-

Posts

112 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Goldilocks

-

-

Perth Mint - I used them but am glad to be shot of them - margins to get in and out are high, dealers take about 3 per cent'ish I think, selling and buying is cumbersome, you have no say in the exact spot price settled, delivery of certificates was slow and messy, took weeks, some got lost, nightmare, ditto getting the funds wired to banks, I could not recommend them - see Ted Butler on the Perth Mint, I've also read horror stories, one chap waited five months for delivery of ALLOCATED!!! silver that he was paying big bux for alleged storage, lol, 5 months because obviously Perth did not have the physical silver they claimed to have and had to scrabble around on the open market to find the metal. Fact is it is a paper pool account just like Kitco - were silver to say reach 100 an oz next month and a deluge of investors wanted delivery, they wd not get it, ditto getting funds settled at 100 bux an oz, because it is just like the fractional reserve banking system, all works ok as long as 97 per cent of folks leave their paper money with the entity, but if delivery is neede pronto then it all ends in tears...

Finally Peth is AAA rated, lol, so were many banks and hedge funds that have gone tits up - we have no idea what Perth are exposed to via sub prime and derivatives, and one more thing - they are insured by Lloyds, but if the financial implosion happens on the scale Sinclai and cgnao and others have itemised, then Lloyds will go under too.

Tell yr friend to buy 200ks of physical gold, and put it in several secret locations - NOT banks, as banks are going to possibly suffer runs, not worth the risk, also the confiscation question with banks, and if he buts UK sovs, then no CGT either, fuggedaboudit...

Thanks every one for the replys to my friends gold investment indecisiveness. i will show him your replys & links later to-day

I personally got Allocated Silver Perth Mint certificates,i got my broker to get me the serial numbers and weights which they did within a week, haven't got any problems yet, but i'm hoping it will remain so, i have paid the storage fees for the year,and like the fed i will monitor the situation closely.

I don't like the fact that it took someone 5 months to get delivery of allocated metal with the Perth Mint, i should think supply shouldn't be a problem with them owning a mine or two and a refinery!

-

I'm stuck on the "if it ain't allocated it ain't real gold" view.

You can see James Turk doesn't think much of any paper version of gold.

He obviously has a vested interest in saying that, but what he says makes sense to me anyway.

If you agree, and therefore want allocated, that only leaves two basic options:

1. Buy some and store it yourself

2. Buy some and get someone trustworthy to store it for you.

For (1) you can use safe deposit boxes, banks, etc etc.

For (2), as you can see above, there aren't many options. BV, GM, the Perth Mint allocated storage option......

http://www.perthmint.com.au/ig_allocated.aspx

Personally, as many others have said on here, a mixture of (1) and (2) seems to be a nice option.

And the more you spread it around, the less risk you have with any one options.

None of the above options will take more than say a week total to liquidate !

Less with GM & BV. Just a few days while the money transfers.

Yeah tried telling him to go for allocated, but he doesn't want to pay the fees on storage etc, he really wants to get into gold/silver but he is indecisive and knows the etfs/ pool accounts are messy stuff ,he also is coming up with the can't eat gold

crap that he has read on a certain site,and that it "gold/commodities" is in a bubble, but i am trying to convince him that the train will leave the station without him if he doesn't hurry up.

-

Wasn't their a real life film about a guy who was America's biggest coke suppler in the 80's that stored his ill gotten gains in one of the banks in panama and there was a coup, and the new leaders decided they would like to keep his millions banked there, messy i would think.

-

Maybe that at least partly answers the many questions we get on here about ETFs

Hi, Steve or anyone what do you's reckon on the Perth Mint certificates unallocated for a friend, I,ve tried to convince him for about a year to get into gold/silver, he has a 200k in sterling ,but wants to keep it for building a house,he already owns the land but is going to take another year or so with planning, i tried telling him about etfs the article above should put him off, he won't buy physical has he wants to liquidate quickly & is a bit frighten at the moment of inflation eatng his hard earned cash.

I would think even though the pool accounts with the Perth Mint would be a better bet than the etfs, even so they are only a promise,plus the Aussie gobberment own the Mint,and have a working gold/silver mine,so if things go tits up, he should at least get something,even if they have to dig for more metals in my opinion,this is what i would maybe do in his position.??

-

Ah, you've got me at it now

PS I see we found the same dead cat with Google

)

)Ssshhhhh! yes got the pussycat from google, but i came up with the red line, i think maybe yours could be in breach of copyright too.

-

My first ever chart.

I think this chart explains why the Dow,Dollar and world markets are up during the ongoing crisis in the Financial system.

I am waiting for the gold rocket to take off in the next few days as people realise that it is all bullsh1t with the surge in stocks & currency markets.

Copyright Goldilocks.

