-

Posts

1,571 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by cgnao

-

-

On Nov 26th gold was 820. 3 trading days later it was 760. We got the smackdown.

I am now hearing rumours from the same source that there is an urgency to try and get it below 600 EUR.

The source also tells me GBP is on the verge of a precipitous slide.

-

You are really convinced for the smackdown. Is it today Cg?

I am hearing rumours from a source that has rarely been wrong.

The source says it's coming soon but doesn't know when.

The source also says if it fails there is going to be a discontinuity.

If I had to bet, friday afternoon in NY trading.

It usually starts with gold stocks being pounded a few hours before the smackdown proper.

-

I say we'll get both hyperinflation AND civil disorder or possibly war.

However this is the typical pre-smackdown article.

Prepare for the £500 goobye kiss.

http://www.telegraph.co.uk/finance/comment...d-unravels.html

Citigroup says gold could rise above $2,000 next year as world unravels

Gold is poised for a dramatic surge and could blast through $2,000 an ounce by the end of next year as central banks flood the world's monetary system with liquidity, according to an internal client note from the US bank Citigroup.

Last Updated: 4:48PM GMT 26 Nov 2008

The bank said the damage caused by the financial excesses of the last quarter century was forcing the world's authorities to take steps that had never been tried before.

This gamble was likely to end in one of two extreme ways: with either a resurgence of inflation; or a downward spiral into depression, civil disorder, and possibly wars. Both outcomes will cause a rush for gold.

"They are throwing the kitchen sink at this," said Tom Fitzpatrick, the bank's chief technical strategist.

"The world is not going back to normal after the magnitude of what they have done. When the dust settles this will either work, and the money they have pushed into the system will feed though into an inflation shock.

"Or it will not work because too much damage has already been done, and we will see continued financial deterioration, causing further economic deterioration, with the risk of a feedback loop. We don't think this is the more likely outcome, but as each week and month passes, there is a growing danger of vicious circle as confidence erodes," he said.

"This will lead to political instability. We are already seeing countries on the periphery of Europe under severe stress. Some leaders are now at record levels of unpopularity. There is a risk of domestic unrest, starting with strikes because people are feeling disenfranchised."

"What happens if there is a meltdown in a country like Pakistan, which is a nuclear power. People react when they have their backs to the wall. We're already seeing doubts emerge about the sovereign debts of developed AAA-rated countries, which is not something you can ignore," he said.

Gold traders are playing close attention to reports from Beijing that the China is thinking of boosting its gold reserves from 600 tonnes to nearer 4,000 tonnes to diversify away from paper currencies. "If true, this is a very material change," he said.

Mr Fitzpatrick said Britain had made a mistake selling off half its gold at the bottom of the market between 1999 to 2002. "People have started to question the value of government debt," he said.

Citigroup said the blast-off was likely to occur within two years, and possibly as soon as 2009. Gold was trading yesterday at $812 an ounce. It is well off its all-time peak of $1,030 in February but has held up much better than other commodities over the last few months – reverting to is historical role as a safe-haven store of value and a de facto currency.

Gold has tripled in value over the last seven years, vastly outperforming Wall Street and European bourses.

-

£500 goodbye kiss shortly.

-

Gold and silver have risen strongly last friday and today, and yet the PPT has NOT smacked them down ...why?

PPT has and is braking gold & silver. Massively. You have no idea what would have happened if they hadn't.

Anyway, it won't work for much longer.

-

http://www.coininvestdirect.com/main.php?a...rate=pound_rate

Krugerrand: buy £544.58 sell £596.78

http://www.goldline.co.uk/bullionCoinsPage.page?coinId=48

Krugerrand: sell £ 611.00

http://www.goldline.co.uk/bullionCoinsPage.page?coinId=71

Britannia: sell £ 616.50

http://www.proaurum.de/preisliste.jsp?action=showList

Krugerrand: buy EUR 637.50, doesn't sell

Philharmoniker: buy EUR 631, sell EUR 675 (3 weeks wait)

http://www.proaurum.ch/preisliste.jsp?action=showList

Krugerrand: buy CHF 970, sell CHF 1058.50

-

Ladies and Gentlemen,

THIS IS IT

-

MUHAHAHAHAHHAHAHAHAHHAHAHAHAHHAHAHAHAHAHAH

http://www.foxbusiness.com/story/markets/c...ies/gold-hands/

Monday, November 17, 2008

Why Gold Is Down, But You Can't Get Your Hands on Any

At first glance, it appears as if the gold bugs, those bullish on gold, have been stepped on this year. Spot gold is down nearly 30% from its peak of $1033 an ounce set earlier in the year.

