-

Posts

1,058 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by webmaster

-

-

FNV/ Franco Nevada ($110.34) /UGL: $61.88 =r1.78x; RGLD: $120.42, r1.95x

.... Start, 03.02.20 : ($109.94) /UGL: $52.70 =r2.09x; RGLD: $100.05, r1.90x

FNV: All: 10yr: 5yr: 2yr: Ytd, $110.34, (range:102.29 to 161.25) PER: 31.1, Yield:1.23%

FNV: All:

Ratio: FNV to UGL: ($110.34) / $61.88 =r1.78x

Ratio: RGLD to FNV

-

Phl REITs / Philippine REIT Stocks, 2023 updates. (pg.5)

Date= : MReit, pct. : RCR, pct. : TLT : AReit, pct.: MEG, pct.:

1.03.22: 19.32, 13.4%: 7.80: 5.41% / 144.30: 49.10, 34.0% 3.16,2.19%

1.03.23: 14.24, 14.0%: 5.94: 5.85%/ 101.46: 35.20, 34.7% 2.05,2.02%

1.03.24: 12.44, 12.7%: 4.99: 5.08%/ $98.31: 33.70, 34.3% 1.98,2.01%Fav. REITS: RCR: 5.48/T-93.78=5.84%, AR-32.00, MR-13.94, DD-1.22, FR-3.11

: Fav. REITS: from Oct.'21

RCR (5.48) to RLC (16.20) =33.8% /TLT ($93.78): 17.3%: w/Mreit (13.94) @1.26.24

12.18: (4.66) to RLC (15.60) =29.9% /TLT ($99.15): 15.7%: w/Mreit (12.00)

AReit (32.00) to ALI (34.00) =94.1% /TLT ($93.78): 34.1%: w/Filrt (P3.11) @1.26.24

12.18: (33.60) to ALI (33.95) =99.0% /TLT ($99.15): 34.2%: w/Filrt (P2.63)

MReit (13.94) to MEG (1.98) =7.04x /TLT ($93.78): 2.11%: w/AGI (11.32) @1.26.24

12.18 : (12.00) to MEG (1.95) =6.15x /TLT ($99.15): 1.97%: w/AGI (10.10)

VReit (P1.73) to VLL (1.75) =98.9% /TLT ($93.78): 1.84%: w/ddmpr (1.22) @1.26.24

12.18: (P1.70) to VLL (1.64) =104.% /TLT ($99.15): 1.97%: w/ddmpr (1.22)

REIT Dashboard, 12.29

4stk Areit: Mreit: RCR: Filrt:

Last 33.40: 12.30: 4.89: 2.58:

Div. P2.20: .984 : .391: .284

Yld: 6.59%:8.00%:8.00%:11.0%

4Ave.= 8.40%, 6Ave=8.57%

Ph10yr: 6.00%, 5yr: 5.96%

+VREIT : 1.67, .158, 9.46% (N/A

+Ddmpr: 1.21, .101, 8.35% (N/A

R/tIt 4.95%/ PSEI: 6,450: 7.58%

TLT, : TYX = US,LT: Prem.

$98.88, 40.19=-4.02: 4.38% prev.3.94%PHL Govt Bond Yields: 10yr.etc: yrEnd'22: 6.98%, '23:6.00%

WkEnd Areit: Mreit: RCR : FILRT= AveDvPh.10yr TLT = US,Lt.: prem./

YE'22 35.40: 14.48: P5.85 : P5.50 : 6.52%v6.98% 100.7: 3.92%:

WkEnd Areit: Mreit: RCR : FILRT=AveD.vPh.10yr TLT = US,Lt.: prem./ 6ave.

