-

Posts

1,725 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by FWIW

-

-

I'll be saying those words in a different context in 2 weeks... first child due. Hoping it will be a double celebration

Great news Doc!

Real life changing moment - I started to look at the world in a 'new' way once my daughter was born, and more importantly take action to plan and prepare for the future.

All the best!

-

Today's Funny talks.

Audi President: Chevy Volt Is a ‘Car for Idiots’

--------------------------------------------------------------------

A Special Message from Jesse ; ( hehe ...Form My Mentor)

Good Night !

Again ! Trust yourself ....

From:

Great video Jesse!

So do you recommend MarketClub? Looks very impressive from the few minutes i have explored their website. Might try the 30 day free trial...

-

Golds rocketing. Good old Ker, a coincidence? I think not

Looks like the perfect set up for a big move up over the autumn and winter. I'll drink to that!

Looks like the perfect set up for a big move up over the autumn and winter. I'll drink to that!Ker is worth his weight in gold...and silver....

Please don't ever agree with us Ker - we will all be doomed when that happens!

-

Can't think of any.

Leverage? So when you

losewin youlosewin big? -

If he bought it for 375,000, then that is what it is worth. An asset is only worth what it can be sold for.

I would not make an offer on a property today unless I was extremely embarrassed with the amount I was offering. I wouldn't want to tie up all my capital in a property/properties, and certainly wouldn't want to become overly indebted.

Staying on the side-line and liquid in strong currencies is the way to go. Easy to do when you consider property is over-valued, and property ownership over-rated.

Exactly what i said....

He seems to be of the opinion that now that has bought it (and will no doubt paint it, etc) it will be worth much more than £500,000!

I am sure this psychology is unique to the UK house market. We have had years of 'as safe as houses' and fairy tales of the 3 little pigs and the brick house...

-

Assuming your points above, that the pound will remain relatively strong, that deflationary forces will dominate the economy, and that the bond market will remain intact, I would still come to the conclusion that house prices will crash. Rather than house prices being supported they will have to fall. How could the present support/bounce in house prices be sustainable when the population finally gets it that they are in for years of deflation and increasing unemployment?

The main casualty of deflation is the deflation of asset prices and government policy is now at best only delaying an inevitable process. Consumer psychology has not completely turned yet, the house buying mania is still alive, there are still some cashed up buyers around.... once these conditions no longer abound, it does not matter what government does in order to support house prices and they will start to decline.

A colleague of mine has recently told me that he has bought a house worth £500,000 for £375,000...apparantly he got the deal done as he has superior negotiaton skills to anyone else.

It's logic like this that has got this country funked...

Anyway, we all have a long way to go down yet. I think 2012 is a key date for this uk hpc.

-

Yesterday was a bank holiday in the UK, so I missed this action to get some more gold!

However, it is a very intersting pattern if you use Fibonacci Retracements and think the PPT may operate during NYMEX hours...it also shows that if you are trading gold and are long then you need at least a $10 or more stop-loss.

We are now slightly above the 61.8% support area - could go over $955 or down to $947 depending on how the gold gods feel.

-

Yes Wan is still doing the circuits. I spent much time editing my rude post in reply to him but finally just posted

:lol:

:lol:  :lol: as I though it best not to be rude.

:lol: as I though it best not to be rude.I feel your pain mate! I really have to hold off posting replies to him - what annoys me the most is that if you ask how he arrived at his conclusion/view point he just ignores you or posts another chart which has a diffferent 'conclusion'!

I'm still waiting for $6.60 silver as 'wan' promised us ages ago; and $450 gold would be most welcome...

-

It means that the anticipated rally, the "tradeable rally" that Bob predicted last autumn/winter, has happened and is ending.

Yeah right!

Coz paper is back in fashion?

-

-

Meant to post this yesterday but got sidetracked!

Anyway, something has got to happen in the next few days. I am sure the PPT are on red alert today.

Probably hard for you to see, but the 60 day SMA is about to move above the 50 day SMA, puttting all my little ducks in the right order. Also the midpoint median line is also there to lend some support.

More info here: http://www.thegoldandoilguy.com/WeeklyComm...gNewsletter.php

-

We are about to enter the twilight zone...

I have a bad feeling about this one...

-

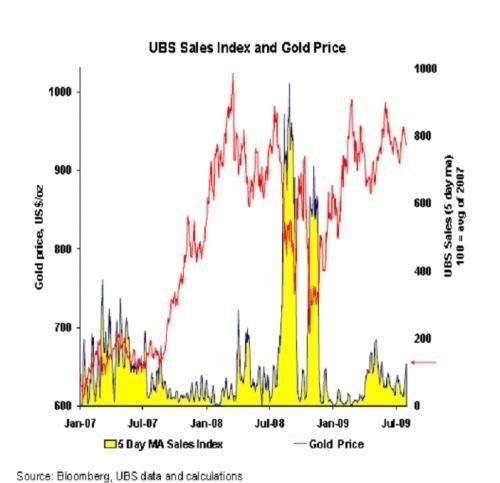

hmmm...nice sales!

Silver and gold very near their 100 day SMA!

-

These $10 off 'sale' prices are so very nice! Like the good doctor has been saying, buy it regularly and relax.

BTW - while watching the England game the other night, I saw an advert from this co: http://www.gotgoldgetcash.co.uk/index.html

Also, the FT has had on the bottom right corner front page an advert from a company trying to get the message across that Sterling is being debased!

advert

http://specials.ft.com/vtf_pdf/130809_FRONT1_LON.pdf

company

and a post worth reading: http://www.sterligoff.com/blog-post-12-08-09

-

-

End of last thread:

http://www.greenenergyinvestors.com/index....st&p=120597

I thought we'd start the month with what I think is one of the most interesting gold charts ever.

