-

Posts

157 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by drminky

-

-

What do you think of DrBubb's prediction?

Assuming a 50% retracement from low to high of the oil uptrend (which gold did pretty near spot-on @ $845), that would give a $100 target for oils' low. I can't see it getting much below that at a stretch, but then again, these days almost nothing in these 'free markets' would surprise me..

-

Daily smackdown time again.

I get the feeling they are setting up a 'short suckers trap'. 5 days in a row we've had the smackdown at exactly the same time every day. This is getting too predictable, too easy a trade. I wouldn't be surprised to see the big boys change the game very soon and catch the danny day-trader shorts with their pants down..

-

-

Loaded up on some gold shares today that I'd always wanted but never had a good opportunity of late to grab. I don't see too much more downside potential left in this latest selling frenzy, although im usually a day or two early on these calls.. I just wish I had more powder!

damn you Monthly pay!

Oh well, Guess its the beaten down Natgas stocks for the beginning of the month then..

-

Very true.

But gold is no good to a pensioner - it doesn't generate an income. In fact, it generally costs money to store. All a pensioner could do with gold is to slowly sell it in order to eat etc., with no chance at all of ever being able to top up again.

At least Gold is preserving a pensioner's buying power. Something traditional pension investments like cash deposits and bonds, or more recently non-traditional ones like real estate are failing to do, whether or not they provide an 'income'. As far as stocks and shares go, there's only a precious few that provide a solid, dependable yield above inflation (And no, i don't mean the financials with their supposed high yields, which have no chance in hell of ever being able to actually pay out in future)

And, as Frank Barbara wisely pointed out a few weeks back on FSN before Indymac went bust, now is the time to be more concerned about the return OF your money, rather the the return ON your money..

-

Honestly, I am loving the PPT and their manipulations right now. I made a nice little profit shorting the financials, even if i did close the position a couple of days early. Its brilliant being given the opportunity to have another go handed to you on a plate!

-

What do the esteemed members of this board think of Gammon Lake and Alamos Gold? Possible acquisition targets? These seem to fit the target criteria Jim Pupluva keeps alluding to.. 2-3 million ounce reserves, in the Sierra Madre region of Mexico, just starting to produce, lots of exploration upside potential, stocks knocked down nicely from their highs..

-

Silver could be a very good buy here, it's been thrown on the floor like no-one wants it. But you'd have to be very brave to go long right now. I suppose that's where the profit is, buying when everyone else is fearful.

I have a long from $16.69 and I'm wondering whether to hold onto it or sell out now just in case. I'm pretty sure PMs are going to take a knock today, and even if it's only for a very short time that still means I could be able to buy back lower.

Edit: Just sold at $16.76. I believe the market will react in a manner negative to gold whatever the Fed says. I'm on standby to buy the dip (if it happens).

I've almost given up trying to figure out how the hell your average joe trader (or average hedgie) thinks anymore.. The media, Government and educational instituions have done such a brilliant job of dumming down and spinning ass-backwards truths all over the place that barely one in a thousand seems to understand what is actually going on anymore - let alone the people in charge!

I love the bloomberg article yesterday about gold:

http://www.bloomberg.com/apps/news?pid=206...fer=commodities

``Inflation makes gold go lower because central banks have to raise interest rates to control it,'' said Leonard Kaplan, president of Prospector Asset Management in Evanston, Illinois. ``Higher inflation means higher interest rates and that's negative for gold.''

Umm.. inflation is BAD for gold now?

it took a lot more than a few quarter-point hikes to stop gold's run in the 70s..

-

Of course the price will now go sky-high within Vietnam.

Could this happen at some stage in the US and UK as well? The price would then explode in a buying panic, which is when you maybe would like to sell and switch into houses or general stocks. But I think we're still far from this.

'Vietnam’s communist authorities have temporarily suspended all gold imports in a bid to tackle the country’s spiralling trade deficit and help support the depreciating local currency, the dong.'

Long dong anyone?

