-

Posts

217 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Meralti

-

-

UK builders see value of orders collapse

The total value of new work awarded to the UK’s 50 leading construction companies fell by 39 per cent during the 12 months to MayHow BDEV looking?

-

I know that, but I never said the debt halves, rather the deficit halves.

However, if you are inflating the money supply (through QE or whatever other means), your debt indeed reduces in real terms.

QE is amazing in this respect, printing money then using it to buy bonds to keep the yields low (which of course would normally rocket if you started printing money).

It's genius really!

A lot of people don't seem to get that.

Also, income is not unchanged. It is, and will keep on, rising. If inflation gets higher, so will the call for wage rises. The population will not sit on their hands forever.

This seems remarkably complacent and smacks of bull-ramping. I see no sign of wages rising anywhere near the rate of inflation.

Nor are they simply garrenteed to rise, especially with rising unemployment.

But more importantly cost are likely to increase for other reasons, removal of implicit tax payer support for mortgage lending.

The end of the special liquidity scheme began last month, and repayment are due to start this month. The money mnade available is due to be repayed by January next year (I think this is the right date). But I haven't seen any comment about this in the press.

Lenders who need to repay money they have borrowed from the scheme will not be able to lend at low prices. Those that were not involved in the scheme will probably raise rates on mortgage deals because of lack of competition.

There was talk of a £300bn funding gap opeing up between what property buyers wanted to borrow and the available funds. This will naturally lead to rising rates.

I talked about this a few month ago when I posted about changing government policy.

Isn't it time to admit that the only thing supporting pices is an ultra low base rate; and domestic rates can rise independently of base rates and probably will unless the funding shortfall can be met by other means.

In this way the BoE can let domestic rates gradually rise while doing nothing with base rates. Therefore if prices fall due to lack of mortgage availability it isn't their fault - it's the domestic banks.

-

Sounds like there is ballooning debt on the other side of this equation. Inflation will sooner or later erode these short term gains. (I guess that's exactly the point of this article: the pain has been delayed.)

Yeah, classic electioneering by Brown. Give-aways before and election, pain afterwards as it's clawed back.

-

Actually the debt isn't the highest in the developed world, but, the deficit is and that is what is being cut. I stated that the cuts are not as bad as everyone was saying they would be, and they are not. But that was just government expectation management. Tell them the worst, then it's not so bad when the real numbers come out.

The real cuts will get rid of the deficit as they are planning, if they stick to the plan and the markets are happy with this.

See for yourself, yields are still falling

Sorry for the typo (I wasn't concentrating) it is the deficit that is the highest, however the total debt is continuing to grow regardless of the planned deficit reduction (which is what I meant). But the point that you're missing is the deficit reduction is dependant on growth. If GDP begins to fall then the deficit will actually increase. This is a bind: if GDP increases, we get growth and upwards pressures on inflation, leading to upward pressure on interest rates. If GDP fall the deficit increases, leading to either the necessitity for further cuts or an increasing cost of borrowing - increasing yields. The line being trodden is extremely fine and vunerable to external shocks.

I agree, and heh, check all my posts, I try to look at both sides and have stated several times I expect prices to fall nominally by about 5 to 10% over a year or so. I just don't see an "end of the world" scenario as some seem to.

Does that make me a bull?

Ok, so the end of the world will be avoided at all costs. For what it's worth I'm looking for a 20% fall over the next 2 years or so. That said, a European bank failure could wreak havoc.

-

The UK debt is LONG dated (Twice as long as most others) and the deficit is being taken under control.

And yet it continues to increase every month and it at it's highest level ever. Uk government debt is one of the higheest in the developed world. You yourself have stated that cuts are not really being implemented and so can be discounted as having any effect on the market. Now you claim the deficit is under control.

While it is likely house prices will continue to drift down (real more than nominal), like it or not, the debt crises affecting other countries has been averted here.

If the Con-libs keep to their targets, as they appear to be doing, there will not be a sov debt problem in the UK.

Simply stating that thing are not a desperate as it is for the PIGS does not mean that there will be no nominal fall. I'm beginning to see reductions in asking prices for the first time in 18 months. You bulls really do need a fresh tranche of QE to get thing moving again.

