-

Posts

3,768 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by ziknik

-

-

Not me, but it's now the most emailed story and second most read

And it’s got links to ATS Bullion, BullionVault and Bairds websites on the right-hand side.

-

Thanks for your views, BigT.

Does anyone know of a good place to see the current oil price and oil price charts? (Apologies for polluting The Gold One with oil talk!

)

)Try these two.

This one is my fav chart because Gold/silver prices available in a range of currencies. You can overlay PoO (Brent) or a currency on to your gold or silver chart.

http://goldprice.org/live-gold-price.html

On this one, you can have multiple versions of the above on the same screen. Its got a WTI oil and well as Brent. Gold and Silver in USD only.

http://netdania.com/Products/ChartStation/ChartStation.aspx

-

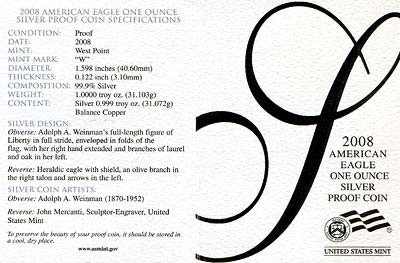

No the thickness would have to be the same. It would only change if the design, diameter or weight changed as well. I think that in one advert you have the nominal thickness stated and in the other the maximum thickness. There is always a margin of error in any engineering work, people just never state it.

Coins are also created by being struck rather than milled or cast. If too much power is applied by the press then the outside edge of the coin is raised whilst the inside thickness reduced, if too little then the opposite affect occurs. This is another reason why a small difference in thickness is not really a problem.

So when I measure my Eagle coin, it’s OK as long as the thickness is +/- 10% providing the diameter and weight are about right (?)

Thanks for your BTW guidance. I really appreciate it.

-

It works. Thanks

-

-

Hi Guys,

this is my first post here, I'm a convert from HPC, I see this site as a distillation of the quality posters from HPC

It looks like we will see more drops for gold as this plays out?

Has anyone noticed the thin trading warnings on BullionVault?

Welcome to GEI.

There's some talk about BV here

http://www.greenenergyinvestors.com/index.php?showtopic=4469

-

I've found another 2008 silver eagle. I’m a bit confused now. Is it possible that the proof and uncirculated have different thickness?

Silver Eagle 2008 (uncirculated):

Diameter – 40.6mm

Thickness – 2.98mm

Weight – 31.103g

-

I’ve spent hours looking for the thicknesses of coins. I’ve managed to find some. I though others' may find this useful

Silver Eagle:

Diameter – 40.6mm

Thickness – 3.1mm

Weight – 31.103g

http://24carat.co.uk/frame.php?url=2008use...llioncoins.html

Silver Philharmonic:

Diameter –37mm

Thickness – 3.2mm

Weight – 31.103g

http://austrian-mint.at/silberphil_daten?l=en

I’m still looking for Silver Britannia and Silver Panda if anyone can help

-

Did they work out if it was 700 Bn a month or total in the end?Don't forget bank reserve requirements to zero too... (did that get in?)

I'm not 100% certian, but I think it is mostly unchanged from last time.

-

well I put my money where my mouth is also

(sold at 840) and I am saying that if the bill is passed (which I would be very surprised it does not) Gold will dip below 820.

(sold at 840) and I am saying that if the bill is passed (which I would be very surprised it does not) Gold will dip below 820.What time is the result of the vote btw?

It's passed

-

By the way, I did mention this but got no response.

Do any of you guys use this great website ?

http://netdania.com/Products/ChartStation/ChartStation.aspx

Gold is still alive on there

Great link. Thanks.

I was using Goldprice because it gives live gold and silver in a choice of currencies but it has stopped working on my work computer.

-

thanks for the answers guy. i think i shall diversify!

If you’re looking for small gold coins, have a look at French coins on coins invest direct. They have a lower premium (over spot) than Krugs

-

-

...

The vast majority of physical silver is apparently still being sold at spot - eg. 1000oz bars. When the majority of the physical silver trade market starts using prices that are different to 'paper' spot prices - then that's a proper divergence. I don't see how what's going on just in the retail investment trade can be held up as evidence for anything other then the state of play in that small(?) sector of the silver market.

