-

Posts

1,725 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by FWIW

-

-

Rest assured I don't either

I don't think it really reaches a conclusion to what will happen, just that it is a very scary situation that is developing and that either outcome will bring a lot of problems. I think that he is commenting on why the short positions are being allowed to reach such ridiculous levels, that obviously can not be fulfilled.

Fear, Uncertainty and Doubt. Mindless FUD....only thing it proves is that the money masters will not give up without a fight.

Stay strong, long and physical.

-

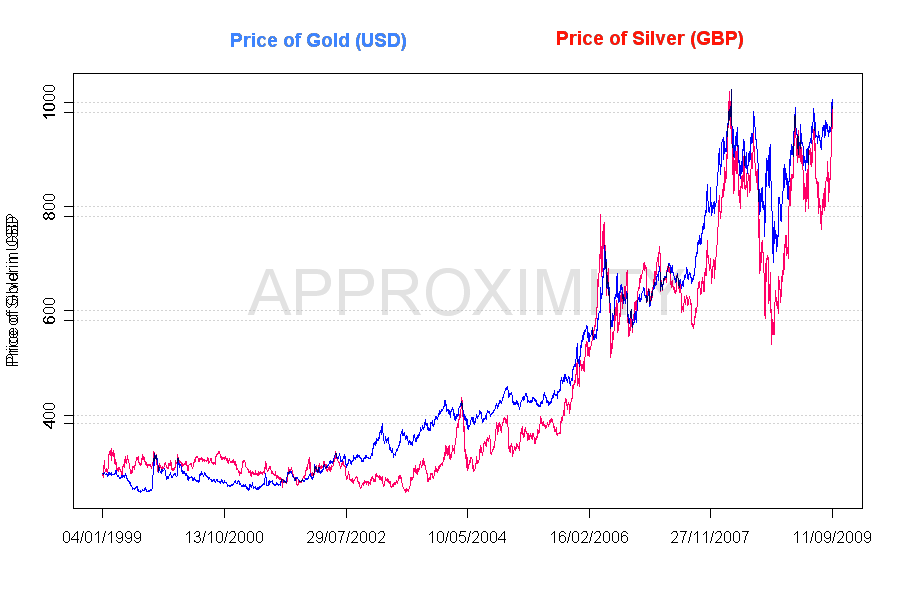

Yes they are very similar, I am not sure as to why that would be.

Thanks for that pixel8r - you'll have to tell me how you came up with that so quick!

What would be interesting is to see the price of oil in Yen overlayed on that...

We might get some more clues on what could happen next and more importantly when.

Elesewhere this was posted: http://mises.org/story/3663 it is essential reading.

-

I find it curious that this graph of silver in GBP is very similar to gold in USD. Both are displaying the possibility of a inverse head and shoulders pattern, which hopefully should be completing over the next few weeks. In silver/GBP if it completes we should be looking at a price above £14 per ounce.

Yes, looks uncannily familiar... maybe this is the mo of the manipulation??

I think an overlay is in order...unfortunately i am writing this on someone else's computer!!!

Any takers?

-

Don't know why but when I looked at your graphs and posts GF, this song came into my head...

From: http://www.youtube.com/watch?v=JIR7ZPIIHQw

Enjoy!

-

Back on topic about Gold...

http://www.marketoracle.co.uk/Article13386.html

and some forex analysis:

http://www.marketoracle.co.uk/Article13383.html

Quote:

In short, expect commodities, other currencies and the broad stock market indices to continue to exhibit sideways to upward grinding price increases over the course of the next 2-3 weeks. Once the USD puts a bottom in, all of the above are likely to decline due to their inverse relationship to the USD at present.

-

I know this not the best place to put this...but a lot of us follow usdjpy, and thought we might discuss this?

Big yellow blob is where we need to pay attention. I've been riding this down for a while, and my green line has never even been touched.

IF she bounces off the bottom blue line, breaks through the green line and breaks through my 38.2 fib retracement, then I will go long! That's a big IF!

If she breaks through bottom blue line, lower bollinger band and white median line then the usa are funked...

Of course I only do this to turn fiat into PM's!

-

It would be lovely if the ordinary investor sold his stocks into this bank sponsored rally and got gold real money back Its interesting how gold is hovering arround the $1000 mark, drifting above durring asian trading. Soon it will be no big deal that gold is +$1000 as it has flirted arround that level so long.

Can't believe you didn't say Gold AND Silver!

-

Sorry if this has already been posted...

http://seekingalpha.com/article/160619-the...icle_sb_popular

-

Something not right here:

That's why I say if you're gonna trade gold then you need your stop-loss greater than $10....

Keep it real, keep it physical....

Not sure if 'someone' is trying to hit the longs SLs at 980-982 area....anyone else see this on their trading platform?

Kitco not reacting...

-

I have chosen my 'flation route & after much deliberation & a bit of a late change to my buying plan, I have gone in approx 70/30 silver/gold. I initially was just going to buy all gold as I didn't really have an understanding of silver. I then spent the last 4-6 weeks getting my silver knowledge up to speed. (GOM speed that is

)

)I am annoyed at myself tbh as I should have been more aware of other metals, not just gold.

edited

I must say if copper has a phd in Economics, then silver has a 1st class honours degree!

