-

Posts

1,988 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by wren

-

-

I believe BullionVault have its own internal bidding system too (although I have only used GoldMoney so far).

It has a market board. So customers and BV itself place bids and asks and people buy and sell as they choose. Most of the trades at present are BV-with-customer (the counterparty involved is named (nickname) on the email confirmation and I have seen only BV as my counterparty over many trades).

As bars can be withdrawn it is connected physically to the rest of the physical market which should keep arbitrage down.

-

According to Jim Willie a a gold bullion bank run is currently in progress -

FW: contact with strong ties to info sources

Any link?

-

Taxi ride today in Auckland New Zealand

Taxi driver tuned into one of the talkback stations that runs spruiking advertorials.

leveraged gold investment ad caught my ear. Spend $10,000 and get leverage to 30,000 worth of gold. Yada Yada Yada.

Sounds like its getting bubblicious

Public awareness has to start sometime.

Very much at the beginning still in my opinion.

Thanks for that interesting anecdote.

-

Gold is at €782.75.

I exchanged euros for gold.

-

Lots of us on here have bought from CoinInvestDirect and I have heard of no suspicions of fakes.

It is surely a big dealer. I find it convenient because I can pay euros direct between bank accounts.

One place in Yorkshire frequently mentioned is WeigtonCoinWonders in Weighton. Several here have recommended it saying the owner is a nice chap.

Link:

http://weightoncoin.com/coins/

-

0.8% on silver too? That's very good compared to GM - I think that's worth opening a BV account for, in fact! I was having a chat with my father about which is best and this may swing it for BV.

BTW, is their a thread comparing the two anywhere? I have a GM account and I'm very pleased with it, but would be good to know about other experiences.

That's what it says in the email quoted above:

#1. Silver Dealing CommissionRuns independent of gold, but is charged at the same rates. So

you'll pay 0.8% on your first $30,000-worth of silver, 0.4%

on the next $30,000 and so on, regardless of your gold holdings.

#2. Silver Custody Charges

Also independent of gold, but slightly higher, because silver takes

up more physical space in the vault. You'll pay 0.04% per month on

the silver you hold (minimum $8 charge). The annual rate is 0.48%.

Comparisons are probably scattered through different threads. It would be best to read the guides to each thoroughly and compare.

I have gold at BV. But I'm probably done with buying silver having averaged in all summer.

-

Another dissapointing afternoon for the paper bugs

I've been thinking that maybe people should wait at least 24 hrs before getting excited about some move in the dollar or gold.

-

I don't want to visit that site. What is a BOB?

The article says "bolt out the blue".

Dollar Fear Trumps Greed in Guarding Against Rebound (Update2)By Liz "Elizabeth" Capo McCormick

Dec. 7 (Bloomberg) -- Traders in the $3.2-trillion-a-day foreign-exchange market are paying the highest prices in more than a year to protect against a sudden rebound in the dollar after its worst annual performance since 2003.

http://www.bloomberg.com/apps/news?pid=206...tfpcU&pos=4

-

All BV customers will be able to access silver - 02/01/10.

Thanks for letting us know.

I already have a lot of silver at GM so probably won't buy at BV. Nice to see that their commission will be only 0.8% to buy or sell silver, the same as gold.

-

You can't have a nice debate on this forum anymore.

I think I'll leave.

Dr Bubb - please can you delete my i.d.

Thankyou.

You can put other posters on ignore. Go to their profile and somewhere on the left-hand menu is a button "Ignore this user" or something like that.

That way their texts do not appear to you but you can open with a click if you want.

-

Hi,

I am wanting to buy a bit of gold as a hedge against inflation/hyperinflation. I have looked into it over the past few days and am thinking about buying gold sovereigns from ATS Bullion or Coinvest, would you recommend either or both of these dealers? Also, I haven't been able to find out why different Gold Sovereigns with the same gold content are priced differently on the same site (there are some at £180 and some at £190 on coinvest), is it worth paying the extra £10 (would I get back more than the approx. 2% extra I paid for the £190 coin when I came to sell it) or is it just the rarity value that increases the price?

...

I have ordered from CoinInvestDirect several times and I am happy with their service. Note that I am located in Finland but many in the UK have posted here that they are happy with their service.

I think the sovs differ in price according to demand - older ones are a bit more expensive, presumably as people are willing to pay a bit more. Note that CID lists their buy price alongside their sell price which gives an idea of what you could sell for. It's likely that you would not get back the extra when you sell.

I think the price of UK houses will drop in gold, possibly in GBP also but inflation fights against that (I still guess the crash will kick off again probably after the election. The UK is in a sorry financial state.)

Note that in the UK sovs and Britannias are not subject to capital gains tax as they are classed as legal tender coins. So for UK residents they could be the best. Sovs tend to be cheap on a per gramme basis at least the last time I checked at CID.

-

Sunday Times

December 6, 2009Chancellor Alistair Darling’s £40bn cut in public spending

Alistair Darling will this week tell government departments that the money has run out and they face a three-year cash freeze on spending.

The message, the toughest to be delivered by a chancellor since the last Labour government was bailed out by the International Monetary Fund in the 1970s, will mean public sector pay freezes and big job cuts. The cash freeze in Whitehall will mean a “real” cut of nearly £40 billion in spending over three years.

http://business.timesonline.co.uk/tol/busi...icle6945979.ece

-

Investing in gold for me is a way to protect my savings in uncertain times so I am definitely a buy and hold investor.

