-

Posts

5,790 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Steve Netwriter

-

-

We certainly have !!!!

And still rising today

-

Here you go, one on silver:

Why the silver price is set to soar

http://www.moneyweek.com/file/28810/why-th...et-to-soar.html

-

IMO you're thinking about this all wrong.

Gold & silver are not commodities. They are not copper or iron ore or wheat.

It's not about supply and consumption.

It's about scarcity and characteristics.

It's not about what uses they have. It's all about this:

I'll spare you the 'goldbugs' bit about which is the oldest currency, currencies don't last, and all that.

All you really need to know is that gold (and silver) have and are used as currencies.

Then all you need to do is ponder which currencies will do best from now.

I'll give you a choice: US$, Euro, GBP, JPY, Aus$, NZ$, Gold, Silver.

If you know what the M3 growth is for the top 20 economies, and compare it with the growth in quantity of gold and silver, I think you'll get the right answer

Try these. I think the arguments for silver are similar to those for gold.

FUNDAMENTAL REASONS TO OWN GOLD

BY: JOHN EMBRY, CHIEF INVESTMENT STRATEGIST OF SPROTT ASSET MANAGEMENT INC. &

SPROTT GOLD AND PRECIOUS MINERALS FUND.

http://www.sprott.com/pdf/reasons_to_own_gold.pdf

This is a very long but very informative read about gold.

http://www.gata.org/files/RedburnPartnersG..._11-12-2007.pdf

Steve

-

I've been told that this provides better gold prices:

Pool Accounts

-

I've found the answer to the question.

It's the cost of tyres

Canada's Barrick Gold Corp. is so concerned about the worldwide shortage of the giant tires it needs for its massive mining trucks and loaders that it is lending a Japanese tire maker $35-million (U.S.) to help it finance a plant expansion.

Canada's Barrick Gold Corp. is so concerned about the worldwide shortage of the giant tires it needs for its massive mining trucks and loaders that it is lending a Japanese tire maker $35-million (U.S.) to help it finance a plant expansion.Barrick, the world's largest gold miner, said Wednesday that it is lending the money to Yokohama Rubber Co. Ltd. as part of a 10-year agreement to secure the supply of "potentially more than $200-million" worth of off-the-road tires, at the rate of some 1,300 tires a year starting in 2009.

The tires retail for as much as $60,000 apiece, but the global shortage has seen them sell for as much as $300,000 each in Internet auctions, according to Barrick. (That's the equivalent of more than 325 ounces of gold at today's price of $920 an ounce.)

Yokohama will use the loan to help finance a $50-million expansion of its Onomichi plant, near Hiroshima, including a new building, production line and related equipment, the mining company said in a news release. The tire maker also will deliver the tires directly to Barrick's mines and provide technical assistance to each site to make sure the tires being used there will have the proper rubber compound, tread pattern and so on.

"This is an innovative response to a worldwide tire shortage now facing the mining industry," Barrick chief executive officer Greg Wilkins said in a news release.

Barrick to Fund Yokohama OTR Tyre Expansion

http://www.tirereview.com/default.aspx?typ...&item=10413

Well maybe not, but I thought you guys might find it interesting.

Steve

-

Ace,

Many thanks for your reply. As I said, it's not my field, and your reply is very informative.

I think I might be tempted to consider this area, but I'd have to do a lot of research first. I can see already how little I know compared to what I'd need to.

I suspect I'm going to miss the boat on it anyway.

Steve

-

I have been tempted to stick my nose in to this subject. It's not something I know much about, but I have heard the odd thing.

It seems from what I've heard that the junior mining area is much more risky, and requires money to fund them until they start making money.

The thing I heard is that when markets crash, and people need cash, they will sell things like junior mining shares. That will reduce the money available, making it impossible for some of them to continue. Only when there is money available again, will they be able to continue.

My impression from what I've heard is that owning junior mining shares is not anything like owning gold because of the above. You're not investing in the gold they haven't got out yet.

Oh, and because of the risk you need to buy lots of companies, as many will fail. Like penny shares.

Just what I've heard.

-

This is not my area, but I came across this:

Gold mining shares are not eligible as portfolio insurance since they have an ambiguous correlation to traditional financial assets. While from time to time they may be negatively correlated, and there is no question of their ability to benefit from promising trading opportunities, long-term wealth preservation demands fully allocated, segregated, and insured gold bullion.The counterparty risk involved in owning gold mining shares is not zero. Worse still, the full extent of this risk is unknown. To complicate matters further, many a government (such as that of Ecuador) keeps a jaundiced eye on its gold mining industry and is trying to determine the most opportune moment to expropriate foreign shareholders. Gold bullion is not dependent on anyone's promise, representation, or ability to perform (nor, if properly stored, is it dependent on the propensity of the government to expropriate), in a word: gold bullion is not someone else's liability.

Therefore it is the only agent that can provide the necessary protection against both contingencies: systemic collapse and slow monetary debasement, while incurring the lowest possible level of risk.

-

I have. I've also used:

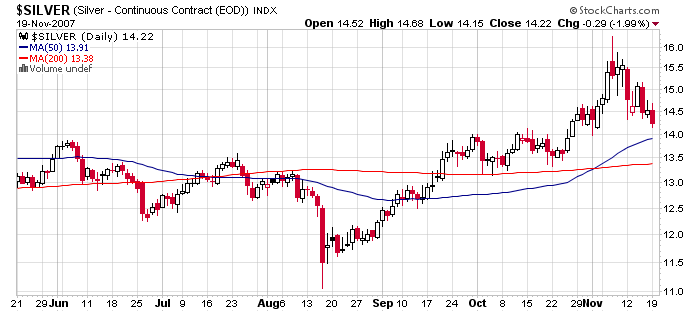

COMMITMENT OF TRADERS REPORT SUMMARY - SILVER

http://www.technicalindicators.com/silvcotreport.htm

and

http://www.softwarenorth.net/cot/current/charts/SI.png

I tend to look more long term, and what I've read suggest to me that silver will follow gold up.

I think this is my favourite article on Silver:

Why Silver Is Lagging the Gold Bull Market

http://www.marketoracle.co.uk/Article2577.html

Steve

-

Silver has dropped to £6.89/oz. Has been up around £7.40 (about 7.4% down)

So, how much further is it going to fall ?

Please tell me precisely when to buy

-

I haven't been looking at Silver, but came across this article, which I thought covered the subject rather well.

It's certainly something I'm now going to be looking at in more detail.

Why Silver Is Lagging the Gold Bull Market

-

Listening now. Thanks

-

Don't you think that's a bit harsh ?

We need bears AND bulls, otherwise the system would break down and there would be no trading !

I think my answer would be this.

Any rich investor is going to be looking at the market and looking to at least not lose money on it.

In the current climate, it looks more and more likely that prices will fall, and so however rich someone is, they are not going to throw their money away, they are going to haggle the price down with regard to the current climate.

I agree with DrBubb though on leading and lagging indicators. Future job cuts in the city being more relevant than past employment levels or bonuses

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

I think we might be in for exactly the opposite.

If the demand overwhelms the shorts, it could go ballistic.

A correction would be good though.