-

Posts

3,768 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by ziknik

-

-

^^ Thanks, that's really useful

-

Well I just bought some 880 PUTs. We'll see how they do. Nothing I can't afford to lose.

...

Which broker are you using for your options?

EDIT: Thanks

-

Just a quick post to let you guys know that I am going on my hols (Florida) and won't be posting while away!

Gold is still doing what it always does!

Hopefully when I get back (in 10 days or so) it should have broken $960...

I hope you’ve taken a list of all the local silver coin dealers

-

Im pleasantly suprised how well gold is holding up durring these summer months. I have been away for some time due to moving house and I lost my internet connection, so I have not been able to keep up with things. I hope everyone is OK.

While you’ve been away: CID have started selling silver Britannia’s and you missed a good offer on silver phillies

Checkout the video this guy just posted on the 2009 Philly

http://goldismoney.info/forums/showthread....2148&page=5

The real specs should be 2.0mm thick, 37.00 mm diametre, weight 31.1030

This coin comes in at 36.96mm diametre, 1.68mm thick and 31.10 weight

Could you tell the difference without measuring it ??

It might still all be a wind up, but still very interesting

How can the fake coin be thinner that the real coin? The fake must have platinum in it (?)

-

ok, results in:

diameter 30.00mm (true=30.00)

thickness 2.80mm at the thickest point I could find (true=2.87)

mass 31.13g (true 31.1+g)

so it compares favourably, though slightly thinner. - but the mass is dead on so I am sure it's not a fake as it would otherwise have to be made from like Osmium or Platinum or something WAY rarer than gold.

Panic over.

EDIT: FishingWithJesse; authorised resellers? - in the UK for maples!? - This was from CoinInvest

CID are a reputable dealer. They wouldn’t send you a fake coin (

)

)Phone them and ask about the red(ish) colour. They’ve been very good whenever I have phoned them

-

Double Post:

The Rightmove Survey only monitors the ‘initial’ asking price.

Modifications to asking price are not monitored.

So the survey will not measure any house that is having its price repetitively cut unless it is re-listed with a new agent.

I don’t think it is fair to call this ‘Seller Delusion’.

EDIT: And, the Rightmove Survey data should be shifted over by 8 months*. The houses going on the market today are not going to sell today.

* or whatever the average selling time is at present.

-

Friend selling a couple of porperties in SW19 says property seems to be red hot again and getting full asking price...maybe the bounce will go on for a while longer than most of us on here were expecting?

It’s dead round my way (South Manchester). There are a couple of asking price rises on Property Bee. The vast majority of price moves are falls despite the good news

I suspect the recent gains in the Haliwide indices are encouraging sellers to hold out for their asking price. Though I cannot be sure as I haven’t been to a single viewing yet and don’t intend to view anything until Haliwide dips further.

Virtually nothing is selling (nothing I am interested in buying). Unfortunately for me, many of the small terraced houses I wanted have been removed from the market.

-

...

Silver Porn - who's the apologetic voice? Sounds like Hugh Grant

He’s going to get burgled.

I shouldn’t say where I think he lives. But I might be keeping an eye out for elephants next time I am in the area I am thinking of. (I have no intention of burgling anyone)

-

You can still get them at that sort of price if you have them shipped to a European mainland address (not the U.K.) due to the lower rate of value added tax at 7%.

I bought a small stack of them about three weeks ago. I paid £11.48 each. I expect VAT to be going up in the UK (above 17.5%) soon so it makes sense to load up on silver coins when a buying opportunity comes along.

Welcome to GEI btw

-

Unfortunately I missed that one.

The 2009 1oz Britannia is still available at the "special" price.

The Britannia is not on special anymore. Specials have a buy limit and the title says special in big block letters. http://www.coininvestdirect.com/main.php?a=11&id=322

Must be a coincidence that the price now is the same as the old special price.

The silver phillies offer ended in the last few days. They price wasn’t fixed. They were around £11.50.

-

Hmmm... to hazard a guess.... Uncertainty?

Certainty. Certainly in my case

CID have another special offer on Saturday morning (tomorrow). Here's the email:

CID have another special offer on Saturday morning (tomorrow). Here's the email:...

It was a one ounce Krug for £594

They've still not sold out of the last special offer - gold has been below the special fixed price since the offer began!Wasn’t the last offer a one ounce silver philly? – They’ve sold out

I wondered why no one on GEI was talking about this yet....

There was a couple of threads last week. Maybe the week before

-

Chancellor Alistair Darling is to meet with the banks next week to remind them of their legally-binding obligation to lend more money to homebuyers.