-

Halifax is now down 20% since mid-2007 peak, and general inflation accounts for another 12-13% since, so we can now accurately say that UK Property has had a third of its value wiped off in real terms since peak. We knew that real prices would have to fall by 50% to for them to revert to trend, and this now looks bang on target.

I still don't think that we'll get big nominal drops, however. More a long slow grind down over the next 3-4 years with inflation doing the rest.

The inflation argument is nonsense. If anything inflation will decrease prices further. There are two kinds of inflation, cost push and demand pull. We're seeing cost push. Demand pull is where rising wages drive price increases; this is what is needed to make the mortgage more debt affordable are we're not seeing it. Cost push is where prices rise because of rising costs to foreign manufacturers or home currency devaluation. This does not decrease the relative debt levels measured in the home currency. It simply reduces even further the amount of income that can be expended on debt repayment and interest.

-

Well, that seems to have been ruled out - the bull is strong on BDEV.

Look for double top next.

Looks like it's happening on low volume though.

-

So the NSA was up 0.31%, doesn't the figure come in about 4% in a normal market this time of year that's why we get SA. How does it compare to 08/09 for the same month.

Taken from the forex factory

Release Date Actual Forecast Previous

------------ ------ -------- --------

May 9 2011 -1.4% 0.2% 0.0%

May 7 2010 0.1% 0.6% 1.0% Revised From 1.1%

May 6 2009 -1.7% -1.0% -1.9%

May 2 2008 -1.3% -0.6% -2.5%

May 10 2007 1.1% 0.7% 1.2% Revised From 1.0%

-

Latest Halifax data is is -1.4% MoM, against a forecast of +0.2%.

See forex factory

So much for the spring bounce, that's a return to crash cruise speed.

-

Agreed, I hadn't seen this one before.

Question is, is this just showing the end of MEWing and the move towards paying debt down?

It represents the total debt secured against property. So, certainly the fall in MEW is included along with the absolute fall of new mortgage lending. I don't think that it includes the paying down of debt as that is not new lending.

-

Great chart.

Now here's a dumb question: Is this "stock" or "flow"- ie total Outstanding or volume over a year?

If total outstanding debt, then the debt amount may just need to move sideways for another 1-3 years, and the market may be closer to a low than I had thought.

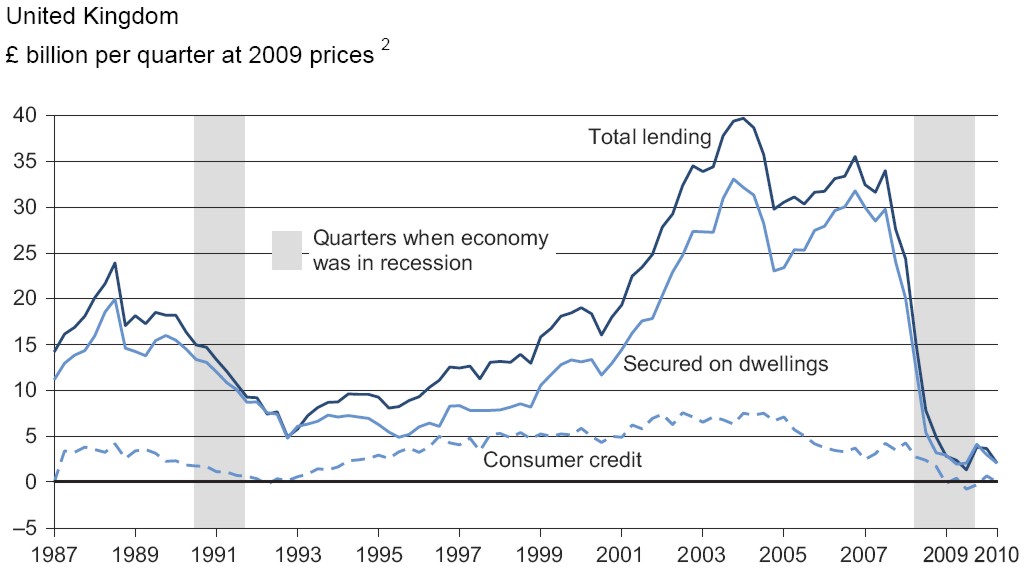

This chart is taken from a report produced by the office for national statistics.

