-

Posts

3,768 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by ziknik

-

-

Germany mainly produce silver 10 Euro coins about 200,000 of them each year plus about 1 Million of commemoratives, but I think that the author has in mind Austrian Philharmonics, I still haven't seen any mintage figures for 2008 but I think it was very high! The Austrian Mint also produce Euro and commemorative specials.

I’m a bit surprised that Germany is Europe’s biggest silver coin producer yet I have never seen a [modern] German silver coin for sale. I’m starting to think others are snapping up the best German coins and leaving riff-raff like me with the Eagles & Maples.

Do you know where can I buy (look at prices) Germany silver coins?

Pro Arrum; Germany’s biggest coin dealer, doesn’t have any German coins for sale.

http://www.proaurum.de/edelmetallshop/silb...mp;showAll=true

Austria was listed separately in the article.

...The notable exception has been Austria, which saw unprecedented demand in 2008, as fabrication of coins skyrocketed from a 2007 figure of 0.5 Moz (16.5 t) to 7.8 Moz (242 t) in 2008, in line with the overall rise in physical investment demand in Europe last year (a trend which particularly benefited the newly launched Austrian Philharmonic one ounce bullion coin).

...

-

CID have started their offer early.

The coin is 1000 Schilling, Babenberger 1976 for sale at spot price.

Max 3 per customer in 12 hours

-

interesting excerpt from the 2009 GFMS Silver Investment Report:

Silver Coins

...

In Europe, the coin market has been dominated by the production of commemorative and collector coins, of which the largest producer has been Germany.

...

I didn’t know Germany produced a silver coin

.

.What do they make?

-

Cool, I missed the offer last time.

Alarm clock set. 09:00 hrs BST (08:00 hrs UTC)

-

I put in an order for some silver eagles this week: basically, I liked the price of them (cid) and in addition to that I think that their premium may get wider as the year progresses because it is logical that there will probably be increased demand from US buyers as the $ depreciates. Does anyone agree/disagree?

remember how late last year the US Mint stopped production, can it happen again

£13.80 is a good price. I don’t remember seeing the Price of an Eagle this low for a long time.

A 2.5% VAT rise is coming in December/January. So it is inevitable for the premium to rise. We could be seeing VAT go to 19% in 2010 if taxes are raised.

FWIW, I think you are right about US demand.

Personally, I think the premium is irrelevant at the moment. I expect to be selling my 1 ounce bullion coins for at £250 in the future.

-

ebay spreads are tiny at the moment:

http://cgi.ebay.co.uk/jubilee-head-full-so...93%3A1|294%3A50

I’ve noticed the coins selling cheap are from sellers who have never sold a Sov on ebay before.

I’m not sure I’d want to be the first to hand over money

EDIT: weird fish top

-

Does anyone dare to add at these prices?

A Sov costs £150 at CID.

It’s not a bad price.

I would buy if I had any spare cash.

-

OFF TOPIC

Here is something for the Shorterz and traders:...

I prefer this version

From: http://www.youtube.com/watch?v=ruED5XlIeug

This is an invasion

An occupation

Immortal Technique

The evil genius DJ Green Lantern

And you're now understanding guerrilla warfare

Is being spread by the superpowers of the industry

To the 3rd world underground of the streets

This is for all those who have been labeled extremists,

maniacs, terrorists, shit.

Welcome to the 3rd world.

Invasion, a ramp of monetary inflation,

That brought us all to the footsteps of this nation,

Peruvians, Haitians, Ecuadorians,

Nicaraguans, Colombians, Salvadorians.

Invasion, a ramp of monetary inflation,

That brought us all to the footsteps of this nation,

Peruvians, Haitians, Ecuadorians,

Nicaraguans, Colombians, Salvadorians.

Invasion, a ramp of monetary inflation,

That brought us all to the footsteps of this nation,

Invasion, a ramp of monetary inflation,

That brought us all to the footsteps of this nation,

Peruvians, Haitians, Ecuadorians,

Nicaraguans, Colombians, Salvadorians.

Invasion, a ramp of monetary inflation,

That brought us all to the footsteps of this nation,

Peruvians, Haitians, Ecuadorians,

Nicaraguans, Colombians, Salvadorians.

They call us terrorists after they ruined our countries.

Funding right wing, paramilitary monkeys,

Torture the populaces, then blame the communists,

Your lies are too obvious, propaganda monotonous

And that's not socialist mythology,

This is urban warfare, to the streets of your psychology.

So I'm like the legs of a paraplegic really,

Cuz I'm still part of you, even if you can't feel me.

You can never debate me, the m4's at your baby,

Like troops and gats in Iraq do daily.

So you can marginalize the way you portray me.

But don't get Hollywood and try to play me,

We could shoot it out in a dinner, like juce in the 80's.

New jack city, classic rock mack --

--You got a contract to kill me, motherfucker that's fine.

Cuz there's a contract to kill your family when I die.

So when your car explodes, don't be surprised.

Soldier, I'm like marine core c4, even blow this spot with the beat rocking at 3.4.

Canvas the flow, like the ghost of Michaelangelo,

This is the anthem, Immortal Technique and DJ Green lantern.