But a two tiered market has developed where speculators have been badly burned trading gold futures, while some investors holding actual physical gold have managed not only managed to keep their shirts, but have held on to gains for the year.

Dealers and analysts are calling it an “upside down” market where physical gold, including coins and bars, are in short supply and far more expensive than the price quoted on New York Mercantile Exchange’s COMEX division.

What’s sparking the demand for physical gold? You need to look no further than the financial landscape surrounding investors.

“I’ve never seen anything like this,” says Scott A. Travers, author of The Coin Collector’s Survival Manual. “1979 and 1980, the go-go years of Jimmy Carter, gas lines, inflation, interest rates at extraordinary levels had people rushing to tangibles. The frenzied pace for yellow metal today has exceeded those tumultuous levels.”

On top of a slowing economy, liquidation by cash hungry hedge funds has gotten much of the blame for the slide in commodities futures prices including the metals group.

In recent trading, the active December contract has traded in the area of $740 per ounce, while one-ounce bars of gold have been trading at or near 20% premiums to the front-month futures contract, according to gold dealers. Usually the premium is only about 5%.

The same goes for silver, where Comex paper futures are trading at just over $9 an ounce, compared to physical supplies commanding prices above $12 an ounce.

There’s an even greater discrepancy involving average uncirculated one-ounce late 19th and early 20th century gold coins known as $20 Liberty and $20 St. Gaudens coins. These particular gold coins, which normally attract a price of about $70 an ounce above spot, are attracting bids of at least $1,100 a piece.

Online auction sites have experienced active auctions for one-ounce gold coins. A quick check of eBay (EBAY) yields a variety of examples of gold coins trading at big premiums to the spot price. A 1908 one ounce $20 Double Gold Eagle had attracted more than two dozen bids and price of over $1200.

Says Travers, “physical gold does well in times of economic distress, calamity and blood in the streets,” adding that “gold is really a quasi-currency; as people worry about a possible collapse of the banking system. With (Treasury Secretary) Paulson’s change of policy on how to use TARP funds, the collapse of the global banking system is still not off the table.”

While the price of gold futures has sunk into the low $700 per ounce range, World Gold Council data show that a pricing floor may be developing, even for beaten-down Comex contracts, due to lower gold production. Through the second half of the year, the Gold Council reported a 4% drop in mining output and a decline in central bank sales.

-

-

-

http://www.coininvestdirect.com

Ounce bar

Buy £528.01 Sell £574.14

Krugerrand

Buy £537.47 Sell £598.54

Maple leaf

Buy £527.61 Sell £601.11

Philharmoniker

Buy £522.67 Sell £575.42

NUgget

Buy £532.54 Sell £603.68

Sovereign

Buy £120.70 Sell £137.86

Britannia

they don't even tell you lest you have a heart attack

Luna

Buy £589.24 Sell £693.59

-

Rigged markets are ALWAYS side stepped in the long run.

COMEX is a disgrace and will blow up in smoke soon.

http://www.firstmajestic.com/s/NewsRelease...nancial-Results

Fri Nov 14, 2008

Third Quarter Financial Results

FIRST MAJESTIC SILVER CORP. (FR-T) (the "Company") is pleased to announce the unaudited financial results for the Company's third quarter ending September 30, 2008. The full version of the financial statements can be viewed on the Company's web site at www.firstmajestic.com or on SEDAR at www.sedar.com.

....