06.30: 34.70: 14.54: P5.80: P3.83= 6.89% v 6.49% 102.9: 3.86%: 3.03% 7.20%

09.30: 32.80: 12.30: P4.90: P3.04=8.09% v 6.00% 88.69: 4.71% : 3.38% 8.22%

10.31 : 32.80: 12.18 : P4.74: P3.00= 8.19% v 6.00% 83.58: 5.02%: 3.17% 8.36%

11.30 : 29.85: 12.50: P4.65: P2.79= 8.45% v 6.00% 91.56: 4.51%: 3.94% 8.60%

YE'23 33.40: 12.30: P4.89: P2.58= 8.40% v 6.00% 98.88: 4.02%: 4.38% 8.57%US.Yield.Curve : 2yr: 4.65%, 10yr: 3.76%, 30yr: 3.895% at 7.14

4xREITS vs.TLT: Jan'22: 8/'22: 10d / 6.30.23: 5.80 /102.94

= RCR ratio: 5.63% TLT, was 5.63% at 2.09

-

-

LAND: 5yr: Ytd: 0.76 +0.01 (Range 0.6857 to 1.09 ) PER: 5.57, Yield: 11.44% BV: 1.83, 41.5%

CDC: 5yr: Ytd: 0.67 -0.03 (Range 0.6341 to 0.80 ) PER: 3.86, Yield: 4.30% + 2.5% stock div, BV; 1.94, 34.5%

"CITYLAND'S PIONEER HEIGHTS 1- MOVE IN NOW"

Cityland Development Corporation is proud to announce the turn-over of its latest project - Pioneer Heights 1, a 24-storey office, commercial and residential condominium located along Pioneer St., Barangay Buayang Bato, Mandaluyong City. With the completion of the Kalayaan Bridge of the Bonifacio Global City (BGC) - Ortigas Link road project, travel time to the cities of Pasig, Makati and Mandaluyong has been reduced drastically, thus making Pioneer St., a bustling hub for commercial and residential establishments. Carefully planned amenities such as swimming pool, clubhouse, gym, multipurpose I event area, viewing deck and 24 hour association security are provided to make condo living enjoyable and comfortable. Meticulously designed residential units in studio, studio deluxe, 1- bedroom deluxe, 3-bedroom, commercial and office units are now available in cash and easy installment terms on a first-come, first served basis.

An ongoing promo for installment downpayment payable up to 20 months with 0% percent interest is currently being offered. Cityland, a trusted name in the real estate industry is constantly developing condominium units at strategic places around the city to provide good investment for every client. At Cityland, we commit, we deliver.

-

Buyer: FTLF / FitLife Brands: Last: $22.15, PER: 25.3x, Yield: n/a

FITLIFE COMPLETES PREVIOUSLY ANNOUNCED ACQUISITION OF MIMI'S ROCK

TORONTO , Feb. 28, 2023 /CNW/ – Mimi’s Rock Corp. (TSXV: MIMI) (” MRC ” or the “Corporation “) is pleased to announce the successful completion of its previously-announced statutory plan of arrangement under the provisions of the Business Corporations Act ( Ontario ) (the ” Arrangement “) involving FitLife Brands, Inc. (” Parent “) and its wholly-owned subsidiary, 1000374984 Ontario Inc. (the ” Purchaser ” and, together with the Parent, the ” FitLife “).

Pursuant to the Arrangement, among other things, the Purchaser acquired all of the issued and outstanding common shares of the Corporation (the ” Common Shares “). The Arrangement became effective at 12:01 a.m. ( Toronto time) on February 28, 2023 (the ” Effective Time “), resulting in MRC becoming a wholly-owned subsidiary of the Purchaser.Dayton Judd , CEO of FitLife commented, “We are excited to welcome Mimi’s Rock to the FitLife family. We look forward to working closely with the talented team at Mimi’s Rock to help drive further growth and profitability for their brands.”

Under the terms of the Arrangement, each former shareholder of MRC is entitled to receive a cash consideration of $0.17 per Common Share (the ” Cash Consideration “). Further, under the Arrangement, all options to acquire Common Shares outstanding immediately prior to the Effective Time have been accelerated and cancelled in accordance with their terms.

-

RGLD ($119.08, r1.94) /UGL ($61.35) SAND ($4.86, 7.92%), GROY ($1.48, 2.41%)

w/FNV ($111.11. r1.81)

Gold Royalty Co’s

Sym. : Last : PER : Yield: B.V. : P/BV : 2023: 2027: chg%: MkCap: MC/'27

FNV : 111.11 : 31.3: 1.22% 35.24: 315%: 630k: 790k:+25.4%: $21.3B: $27.0k

(peak) 161.00: 45.4: 0.84% 35.24: 457%: 670k: 800k +19.4% $30.9B: $38.6k

RGLD: 119.08: 33.6: 1.34% 39.48 302%: 335k 400k +20%E $7.82B $19.6k

TFPM: $13.44: 57.5: 1.53% $9.03: 149%: 107k: 140K +30.8% $2.70B: $19.3k

SAND: $ 4.86: 97.0: 1.20% $4.73: 103.%: 95k: 125k +31.6%: $1.44B: $11.5k

GROY: $ 1.48: N/A: 2.70% $3.64: 40.6%: ?? k: ?? k +66%E: $215M: ??

