-

Posts

366 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by happy

-

-

-

-

-

-

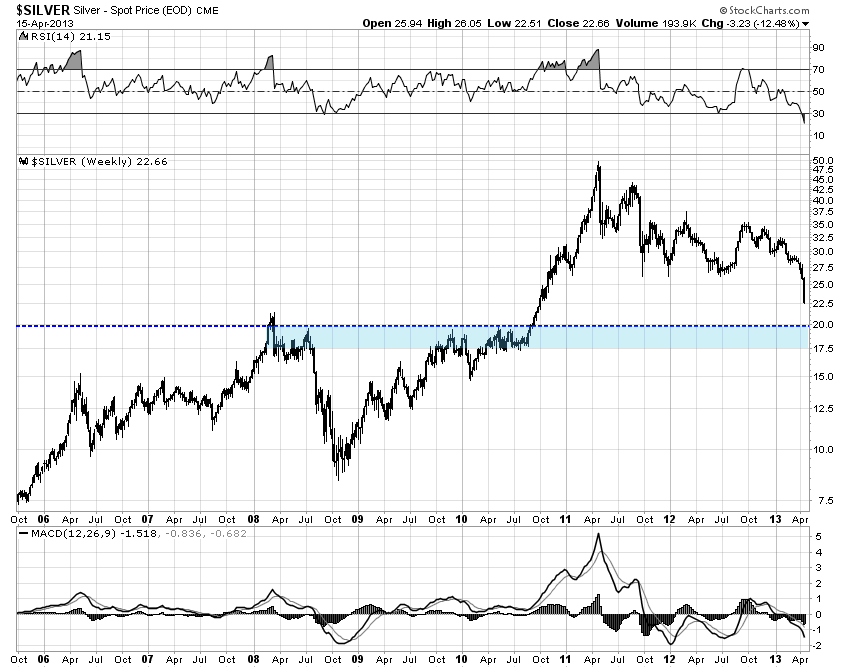

from transcript 18. April, 2013

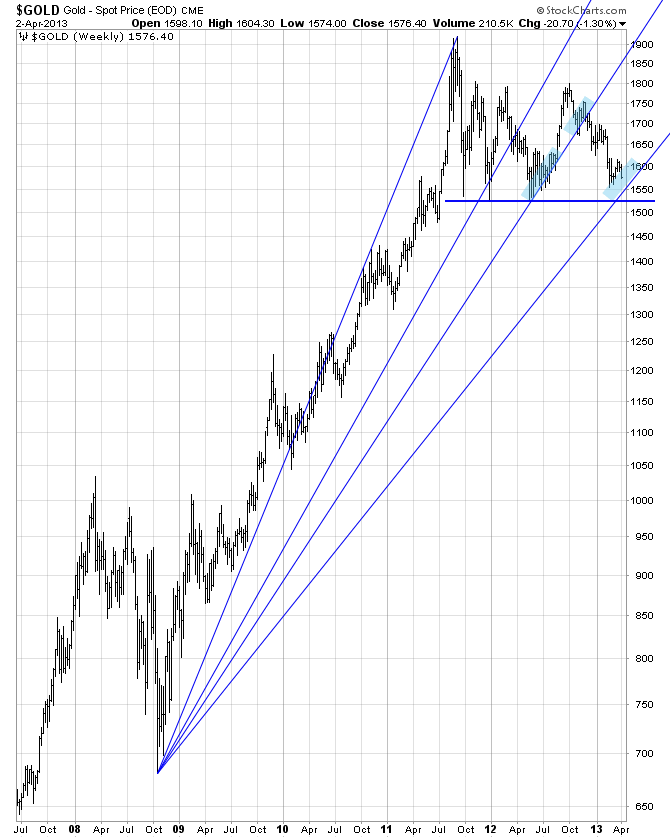

I’ve been warning customers for a long time that I thought the high of $1,900 in 2011 was probably the top. I said there was a chance we might go comfortably higher a little bit, but I kept repeating that most likely was the end of the pattern and that it would finish at a lower high.. . .

We needed to see a drop in the gold market bigger and faster than anything we’ve seen during Wave 5, which I think started way back in 2008 or early 2009. That has been accomplished. That’s the first stage of confirmation.

