-

Posts

1,725 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by FWIW

-

-

http://ftalphaville.ft.com/blog/2009/03/05...es-the-pundits/

Also since November, gold never fell below its 50-day moving average. Finally, the latest retreat remains within the upward channel, suggesting support remains holding at 890. Only a breach below 888-887, will cast serious doubt on the current bull run. if there’s one singular reason gold is unlikely to repeat the October selloff is that today central banks are either at or on their way to quantitative easing (Fed, BoE, BoJ & BoC), followed closely by the SNB.

-

Hasn't it already done it's 'from $1000 down to $700' bit?

I don't know - that's why I can't get my head around EW's. I just think that someone can draw lines and make it say whatever they want. A bit like horoscopes for nerds...

If they had dates on each of the stages, like when the prediction was made, the current Gold USD price, etc. It would make them easier to understand and therefore maybe easier to debunk?

From my Fundamentalist view points - this is a once in a multi-generation event. When GMTV start trying to explain Quantitavie Easing at 6.30 am, you must know the gig is up? Especially when they start saying things like "Creating money out of thin air" to help the economy...

Now nobody is asking what will happen to that money e.g. BOE will buy 'assets'. But what if that money was used to instead prop up the GBP or any other fiat brethren? Who would know? The GBP could then be kept going. Maybe even that cash could be used to short GOLD ETF's?

I feel that once the BOE drink this kool-aid, they will be back for more...You see it is GREED. IT IS IN THEIR NATURE.

-

I much prefer Alf Field's elliott wave analysis, which has been spot on so far

- Major ONE up from $256 to $1,015 (actually 4 times the $255 low);

- Major TWO down from $1015 to $699, say $700 (a decline of 31%);

- Major THREE up from $700 to $3,500 (a Fibonacci 5 times the $500 low);

- Major FOUR down from $3,500 to $2,500 (a 29% decline);

- Major FIVE up from $2,500 to $10,000 (also a 4 fold increase, same as ONE)

So are you saying that if you can afford to wait to buy more gold, then wait until it get's anywhere near $700?

I might try this strategy with a portion of my USD cash pile!

-

I don't get Nadeem's EW counts. Correct me if I'm wrong, shouldn't it be 3 impulse waves up and 2 corrective waves down for the bull cycle (e.g. 1-2-3-4-5) followed by 2 corrective waves down and 1 impulse wave up for the bear cycle (e.g. A-B-C), thus completing the whole gold market lifecycle? And in the 2 corrective waves down of the bull cycle, shouldn't they take the form of an A-B-C wave, rather than a 1-2-3-4-5 wave? Seem to me like his counts are mixing-up secular bear and bull lifecycle waves.

I don't understand Elliot Waves - Looks like Kerplunk to me! I was hoping someone could explain it in very simple terms to me....especially the part about gold going to $820 mid 2009.

-

Just talked to my usual source who informed me that the gold bottom is in.

Hey cgnao - any updates from your source? Today was a real rollercoaster!

This is from http://www.marketoracle.co.uk/Article9241.html

Gold Quick update ($920)- The trend so far is close to the forecast for 2009 ( Gold Price Forecast 2009 )as illustrated by the original graph below that called for a rally to $960 by early March and a decline to $820 by Mid 2009. Yes gold broke above $960 to above $1000, which on face value is a sign of relative strength. However time wise gold has turned lower a little earlier than originally anticipated this therefore is a sign of weakness, which therefore neutralises the stronger price run and continues to confirm the trend towards the target of $820. However the rate of decline suggests an earlier low probably by late April 09.

-

[in words of Bush]

Fool me once - shame on you.

Fool me twice - shame on me.

Fool me thrice - ????????! Bring on the sales!

-

It's not entirely baffling; look at a long term ~20year 'high-low-close' chart in GBP and USD. You can clearly see there that the volatility of GOLDUSD is lower than GOLDGBP. You can of course use this volatility to your advantage; like me buying at $939 this week; but when the pound was afew % higher vs the USD... I could see it entirely possible we have major drop in te GBP so I was looking for an uptick in GBPUSD at a low-ish point in GOLDUSD.

For those of you who need some help on 'seeing' why getting rid of your GBP for gold is a no brainer, here is a chart:

Is the trend 'your' friend?

Also Jim Rogers explains it very well here: http://link.brightcove.com/services/player...tid=14510970001

-

Seasonals - where does the biggest demand for gold come from?