Does that mean gold is bad for a strong dong? hmm might have to rethink my strategy!

-

Seems the goldstocks are shrugging off this latest move. At least mine are mostly all back in positive territory for the day. And why should they buy it?

today so far

Oil up

Natural Gas up

Iron Ore up

CRB up

Yet we are supposed to believe this is somehow NOT indicative of inflationary pressures weighing on the currency??

-

But wouldn't changing the tax laws to discourage the rich doing that with their capital equally be a government intervention? Not all interventions are bad in my book, but I do believe that governments get addicted to the idea of intervention and take it too far more often than not.

Well, more a case of stripping back government intervention than creating more. Part of the reason the rich shut down their factories and went into tax-free bonds was to escape the 90% income tax slapped on them by Roosevelt. Ironically, it was probably this shift into bonds that enabled Roosevelt to expand the US debt massively to fund his New Deal programs.. So the end result was essentially shifting from producing things to borrowing off future productivity (debt), another thing our governments seem rather fond of..

-

Incidentally, looking into it further I made an interesting mistake.

The money supply did indeed fall at the start of the deflationary period, because the previous system of silver and gold was changed by an 1873 act which demonetized silver (The "Crime of 73"). As a result, a lot of people lost out directly, and deflation ensued as the money supply was cut in half.

Also, this was widely seen (possibly correctly) as a conspiracy (by bankers who were in cahoots with London financiers who had most of the gold).

So you could see the whole affair as proof that bankers try to fix things in their own interests and that monetary anarchy would be preferable to a centrally imposed standard. It's an interesting period to look at either way though as it gives a different perspective on things. You also had the Greenbackers arguing that paper money was better for the poor, and that mineral standards were only there to protect the wealth of the rich, in the same period.

(For nerds like me, it's also interesting to note that the Wizard of Oz is widely claimed to be political allegory for bimetallism, in which the silver shoes end up defeating the yellow brick road which symbolized gold).

Yes, the US populace historically had a distrust for gold, especially in the 19th century, which they suspected was too controlled and manipulated by powerful european banks and families. There was a distinct preference for using silver as money in the US compare to europe, as supply was more abundant, therefore harder to control by a 'cartel'..(sound familiar?) Also, because of greater supply, it had a slightly more inflationary bias than gold did, which is why farmers were generally for the bi-metallic standard (hence the wizard of oz), to give support to their produce prices, and help them manage their debts..

The argument of the Greenbackers is essentially the same Keynsian argument that inflation benefits the poor and punishes the rich 'coupon clippers' (bondholders). In recent history, since the US had come off the gold standard, income disparity has grown markedly, and average wages have collapsed to 1/3 of their real value, which doesn't support this case. Explains why it now takes two incomes, not one to support a family. In fact, one could argue that inflation hits the poor hardest, as the asset rich are able to benefit from asset price appreciation more than the asset poor, and thereby protect themselves. Those on a fixed income (wage earners, pensioners etc) will fare the worst in an inflation..

I would argue that the problem of the 'coupon clippers', in which the rich put their capital into non-productive tax-free government bonds instead of deploying that capital productively in factories etc (esp during the great depression), has more to do with short-sighted punitive tax laws than with the monetary standard. Capital will always flow to where the highest returns are to be had, gold standard or not. Governments in their well-meaning attempts to 'income redistribute', and in their less well-meaning attempts to grab money for themselves, inevitably end up rewarding the unproductive at the expense of the productive, and distort the capital flow accordingly. Of course, they don't see the effects of their interventions for what they are, and always look for the next person to blame for the economic woes they cause..

-

I'm usually the last one to agree with the actions of this government, but on the issue of wage restraint I can see their logic. They are not, as drminky suggests, doing this to keep wage inflation low to "send the housing market and economy into a tailspin", but instead they are simply VERY scared that a wage-price spiral could develop which really would devestate absoutely everything.