A lot of people think, “This big sell-off in gold is probably done. All the weak ends have been shaken out. The banks and all these people have been holding. It was just overly subscribed and invested in. It’s just temporary. We’re eventually going to go higher.”

Wave Theory says completely the opposite. This confirmation event indicates that Wave 5 is finished. Of course, Wave 5 is the end of an even bigger pattern. After this first decline, we might bounce for a little while, and maybe even bounce quite a bit. It could bounce as much as $150 off this current low, but then we need the next stage of confirmation. It won’t be confirming the end of Wave 5. It will be confirming the end of the entire pattern that started at the low in 2005.

Unfortunately for anybody long on gold, this requires that we’re going to drop below $1,000 sometime potentially this year. We’re talking about another catastrophic decline in the price of gold to levels that people currently cannot imagine.

. . .

If everybody got extremely concerned and super bearish and pessimistic all of a sudden, that’s probably the low. That has not been the case. It has just been, “Oh my god! What’s happening? Why did this happen? That’s just temporary. Everything is going to get back to normal.”

. . .

People don’t understand that we’re not in the kind of financial world we were 200 or 100 years ago.

. . .

The money that is in the system gets there through the actual request to borrow money. The money doesn’t exist before the request, and then it does exist once the request occurs.

Our whole system for the last 100 years has been built on this growing request for credit and growing economic-industrial complex and businesses all needing money and borrowing it from banks. That borrowing process created the money.

What we’re experiencing now is the end of that credit explosion that has been going on for at least 100 years since the Fed was formed. They were formed in 1913, I think. That means it has been exactly 100 years.

That whole process is coming to an end, according to the gold structure. We’re actually going to start the reverse of that, which would be a credit implosion.

. . .

Based on gold versus the dollar, it indicates that the peak of the credit expansion occurred in 2011.

. . .

The big crash in Gold we saw this week is an indication that that game is now over and that the whole world will be going through a credit implosion.

. . .

Cash will probably be the best place to have your money for the next few years, and it’ll be almost like an investment.

. . .

I’m not sure exactly how this is going to pan out, but I’m virtually positive that the Gold market has peaked, that we’re going to be in a bear market for three, four or five years minimum and that the downsize target minimum is way below $1,000.

-

"Gold had its best day in 3 weeks ending back above $1425 and its best 5-day run in 18 months..."

So far so good...................................................

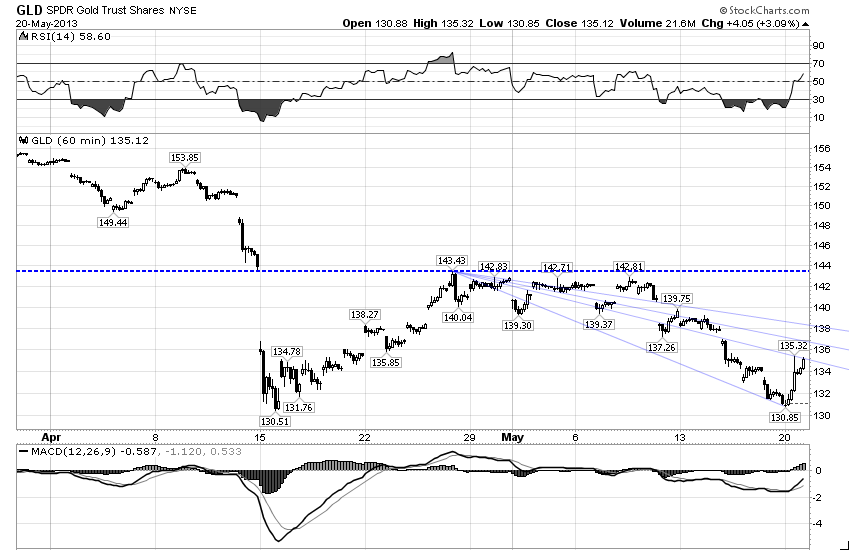

nice one! still, price action so far looks very much like a dead cat bounce / rising wedge.

-

ETF outflows? People selling real, physical ounces or just paper? Are we talking about pallets of gold bricks here or just paper?