Is this merely a stunt such that he is seen to be doing something knowing full well that the banks won't/can't increase lending? Or is this maniac actually going to force this regardless of any other consequences it may have?

I can't bring myself to buy a place for me and my family just now at these ridiculously over priced levels. And yet I get a nasty feeling this government will do anything to keep nominal prices at their current levels while sterling gets trashed in the process. Gold is looking better by the day...

I believe the banks agreed (verbally) ‘to maintain lending at 2007 levels’.

There's no any legal requirement to lend to anyone. And certianly not targeted lending at homeowners.

‘Maintaining lending at 2007 levels’ could mean more than one thing. The actual meaning of the words were never defined.

In any case, mortgage lending was mostly done by foreign lenders who have decided to leave the UK. The Building Socienties are shutting up shop and the UKs biggest mortgage lending banks are all gone too (in no particular order)

1. Northern Rock

2. Bradford and Bingley

3. HBOS

4. Alliance & Leicester

Only the Bank of England can support house prices.

(I'm not certian of any of the above btw)

EDITED

-

http://uk.reuters.com/article/idUKLNE56F01...ndChannel=11595

Gold to shine as dollar ailsLONDON (Reuters) - Gold prices are set for solid gains this year and next, with the $1,000 mark in sight, as potential inflationary concerns and a softer dollar outlook prompt analysts to ramp up forecasts, a Reuters survey showed.

The poll of 48 analysts and traders showed that expectations for gold prices this year have risen 7.8 percent to a median $930 from $862.50 in a similar survey carried out in January, when fears over the economic outlook were at their height.

-

I thought they buy their physical through exchanges and take delivery? So if they use Comex, they can't be sure they get the real stuff?

GoldMoney uses the London Bullion Market in Europe

(?)I'm not sure what they do for their US customers.

Edit after post below

We buy gold and silver in the London and Zurich markets and we are daily replenishing this inventory, which we resell to our customers. All bars we purchase meet the standards of the London Bullion Market Association. There is no minimum or maximum transaction for our customers. -

I’m losing track of all these stupid schemes.

http://www.independent.co.uk/news/business...ps-1745114.html

Treasury scheme to help property market is not working, say MPsThe Treasury's Asset-backed Guarantee Scheme (ABS), one of the key policy measures enacted by the Government to get the housing market moving again, "seems not to be working", according to MPs. The guarantees were made available in April, but none of the major banks has issued a security with such a guarantee.

…

-

seek and ye shall find..................Please be aware that the Perth Mint will not be producing any more 2009 1 oz Silver Kookaburras, as they have hit their mintage limit.

Pro Arrum have them for a reasonable price. I'm not sure if they deliver to the UK

http://www.proaurum.de/edelmetallshop/silb...11536613bf8026e

-

The BofE can increase house prices any time they want by using brokers (like Paragon) to hand out BofE mortgages or another scheme like homebuy, ownhome, etc. Sterling is toast in the long run anyway so it’s not going to make too much difference to the long term outcome.

...

HMG scraps My Choice Homebuy and Ownhome. The money has already been spent anyway.

New Build Homebuy and Homebuy Direct are not scrapped.

http://www.ft.com/cms/s/0/eb9dea30-6f34-11...144feabdc0.html

Schemes to help first-time buyers scrapped…

Ministers have quietly scrapped two of the most popular schemes aimed at helping first-time buyers on to the housing ladder.

The government invested £200m ($324m) through MyChoiceHomeBuy and Ownhome, known collectively as Open Market HomeBuy, over the past year alone.

…

“Government funding is still available for first-time buyers and we intend to focus all our efforts on helping people into homes through new-build schemes, which create jobs and homes such as HomeBuy direct and New Build HomeBuy,” he said.

-

Ratio nearing 73. Anyone thinking of buying silver with gold if it hits 80?

It is my plan to do so in the future using GoldMoney. I can’t at the moment because I haven’t swapped any silver to gold yet (I don’t have any gold at GM)

For now, I will stick to buying silver. I have aquired some new funds and will be able to average in throughout the year

I think things will get a lot more volatile in the future and allow me to swing trade between the metals.

GM has platinum too.

-

...

The diverse French 20 franc coins are a bit more expensive per gramme than the sovereigns but not a massive difference. The Austrian 8 florin (same size as a 20 franc) is the cheapest of this size of coin.

Are 20 franc coins very popular in the UK or elsewhere? I like the way that several countries had 20-franc coins with exactly the same amount of gold (France, Switzerland, Belgium, Italy and Austria for sure - any other countries?).