So that's the main point to notice in all of this - a wage-price spiral as we had back in the 70's is now a VERY real possibility. ...and I would argue, actually quite likely! PM's will rocket in such a scenario, and we may find ourselves there in just 12-24 months on current trends.

Sorry, you seem to have misunderstood. i'm not saying they are DELIBERATELY trying to send the housing market and economy into a tailspin.. quite the opposite. And its true they are afraid of the wage-price spiral repeat of the 1970s. But they are trying to have their cake and eat it too, and it simply cannot work forever - something has to give. They are debasing the currency with reckless abandon in order to bail out the banks, yet trying to hold down wages. So real wages get crushed and the middle and lower classes get squeezed. Sure, it means they can go on printing money for a bit longer without it showing up in the cpi numbers as much (as deflating real wages hold down the so-called 'cost-push' inflation somewhat), but sending your consumer base into food and fuel poverty is going to be devastating to the economy in the long run. They have got away with it until last october by loading the consumer up with debt to keep the party going, but what will they do now? Consumption of non-essentials is going to take a long long slide to oblivion for all but the wealthiest, taking those industries down with it..

- "The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists." - Hemingway

-

There was also talk of weak trade unions etc. How quickly do you think will people join the unions once they see how they're going to get squeezed? It's going to be very quick IMO.

IF you are lucky enough to even HAVE a union!

People I talk to know they are being squeezed, but there's a sense of resignation that there's little anyone can do about it. Wages in my industry have been nominally static since 2000 or so, and I'd wager my industry is not at all unique.. Unless you are lucky enough to be in an industry that is benefitting from the commodities boom, there's just not the margins there to be pressing for pay rises.. Why? because wages are being held down, so noones got money to spend, yet input costs continue to go up, so margins are squeezed, so wages are further held down. Viscous spiral..

Its pretty sad that about the ONLY thing to be in permanent real deflation, never taking any benefit from all the money creation, whether its boom or bust is the price of human labour ..unless you were a banker, that is..

-

http://news.bbc.co.uk/1/hi/business/7460475.stm

Hey, ho! Food and fuel prices go up. Let's make sure at least wages don't!

Love it!

Its a joke isn't it? Typical ass-backwards thinking from our elected representatives. Governments are so desperate to hold wages down, they are completely blind to the fact that by doing so, they will send the housing market and economy into a tailspin, as the working and middle classes get crushed into financial oblivion. In holding down nominal wages, they completely short-circuit about the ONLY advantage of currency devaluation - relieving the real debt burden on the people, so instead, we just get all the negatives of inflation. How exactly is the economy supposed to recover when all our wages won't afford enough food to eat and gas to heat?

-

That is hilarious isn't it. Meaningless government bullshit, but of a comical sort.

Do you think they actually BELIEVE the bullshit they spout? Now thats an alarming prospect!

-

1972 according to this data from the Labour Research Organisation, but close enough..

http://www.workinglife.org/wiki/Wages+and+...%281964-2004%29

..of course, the REAL picture from the 80s onwards would be far worse if proper inflation figures were used in the adjustments..

Actually, just did a rough calculation based on John Williams' Shadowstats CPI numbers, and the picture is far more grim! For the most recent numbers (2004), I'm getting back approximately $113 in 1982 dollars.. thats about 1/3 the real wages of 1972! ..ouch!

-

Do you have any stats to back that up?

1972 according to this data from the Labour Research Organisation, but close enough..

http://www.workinglife.org/wiki/Wages+and+...%281964-2004%29

..of course, the REAL picture from the 80s onwards would be far worse if proper inflation figures were used in the adjustments..

-

200 DMA quickly approaching now. Seems to have taken forever!

Not only that, look at the positive divergence on the RSI and MACD from the low in early May to this new low in June. Downside momentum is stalling..

-

That depends entirely on whether cost inflation is higher than wage inflation. For most of the century wage inflation has outstripped cost inflation, leading to rising real incomes on average. So what you are saying has been factually inaccurate for most of the last century, although it is probably the truth right now.

In the Case of the US, REAL wages peaked in 1971, within a year of coming off the gold standard. Since then, real wages have declined, despite the massive secular boom from 1981-2000. Doesn't really support the Keynsian case that inflation and fiat has been better for the poor than the rich. Seems quite the opposite in fact. In fact, inflation really benefits those that are already asset rich, and punish those who hold most of their wealth in cash. And guess who disproportionately hold most of their wealth in cash? The lower middle class, the working class and the poor..

-

Let him speak. The chart will look better after one more retest of $850

Something for yall to put this latest gold selloff into perspective

-

Fed is committed to managing inflation expectations rather than inflation. Bernanke is just talking the talk.

Exactly. They are playing bluff. And even if they DID raise interest rates by .25% there'd be a massive selloff in gold, and i'd be buying with both fists. How quickly people forget that in the 1970s, gold rose most whilst interest rates were going UP! There is no way in hell the wall street controlled fed are about to kill themselves by hiking interest rates to above REAL inflation Volcker-style. Interest rate hikes, if and when they come, will lag and lag tearaway inflation for years yet.. The Fed care not for the pain of the american consumer. All they care about is saving themselves.. the rest is 'managing inflationary expectations'..

-

The May gold investment and trading thread asks "Has Gold found a bottom at $850 per ounce?"

Just eyeballing this chart of 3-month Au, Ag, Pt and Pd shows it has, and that the date of May 1st was the recent bottom not just for gold, but for all PMs.

Platinum and Palladium have thereafter shown a good recovery, with gold and silver showing dithering upwards movement. In the next week, I'm looking to see if gold and silver follow the pattern of platinum and palladium with a convincing move upwards.

PMs starting to recover from the "Ides of March (and April)" ?

I do hope so.

Thats a bullish sign. Platinum has often lead gold in moves to the upside.. Probably more so these days owing to the tight supply arising from the power crisis in South Africa. Lets see if it pans out this time..

-

Oh-oh. Gloomberg: Oil Surges to Record Above $127 on Speculation China Will Boost Purchases

http://www.bloomberg.com/apps/news?pid=206...&refer=home

It's a bubble, right?

EDIT: The shiny yellow one just scratched along the lower side of $900 ($899.50).

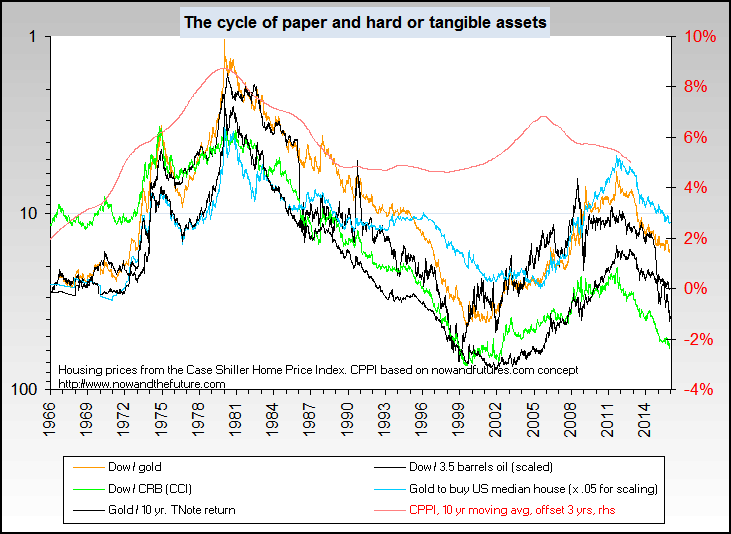

I've starting taking profits in some of my oil positions today, and rotating these funds into gold stocks. Sure, oil supplies are very tight right now, and i would never sell my core positions, but that gold:oil ratio is unsustainably low IMO. The big opportunities right now are in gold and probably uranium too, if that floats your boat..

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

More Government sheep herding

..and watch the subsequent downward revision of job numbers go completely unnoticed..