-

Posts

3,447 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Perishabull

-

-

I am not regarding chart action but purely the earnings profile over last 4 years.based on my calculations, something is very odd about kgc because my pricings are

18.97 is buy target - so I would have been under water if I'd been buying since last year.

26.72 is fair value

34.46 sell

My model is avery at odds with current market price. Most stocks miners are about fair valued right now according to my maths. The only cheap things are kgc, ssri, pass and svm which I have acquired alarming quantities of over last month or so. Please see post above for details.

Peppa, you're not in any way related to Percy are you?

-

Have we seen the low?

-

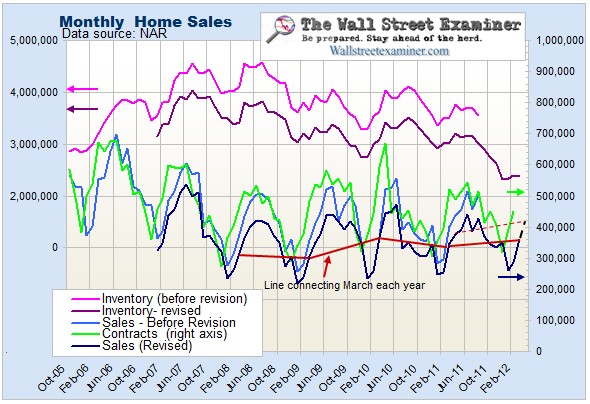

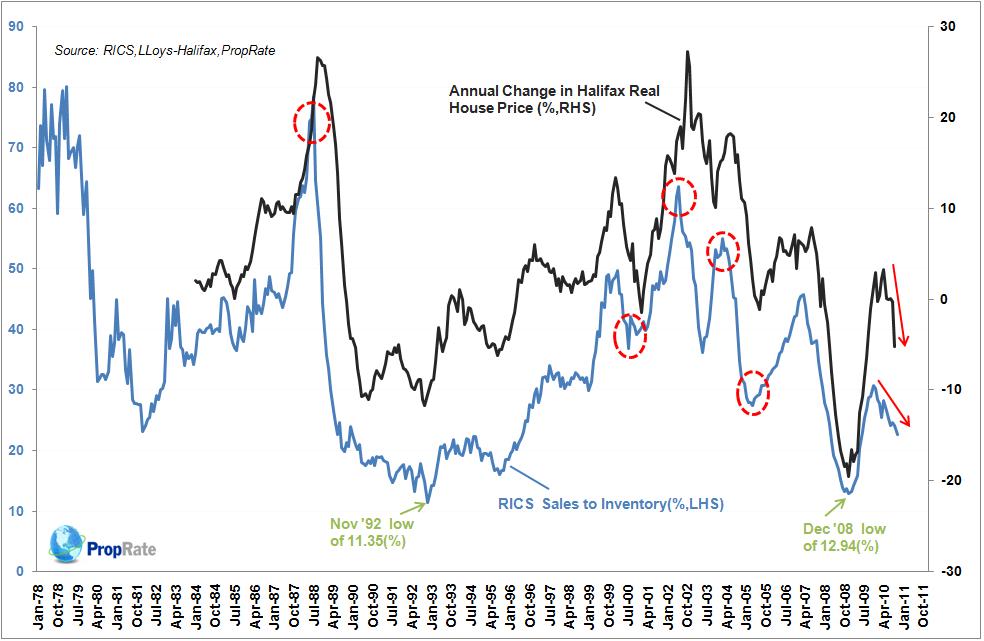

Here's a chart from http://proprateanalyst.wordpress.com/showing how sales to inventory leads house price growth;