Gold at the moment is getting 9x A* in GCSE's but we all know that the exams are too easy....

This has been surprising to me, as I held a view that silver was somehow inferior. Maybe the Hunt brothers knew something all along? We should learn 1 key lesson from their obvious mistakes - never ever buy PMs with borrowed money!

-

What's this!? Shock, gasp.... GF thinks things are no longer going hyper?

PS: Notice I refrained from the deflation word and used deleveraging instead.

I've been telling you for years there is no

spoondeflation...

-

Looks like the sales are on...

How far will China allow it to fall before they announce that the Yuan will become a gold-backed currency?

http://www.reuters.com/article/rbssBanks/i...EK9879920090908

-

a bit of humour this morning:

we are all obviously missing a trick or two it would seem:

"How to buy gold for only $329 an ounce while others are paying more than $900 an ounce."

the only problem is that he only has 11 free copies of his book left. The strike through's haven't copied across from the website. Was a 100 copies, then 75......you get the picture.

"Hurry! Only 100 75 50 25

11 free copies remain!"

I fear we may miss the boat though because:

"Hurry! This offer expires: TODAY -- Wednesday, September 9th -- at midnight"

this $329 an ounce is current for today btw.

:lol:

:lol: you have to ask yourself, if you are switched on enough to be buying gold, why on earth would you buy his book ?

You seen the author's name? Nathan Slaughter!

More like lambs to the Slaughter!

EDIT TO ADD: If this is true can someone do this and then sell me the physical for $660 per oz?

-

smug mode !

only downside is I wish I had bought more at $750

ah well - cheers guys

If PPT get their way then we might be able to get some at the sales!

We should all be like 'golden' boaconstrictors at the moment - everytime they breath out we squeeze them a bit harder. Rinse and repeat until the PPT are dead.

Also I heard this song on the radio and in my mind I replaced the word 'baby' with 'bernanke'...

Cheats never prosper.

-

-

Don't read too much into it - it's just where one of my thick freehand resistance lines is drawn (which disects the wick from 17th March 2008 - actually 1003.15 is more precise, but this is not an exact science).

1003.15 exactly - i thank you!

In my best Lord of the Rings voice - "And so it begins".

-

-

That's a really precise number. What is the significance of the 0.21? [Genuine question]

Don't read too much into it - it's just where one of my thick freehand resistance lines is drawn (which disects the wick from 17th March 2008 - actually 1003.15 is more precise, but this is not an exact science).

-

I dont post much on this forum

mainly because I have very little expert knowledge on the subject

although I do read it intensely and am learning a great deal

Just wanted to thank all the contributors for sharing and doing so

in such a polite and considerate manner

I also at times visit HPC as I notice a few on here also do

It really is the absolute pits in comparison

keep up the good work boys and girls ,your forum is a pleasure

Nice to see someone new!

Time to sing a song?

"I believe that new members are our future, treat them well and let them lead the way!!"

-

I'm still reading this article:

http://www.marketoracle.co.uk/Article13257.html

We gold bulls need to be extra careful - the G20 meeting makes me nervous; we shouldn't forget they have an infinite supply of digits to manipulate the markets. I would be less nervous if gold closed above $1000.21 and stayed above it!

-

Advert on the front page of my local paper

Gold Rush

WE WILL BUY YOUR GOLD FOR CASH

"High gold prices have seen a new industry spring up overnight, & the formally taboo subject of selling second hand jewellery has quickly become mainstream.

"People truly underestimate how much thier unwanted or broken jewellery is worth, the average sale is over £145.00.

Its very exciting when you tell someone the good news"

In my local paper too!!!

There is some mention that the government are behind these companies....

So we brits sell our gold, our government holds it and then the chinese buy it....maybe this is what is being discussed in the G20 - Brown must be proud of raping his own country and its people..Now he'll be selling the family silver to the Chinese and hope that they go easy on

ushim. -

Where did you find that vid, FWIW? More where that came from? Can't seem to find it on the Graceland site.

I got that in an email update - you need to signup for daily free alerts.

Probably a bit naughty of me to put the direct link here though; but hopefully you guys will signup?

I'm looking forward to part 4 where the "pyramid" basics should be explained. I think this strategy is very good for trading electronic gold/silver; however it is no substitute for the real deal.

-

nice video here:

http://www.gracelandupdates.com/video/ucrisis3/ucrisis3.html

INO energy ball also mentioned Jesse!

We all live in interesting times! Got gold?

-

Bill posted the other day that he is not against gold as an investment.

However, considering the 19th century "cross of gold" experience, he is against the so-called "gold standard". It seems that the problem back then in the USA was that few people owned gold but many owned silver (coins and plenty of silver mines in the west to boost supply). So a gold standard basically put most of the money power in the hands of a small clique especially bankers who would use it to back fractional reserve banking.

This is why I dislike the phrase "gold standard" as on the face of it it implies 100% gold-backed money which was not the case.

I think we need to follow the yellow brick road, wearing our silver shoes.

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

Yes please -maybe you could start a thread? I am also wandering where you got the data from. I can't seem to find the good stuff at aproximity!