend looked at the etfs and Perth Mint ,he has decided to dip his toes in and buy physical coins,like kruggers about 20k it total for now , was suggesting coininvestdirect.com but would they ask for id crap for been over the official 5k limit or spread it around Bairds,Chards,ATS and so on to keep the greedy tax abusers and collectors from been nosey.

I know people here have used them and recommenced them as trustworthy etc..

-

There are some rumours on the web about HBOS today. In my opinion, Darling will have to nationalize half of the UK banking sector in the end. The UK will be in a depression for a very, very long time since it's all going to be paid for by the British people.

http://www.bloomberg.com/apps/news?pid=new...id=as68q6vvGwfY

Don't you have to love them? He says exactly the same thing Bear Stearns said a day before the lights went out.

NOTE: A bank is liquid as long as everyone does not take their money out. It's a con-game. No con-fidence, no bank.

It seems as if the piggy banks in the states are begging for more from the as well fed. and the famous gold short sellers , i pity the taxpayers.

:lol:

:lol:

Callan said Tuesday that Lehman

Lehman Brothers Holdings Inc

LEH

46.49 UNCH 0%

NYSE

Quote | Chart | News | Profile

[LEH 46.49 --- UNCH (0%) ], which reported better-than-expected earnings on Tuesday but has faced persistent rumors of a Bear Stearns-type liquidity crisis, plans to borrow from the Fed through the discount window.

Lehman followed up on Callan's announcement by borrowing from the window within minutes of her appearance. At 5 p.m. New York time, Lehman borrowed $2 billion, sources said -- a small amount relative to the bank's $375 billion balance sheet.

Goldman Sachs

Goldman Sachs Group Inc

GS

175.59 UNCH 0%

NYSE

Quote | Chart | News | Profile

[GS 175.59 --- UNCH (0%) ] also used the discount window late Tuesday, sources said, but it wasn't clear how much money the investment bank asked for.

http://www.cnbc.com/id/23696332

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

Yippie!

Got out of my Silver Perth Mint Certificates (paper promises) converted to dollars to save on FX charges

and bought physical gold in dollars to be delivered from a USA depository yesterday.(Cheaper)

Phew! i had to wait over a year+ to wait for the silver price to go up...i would've preferred being into silver but i didn't trust The mint with no public Audit of its bullion,and with all this talk for every coin," their are 50 odd pieces of paper having claim to them". i done the maths and didn't like the fishy smell.