-

I'm racking my brains at the moment. I know this is a cartel driven sell-off, but how will the media be able to justify it? I can't think of a single plausible reason they could give. Even the old classic, profit taking, doesn't fit given the inflationary news and the persistance of the sell off.

Seems the cartel's hand is a bit too obvious in this one for its own good.

Thats it you's were all wrong about the dollar collapsing ,I'm not going to listen to any VIs talking about gold going up.

I'm going to sell all my gold and buy dollars, it's looking good now,

I'm going to swallow the blue pill and believe what the governments tell us, that everything is strong and stable.

WOW! whoopee, yippee.

-

Happy days are here again

The dow crashes yesterday on the bad news,

today it goes up on Lehman getting rescued from their other buddie banks/fed

Sick bucket please!

-

As we go through the day...

Gold chart # 1 ................... : Gold chart # 2 ................... :

.

. .

.Looking like some rates cuts are going to be announced shortly in my opinion by the PPT , they have to smack gold down before they go on telly, or they would look foolish with precious metals soaring while they speak.

Bill Murphy (Gata)explains the joke better.

http://news.goldseek.com/LemetropoleCafe/1205697679.php

I can hear President Bush on CNBC, speaking in New York, talking about our free markets in America. I want to throw up. He is now ranting about "freedom" flourishing. This time I did throw up.

-

Here is another Pluto prediction, a very bold one. Another rate cut in the am before markets open and or a banking holiday. Yes, I know, a little bearish, but the what the heck.

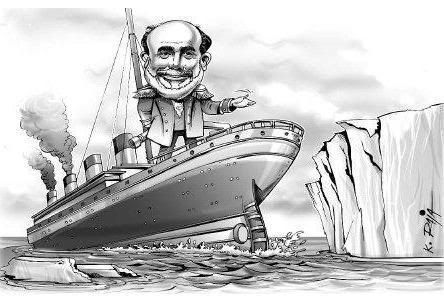

Naw i think Bernake will go full steam ahead!

-

I would have thought all this bailing out Bear Sterns via JP Morgan and brokered by the fed etc ,and bush going on tv today as well as the nervous looking Bernake ,really gold should have went up a lot further up like $1050 at the very least.

-

Just came back from a party. People start approaching me more and more chatting about collapsing banks, house prices and the rise of gold.

The message is getting out more and more. Today was very interesting for me, because I observed such a high interest in these topics from people who seemed to be a little more passive before.

Great day for a party, i hope you endeared them all with the rise of gold.

It's funny about people talking about the collapse of banks/house prices, about September a guy i know was wanting to buy a council flat in a sh*thole of an estate at about 145k( estates agents call them apartments here)and i started ranting about the coming recession,and banks collapsing, and that houses will fall 50% or more over the next few years and i got the feeling he thought i was a doom merchant, i wonder did he take that advice i give him??

Most people i talk to know it is going to be bad, but a few property investors i talked to reckon it will be ok after this summer,

it was like talking to John Nadler Kitco's gold analyst that gold was going to the moon, no point

-

Makes me wonder...

What are the best search terms? I can put them into GEI's keywords

"Gold thread" "Gold chat" ...? what else?

Gold investment discussion, i think lots of people will " google gold investments over the next couple of years, that should put you at the top of the search engine.

goldie

-

...says J.Sinclair before Gold hopped thru $1,000 per ounce...

Dear Extended Family,

Never in economic history has there been a night like tonight. I am writing later than usual because of the enormity of all the converging forces. The euro reaches for $1.60, the Middle East oil producers are in shock, and the IMF tells the world to “plan for the worst.”

The reason this missive is late is because I am reverberating at the speed of the disintegration. These cursed OTC derivatives and their makers, who incidentally made the international banking community rich beyond your wildest dreams, are now unwinding at lightening speed.

Do you think any entity with any OTC derivative now has faith in the paper?

This paper is $550 trillion plus dollars in notional value. The horrible fact is that in bankruptcy notional value becomes real value with the capacity to destroy the world financial system.

The above is no wild assumption. It is hard, cold fact.

Expect currency intervention to slow down the rise of the euro.

Intervention has never worked. It will not now. In fact, it will backfire so fast that the effort will be abandoned, making things even worse.

Intervention in currency, the dollar, will only provide the capacity for other central banks, oil producers and holders of high risk long US treasury paper to diversify out in huge amounts of decaying dollars at singular prices.

I could go through a tome on how intervention works, but accept that any rise in short rates will break the bank immediately. Intervention in the euro/dollar is another practical impossibility except as a bluff.

There is no practical solution to today’s TERMINAL problems and that means you are up to your eyeballs in alligators.

You must protect yourselves.

Gold is going to $1650. In all probability my major error will be in forecasting a price that is much too low for gold.

The ratio spread long the major gold producers, short the juniors, is going to kill the math whizzes that think they are in the captain’s seat. The reason is the only value still in precious metals shares lies in the best junior issues these geeks have been hammering.