Total net lending to individuals by banks, building societies and other lenders is a measure of thevalue of new loans, less repayments, over a given period. Figure 6 (the chart) shows flows of net lending to

individuals over the past 23 years

...

The increase in total net lending between 1993 and 2004, adjusted for inflation, was driven

primarily by growth in new loans for house purchases secured against those dwellings. The flow of

net lending secured against dwellings fell in the recession of the early 1990s, and then started to

gradually increase after 1996, and more rapidly from 2000 onwards with the acceleration in house

prices. In Q4 2003 the flow of net lending secured on dwellings peaked at £33.1 billion, followed by

a decline and subsequently another peak at a similar level in Q4 2006. It then decreased again,

with the pace of decline increasing sharply at the beginning of the economic downturn which began

in 2008; falling to £2.0 billion in Q2 2009, increasing to £4 billion in Q4 2009 and falling again to

reach £2.1 billion in Q2 2010. The flow of total net lending reached a low point of £1.4 billion in Q3

2009, increasing slightly to £2.3 billion in Q2 2010. Although the flow of net secured lending in real

terms remained positive during the recent financial crisis, the real stock of loans outstanding has

fallen since Q1 2008.

So this chart shows flow and therefore represents the flow money from new lending into housing.

-

Take a look at UK private debt posted here on the property board.

-

Here's a good chart taken from the following blog: Cynicus Economicus

It shows total, debt secured against property and consumer credit for the UK. The shape will be pretty familiar to followers of property. Compare this chart to that of UK house prices and we see that it leads by about 4 years.

The pattern shows the same peak, local mimumum, suckers rally and secondary top as property (but preceeds property by 4 years or so) take look and what happens next. If uk property continues to follow private debt we are duw to see some specactular falls soonish, with a trough in mid 2013.

-

Bubb,

Beautiful head and shoulders pattern playing out on Barratt BDEV.

I can't post my chart, but check it out. Left shoulder late Feb.

This looks like a great call. Relatively high volume on the formation of the shoulder lowish at the head and really low now the right shoulder seems to be forming.

-

Agree on most, but if the institutional investors buy up these places to rent them out, doesn't that put upward pressure on those remaining for sale to private individuals (less supply etc)?

Could put downward pressure on rents though, unless they create a cartel.

These bulk purchases will be for repossed properties from banks and new builds from developers. The market is now stalled and propped up by low interest rates. These bulk transactions will take place at hefty discounts, perhaps as much as 50p on the pound. This will lower prices but may not be fully reported to the indices.

-

If this is correct, this could provide some support for prices. Should also enable the banks to sell off whole portfolios quicker.

It may provide some support. But it looks as if it is principally aimed at banks and housebuilders. This will allow banks to sell large portfolios of repossessed properties and housebuilders to sell large numbers of unsold new builds to institutional investors at a tax advantage. This will allow the market for these sort of properties to clear, at least in part. Which actually may well put downward pressure on the market. Any support will come from large bulk deals done behind closed doors and off-market, as it were. The tax break is therefore a subsidy for banks with bad loan books and housebuilders. I'm not sure it will do much for the small scale BTLer or anything at all for people selling their PPR. It should also stimulate new building if housebuilders start to clear their stock. Construction boosts GDP while simple changes of ownership do not.

Oh yeah, institutional investors entering the rental market on a large scale will probably start to push down rents after a while. The kind of properties that will be most effected by these changes were always destined to become social housing anyway.

-

The "prophet of property", Tony Pidgley, the chairman of Berkeley is looking at continuing improvement in the market.

Investors like Berkeley’s upbeat forecast.

"Happy Days for the Housing Market"

And he doubless referred to the recent data from Zoopla to back up this sentiment.