4-5 Ave. === 54.9: 1.60%: === : 182.0% -

Gold has one big advantage over Bitcoin - Sandstorm Gold's Nolan Watson

(Kitco News) - Central bank buying will favor gold over Bitcoin, said Nolan Watson, president and CEO of Sandstorm Gold.

On Thursday Watson spoke to Kitco.

Sandstorm Gold (NYSE:SAND) is a royalty and streaming company headquartered in Vancouver, B.C. In 2023 the company forecasts production of 95,000 ounces. Watson is also an executive on the World Gold Council.

Looking at the gold market, Watson said the metal is benefiting but the miners are not.

"Central banks and governments around the world are buying gold, but they're not buying gold equities," noted Watson, which is resulting in higher metal prices but not necessarily higher stock prices for the miners.

To track what's happening in the gold space, pay attention to gold ETFs, said Watson. He said that there's been net liquidation out of gold ETFs over the last 18 months due to institutional investors selling because of the high interest rate environment.

"That is about to reverse. If you actually look at the trend of net liquidation of gold ETFs it's getting smaller and smaller every month," said Watson, who expects the trend to change in the next month or two.

Gold prices hit an all-time high in early December, but cryptocurrencies have had their own run with Bitcoin doubling off lows at the start of the year. Watson said that gold has nothing to fear from Bitcoin.

"Gold is going up because governments and central banks are buying gold," said Watson. "Governments and central banks are not buying Bitcoin. The fundamental thing that is driving the gold price is separate from...what's happening in crypto. There used to be thousands of crypto coins and the total cumulative market cap was getting close to a trillion dollars in crypto. That's all evaporated except for a few core things like Bitcoin and Ethereum. As an asset class crypto has lost a huge amount of ground to gold even though the Bitcoin prices come up."

Operationally, Watson highlighted some future projects that will grow its ounces: Equinox Gold's first pour at Greenstone in 2024, Barrick Gold's Cortez Complex in 2027 and SSR Mining's Hod Maden also in 2027. Watson was most excited about the Ivanhoe Mining's Platreef production that will come online next year.

Sandstorm has been busy deal-making in the past 18 months. The company had to take on debt to fund the deals, as well as issue equity, which has weighed on the stock. Over the past year, Sandstorm is down about 8% in an up market for gold. In 2022 Sandstorm took on debt funding for acquisition of $637 million after acquiring Nomad Royalty Company, as well as nine royalties and one stream from BaseCore Metals. By the end of 2024, Sandstorm expects to nearly halve debt levels.

"Our portfolio is much bigger," said Watson. "It's much more diversified. Most of the things that we

bought—most of the value that we paid for—is very large and very low-cost. [The operations] are very long-life mines that are being built now."Watson said production is going to increase 50% to 60% over the next few years.

"We're sort of in this awkward phase where we made all of these acquisitions. We're not getting the benefit from it yet, but the mines are being built."

> xx

-

ss

McEwen Mining expects to achieve its 2023 guidance with strong gold production in October-November

According to the company, as a result of the strong performance at Gold Bar, partially offset by slightly lower production at Fox and San José, its forecast for the full year 2023 is now estimated at 154,200 GEOs, at the lower end of its 2023 guidance of 150,000-170,000 GEOs.

Importantly, McEwen said that its monthly production is projected to remain “strong” in December and into Q1 2024.

“The additional production from Gold Bar, combined with the announced flow-through equity financing for Fox exploration and development, puts us in a good financial position to enter 2024. Our focus is on driving continued operational improvements and growth projects across the organization,” commented Rob McEwen, Chairman and Chief Owner.

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina.