...

I think that is a very valid point. I believe Gold Money buy and sell based on the price of silver bars and not the paper market. It will be interesting to keep an eye on the GM price for signs of divergence.

I’m not sure if there is any at this point in time. Can anyone confirm?

-

I mean it was either a bad prediction or a misleading one.

If by 'explode' he meant spike up by up to 10% before fallnig massively, then it was a bad use of words.

If he meant 'go up massively' then I'd argue that a 5-10% spike followed by falls makes it a bad prediction.

It’s a bit unfair that you are picking on a 10 week old prediction. If silver goes up 200% (from today) would you then say it was a good prediction? What if it goes on to fall 50% (after the 200% increase). Would it then be a bad prediction again?

I said earlier in this thread that I thought it was a good prediction at the time and nothing has changed. At the time it was a good prediction.

I’d consider this Cgnao post to be current. Do you think it is a good one or a bad one?

http://www.greenenergyinvestors.com/index....ost&p=56855

So had I predicted this morning that Croatia were going to "stuff" England, you would be happy to proclaim me right because the Croatians had the most possession in the first 20 minutes?I think you have picked a bad example. If Croatia had scored first (I don’t know if they did or not) I may* say that you were right at the time if asked.

I find it interesting that you seem fascinated by my earlier conclusion. Have we met before?

* I don’t really give a **** about football, so I probably wouldn’t have listened to your prediction if this was a real situation

-

Do you count 17.50 to 18.50 as an explosion? Or even 17.50 to 19.30?

Over what time scale? (I’m not sure what you are getting at).

So had the price fallen by 50c on that day, and subsequently risen 40% you would say that the OP's original prediction was wrong?That’s right

-

Even though the price of silver is down nearly 40% just ten weeks after he made the prediction?

yes

-

So has the price of silver (I mean REAL silver, not paper silver) exploded upwards?

I’m afraid I can’t remember the price of coins or bars on the day.

-

So you are saying he was right then?

I’m going off memory, but yes. Silver did explode upwards.

-

Just a thought, but why would a silver merchant want to accept cash for silver if they thought there was going to be a massive inflation? Why not just lock the doors and sit in the vault with the inventory waiting for D-Day?

You could say exactly the same thing about any product for sale. Why do bakers sell bread, why don’t they stop selling it, wait for the price to go up and then sell it?

Or indeed why would they re-order stock if they thought that the price was going to fall?That could be true for a small tin pot amateur coin dealer but it is not going to be the case for large distributors and suppliers. The large outfits are likely to have set contacts above spot or prices fixed for a period (days or weeks). They don’t have to order any amount of stock until they know it has sold.

Take a look at Royal Mint for example. Their prices have not moved for months.

-

So how's the upward explosion going so far.

I ask merely for information.

[from memory] To be fair, silver did rocket up that day about 20 minutes after Cgnao made that post.

-

Because there is still a tiny chance of massive deflation....even after the Feddie and Frannie bail-out.

I think you made the word ‘tiny’ too small. I can’t see it. I’ve corrected the above quote

I think you made the word ‘tiny’ too small. I can’t see it. I’ve corrected the above quote

-

thesilverexchange.com allegedly accepts credit cards. I would possibly just start paying all running expenses with the CC and average in. Anyway, we're not there yet, and I might actually not do it anyway if IRs are forbiddingly high. It was more of a joke.

I’ve got a cashback credit card. I was thinking that I could buy silver, get the cashback and use it to buy more silver.

Looking at the prices, it’s not really going to work out for me. Coindirectinvest is a bit cheaper once you add on the UK VAT

http://www.thesilverxchange.com/

-

Cue OPEC.

Right on cue

http://news.bbc.co.uk/1/hi/business/7607508.stm

Oil rises on Opec production curbOil prices have risen to more than $103 a barrel, reversing earlier losses, after OPEC agreed to return to its late 2007 production levels.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

A trend of Google searches for ‘Bullion Vault’.

I have seen some better info posted from Google, but I am not sure how to get it.