Real, physical ounces . . . by the truck load!

Cf., GLD Holdings Plunge

The amount of gold bullion GLD has hemorrhaged recently is amazing. To put it into perspective, earlier this week the rumor that embattled Cyprus may be forced to sell its official gold reserves made news. The Cypriot government owns 13.9 metric tons of gold. But on a single trading day alone in February’s gold capitulation, GLD had to sell 20.8 tonnes! The supply recently added by GLD dwarfs everything else.

The amount of gold bullion GLD has hemorrhaged recently is amazing. To put it into perspective, earlier this week the rumor that embattled Cyprus may be forced to sell its official gold reserves made news. The Cypriot government owns 13.9 metric tons of gold. But on a single trading day alone in February’s gold capitulation, GLD had to sell 20.8 tonnes! The supply recently added by GLD dwarfs everything else.Why is GLD dumping gold so aggressively? While silly conspiracy theories abound as always in the gold world, the reality is far less provocative. GLD’s mission is simply to track the price of gold. The World Gold Council (which is funded by leading gold miners) created this gold investment vehicle in November 2004 to offer stock investors an easy, cheap, and efficient way to obtain gold exposure in their portfolios.

The gold miners created a direct conduit for the vast pools of stock-market capital to chase gold. The only way for GLD to fulfill its mission of tracking gold is for this ETF to shunt excess GLD-share demand and supply into underlying physical gold bullion itself. This capital sloshing into and out of gold via GLD has naturally had a massive impact on global gold prices. And lately gold has suffered a major GLD exodus.

longer term picture:

-

CHART: Gold price vs ETF tonnes shows crash was inevitable

There has been no shortage of explanations for the ferocity of gold's two-day retreat – from $1,560 at the open on Friday to a low of $1,329 late Monday.These range from the more out-there arguments – it's a central bank conspiracy and/or Wall Street market manipulation – to the more mundane: technical breaches, margin calls and a stronger dollar.

But perhaps the crash in the gold price has a really simple explanation; and one that was signaled to investors way in advance.

As the chart shows gold-backed ETF outflows that started early in the new year really took off in February and just accelerated from there.

There was no way gold could hold up in the face of this rapid liquidation by gold's most ardent (former) supporters.

Buying of gold ETFs – fondly referred to as the people's central bank – played a huge part in gold's 12-year bull run.

So perhaps it was a central bank conspiracy after all.

Just not the one you would've expected.

-

Happy, it will be very interesting to see the public opinion chart on gold, when its updated...

Indeed. Ridiculous I imagine!

-

-

-

Well it's now $205 down from the open on friday to the lowest point so far today.

Monster volume so far 512,000 GCM3 (June) contracts traded. This is the highest volume of trade in one day in the history of the gold futures market and we are only part of the way through the day.....

I think when all is said in done we may hear news about the wipe out of a hedge fund or two.

looking like the proverbial "fat tail" event

how far does the time series go back? any idea the last time Gold hit -3 standard deviations ?

-

-

could it be due to Cyprus having to sell their Gold,

from Zeal Intelligence: GLD Holdings Plunge

The amount of gold bullion GLD has hemorrhaged recently is amazing. To put it into perspective, earlier this week the rumor that embattled Cyprus may be forced to sell its official gold reserves made news. The Cypriot government owns 13.9 metric tons of gold. But on a single trading day alone in February’s gold capitulation, GLD had to sell 20.8 tonnes! The supply recently added by GLD dwarfs everything else.Why is GLD dumping gold so aggressively? While silly conspiracy theories abound as always in the gold world, the reality is far less provocative. GLD’s mission is simply to track the price of gold. The World Gold Council (which is funded by leading gold miners) created this gold investment vehicle in November 2004 to offer stock investors an easy, cheap, and efficient way to obtain gold exposure in their portfolios.

The gold miners created a direct conduit for the vast pools of stock-market capital to chase gold. The only way for GLD to fulfill its mission of tracking gold is for this ETF to shunt excess GLD-share demand and supply into underlying physical gold bullion itself. This capital sloshing into and out of gold via GLD has naturally had a massive impact on global gold prices. And lately gold has suffered a major GLD exodus.