-

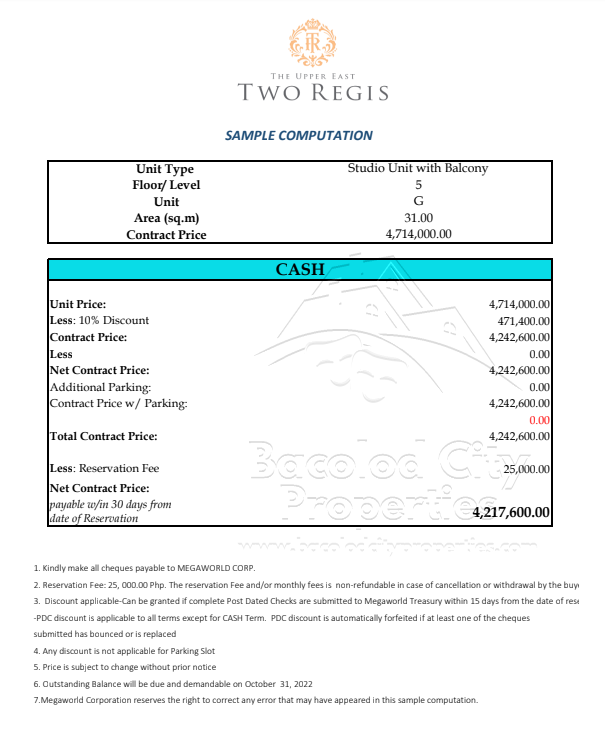

C08488: Megaworld press release - 1

"MEGAWORLD, SUNTRUST TO DEVELOP NEW TOWNSHIP IN PUERTO PRINCESA, PALAWAN"

Megaworld, the country's pioneer developer of integrated urban townships, together with its wholly-owned subsidiary Suntrust Properties, Inc., will develop a 6-hectare property into a 'lifestyle estate' in Puerto Princesa City, Palawan. Located along the Puerto Princesa South Road in Palawan's capital city and overlooking the Puerto Princesa Bay.

BAYTOWN PALAWAN will be Megaworld's 31st township development in the country. It will host residential condominium projects, hotels, as well as commercial retail developments. "Finally, we are building our signature concept of a 'lifestyle estate' in this Palawan capital city where the residential components of the township perfectly blend with the commercial hub, and of course, the hotel developments within the mix as well. Our themed residential condominium clusters will complement the city's relaxing natural environment," says Harrison Paltongan, president, Suntrust Properties, Inc. "We are bringing the vibrant concept of our very own Forbes Town BGC to Puerto Princesa.

We are excited on how Baytown will be able to transform the cityscape of Puerto Princesa," says Javier Romeo Abustan, vice president of sales and marketing, Megaworld Palawan. Most of the residential condominium clusters inside BAYTOWN PALAWAN will be developed by Suntrust Properties. Megaworld will also be developing an upscale and exclusive residential community within the lifestyle estate. The company is slated to start land development by next year. It is allocating P7 billion to develop the lifestyle estate in the next 5 years. BAYTOWN PALAWAN is Megaworld's second mixed-use development project in the Province of Palawan. On the other hand, this is Suntrust's first development in the province as part of its expansion across the country.

-

WAKE UP, People!

There is much uncomfortable TRUTH here.

They cheated and admitted it - this is almost 10% of the 2020 VOTE that the voters themselves admitted that false ballots were sent in. (43% x21%= 9%., call it 10% of Votes cast.)

I reckon virtualy ALL of those votes were for Biden. They were programmed to think they were SAVING DEMOCRACY. But now they should see they undermined it. I expect a majority of those who cheated now regret it.

-

12.13 Areit: Mreit: RCR: Filrt: Vreit ddmpr

Divs: 2.19 : .984 : .391 : .284: .158 : ???

Hist: 2.12 : .984 : .391 : .284: .1574: .1008

last: 0.55 : .246 : .0979: .071 : .0400: .0255

5ago .49 : .244 : .0974: .088 : .0361: .0273

REIT Dashboard, 11.30

4stk Areit: Mreit: RCR: Filrt:

Last 29.85: 12.50: 4.65: 2.79:

Div. P2.19: .984 : .391: .284

Yld: 7.33%:7.87%: 8.41%:10.2%

4Ave.= 8.45%, 6Ave=8.60%

Ph10yr 6. ??%, 5yr: 6.??% ??