Amazing chart - can you tell me where you got it from? I want to use it as a timing tool!

-

Just a quick post to let you guys know that I am going on my hols (Florida) and won't be posting while away!

Gold is still doing what it always does!

Hopefully when I get back (in 10 days or so) it should have broken $960...

I'm back from my hols (now the wife has allowed me to post again!)..and look at the POG....$960!

Had a few well informed taxi drivers who were telling me that the FED is a private bank and that this credit crunch is down to them! I was surprised that the taxi drivers knew this - I think they know what is coming.

A themepark ticket 're-seller' started to tell me about how the Chinese have the upper hand now, and the dollar will become worthless very soon especially if the Chinese decide to dump their dollars. Very surprised to learn that the common man in US still understands what is happening. This guy also told me that a few years ago there was a forex booth in every mall, now to change sterling to usd I had to hunt one down in a big shopping centre. He said that the recent volatility in forex markets had killed these small guys.

Disney was packed; my hotel/appartment complex was packed. Lots of people suffering financially though and just muddling through. Lots of people blaming Wall Street and looking for some kind of 'justice'.

Ohhh forgot to add that I hadn't seen as many old people (who should have retired in my book) still working really hard. All the waitresses in Disney and Seaworld seemed to be older than 65. In fact had a quick chat with a waitress who was 81. She said she keeps working to stay busy and provide for her grand-daughter. Is this what the UK has to look forward to?

The telly always had adverts for gold on usually from a company called goldline http://www.goldline.com/

Also adverts for turn your 'gold into cash' outfits: http://www.cash4gold.com/

Most of the US news channels concentrated on the 'teachable' Gates/Cop moment - a real load of rubbish in my book to keep the serfs occupied whilst the great heist continues.

-

Just a quick post to let you guys know that I am going on my hols (Florida) and won't be posting while away!

Gold is still doing what it always does!

Hopefully when I get back (in 10 days or so) it should have broken $960...

-

Some updated us hpc commentary from Mish...

http://globaleconomicanalysis.blogspot.com...-to-bottom.html

-

http://www.guardian.co.uk/money/2009/jul/1...e-loans-dropped

Great! 125% for everyone!!

100% guaranteed. I suggest 200% IR only mortgages to anyone who wants it in order to get this market moving.

Seriously, how idiotic are these people?

I think they are playing the 'can't beat the idiots, then join them' card...

If the masses go for these 'jumbo' loans then once agian the bubble will reinflate - only to deflate worse next time...

Everyone needs a home, so I can understand why some people 'need' to buy.

-

Not everyone here who buys gold intends to swap back for more paper...

-

Thanks for posting. I don’t really know anything about TA so I really appreciate when others take the time to post stuff like this. Out of interest, why did you chose the real house price chart over the nominal one?

I’m expecting house prices to drop to around 2.5 - 3 times average salary at the very bottom of the market. I think you are in the right ballpark with 90k.

Inflation should cover up some of the mess.

Without inflation, the bottom could be down to around £60k.

I’m not sure about time scales. House prices may fall for another 20 years or more relative to average salary. Though I think we’ll get the nominal falls out of the way around the end of next year.

BTW, 2019 (ish) ties in nicely with the end of K-Winter.

I chose the chart primarily to 'test' my theory. The original chart is here:

http://www.housepricecrash.co.uk/graphs-av...house-price.php

Another, reason to use this chart was the fact that more data does not necessarily mean better analysis. This chart conveniently goes back to 1975, which is just after we all went 100% fiat.

We are truly in uncharted waters with this HPC. Something will break under these stresses.

The 2019 date is what really surprised me - I 'beleived' that inflation will take care of it; however, I cannot ignore the facts.

Would be good if you could show me how the k-winter figure was arrived at. I know diddly about elliot waves...

-

Hi FWIW

I'm assuming that you're looking to see how far house prices will retrace in this correction, in which case I think you've drawn your fibs the wrong way round - could you possibly draw them from the 1996 low to the 2007 high i.e price retraces to the 23,38.2,50,61.8 in that order. Great idea BTW - i've been looking for a similar chart but never found one.

thanks

Jin

Hi Jin,

I think the blue fib does most of what you want.

I was using this trial software: http://www.omniumsoftware.com/chartoverlay.htm

and guess what my trial has run out!

So it may be easier for you to show me what you mean?

Regards,

fwiw

-

I have recently been thinking about houseprices, and put together some TA charts. I almost never put this up because I feel the results are not what I 'expected' and I was afraid you lot would think I was a few fries short of a happy meal.

Anyway, publish and be damned as they say:

First pic - HPC chart with Fib retracement from high to low.

Nothing too worrying there; but it made think about the earlier peaks and so I added some fib retracements to them...

So, what does it mean?

The leftmost green fib shows that the 70's peak fell to the 38.2% level with 3 years up and 4 years down.

The middle red fib shows that the 89 peak fell to the 23.6% level with 6 years up and 7 years down.

The rightmost blue fib is where I go a bit loony tunes and try and predict the future based on my observations of the past. So the next fib in the sequence would be 14.6%, and as we had 11 years up it will take 12 years down (again following the past up-down sequence/pattern). This is around the £91k mark for the average house in 2019.

Now, the reason I am perplexed is that one side of me does not believe that the powers-that-be would allow so much pain. They 'should' be able to debase our currency and inflate us out of this mess. Good for my gold and silver...

The other side of me worries that maybe 'they' can't do anything about this, due to other foreign banksters, and the best to hope for is a slow 12 year grind to the bottom. Not good for my general well being...

Please discuss, shoot down but don't ignore!

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Congrats m8!

Keep it real!