I am happy make small loss for the case of security.

However I must say I have been surprised by the rapidity of the rise in gold the last couple of months and wonder if it is sustainable.

I expected a much more gradual rise.

About every 2 years or so gold has had a massive upleg. When it moves like this it really moves and many of the gold bulls are surprised at the speed.

See the 2 articles I posted earlier to put it in the context of the whole bull market. This has happened before in the winters of 07-08 and 05-06.

If it goes like the 2 previous big uplegs this could continue until the spring with some minor corrections along the way.

-

Putting the recent increase in price in the context of the whole gold bull market so far.

http://www.gold-eagle.com/gold_digest_08/hamilton120409.html

Another article:

http://www.gold-eagle.com/editorials_08/hamlin120409.html

-

Interesting that Auntie Pravda never mentions the price of gold in GBP even though the BBC is nominally a British entity.

-

It's now been closed to non-Swedes due to too much traffic.

-

What are the other 'Magic Numbers' Sinclair is calling for?

This picture gives more numbers than the original "angels". 1650 has been his top target for years.

It's bigger and clearer at this link:

http://jsmineset.com/wp-content/uploads/20.../Sinclair32.jpg

-

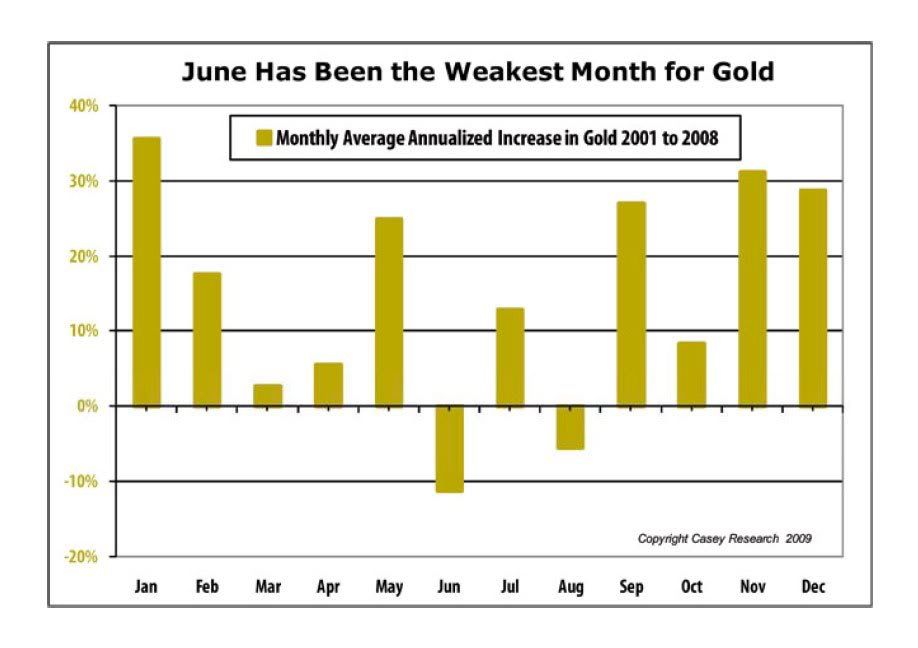

Just a reminder that the average seasonal factor is still very strong for Dec, Jan and Feb at least.

As a largely buy-and-hold guy I expect just to hold and sit through these winter months.

-

Indeed. I do think that we must get a correction though. Either that or we go parabolic right here - in which case so be it.

A consolidation soon would be good and many are saying the same:

This chart shows some of the past doji candles and what happened to the price of gold soon after. What this candle is telling us is that the buying and selling pressure is equal. So we know momentum is slowing and we should expect a consolidation or correction.Because gold has rocketed higher, indeed going almost straight up in the recent weeks, I expect a pullback to be very quick. A drop to the $110 or even the $100 level in the coming weeks is not out of the question, but we all know commodities can go parabolic for several months (straight up). This is why we continue to tighten our stops and keep holding out long positions.

http://www.gold-eagle.com/editorials_08/vermeulen113009.html

And Technically Precious With Merv:

http://www.gold-eagle.com/editorials_08/burak112909.html

Jim Sinclair talked of a "Swiss stair" which seems to have occurred over the last few weeks. The idea being that big buyers have moved in fairly rapidly on each small correction making a sort of "stair".

-

It doesn't look like it.

At GoldMoney, although I haven't tried it yet, it's possible to swap metals directly which is cheaper than selling for cash and then buying the other metal.

I'll look forward to seeing silver at BV when it is fully public next week.

-

Please let us know how you managed it - I cannot see any way of buying silver.

It seems that only select existing customers can see silver before the full public launch (as implied in the email).

@Wanderer

Is it possible to swap directly between silver and gold without going via a paper currency?

-

USD 1201.20

EUR 794.41

Silver USD 19.18

-

However, I like the fact that this thread has had only 83 hits in 3 days Certainly not pulling in the crowds currently.

Although this is in the Members Only forum which probably keeps the numbers down.

-

Hilarious audio posted by GF.

An article at the oildrum about "peak gold"

http://europe.theoildrum.com/node/5989

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Not crazy. Good luck. I think you've got a fair chance.