+VREIT : 1.68, .158, 9.63% (N/A

+Ddmpr: 1.23, .101, 8.21% (N/A

RXI 9?.??/ PSEI: 6,224: 1.56%

TLT, : TYX = US,LT: Prem.

$91.56, 45.13=-4.51: 3.94% prev.3.42%REIT Dashboard, 10.31

4stk Areit: Mreit: RCR: Filrt:

Last 32.80: 12.18: 4.74: 3.00:

Div. P2.12: .984 : .391: .301:

Yld: 6.46%:8.07%:8.25%:10.0%

4Ave.= 8.19%, 6Ave=8.36%

Ph10yr 6. ??%, 5yr: 6.??% ??

+VREIT : 1.66, .157, 9.46% (N/A

+Ddmpr: 1.28, .101, 7.89% (N/A

RXI 9?.??/ PSEI: 5,974: 1.56%

TLT, : TYX = US,LT: Prem.

$83.58, 50.22=-4.20: 3.42% prev.4.06%REIT Dashboard, 9.30

4stk Areit: Mreit: RCR : Filrt

Last 32.80: 12.30: 4.90: 3.04:

Div. P2.12: .984 : .391: .301:

Yld: 6.46%:8.00%: 7.98%:9.90%

4Ave.= 8.09%, 6Ave=8.22%

Ph10yr 6.??%, 5yr: 6.??% ??

+VREIT : 1.69, .157, 9.29% (N/A

+Ddmpr: 1.30, .10E, 7.69% (N/A

TLT, : TYX = US,LT : Prem.

$88.69, 47.11=-4.03: 4.06% prev. 3.46%PHL Govt Bond Yields : 10yr.etc: yrEnd'22: 6.98%

WkEnd Areit: Mreit: RCR : FILRT= AveDvPh.10yr TLT = US,Lt.: prem./

YE'22 35.40: 14.48: P5.85 : P5.50 : 6.52%v6.98% 100.7: 3.92%: 2.60%WkEnd Areit: Mreit: RCR : FILRT=AveD.vPh.10yr TLT = US,Lt.: prem./ 6ave.

05.26: 33.65: 13.90: P5.76 : P4.30= 7.06% v 6.05% 101.1 : 3.97%: 3.09%, 7.16%

06.02: 33.50: 14.00: P5.70 : P4.21= 6.84% v 5.92% 102.0: 2.96%: 3.88% 7.20%

06.30: 34.70: 14.54: P5.80: P3.83= 6.89% v 6.49% 102.9: 3.86%: 3.03% 7.20%

07.28 : 33.00: 14.20: P5.32: P3.40= 7.43% v 6.53% 99.81: 4.03%: 3.40% 7.56%

08.31: 34.20: 13.90: P5.29: P3.38= 7.66% v 6.00% 96.64: 4.20%: 3.46% 7.99%

09.30: 32.80: 12.30: P4.90: P3.04=8.09% v 6.00% 88.69: 4.71%: 3.38% 8.22%

10.31 : 32.80: 12.18 : P4.74: P3.00= 8.19% v 6.00% 83.58: 5.02%: 3.17% 8.36%

11.30 : 29.85: 12.50: P4.65: P2.79= 8.45% v 6.00% 91.56: 4.51%: 3.94% 8.60%

12.30: ???? -

TLT is moving UP. since end Oct. But only Areit has moved up so far. And you could argue that AReit is just recovering from a sharp selloff, after a DIV payment, and a some Asset buying news, which hurt the stock for a few days

To me, this means that Phl. REITS are an attractive BUY right now, with 8%+ Yield

AREIT (32.05) / TLT (94.62) =33.9%, Mreit (11.96), RCR (4.70).. 2022: 2023: Ytd: 10d:

AREIT-etc.. 2022:

===

-

PLC / BEL : YTD: P 0.59 / P 1.17 = 50.4%; Highs: 0.69 /1.49= 46.3%, Lows: 0.455 /1.11= 41.0%