-

-

Trust in Gold Not Bernanke as U.S. States Promote Bullion

By Amanda J. Crawford - Apr 8, 2013 6:01 AM GMT+0200

Distrust of the Federal Reserve and concern that U.S. dollars may become worthless are fueling a push in more than a dozen states to recognize gold and silver coins as legal tender.

Lawmakers in Arizona are poised to follow Utah, which authorized bullion for currency in 2011. Similar bills are advancing in Kansas, South Carolina and other states.

The Tea Party-backed measures are mostly symbolic -- you still can’t pay for groceries with gold in Utah. They reflect lingering dollar concerns, amplified by the Fed’s unconventional moves in recent years to stabilize the economy, said Loren Gatch, who teaches politics at the University of Central Oklahoma.

“The legislation is about signaling discontent with monetary policy and about what Ben Bernanke is doing,” said Gatch, who studies alternative currencies at the Edmond, Oklahoma-based school. “There is a fear that the government, or Bernanke in particular and the Federal Reserve, is pursuing a policy that will lead to the collapse of the dollar. That’s what is behind it.”

Bernanke has pushed interest rates to near zero since the 18-month recession that began in December 2007. The Fed said in March it would continue buying $85 billion in securities each month in a program known as quantitative easing that has ballooned its assets beyond $3 trillion and is aimed at keeping long-term borrowing costs low to support economic growth.

. . .

Texas Depository

In Texas, lawmakers are considering a measure supported by Republican Governor Rick Perryto establish the Texas Bullion Depository to store gold bars valued at about $1 billion and held in a New York bank warehouse. The gold is owned by the University of Texas Investment Management Co., or Utimco, which took delivery of 6,643 bars of the precious metal in 2011 amid concern that demand for it would overwhelm supply.

The proposed facility would also accept deposits from the public, and would provide a basis for a payments system in the state in the event of a “systemic dislocation in a national and international financial system,” according to the measure.

Should Texas take such a step, it would offer sovereign backing for deposits and make buying and storing gold easier, said Jim Rickards, senior managing director at Tangent Capital Partners LLC in New York and author of “Currency Wars: The Making of the Next Global Crisis.” He said the coin measures, while impractical, have symbolic value.

“We are seeing a distinct movement back to a world where gold is considered money,” Rickards said.

. . .

Tax Breaks

In Utah and some other states, the measures also eliminate state capital gains or other taxes on the coins.

Critics say the state measures are unwieldy. In Arizona, Senator Steve Farley, a Democrat, unsuccessfully offered an amendment that would have recognized as legal tender other state commodities, such as citrus fruit, as well as sunbeams. The amendment was intended to reflect the absurdity of the bill, said the 50-year-old lawmaker from Tucson.

“It is simply grandstanding to get people afraid that somehow President Obama’s agenda is going to drive us into hyperinflation and economic collapse,” Farley said. “We have enough real problems to deal with. I don’t see undercutting our entire financial structure as a priority.”

In Utah, officials haven’t yet figured out how to accept gold and silver for tax payments -- though some residents have asked to pay that way -- or integrate the precious metals into commerce, state Treasurer Richard Ellis said. Lawmakers have established a task-force to study implementing the law and to examine how the state can accept gold and silver, with their fluctuating values, for payment, Ellis said. He’s not optimistic that it will work, he said.

Regulatory Barriers

“People point to Utah and say we are leading the way, but nothing much has happened because regulatory hurdles have gotten in the way,” said Ellis, a Republican. If gold and silver is being used in the state as legal tender, it is probably only in transactions between individuals, he said.

The Utah Precious Metals Association, established after passage of the 2011 law to advocate for the use of gold and silver coins, has about two dozen members enrolled in a two month-old bill-pay service in which their accounts are held in gold, said Lawrence Hilton, the group’s chairman. Hilton envisions a future with an alternative monetary system based on precious metals in which merchants accept silver coin while gold mostly backs electronic transfers.

. . .

-

-

-

Hello!

Nice to be here

I have been lurking for some time and have enjoyed reading many of the threads on here. Perhaps it is time to join in the discussions!

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted