-

Posts

2,493 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by lowrentyieldmakessense(honest!)

-

-

from Ellen Brown

maybe Bill Still is right

He indicates that the British government is already funding more of its budget by seigniorage than Weimar Germany did at the height of its massive hyperinflation; yet the pound is still holding its own, under circumstances said to have caused the complete destruction of the German mark. Something else must have been responsible for the mark's collapse besides mere money-printing to meet the government's budget, but what? And are we threatened by the same risk today? Let's take a closer look at the data.History Repeats Itself - or Does It?

In his well-researched article, Hutchinson notes that Weimar Germany had been suffering from inflation ever since World War I; but it was in the two year period between 1921 and 1923 that the true "Weimar hyperinflation" occurred. By the time it had ended in November 1923, the mark was worth only one-trillionth of what it had been worth back in 1914. Hutchinson goes on:

"The current policy mix reflects those of Germany during the period between 1919 and 1923. The Weimar government was unwilling to raise taxes to fund post-war reconstruction and war-reparations payments, and so it ran large budget deficits. It kept interest rates far below inflation, expanding money supply rapidly and raising 50% of government spending through seigniorage (printing money and living off the profits from issuing it). . . .

"The really chilling parallel is that the United States, Britain and Japan have now taken to funding their budget deficits through seigniorage. In the United States, the Fed is buying $300 billion worth of U.S. Treasury bonds (T-bonds) over a six-month period, a rate of $600 billion per annum, 15% of federal spending of $4 trillion. In Britain, the Bank of England (BOE) is buying 75 billion pounds of gilts [the British equivalent of U.S. Treasury bonds] over three months. That's 300 billion pounds per annum, 65% of British government spending of 454 billion pounds. Thus, while the United States is approaching Weimar German policy (50% of spending) quite rapidly, Britain has already overtaken it!"

And that is where the data gets confusing. If Britain is already meeting a larger percentage of its budget deficit by seigniorage than Germany did at the height of its hyperinflation, why is the pound now worth about as much on foreign exchange markets as it was nine years ago, under circumstances said to have driven the mark to a trillionth of its former value in the same period, and most of this in only two years? Meanwhile, the U.S. dollar has actually gotten stronger relative to other currencies since the policy was begun last year of massive "quantitative easing" (today's euphemism for seigniorage).3 Central banks rather than governments are now doing the printing, but the effect on the money supply should be the same as in the government money-printing schemes of old. The government debt bought by the central banks is never actually paid off but is just rolled over from year to year; and once the new money is in the money supply, it stays there, diluting the value of the currency. So why haven't our currencies already collapsed to a trillionth of their former value, as happened in Weimar Germany? Indeed, if it were a simple question of supply and demand, a government would have to print a trillion times its earlier money supply to drop its currency by a factor of a trillion; and even the German government isn't charged with having done that. Something else must have been going on in the Weimar Republic, but what?

Schacht Lets the Cat Out of the Bag

Light is thrown on this mystery by the later writings of Hjalmar Schacht, the currency commissioner for the Weimar Republic. The facts are explored at length in The Lost Science of Money by Stephen Zarlenga, who writes that in Schacht's 1967 book The Magic of Money, he "let the cat out of the bag, writing in German, with some truly remarkable admissions that shatter the 'accepted wisdom' the financial community has promulgated on the German hyperinflation." What actually drove the wartime inflation into hyperinflation, said Schacht, was speculation by foreign investors, who would bet on the mark's decreasing value by selling it short.

Short selling is a technique used by investors to try to profit from an asset's falling price. It involves borrowing the asset and selling it, with the understanding that the asset must later be bought back and returned to the original owner. The speculator is gambling that the price will have dropped in the meantime and he can pocket the difference. Short selling of the German mark was made possible because private banks made massive amounts of currency available for borrowing, marks that were created on demand and lent to investors, returning a profitable interest to the banks.

At first, the speculation was fed by the Reichsbank (the German central bank), which had recently been privatized. But when the Reichsbank could no longer keep up with the voracious demand for marks, other private banks were allowed to create them out of nothing and lend them at interest as well.4

A Story with an Ironic Twist

If Schacht is to be believed, not only did the government not cause the hyperinflation but it was the government that got the situation under control. The Reichsbank was put under strict regulation, and prompt corrective measures were taken to eliminate foreign speculation by eliminating easy access to loans of bank-created money.

More interesting is a little-known sequel to this tale. What allowed Germany to get back on its feet in the 1930s was the very thing today's commentators are blaming for bringing it down in the 1920s - money issued by seigniorage by the government. Economist Henry C. K. Liu calls this form of financing "sovereign credit." He writes of Germany's remarkable transformation:

"The Nazis came to power in Germany in 1933, at a time when its economy was in total collapse, with ruinous war-reparation obligations and zero prospects for foreign investment or credit. Yet through an independent monetary policy of sovereign credit and a full-employment public-works program, the Third Reich was able to turn a bankrupt Germany, stripped of overseas colonies it could exploit, into the strongest economy in Europe within four years, even before armament spending began."5

While Hitler clearly deserves the opprobrium heaped on him for his later atrocities, he was enormously popular with his own people, at least for a time. This was evidently because he rescued Germany from the throes of a worldwide depression - and he did it through a plan of public works paid for with currency generated by the government itself. Projects were first earmarked for funding, including flood control, repair of public buildings and private residences, and construction of new buildings, roads, bridges, canals, and port facilities. The projected cost of the various programs was fixed at one billion units of the national currency. One billion non-inflationary bills of exchange called Labor Treasury Certificates were then issued against this cost. Millions of people were put to work on these projects, and the workers were paid with the Treasury Certificates. The workers then spent the certificates on goods and services, creating more jobs for more people. These certificates were not actually debt-free but were issued as bonds, and the government paid interest on them to the bearers. But the certificates circulated as money and were renewable indefinitely, making them a de facto currency; and they avoided the need to borrow from international lenders or to pay off international debts.6 The Treasury Certificates did not trade on foreign currency markets, so they were beyond the reach of the currency speculators. They could not be sold short because there was no one to sell them to, so they retained their value.

Within two years, Germany's unemployment problem had been solved and the country was back on its feet. It had a solid, stable currency, and no inflation, at a time when millions of people in the United States and other Western countries were still out of work and living on welfare. Germany even managed to restore foreign trade, although it was denied foreign credit and was faced with an economic boycott abroad. It did this by using a barter system: equipment and commodities were exchanged directly with other countries, circumventing the international banks. This system of direct exchange occurred without debt and without trade deficits. Although Germany's economic experiment was short-lived, it left some lasting monuments to its success, including the famous Autobahn, the world's first extensive superhighway.7

The Lessons of History: Not Always What They Seem

Germany's scheme for escaping its crippling debt and reinvigorating a moribund economy was clever, but it was not actually original with the Germans. The notion that a government could fund itself by printing and delivering paper receipts for goods and services received was first devised by the American colonists. Benjamin Franklin credited the remarkable growth and abundance in the colonies, at a time when English workers were suffering the impoverished conditions of the Industrial Revolution, to the colonists' unique system of government-issued money. In the nineteenth century, Senator Henry Clay called this the "American system," distinguishing it from the "British system" of privately-issued paper banknotes. After the American Revolution, the American system was replaced in the U.S. with banker-created money; but government-issued money was revived during the Civil War, when Abraham Lincoln funded his government with U.S. Notes or "Greenbacks" issued by the Treasury.

The dramatic difference in the results of Germany's two money-printing experiments was a direct result of the uses to which the money was put. Price inflation results when "demand" (money) increases more than "supply" (goods and services), driving prices up; and in the experiment of the 1930s, new money was created for the purpose of funding productivity, so supply and demand increased together and prices remained stable. Hitler said, "For every mark issued, we required the equivalent of a mark's worth of work done, or goods produced." In the hyperinflationary disaster of 1923, on the other hand, money was printed merely to pay off speculators, causing demand to shoot up while supply remained fixed. The result was not just inflation but hyperinflation, since the speculation went wild, triggering rampant tulip-bubble-style mania and panic.

This was also true in Zimbabwe, a dramatic contemporary example of runaway inflation. The crisis dated back to 2001, when Zimbabwe defaulted on its loans and the IMF refused to make the usual accommodations, including refinancing and loan forgiveness. Apparently, the IMF's intention was to punish the country for political policies of which it disapproved, including land reform measures that involved reclaiming the lands of wealthy landowners. Zimbabwe's credit was ruined and it could not get loans elsewhere, so the government resorted to issuing its own national currency and using the money to buy U.S. dollars on the foreign-exchange market. These dollars were then used to pay the IMF and regain the country's credit rating.8 According to a statement by the Zimbabwe central bank, the hyperinflation was caused by speculators who manipulated the foreign-exchange market, charging exorbitant rates for U.S. dollars, causing a drastic devaluation of the Zimbabwe currency.

The government's real mistake, however, may have been in playing the IMF's game at all. Rather than using its national currency to buy foreign fiat money to pay foreign lenders, it could have followed the lead of Abraham Lincoln and the American colonists and issued its own currency to pay for the production of goods and services for its own people. Inflation would then have been avoided, because supply would have kept up with demand; and the currency would have served the local economy rather than being siphoned off by speculators.

The Real Weimar Threat and How It Can Be Avoided

Is the United States, then, out of the hyperinflationary woods with its "quantitative easing" scheme? Maybe, maybe not. To the extent that the newly-created money will be used for real economic development and growth, funding by seigniorage is not likely to inflate prices, because supply and demand will rise together. Using quantitative easing to fund infrastructure and other productive projects, as in President Obama's stimulus package, could invigorate the economy as promised, producing the sort of abundance reported by Benjamin Franklin in America's flourishing early years.

There is, however, something else going on today that is disturbingly similar to what triggered the 1923 hyperinflation. As in Weimar Germany, money creation in the U.S. is now being undertaken by a privately-owned central bank, the Federal Reserve; and it is largely being done to settle speculative bets on the books of private banks, without producing anything of value to the economy. As gold investor James Sinclair warned nearly two years ago:

"[T]he real problem is a trembling $20 trillion mountain of over the counter credit and default derivatives. Think deeply about the Weimar Republic case study because every day it looks more and more like a repeat in cause and effect . . . ."9

-

An old one

help to forecast a top in gold - of course its a moving target and people could always start burning dollars to reduce the currency in circulation

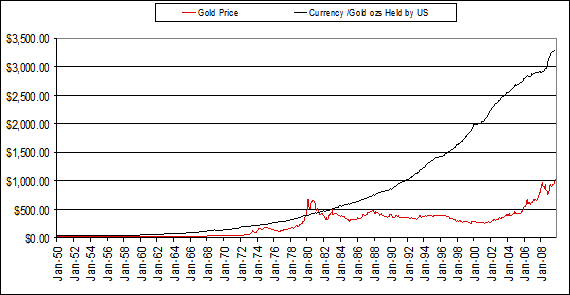

From 1950 to October 1979 the gold price was adjusting for 30 years of monetary inflation. As the graph illustrates, the gold price equaled the gold standard gold price several times between 1979 and 1983.

In 1979, the gold price stayed within 10% of the gold standard gold price for 12 weeks, 11 of which the gold price stayed within 5% of the gold standard gold price.

In 1981 the gold price again stayed within 10% of the gold standard gold price for 31 weeks, 7 of which were with 5%, despite a decrease of 482,261.25 ounces of US owned gold since 1979.

In 1982, the gold price again stayed within 10% of the gold standard gold price for 2 weeks, including 1 week within 5%, despite a decrease of 96,452.25 ounces of US owned gold since 1981.

Finally in 1983, the gold price again stayed within 10% of the gold standard gold price for 8 weeks, including 6 weeks within 5%, despite a decrease of 643,015 ounces of US owned gold since 1982.

Over the course of 3.5 years, the gold price tracked the gold standard gold price in spite of a 30% increase in the currency and a decrease of 1,221,728.5 ounces of US owned gold. The gold price followed the gold standard gold price within 10% for 30% of the time, and within 5% for 15% of the time. This suggests that the metric used to value gold during this period was the currency divided by the ounces of US owned gold. Thus the market backed the US dollar with gold even though the US wasn’t on an official gold standard.

For the gold price to adjust for the past 26 years of monetary inflation, the price will equal $3,286.06 (dividing the currency $859.1 billion by 261,498,900.32 ounces of gold held by the US). Since the Federal Reserve Bank’s average yearly increase in the currency since 1929 is 8% (11.5% since 1971), the $3286.06 gold price will continue to increase an average of between 8% and 11.5% annually. If similar price increases were to occur today as in the 1980s, the gold price could peak as high as $7000, and could easily reach $5500.

-

yes, the level of stupidity and greed amongst our fellow humans never ceases to amaze me.

Just when you think we have run out of stupid people, along come some more.....

I know

madness of crowds

but maybe flouride increases the madness

switch off the tv etc

-

they can keep these ponzi schemes longer than most think

-

Seasonally we are at the time of upwards pressure

I know

September is usually a good month

-

must.......resist.......urge........to............get.........involved..........

......arrrrgggg.............this ...............is................extremely............difficult.

due another downturn methinks

patience

-

I do hope so Pixel8r, I feel that silver is so undervalued.

why they rush

let the price stay low and accumulate some more

-

Are they yellow courgettes ? and are the bug's like this ?

Theres an interesting thread here.........

http://www.growfruitandveg.co.uk/grapevine...tion_49717.html

blackfly methinks

we should have been more vigilant

-

normally the courgettes do great but they have been obliterated this year by some black bugs

-

-

Excitement got to fever pitch last night in the Mabon household as dessert for two (x2 bowls) was Strawberries grown by my own fair hand (with a bit of involvement from Nature).

My missis commented that they tasted 'just like the ones you used to get when you went strawberry picking as a kid' .

Absolutely lovely and suddenly after a slow start, we have a load more coming.

My corn has now started to grow very quickly.

I'd say by 1/3 in the last week alone and there are beans sprouting from everywhere too.

It's great to have access to a garden again, after living for years in a hermetically-sealed flat with no access to nuffink.

sounds great - ours have been poor this year - will try and get them out of pots and into some new raised beds

has anyone tried this

-

<<So I am genuinely sorry, and can only wish you the best, if the tomfoolery that passes for "gold analysis" on the web makes you view this fantastic news as part of the cabal's grand plan.>>

Well put, Sir! A successful business can ignore the prattle of bigots and conspiracy theorists.

who are the bigots

and where are the conspiracy theorists - are they the same people who dont trust the banks and the unstable banking system

-

and if you click on the link, you'll see that it's just another link to a Telegraph article - so a bit weird for Adrian to have chosen to post the link via Icke's website, no?

'oh look it's on Icke's website so it must not be true' is a slightly childish argument, tbh.

Hello all,Ignoring the bile,

yep and i didnt see any racist remarks - unless i missed something

-

What you really mean is it will depend on how many of their clients are bigots.

nope

i think that a lot of people dont want anything to do with that banking dynasty - control the money supply control the world etc

although maybe i will start a few religions that prevent followers from charging interest - that might give people who are not brainwashed a head start on everyone else

-

From another forum

http://www.bullionbullscanada.com/?option=...style=f-smaller

Augmentum Capital has only one client - Jacob Rothschild.

The WGC is the front for GLD and deeply involved in paper gold?

Do you think a Rothschild would be interested in merely taking a part-share of Bullionvault's meagre commission - or is it their $800,000,000 in physical gold that's drawn him?

I've got a substantial holding in BV - I had considered them one of the safer custodians. Not any more - when the wheels come off, they'll go dark and the gold will be gone. Not a lot of point in sueing a Rothschild front company for "your" gold?

Would you entrust your gold to anyone with those partners? Just goes to show how tight physical is getting when those with only 20 tons get taken over.

Where's the best place to buy a bulk order of British Sovereigns?

yep

im moving

-

Non-event to me.

perhaps

but a lot of gold owners do not wish to have anything to do with the Rothschild name if at all possible

-

Laura, everyone has to be responsible for themselves. We all have different models of the world - based on what we have been exposed to in life. A week ago, I was reasonably happy with the risk of owning gold at BV, now I am not.

I know many on this board own gold at BV and do not want to be spooked in any way - well, it is up to every individual to do their own research and draw their own conclusions on whether the recent developments change the risk.

me too

-

-

Tattaaaaaa!

somebody must have fallen asleep at the FED

-

5% down all over in the US

http://stockcharts.com/def/servlet/Favorit...p;cmd=show,iday[Y]&disp=SXA

Gold just went up to GBP 817

GBP/YEN low 129, high 142. Currently down 3%

What's occuring?

gordon brown in charge of the IMF

-

We are in the third gold war since the Second World War – the US (and other western countries/institutions, notably the IMF) lost the first one in the late-1960s to the French and the second one in the late-1970s to the Arab nations. In the report, I’ve used declassified documents from the US State Department to show how on those occasions the US authorities believed they could defy economic gravity right up until the moment when they were overtaken by events, how they falsified economic data to support the dollar and how they negotiated secret deals to stop other governments buying gold. Food for thought I think

-

Nice gain in GBP this afternoon then!

£805£806 currently.whats going on with the YEN

-

As a Eurogold investor I am looking to sell some GLD at some point. Eurogold has gone parabolic.

This is not healthy.

Any guess where approximately is the top?

you cant guess the top with a moving target

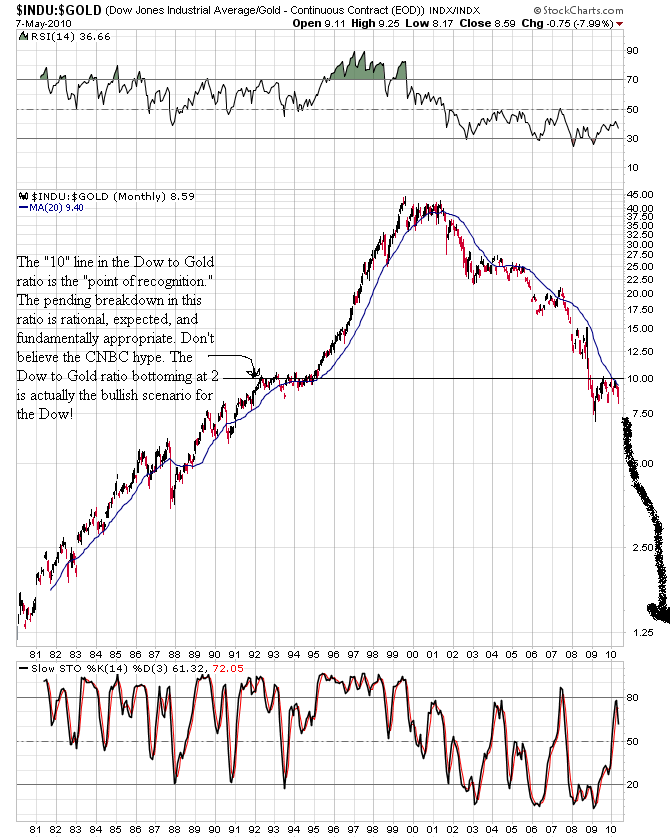

watch other ratios such as gold/oil gold/house prices dow/gold gold/silver etc

-

bought some more today.

did it make you feel better after listening to the central planners budget

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

I think they are more likely to tax the gains on bullion etc heavily