Gold is usually lower in price by the time August/September arrives so why buy in March at a peak?

With that I guess you will be shorting gold to make some healthy profits?

-

Not convinced about buying gold now being a 'no-brainer' in GBP:

http://stockcharts.com/h-sc/ui?s=$GOL...id=p98524378536

Looks set to drift down towards the 200dma while the 200dma rises whereupon they shall meet and THAT will be the time to buy again!

It's a no brainer for me - you might want to put some thought into it...

-

Looks like RH was right with that 840 call!

Anyone got any TA/FA to share? Why has Gold gone down so much?

-

*Why* does every one always quote the dollar prices, even if they are planning to buy in some other currency?!?

It really baffles me, as although they are somewhat correlated (not always, look at the decoupling with sterlings devaluation last year), surely the only price which matters is that which you plan to buy in?

Gold in GBP is still over £650 on GM (now) which still looks pretty expensive to me. I'm sticking to silver and oil stocks for now

Might be due to the fact that the USD is currently the world's reserve currency?

Also, buying gold in GBP is a no brainer in my personal case. See here: http://stockcharts.com/h-sc/ui?s=$GOL...id=p03253663428

-

+1

+1opened a GM account few days back when it was nearing $1000!!!

Timing getting more gold is a 'fools errand'. I just wanted to get out of some more turdling at anything below 940, and in hindsight probably pulled the trigger far too early at 938. I used GM and right this second I could have got 925.60....

Lesson learned by me - Buy in the early hours when it is quite...

At 924 gold looks very cheap....maybe I can find some turdling behind my sofa!!

-

Thank you PPT! Just pulled my trigger at 938!!!

Errr - you can stop the sales now!

Please?

LOL

-

A little evidence perhaps we may be in for a speculative rise in Gold - the telegraph have an entire section dedicated to investing in gold, full of recent articles, even charting the weekly market fluctuations.

http://www.telegraph.co.uk/finance/persona...investing/gold/

It appears to be the next buzz amongst the dinner party discussions. Several years too late as always but could be interesting. If things do work out in a CGNAO style outcome then at least some more people will have protection courtesy of the media. But the cynic in me says someone will be pushing this for their own ends and people will get burned.

GOLD - The Original and Best Bubble.

For all those people that think that Gold's value will collapse, please think about this.

Gold has infinite demand. Everyone wants to be rich and have lot's of money. Everyone wants to be powerful. Gold is money. In the days before 1971 this was gold's function. Fiat on the otherhand was born from a lie.

Those who had no gold, had to work hard for a living.

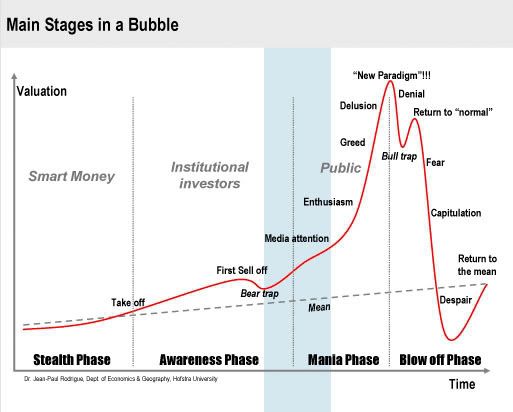

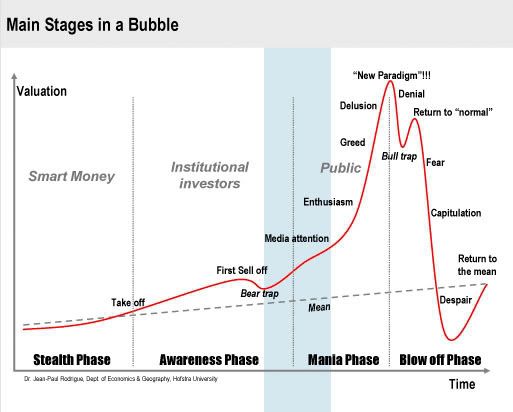

Now don't think of Gold as something that follows the earlier posted chart of the different phases of an asset class. Rather, think that Gold is the CONSTANT that everything else is measured against. That new iPhone is very nice. It will go through all those phases over it's lifetime. Apple know this and will develop a newer model in time, with more features. Old one dies, new one booms. If Apple get the timing wrong, new competitors will appear. This is the free market in action.