In Summary

Equally important to increasing silver production is further reducing costs and expenses where possible. The 2008 operating year thus far represents a year of high costs as a result of the Company's pursuit of aggressive growth based on the expansion of its operations and Resources. In addition, the Company has been negatively impacted this year by higher Peñoles smelter charges, especially on its lead and zinc concentrates. Management is pleased by the many cost cutting measures underway, and it is believed that further improvements in profitability can be achieved and additional improvements are expected going forward as the Company takes additional measures to reduce costs.

Finally, in this turbulent financial and commodity environment, First Majestic has been reacting by cutting costs where ever possible. Due to the mill improvements ongoing this year, mill throughput at each operation has now reached full capacity which is resulting in a more efficient use of equipment and machinery. The Company is continuing to analyze various options to reduce its operating costs and to squeeze out the most optimum margins possible. One example which is proving to add substantial value is management decided to mint 99.9% pure silver into coins, ingots and bars which are actively marketed on the Company's web site. Interest levels for these products are extremely high and are beginning to represent substantial revenues for the Company. These products tend to sell at substantial premiums to COMEX spot prices. It is anticipated that these sales of refined silver products will represent approximately 10% of the Company's silver production by February 2009. The Company is also exploring other ways of selling its silver outside of the normal avenues of commercial sales.

-

I was trying to explain why I considered the dollar price to be important, even if dollars are not your local currency. I didn't actually say buy dollars as such, just that if hedging a strong dollar was your aim, buying dollars would be a more logical (and successful) strategy. I think it's quite funny that gold is being used (in retrospect) to protect against a strong dollar!

My, what a sucker you are.

-

Countdown started...

-

I watch the COT and open interest reports. In my experience, when they show extremes, like now, it is always followed by a big move.

We will see a breathtaking rally in the next few weeks.

100% guaranteed

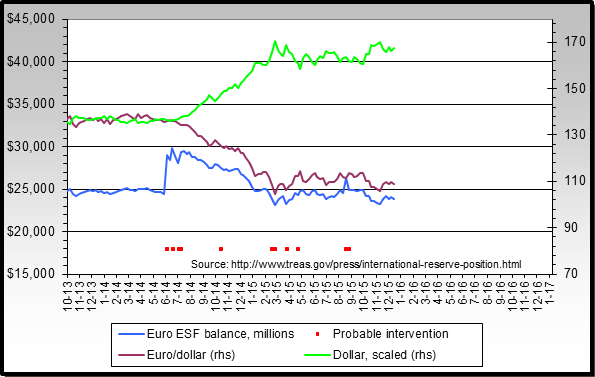

An interesting visual representation of the long USD/short gold trade:

-

How much cheaper is gold buying through your gnome than say Goldline for a 1kg bar? The wait seems to be the same.

It used to be between 1.5 and 2% over london fix, depending on quantity. He told me already the premium will be higher. I'll find out in three weeks time.

-

Shhhhhhhhhh! There's a shortage, don't you know. Play the game!

I am so relieved... The shortage is over... NOT!

Same at ATS bullion and in the whole UK, same at virtually all retail bullion dealers all over Western Europe, including Switzerland. You can't buy in significant size for immediate delivery.

Update: NEW COIN STOCK ARRIVING 10/11 - V. Limited stocks of 1 oz Krugers and 1 oz Maples arriving next week - still delays of approx 2 weeks for gold bars

-

My man has 60 SIXTY!!! brand new Johsnon Matthey .9999 kilo bars for sale at spot + $14.95 per ounce.

http://www.tulving.com/goldbull.html

How much is Fed-Ex from CA USA to Zurich?

Gold could explode well before 3 weeks are up - i.e 15th/16th. Or not!

Not an option sadly.

http://www.tulving.com/New%20Pages/overseas_customers.htm

How Customers Out Of The U.S. Can Now Buy From

The Tulving Company.

Minimum Size Total Order ( Both Gold And Silver)-$20,000

Our Phone Number For International (Canada ONLY) Calls- 800-995-1708 or 714 545-3030 (Other Than Canada And You Will Be Reimbursed IF You Buy From Us)

Storage In A U.S. Depository- First State Depository In Delaware or A Depository Of Your Choice In The U.S. With a segregated account in YOUR name only.