BEL (1.17) / PLC (0.59) = 198%. / Psei (6,463, 64.63)= 1.81% /100

BEL: 10yr: 2013: 2014w/PLC: 2023: last: P 1.16

2014w/PLC: 2022: YTD: P 0.58 / P 1.16 = 50.0%

BELLE Corp. Investments (last: P 1.16) 12.13.23. Value: Ye'22 : Value:

PLC : Prem. Leisure Corp: 79.78% : 24.9B x0.58= 14.49B / 0.475: 11.83B

LOTO: Pacific Online Sys. : 50.10% : .449B x3.20= 1.43B / 1.650: 0.74B

APC : APC Grp, .021 BkV : 48.80% : 3.7 B x.211 = 0.78B / 0.260: 0.96B

Smph: SM Prime Hldgs. : < 1%. : 61.8M x33.4= 2.06B / 35.50: 2.19B

==== Four Traded Co’s. : ===== : ==== === = 18.76B /. === : 15.72B

==== (at 12.13.23 ) : 18.76B / 9.76= P1.92 / BEL sh / P1.61, Nav 3.49

= change from Ye'22: Gain from YE +19.3% / v.ye'21 : P1.22, Nav 3.10

==== ( at 12.13.22): P 1.16: Disc.to MkV: -39.8% /BEL : Belle Corp. : 100%. : 9.76B x1.24 = 11.61 B / P1.22 at ye'22

* PLC pays .0502 div. x24.9B= P2.00B /9.76B= P.205 incoming, 0.06 out

Other investments

+ City of Dreams Resort :

+ LAND for development

+ Premium Leisure amusements

+ Tagaytay Club shares

================ = value: 16.B ?

- Debt Outstanding ??

- Total NAV, ye'22: 3.49 x 9.76B = 34.1B : Ye'21: 3.10 x 9.76B = 30.2B -

-

Updated BTC vs. CRY-3

CRY3: 2023: Oct'23: 10d: Bitcoin miners are catching-up with BTC, esp. MARA

CRY3:

OLD:

HIVE: 2023: YTD: 6mo: 10d: $4.25 > $3.41 last, -20%; twice as volatile as BTC

RIOT: 2023: YTD: 6mo: 10d: $16.00 > $14.06 last, -12%, almost 1.5x as volatile. Filled gap up

BTC Futs: last: $41,705

BTC's GAP up is not filled yet. Honestly, I don't know what is coming next. But I want to stay flexible, and am glad I took some money off the table in that last shot up. My remaining position is almost all Call options with limited risk

10d - Outperformance by HIVE could be a sign of the rally's last phase.

-

-

"Large" GAP of P0.14, updated VREIT > VLL

Date ==: VLL / VReit: Disc. Pct : /TLT, %TLT

04.04.24: 1.58 / 1.72: (0.14): 91.9%, 92.02, 1.72%

12.14.23 : 1.62 / 1.70: (0.08): 95.3%, 96.84, 1.67%, ex.div. 1.62/ 1.74= 93.1%

11.17.23 : 1.61 / 1.68 : (0.07): 95.8%, 89.62* 1.80%

10.31.23: 1.60 / 1.66: (0.06): 96.4%, 83.58, 1.91%

09.29.23: 1.64 / 1.69: (0.05): 97.0%, 88.69, 1.85%

08.29.23: 1.59 / 1.65: (0.06): 96.4%, 96.31, 1.65%

08.02.23: 1.57 / 1.67 : (0.10): 94.0%, 97.09, 1.62%

======VREIT (1.70) - VLL (1.61) : 0.09, Div. Payment of 0.04 coming this week for VREIT

Compare Yields, PERs: VREIT: 0.16/ 1.70= 9.41%, 4.64 PE,

VLL : 0.06/ 1.61= 3.85%, 2.75 PE (VR. yield is 5.56% higher)

TLT vs.V-V : /$98.89 : VLL: 1.63/ 1.65%, VReit: 1.69/ 1.71%, PSEI: 6,547, 66.2, at 12.19.23

TLT: $98.89 : VLL-1.63/ 1.65%, VReit-1.69/ 1.71%, PSEI: 6,547, 66.2, at 12.19.23

Letter below denotes: R- swap to vReit, L- swap to vLL

w/ psei: last: 1.69/6,218 0.00% at 12.12, ?? at 12.20:

VLL vs. TLT: Swapped from VREIT > VLL at 1.62, 1.67% TLT. PER: 2.67, NAV: 9.07, Yield: 3.83%

Date ==: VLL / VReit: Disc. Pct : /TLT, %TLT

12.14.23 : 1.62 / 1.70: (0.08): 95.3%, 96.84, 1.67%, ex.div. 1.62/ 1.74= 93.1%

-

Tucker drops new episode on Gonzalo Lira.