The average value of a home in Britain is £201,000, down 18 per cent from £247,500 in October 2007, according to property website Zoopla.Much of the drop has been seen during the last eight months, with prices dropping 11 per cent since last summer.

Happy days indeed.

-

FWIW - I think the top tier market will freeze if and when stocks crash. The confidence from the buyers at that end of the market will be wiped out.

This happened to some extent in 2008 when EMs were in free-fall. Once QE and thus stocks rallied the top end market returned, having had interim support through the bank bonuses and weak £.

...

If the activity we have seen in the last 2 weeks in equities is the start of a medium term correction then this could signal the top of this 12-18 month rally in the housing market's top tier (regardless of interest rates staying where they are).

People don't often align equity market cycles with housing cycles, but I think we can be more clever to segment the housing market and then draw comparisons.

Agreed and a good post. This tread was losing it way a bit, thanks for helping to bring it back on track.

The top tier is driven by the City. A fall in equities would effect it.

The lower is sliding and the middle sticking or sliding a bit. I'm seeing this were I am.

-

Do they never learn?

You friend is operating in an area beyond "foolish".

Think of him as one of the last fools - who will learn to regret his recklessness

Bubb,

In a rigged market this isn't completely irrational. There is no fear, or very little. It's hard to express the degree of complacency in the UK regarding property. It's going to take a really big wrench to change it and very few people seem to believe that a real change can or will happen. I was mocked again at work for my opinions only last week. Dispite explaining the last six months of falls. Low interest rates are propping up a stagnant market. There's less than half the volumne of money going into property than 4 years ago but it is being spent on somewhat less than 40% of the number of transactions at a similar time. So prices haven't fallen much. Despite the terrible fundalementals people who have bet on property continue to be rewarded for it - for the time being; and most don't lool beyond this.

-

90% mortgages are OK imo so long as they are not given out at more than x3.5 or maybe x4 salary, and on a repayment basis only. Maximum LTV on interest-only should be capped at 75% or 80%, max.

At the end of the day lenders must be sensible.

Most have moved towards this. Mortgages are now difficlut go get and getting more expensive.

-

This view relies on two things, the second of which is the major flaw, if your case is true they both have exactly the same net assets.

1, Rent is on average equal to or more than repayment mortgage and maintenance

2, That this worthless house is not available to the renter to purchase also for zero money putting them in exactly the same position

What could happen based on point 1 is that the rent is on average less than repayment mortgage and maintenance, the renter saves this difference and over 25 years lots of interest is compounded. At the end the buyer has a worthless house and the renter has lots of extra cash.

You're dead right there tallim. However, your argument assumes a fully functioning financial system where true prudence, self-reliance and sound investment are rewarded. This isn't the case right now. The renter in your scenario must speculate in order to receive the compounding of interest you mention and my loose if (s)he makes a mistake. Of course this has been done deliberately to heard people into property and support prices. It looks like it worked with BaB. This is one of the reasons that people like this still think property is a good "investment". It's just another speculation - one that has been up until very recently been supported by government intervention. Of course his arguments for property rely on this policy remaining as it was under Brown. Something he never states explicitly.

-

-

Land reg regional breakdown:

London

- MoM 1.6 YoY 2.4South West

- MoM 1.6 YoY -0.4South East

- MoM 0.5 YoY -0.1East

- Mom 0.4 YoY -0.2West Midlands

- MoM -0.4 YoY -1.4East Midlands

- MoM -0.5 YoY -1.9North East

- MoM -0.6 YoY -2.5Yorkshire & Humberside

- MoM -1.3 YoY -2.6North West

- MoM -2.0 YoY -2.1Wales

- MoM -4.2 YoY -6.1Outside of London the falls are looking quite high.

-

Land registry figures for January

- +0.2% MoM

- -0.9% YoY

The average price in England and Wales is now £163,177; down from the previous figure of £163,814.

However, the previous figure for December 2010 has been revised down to £162,897. Which is why we are seeing a MoM rise.

UK House prices: News & Views

in NEWS Commentary, 2021 & Beyond

Posted

BDEV closes at 110.8, a two week low and UK banks feel pain as reality reasserts itself.