As of June 19, 2008, First State Depository Has Segregated Accounts Which Cost You .005 per year. To compute, that's less than $42 a month for a $100,000 account.

Steps To Place An Order-In This Sequence ONLY.

1) Decide How Much You Initially Want To Spend ($20,000 Minimum)

2) Contact First State Depository in Delaware Or A Depository Of Your Choice And Set Up An Account.

3) Call Us With The Name On The Wire And Tell Us How Much The Wire Is For, Along With Your Depository Account # And The Name And Address Of The Depository.

4) Wire Us The Amount You Want To Spend (Wire ONLY). For International Wire Transfers Our Swift # is CALBUS66

5) AFTER, And Only After, We Have Gotten Funds From You, Tell Us What You Want In The Way Of Precious Metals, When You Choose.

6) Your Leftover Balance Will Be Sent In A Check To Your Depository And Used To Pay Your Storage Bill Or Pay Your Storage Bill In Advance.

7) We Will Ship Your Gold Express Mail, Fully Insured, Thru The U.S. Post Office, And Your Silver Will Be Shipped UPS Ground, Fully Insured, To Your Account At The Depository You Choose.

8) As Soon As You Give Us Your E Mail Address And You Have An Order In Place, We Will E Mail You An Invoice.

9) Please Do Not Ask For Us To Ship Out Of The U.S., As We Will Not Under Any Circumstance Or Situation. We Will ONLY Ship To A U.S. Depository Of Your Choice.

-

My understanding is that THERE IS NO MARKET RIGHT NOW due to manipulation.

As far as I am experiencing, there is no gold market right now due to a shortage.

There is a bloody 3 weeks waitlist to get the kilo gold bars I want to buy with the significant profits of my option "hobby". Not ounce wafers or coins, kilo gold bars! 3 weeks!

To add insult to injury, the sonofabitch gnome of Zurich won't lock the price in. I had to pay him an advance just for the privilege of being given the opportunity to buy at whatever the price will be in 3 weeks. He says it's because it's become "difficult to hedge on the futures market".

-

guys, the buck may go higher, and the DOW could put a new low to 7500 next week

Wait a minute. I think you are shortchanging us. What about the second outlook? I mean, the one we can pick if we so believe?

-

"You may choose the one you believe the most". Hilarious!

Can I say it might just track sideways within a range?

Nah, the red line is more like it.

-

Very few, if any, saw the massive deflationary deleveraging and repatriation of dollars to the US

Deflationary deleveraging my *~^%#*

Note for ignorant suckers: ESF is the US Exchange Stabilization Fund

http://www.ustreas.gov/offices/international-affairs/esf/

Exchange Stabilization Fund

Introduction

The Exchange Stabilization Fund (ESF) consists of three types of assets: U.S. dollars, foreign currencies, and Special Drawing Rights (SDRs)1. The financial statement of the ESF can be accessed through the links on the right hand side to either "Latest Financial Reports" or "Finances & Operations."

The ESF can be used to purchase or sell foreign currencies, to hold U.S. foreign exchange and Special Drawing Rights (SDR) assets, and to provide financing to foreign governments. All operations of the ESF require the explicit authorization of the Secretary of the Treasury ("the Secretary").

The Secretary is responsible for the formulation and implementation of U.S. international monetary and financial policy, including exchange market intervention policy. The ESF helps the Secretary to carry out these responsibilities. By law, the Secretary has considerable discretion in the use of ESF resources.

The legal basis of the ESF is the Gold Reserve Act of 1934. As amended in the late 1970s, the Act provides in part that "the Department of the Treasury has a stabilization fund …Consistent with the obligations of the Government in the International Monetary Fund (IMF) on orderly exchange arrangements and an orderly system of exchange rates, the Secretary …, with the approval of the President, may deal in gold, foreign exchange, and other instruments of credit and securities."

-

new charts, guys

Only a sucKer would trade gold using Technical Analysis.

How very true.

-

If it's genuine and it's just to do with fabrication delays, then it won't last.

Sure it won't last. The spot price will eventually catch up with the real market price.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Update and target for this move. Beware short term pullbacks.