Ep. 47 Gonzalo Lira is an American citizen who’s been tortured in a Ukrainian prison since July, for the crime of criticizing Zelensky. Biden officials approve of this, because they’d like to apply the same standard here. The media agree. Here’s a statement from Gonzalo Lira’s father.

(00:00) American Zelensky critic jailed in Ukraine

(05:14) Where is our State Department?

(08:40) Lira arrested after criticizing Biden

(11:49) Is Ukraine the democracy we’re told it is?

-

-

VIDEOS

One Regis Upper Penthouse FOR SALE - Unit U: P 9.3M, 50 sqm= P186k / 263 views, from July 2023

𝗨𝗽 𝗳𝗼𝗿 𝗦𝗔𝗟𝗘 (𝘢𝘵 𝘢𝘯 𝘪𝘯𝘤𝘳𝘦𝘥𝘪𝘣𝘭𝘺 𝘭𝘰𝘸 𝘱𝘳𝘪𝘤𝘦!) - haha: 9.3M / 50 sq= P 186k per sq

... is a very spacious one-bedroom unit located on the Upper Penthouse (𝘳𝘢𝘳𝘦 𝘧𝘪𝘯𝘥!) of One Regis Tower.

Featuring ✅ One Bedroom unit with bath ✅ Utility Room / Maid’s Room with bath ✅ Kitchen equipped with Modular Cabinets and Granite Countertop ✅ Very spacious 50sqm-unit ✅ Full-sized windows across all areas provide a fresh and airy atmosphere ✅ Pool View ✅ Facing One Manhattan Tower

-

Just thought I could check this.. DotProperty: Bacolod Condo, median: P 157.0k per sq

Megaworld set to turnover 328 units at Bacolod condo ...

https://digicastnegros.com › megaworld-set-to-turnove...

Aug 26, 2022 — The units at One Regis, which were purchased at P101,000 per square meter in July 2018 are now selling at P204,000, or an increase of 102pct. ...AirBNB : "STARTS at 1600 php/night. Good 4-6pax"

UNIT 2BW ONE REGIS PRICE STARTS at 1600 php/night. Good 4-6pax. FREE ACCESS TO AMENITIESTWO REGIS, NEW was around P150k / sq > mid-2024 turnover

UNIT 2BW ONE REGIS PRICE STARTS at 1600 php/night. Good 4-6pax. FREE ACCESS TO AMENITIESTWO REGIS, NEW was around P150k / sq > mid-2024 turnover

-

WEEKLY CHART COMMENTS . Not much interest in the PORTFOLIO, so I may shift the focus.

Towards having occasional WEEKLY CHART Comments like this one...

1. Lower rates! now TLT: $94.5 = US: 4.33%, Phl.-10yr: 6.25%

TLT Is BELLWETHER for the Biggest Global market, the US BOND Market, which influence interest rates everywhere.

The TLT/BOND chart above was posted here 2-3 weeks, ago. I wrote that Bonds looked strong and might push thru important resistance at $91-92. And I would be watching that. What Happened? TLT DID RISE. And closed yesterday at 94.5, having pushed above $95 this week. This rise was associated with a DROP in Long term rates at 4.325% (and as low as 4.12% his week.) That is down from the year's peak near 5.15%, and 4.6%, when TLT was at $90./ Phl. rates are down too... from 7.2% in late Oct. to thu's 6.25% close for the 10 year. The premium of 2.07% over US rates is in normal range.

2. APX now at P 2.90, up from near 2.60

APX / Apex Mining was at about P2.62. I thought it was poised to go higher, maybe over 3.00 as Gold pushed higher - possible to new highs.over $2,080. APX often follows UGL. 2x Gold, the blue line above. Gold did shoot up, and made a visit to a new high at $2,150 very briefly. But it has pulled back now to just over $2,000. APX rose to 2.99, and closed THU at P2.90. (Personally, I sold a small number of shares at 2,99, because I expected some resistance there. If gold can revisit highs, APX could easily trade up to 3.20 or higher.)