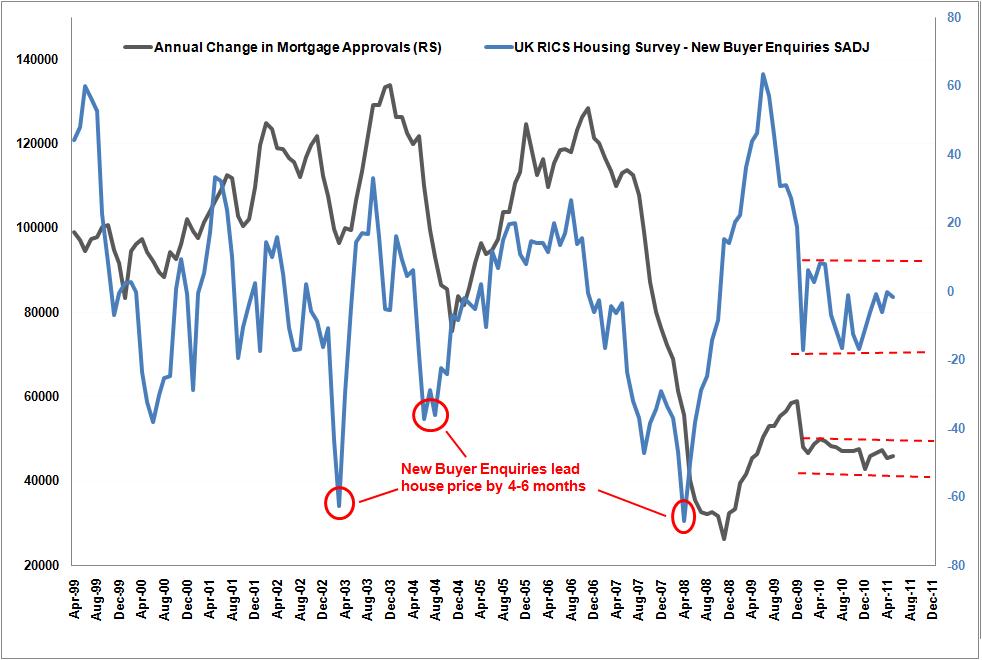

and also how new buyer enquiries lead mortgage approvals;

-

Google search activity over the last few years for "Gold bullion";

-

-

Blythe Masters with a myth to dispel....;

"JPMorgan Not Speculating on Commodities: Blythe Masters

JP Morgan Chase is not in the commodities speculation business, Blythe Masters, head of global commodities for the bank, told CNBC Thursday.

"It's not part of our business model. It would be wrong and we don't do it," she said.The misperception, rampant in the blogosphere, comes from what JPMorgan does for clients, Masters said.

"We store significant amounts of commodities, for instance silver, on behalf of customers. We operate vaults in New York City, in Singapore and in London. Often when customers have that metal stored in our facilities they hedge it on a forward basis through JPMorgan, which in turn hedges in the commodities market," she said.

"If you see only the hedges and our activity in the futures market but you aren't aware of the underlying client position that we're hedging, then it would suggest inaccurately that we're running a large directional position," she added. "In fact that's not the case at all. We have offsetting positions. We have no stake in whether prices rise or decline.""

Video at link

-

GDX looks somewhat ominous...

-

-

Silver Channels Lower During 40% Downtrend

March 21, 2012 - 3:32AM

Silver has moved over 40% lower from its 2011 high. Prices falling off of channel resistance gives traders the opportunity to join the move.

A price channel has emerged with a fresh test of resistance at $37.48 on February 29th. We can see price being contained by support and resistance as it continues its trajectory lower. As price trades under the main trend line we will keep a bearish trend bias on silver and look for selling opportunities.

Giant bullflag?

-

No certainties. Just calculated risks.

The trade has been a long time in the making and based on my macro views combined with the charts.

It was certainly an excellent entry point.

And where do you reckon the Dollar Index / Gold would be trading at with Silver at $100?

-

There's a good chance that buying double silver at 26 and again around 30 will give over a 1000% return if silver spikes through 100 in the next 2 or 3 years.

-

-

Report from the "Chatham House Gold Taskforce" on gold and the international monetary system - http://www.chathamho...s/r0212gold.pdf

Excerpts;

"Gold's use to back the value of the dollar would be impractical and there is little scope for the metal to play a more formal role in the international monetary system, the U.K.'s influential research institute Chatham House or the Royal Institute of International Affairs has said. While a higher gold price may reflect a lack of confidence in key currencies and low returns on other assets, there's no consistent correlation between bullion and economic variables that could be used to inform policy decision making, according to a task force that discussed possible roles for gold.