Francs were used by the Bank of International Settlement until very recently (last few years). Pretty much every bank in the world would have accepted them and I bet they still would.

The coins will be accepted as money throughout Africa.

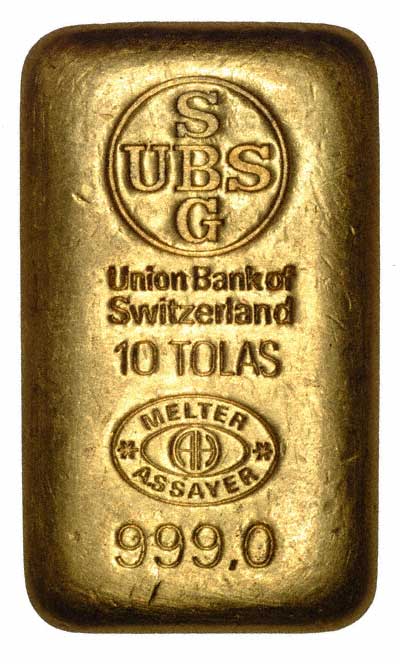

And also Asia because it is very easy to convert francs in to Tola. 40 Francs = 1 Tola (give or take some rounding)

BTW, Bairds produce Tola bars as part of their standard range

-

i think we will know more when they run out (if) due to their limited inventory.

re. the kookaburra, older years sell at a premium (like brits), my guess is that they are sold at a premium from the start and hence will sell less and hold higher value?

The difference between the Kook and Koala prices at CID is unusual. Last year the prices were very similar.

In 2008 my average purchase prices were (including delivery)

Koala: £14.60 (each) mixed years

Kook: £14.46 (each) mixed years

-

Does anyone know why silver britannias (£13.86/cid) are cheaper than aussie kooks (£15.12/cid) when the brit is a limited issue?

CID are clearly stupid.

I paid £14.19 for my first set of Brits. I expected the coins to sell out within minutes. They went up to £14.79 a few minutes after my order and then back down to 14.39.

£13.86 is way too cheap. Is there a danger that CID will crash the Britannia prices if they keep selling them this cheap year after year?

...I feel sorry for those in the UK paying, what is it, 15% VAT?

Yeah, that's right.

-

...

Roubini and Kasriel see USA recovery in 2010. Which probably means a bottom of sorts and a grind forwards to a different place with that reality in place.

...

Do we have a thread on the Roubini video/interview?

-

Now this kind of statement from the boe i find truly scary. I extrapolate from this that they will now try and put in place some scheme that achieves this stabilisation. Regardless of any consequences for sterling and savers.

Can this be achieved? And if so what would be the mechanism?

I don't see how just keeping interest rates low will be enough. Unemployment is rising and wages are falling. BT and BA are asking staff to work for free for goodness sakes!

The BofE can increase house prices any time they want by using brokers (like Paragon) to hand out BofE mortgages or another scheme like homebuy, ownhome, etc. Sterling is toast in the long run anyway so it’s not going to make too much difference to the long term outcome.

The BofE has the ability to print USD and EUR so they can manage Sterling exchange rates in the short term. I think these swap agreements will stay in place for years.

I don’t think they can suppress the gold price forever. I see gold as the only way to protect myself.

Stabilising the housing market is much harder than increasing prices so the BofE will probably over egg the support to be on the safe side.

-

The BofE confirming the[ir] view that stabilisation of house prices [at unsustainable levels] is a good thing

The BofE confirming the[ir] view that stabilisation of house prices [at unsustainable levels] is a good thinghttp://www.bankofengland.co.uk/publication...009/mpc0906.pdf

18 Housing market activity had picked up. The number of loan approvals for house purchase had

increased by 8% in April and the preview of the May survey of the Royal Institution of Chartered

Surveyors showed further improvement across most housing market activity indicators, with new

buyer enquiries and sales both picking up. Both the Nationwide and Halifax measures of house prices

had increased in May, the first time that that had happened since August 2007, and had increased by an

average of 1.9%. But activity remained subdued, with the level of loan approvals for house purchase

less than half of its average of the past decade. In such a thin market there was likely to be greater

volatility than usual in housing market indicators. A stabilisation of house prices at current levels

would benefit homeowners, limiting the reduction in their net wealth and capping the scale of negative

equity, and would provide support to the balance sheet position of banks.

UK House prices: News & Views

in NEWS Commentary, 2021 & Beyond

Posted

I might sign up for some of that myself.

STEP1: Take out huge mortgage that I cannot afford

STEP2: Default

STEP3: Sue HMG for making it possible for me to take out a mortgage that I couldn’t afford