3. MEG: P 1.99 / 94.55= 2.1%, down from 2.4%

MEG. This is a chart from 11/17/23, And MEG looked like it had potential to push higher, making an important breakout above 2.10, "If TLT moved higher." That did not happen. TLT is higher, with lower rates. But MEG has pulled back to THU's close at 1.99. Disappointing, but not the end of the story. As you can see in the chart below, most PHL property stocks have not yet benefitted from lower rates...

4. TLT has soared to near $95, breaking 91 Resistance. REITS, Property co's are lagging

Look at how TLT zoomed up. If that rise continues. I will expect Phl. REITS and property developer stocks to follow. Amazing to me to see: the average REIT div. yield on THU was 8.4%, and hat was almost DOUBLE the level the US Lond Bond rates. That was the biggest premium I have ever seen! I will note REIT yields are correlated with Bond yields but with a lag. I see these stocks as a major opportunity now, and probably MEG and otehr developers too/

5. Bitcoin at $45.K. Hive: $4.20, Riot: $15.80

NO TEARS for me, having SOLD out of BTC. Over the last 10 trading days, BTC was up almost 20% to $45,000. HIVE up 45%, and RIOT up 35%. This was a very pleasing CATCH-up for the bitcoin mining shares I am now holding "instead of" Bitcoin.

-

ARMN / US$3.21 (Range: $2.054 -3.667 ) x 1.355= C$4.35 (C$ 2.77 - 4.92)

ARMN - since 2021: US$3.21 ...

===

CANACCORD BUY RATING, Target: C$8.00 (1.35= US$ ?)

We reiterate our BUY rating on Aris Mining and increase our target price to C$8.00 (from C$7.50) following the company's Q3/23 results and Segovia reserve update announced this morning. Reserves at Segovia have increased 75% to 1.3Moz grading 11.63 g/t following a 114% increase in M&I announced in early November (see our note). The company is also moving ahead with plans to expand the Segovia mill to 3,000tpd from 2,000tpd currently, which it expects will increase production from Segovia to ~300koz from ~200koz currently and should boost total production to ~500koz once the Marmato expansion is complete in H2/25. Beyond Segovia and Marmato, the Soto Norte project (Aris has a 20% interest with option to go to 50%) provides significant further growth potential, in our view. The company is trading at 0.15x NAV vs. junior producer average of 0.42x. Aris remains one of our top picks among junior producers.

Reserve update at Segovia and plant expansion

Aris announced a 75% increase in reserves at its Segovia deposit in Colombia. In addition, Aris plans to expand the existing Maria Dama plant from its current 2kpd processing capacity to 3ktpd given the increased reserve and resource base. The reserve update followed Aris' announcement earlier this month that it had increased M&I resources at the property by 114% to 3.6Moz at 14.38 g/t on the back of its 2023 drill program as well as a review of its geological modeling methods by a third party, for more details on the resource update see our note. We note that Segovia has had a

solid track record of reserve replacement. Segovia represents ~32% of our operating NAV for the company. The resource expansion comes in the middle of a 2023 drill program, drilling over 83km YTD with $10.5 million of a $17 million budget utilized to date. The company expects to drill another ~20km before the end of the year for a total of 105km. Recall that Aris originally planned to drill 84.5km at the property in 2023.

Q3/23 summary

Aris previously reported Q3/23 production of 60koz, EBITDA slightly lower than our forecast on 2% lower sales...

-

INFLATION, CRB, Oil Cycle and Rates

in Gold, FX, Stocks / Diaries & Blogs

Posted

INFLATION & RATE etfs, updated: 12.18.23, 4.07%

/ DBA (21.02), XLE (84.18, r4.00x), OIH (307.92, r14.65), TYX (40.69, r1.94x)

/ DBA (21.02), XLE (84.18, r4.00x), OIH (307.92, r14.65), UDN (18.18)

GDXJ - OIH vs UDN, SLV ... fr.1/2008 w/Dba : 7/2008 w/Dba : updated: 12.18.23