In the same way you can think of 'fiat' money. 'Fiat' has had it's New Paradigm moment and the only way is down folks.

Now let's think about that major liar 'Sir' Fred Goodwin. He knows the score. He knows he has lots of 'fiat' paper. Why do you think he milked RBS? Why won't he give back his pension? Because he knows that when we go 'The Way of Zimbabwe' he will need every penny he can get.

People need to see the Credit Crunch as the SOLUTION and NOT THE PROBLEM.

Now, don't think that getting rid of fiat will be easy. It will not be suddenly toppled from it's throne. Every country in the world has a vested interest in keeping their 'fiat' going.

The only thing I would like you to contemplate is that deceit and lies create very good liars. Honest money will create a more just and fair society. From the truth you get truthful people. Is honesty 'really' the best policy in today's society?

-

Plunging right now - any reason? About to check reuters.

I would put that down to system management...

-

Why you call him Dave? Rodney??

So are we up from here or down? My guess, somewhere in the middle, possibly.....

I have consulted with the tea leaves and here are my findings.

[FWIW goes into a trance and is posessed by Mystic Meg]

For Gold in USD:

Things are not very clear in my crystal ball for Gold priced in USD fiat paper....

Let's consult with the GBP gold gods...

Ahhh things are much clearer with Gold Vs GBP....basically screams BUY GOLD!

But how can we be sure to be sure?????

OK - Let's have a look at GBP Vs USD. Should I stay in GBP or be in USD?

So Mystic Meg has spoken sell GBP, BUY GOLD......

Will Dave agree with Mystic Meg?

[FWIW wakes up from trance]

hmmm. WTF just happened? I need to lay off the coffee!

-

That corresponds quite nicely with the graph below and where I think we are, at the beginning of the media attention stage.

Looks familiar...

-

WEALTH WARNING: IS THIS ARTICLE RAMPING GOLD? OR IS IT JUST THE TRUTH? YOU DECIDE! LOL!

http://www.moneyweek.com/investments/preci...aven-42406.aspx

Everyone I speak to says 'Gold is a luxury item'.

I used to wonder how they would feel if it became an essential item...

-

Very long article here:

http://ftalphaville.ft.com/blog/2009/02/26...ately-buy-gold/

Key message: BUY GOLD

-

interesting article from Hargreave Hale

Very good article - thanks for posting.

I do think that the author gives too much credibility to the Central Banks though. The problem is that all Central Banks behave in the same way, but some will run out of gold to sell at some point. This will mean that the gun will run out of bullets, and the central bank's country will be in hyperinflation or use another country's currency.

Therefore, there exists within the system an inbalance that needs to be fixed. If every central bank is happy for the yanks to be in charge forever more, then there is no problem and therefore no imbalance. We will all move to the good old US Dollars for all our transactions.

However, I do not think it is in the nature of each Central Bank to be 'told' what to do. They will all want to be top of the 'fiat' tree.

Also as Central Banker's they will know how gold is stored in Manhattan or not as the case may be.

This article is also good to keep in mind especially as the CB's are liars...

http://cynicuseconomicus.blogspot.com/2009...ting-money.html

-

My trigger finger is getting itchy!!!!

Come on PPT please get it down some more...I have a pile of sterling I need to swap for something valuable!

-

I think thats a reasonable target, i fear it may get overshot though.

Well if it goes to 740, I will be able to buy up a load more...just like last time!

-

This could go to 800, because of nervous nellies

Oh yes please!

I need more physical...Please let the sales go to 875.

-

The idiots are back in town. This dance around the round number is so ridiculous.

If the price goes down substantially, I'll possibly add to my position some more gold rather than silver or palladium. You have to love the blackboxes, sheeple sellers, and the Cartel.

EDIT: Anyone who tries to trade this should read up on nickels and steamrollers.

I'm looking at getting back in at 950-955. I do have in mind the PPT might start the sales at 930 though.

The way I look at it is, that every month I change some fiat into gold and forget the volatility.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

I have got my crayons out again...

The red box is the first support level. The yellow is the second support level. The green boxes give me a sense of deja-vu. I feel like how I felt in October 2008 investing in gold when everyone told me not to and that I was stupid!

Difference between now and then is that I have my physical and I also have my GoldMoney gold...I also sleep better now!