The prayer that a junior with quality assets has is that the illegal short position is enormous.

This is it!

Georgie Junior on gloomberg now live,he sound's as if he panicking about the whole sorry affair.

-

I've been waiting to do this for a longgggggggggg time.

-

I think we will have loadsa rockets pictures today

:D gold rocket firing on all cylinders , i don't think the cartel can stop $1000+ happening today.

:D gold rocket firing on all cylinders , i don't think the cartel can stop $1000+ happening today.

P.s anybody use Internaxx based in Luxenbourg

Americas Northern rock wannabe in waiting

The name on most people's lips was Bear Stearns.

Chris Whalen, of the financial consultancy Institutional Risk Analytics in New York, said: “The Fed move is confirmation that at least one of the banks is in trouble. A huge part of the banks' inventories are illiquid. If a broker-dealer is illiquid, it dies.”

Mr Maughan said that the most likely victim was Bear Stearns, the first bank to run into trouble in the sub-prime crisis and the one that, among all wholesale and investment banks, is most reliant upon the use of mortgage securities for raising funds in the money markets.

http://business.timesonline.co.uk/tol/busi...icle3542775.ece

-

Just had a little nibble myself, with some more Goldcorp, and Minefinders.

I emailed selftrade online uk brokers for info on certificates in my procession,i really want some junior mining company's under my belt and had picked some as well.

My question is after reading Jim Sinclair about making sure that one gets procession of certificates etc., is there any .company that could provided them, i am a bit paranoid at the thought of some broker sitting on my shares in his/her safe, and if the brokers/financial company's went bust, idon't want to be in line waiting on a bankruptcy judge to give me a couple of pence in a pound.

Me to selftrade

I was wondering if I could buy commodities (junior miners) in the U.S. and Canada and be able to hold onto my own certificates, if I opened an account with you.

I don’t mine paying the fee for the certificates to be in my procession, and I would be going long on the shares as well. 3-5 years.

Their reply; We are unable to deal in share certificates for international paper certificates therefore would not be able to help you with your request.

-

From axstone's thread at goldismoney forum.

just about sums it all up.

Not be long for loads of rocket pictures.

The view from another Bill:

To all; I woke up this morning and saw the $ a little firmer, Gold and Silver softer, and stock futures about unchanged. With the news of this past weekend, I wonder, how is any of this possible? The Dollar should be in freefall, along with equities, and the metals should be "up limit". The Fed puts an emergency $200 Billion into the banking system, JP Morgan says the banks are facing a "systemic margin call", Ambac raised a whopping $1.5 Billion, 70% of ARM munis failed last week, and Fannie and Freddie have had their credit quality questioned, resulting in Billions being dumped on the market. This is not the recipe for disaster, IT IS DISASTER! On what planet do we live? Planet Orwell? It is OVER. I don't know when the masses will realize this fact, but they will. Very shortly! What we have directly ahead is what I call a "garden hose" market. We will see $trillions trying to get out of all things paper, ie $s, bonds, stocks, you name it. This same money will then seek to enter the safe haven of the precious metals markets. The problem will be the "garden hose" syndrome. What is this syndrome you ask? It is the belief that with the push of a button, you can get out, or in. Trying to put Niagara falls through a "garden hose" just won't work! Mathematically impossible. In today's markets the doors out of paper and into the metals are small, and getting smaller everyday. Listening to CNBC, Bloomberg, etc., I can only shake my head. I'm hearing " buy the housing and finance stocks, they led us in, they'll lead us out". Or how about this one. An analyst this morning who touted the "goldilocks" or "soft landing" scenario until a week ago said, "this recession will be mild and over by June". Wouldn't it have been nice if he had given us a little notice ahead of time, warning of a recession? THIS IS SYSTEMIC! Don't listen to me, don't listen to Bill Murphy, listen to JP Morgan! They know. They created, along with other rocket scientists, this game. They have told us the banks face a systemic "margin call". Why shouldn't we believe them? Wall Street firms have the reputation of putting lipstick on pigs, painting pretty pictures, etc.. How bad must the banking system really be if they tell us of a systemic margin call? Are they being square with us, or is the systemic margin call a rosy scenario?

The point is, we are on the cusp of "shock and awe". The average person who listens to financial news and does not dig for the truth will truly be shocked and awed. I issued a Crash Alert to my clientele this past Saturday. I see no other avenue at this point. I pray I'm wrong. Regards, Bill H.

from

www.lemetropolecafe.com

Mar 10, 2008

__________________

-

I went ahead and bought some coins from coininvestdirect on Friday, so will keep you posted with the progress - thanks to those who replied to my query.

by the way, I am not CTT!! just some nobody hpc poster who wants to keep his anonymity! I should have just kept my trap shut about hpc from the start!