The metal can be used to hedge against currency devaluation and other risks as part of a portfolio, but not on its own, it said.

"Reintroducing gold as an anchor would undoubtedly be impractical or even damaging, given bullion's deflationary bias," the task force, which held discussions over eight months, said in a report today. "Gold can serve as a hedge against declining values of key fiat currencies, and can also be useful for central banks looking to diversify their foreign reserves."

While the gold standard may no longer exist, nations and international organizations still have 30,877 metric tons of bullion reserves, valued at about $1.77 trillion.

The dollar has been the world's reserve currency since the U.S. and allies agreed at the 1944 Bretton Woods conference to peg it to a rate of $35 per ounce of gold. It remained the most- traded legal tender after global currencies began freely floating in the early 1970s. The greenback dropped 12 percent against a basket of six major currencies since March 2009. The U.K. suspended the gold standard in 1931, Chatham House said.

"Greater discipline on financial markets might have been helpful in inhibiting the reckless banking and excessive debt accumulation of the past decade," the task force said. "However, with the onset of the global crisis, had gold had a more formal role to play, the rigidity it imposes might also have been a handicap when a more flexible policy response was required."

Including gold in the International Monetary Fund's Special Drawing Rights system probably wouldn't bring substantial benefits, and adding developing economies' currencies to the basket would be more desirable, according to the task force. SDRs were created in 1969 and are an artificial currency that IMF members use to settle accounts with each other and can be converted into hard currencies.

Chatham House was founded in 1920 and is based in London. Members of the gold task force include Gerard Lyons, chief economist at Standard Chartered Plc, Meghnad Desai, professor emeritus of the London School of Economics and a member of Britain's House of Lords, and Catherine Schenk, a professor of international economic history at the University of Glasgow.

"For gold to play a more formal role in the international monetary system, it would be imperative for it neither to hamper the system's performance nor to create unacceptable constraints on national economic policies," the task force said. "

-

I dont understand why Goldfinger decided to leave the site just because Bubb decided it was time for a change in moderators. Seems a bit curious...

Did I miss something?

-

-

Or.... silver had raced up a bit quickly, and now we see the expected consolidation.

Hmmm, it's about time for another CME hike methinks

-

pernicious

How can you frame it as being so when the conclusion hasn't yet been reached?

Perhaps the angels are a freudian slip as opposed to a calculated manipulation.

The suit argument has always been pure nonsense since there are many orders of magnitude between a cheap "good" suit and an expensive one, since one's value judgement is likely to be referenced by his financial disposition and the perception of what constitutes a "good" suit is likely to be highly variable.

-

-

Ja, I am just not really convinced why Detroit should really recover. Maybe with Chicago and Toronto we have enough large and vibrant cities on the lakes, what would Detroit really have going for it? Maybe it is just going to stay like this, with some pockets of normality or even wealth, and the rest just falling appart.

It won't.

Never is a long time.

A more up to date chart from ycharts.com;

-

So far, so good.

Kudos to you Roman, your timing there was very good. That'll look very impressive if silver gets back up to (and perhaps beyond) it's high.

-

Does anyone see that if Ron Paul starts to motor in the US electoral process that Gold could start an altogether new upleg as a result?

We already know how quickly ideas spread on the Internet.

-

~ PositiveDeviant's tip for the day ~

Looking for a new broker?

DO NOT CHOOSE ETRADE

I bought a chunk of GDXJ today, I actually only intended to buy calls (however no options other than for 2014 (!) were available to trade on their platform).

-

The emotions of silver bulls and North Koreans are correlating 1 to 1 right now.

[/YouTube]Surely this must be the low.

-

Is it possible to post another chart which overlays SLV against AGQ?

I edited my previous post (and deleted the chart) replacing it with something that explains it better.

AGQ in black against SLV in blue from August 2010 onwards;

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

How do you think the Euro is likely to do? Since the start of 2011 Silver has been becoming more closely correlated to the Euro;

SLV and FXE

The Swiss pegged their Franc to the Euro on 6th September 2011 and if you look from then on the correlation has tightened.

Here's another chart showing SLV in black with it's correlation to FXE in the box below.

The correlation between the two is currently at 88%.