I have seen this B.I.N deal on ebay, what do people think?

http://cgi.ebay.co.uk/10-oz-Gold-Krugerran...1QQcmdZViewItem

I for one would buy these of this guy if i had anymore paper money

,seems a good bargain i've looked at is feedback and to have one negative in selling over 1200 items he most be a a real honest guy. although he hasn't sold anything over 5k before.

,seems a good bargain i've looked at is feedback and to have one negative in selling over 1200 items he most be a a real honest guy. although he hasn't sold anything over 5k before.I have bought a few kilos of silver and have had no problems from ebay sellers,if you check them out well.

Try using a free tool called http://www.toolhaus.org/

It is great for getting all the bad feedback,that you don't get looking at the ebay one.

-

Do yourself and your family a big favour. Invest in a multi-stage (6 stage preferably) Reverse Osmosis Filtration System. The government is trying to get everyone to drink tap water. So if they are doing that you must smell a rat and act accordingly.

They are setting an example - because you are next!

http://www.bloomberg.com/apps/news?pid=206...Zs&refer=uk

A backlash against bottled water has started in Britain, with some newspapers urging restaurants not to serve it and politicians including London Mayor Ken Livingstone calling for a boycott. Tap water requires around 300 times less energy than bottled water for its packaging and transport and leaves nothing for disposal.

Fluoride is a corrosive poison.

http://www.apfn.org/apfn/poison.htm

"I am appalled at the prospect of using water as a vehicle for drugs. Fluoride is a corrosive poison that will produce serious effects on a long range basis. Any attempt to use water this way is deplorable." Dr. Charles Gordon Heyd, Past President of the American Medical

Association

"fluoridation ... it is the greatest fraud that has ever been perpetrated and it has been perpetrated on more people than any other fraud has. "

Professor Albert Schatz, Ph.D. (Microbiology), Discoverer of

streptomycin & Nobel Prize Winner.

I don't want or have asked for these B*stards to use me or my family to be guinea pigs

So we soon see M.P. drinking glasses of tap water,in the same spirit as the M.P. John Gummer had is daughter eating a hamburger during the mad cow decease crisis and telling the sheeple everything is contained, hmm where has that been said before.

-

Breaking news....cryptic image of cgnao discovered in mushroom cloud

I think I'm on to something big here boys.....Tell me thats just a coincidence....

http://www.housepricecrash.co.uk/forum/ind...p;#entry1005485

cgnao He definitely has a real sense of humour as well he will need it over there i think he likes winding the mods up too.

.

. -

Euroland forecast doesn't look to good either, i wonder how long the Germans will keep propping it all up,and end subsidising Ireland,Spain, and the rest of the parasites on their back. They would be still be driving Donkey driven carts if it wasn't for the big European community handouts, Ireland fleece them well with their nice new motorways and other infrastructure funds, i wonder how many suitcases of money Bertie Ahern forgot about or lost

, in the feeding frenzie from the Germans

, in the feeding frenzie from the GermansUBS warns euro will be pushed close to breaking point

"The coming two years are likely to prove the most testing time for the coherence of the single currency to date," said Meyrick Chapman, the bank's Europe strategist. "We expect that it will emerge unbroken. There is too much political and economic capital invested to break the project. However, adjustments are likely to be severe," he said.

UBS said it was unclear how Europe would deal with the likely crisis when it comes. EU rules forbid the ECB to provide liquidity to banks that are "potentially insolvent".

UBS warned of a "funding freeze" for countries with very high current account deficits, such as Spain, Portugal, and Greece that have come to rely on in massive inflow of foreign money to plug the gap. Spain has built up the biggest cross-border liabilities with foreign debts of $362bn (£180bn), or 26pc of GDP. Italy has accumulated $275bn, Greece $129bn, Ireland $123bn, and Portugal $98bn.

http://www.telegraph.co.uk/money/main.jhtm...0/cceuro110.xml

-

-

I have been exploring this site and it is brilliant,for investment tips but still too complicated for a complete novice, so i am taking it upon myself to learn as much as i can and i found this place that gives a complete novice a bit of an insight to the casino, it even has a quiz after the info to see what one has picked up upon, even a dummie like me can get the terms and answers right.

http://beginnersinvest.about.com/

Hope it helps dummies like me.

After all when gold reaches are target we will need an exit plan

He-he replying to myself.

:blink:

:blink:

i give a bad link for beginners in investing plus quiz for Numptys like me here is the correct one if anyones interested.

http://beginnersinvest.about.com/od/invest...ons_Quizzes.htm

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Yep done the same as you reading & reading again i'm now totally convince 100% that gold will triple or more in the coming year or two,and having a laugh at the cartels interventions.

I've been emailing him links and info on gold, he is visiting for 4 days,so i will keep on at him, and show him the light,his decision at the end of the day,but getting tired explaining in my simple terms.