Don't say shit bitch, you don't want the che che to come and fft.

You know what i sick with, lyrical tuberculosis

Cocaine overdoses, blood comin out your noses

That's when death approaches

March to my death smiling

---

There's no escape from this political asylum

Revolutionaries don't fear execution

Cuz the death ---

It's just the beginning of spiritual evolution

God will reincarnate me as revolution

You can't take out a revolution

You can't kill an idea

Fuck, is you stupid?

You kill that man

He becomes an immortal

Ignore the triplets

This is a fully loaded four four

3rd world underground hardcore

Street hop lock the ---

Motherfucker you should know it

Flash the door to the game

Open it -

-

$14 UP in the last hour

What's happening ??

-

[surprisingly] there are only $47bn of bonds backed by the UKs non- conforming home loans. That’s 20 times smaller than the USAs ‘subprime’.

Does that mean all the 6+ times salary multiples are considered to be ‘prime’ in the UK at the moment?

Our banks went bust before the UK housing market collapsed. The credit crunch has only just begun in the UK.

-

The beeb are ramping gold....always makes me worry...

http://news.bbc.co.uk/1/hi/business/8058360.stm

When did laptops start using gold in industrial quantities???? Maybe some high end ones have gold headphone jacks or something...I think i'll buy some more silver!

From:

-

At what level are people looking to buy silver? I am thinking of starting to pile in at around $12 - 12.50 if we see that soon.

Metals look darn strong here. I think this is in large part due to the QE factor. I will start buying on smaller dips rather than just waiting for the big one. Though will be keeping something in reserve for a big dip if it does eventuate.

I'm buying silver with all my spare cash at the moment.

i'm just buying silver on a monthly basis (not much just what i can afford) when Silver:Gold hit's 50:1 I'll swap it into Gold and start buying Gold monthly.I'm going to start swapping back at 50:1. I will change 10% of my GM silver holding to gold each time the ratio drops by 5

-

MSM article on Gold. Some interesting little bits (and some mainstream BS)

http://uk.reuters.com/article/personalFina...lBrandChannel=0

-

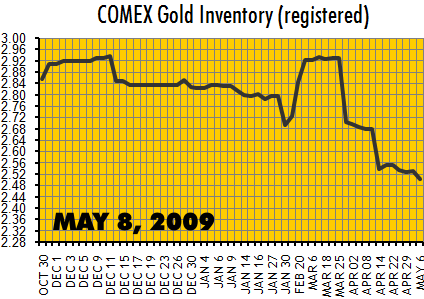

comex inventories down again for gold.

Is that Tonnes or Million Ounces?

-

any of you guys ever sold coins to CID? I'm thinking of selling a few to fund a trip this summer. They stipulate I would be responsible for shipping and insurance (obvoiusly) but I'm wondering who to use for this service and what will it cost? I'm talking a couple of dozen coins with a current value of approx 6k....

I've sold jewellery at Hatton Garden Metals. They pay on the day they receive your coins. You can send using special delivery.

http://www.hattongardenmetals.com/Gold_Coi...Gold_Coins.aspx

http://www.royalmail.com/portal/rm/content...ediaId=63900706

Do you have any sovs? And are you anywhere near Manchester?

If yes, PM me.

-

People are very slowly starting to wake up to the monetary holocaust that is waiting for them.

Will the Royal Mint continue making 2008 Sovs and 2007 Sovs ….. this year?

All the coins from Royal Mint have an issue limit. In 2009 there will be a maximum of 75,000 Sovs, 50,000 1/2 Sovs & 1/4 Sovs (each).

The gold coins already produced this year are equivalent to this year’s entire issue of Sovs.

The issue limit for Brits and other coins is pretty low too.

-

I've done some scientific research in this area, although unfortunately not to the stardard of this MIT group.

Nanoparticles of gold (or platinum) have a lot of potential in physical cancer therapies (X-rays, UV etc.) However, they use minute quantities of metal and will not have much effect on global demand, even if they are the next major breakthrough.

Could the gold be recovered from a tumour and used again in another tumour?

-

...

Why are silver investors so much more inclined to use the Zurich vault, compared with gold investors?

I use BV for gold and GM for silver. Zurich in both cases. A lot of people doing the same as me could have caused the skew.

TBH, I’m a bit surprised GM holds similar amounts of gold at London and Zurich

-

ebay are handing out 10% discount vouchers again!

10% discount on gold

EDIT: you only get the discount on ONE item (not one order)

-

655 450* x current price (88.34) = $57.9M ?

-

The chart from the article is very misleading. I haven't (and will not) read the article.

...

You’re not missing much.

He concludes with (Paraphrased), “I haven’t really proved anything. I might look at it again in ten years”

The plot of housing price over/under value lagged two years compared to the price of gold from 1980 to 2008 (28 years) gives a 78% R-Squared. OK that's not 95% and it's not exactly a long time-series but at least the projection is within the range of the correlation.

Mmm...interesting, might be worth having another look at that in ten years time.

-

...

Is there or will there be a demand in the future for UK hallmarked antique silver (the standard of craftmanship for these items is very high and a modern version would cost a fortune) in India and China in the future?

Anyone have any thoughts it would be greatly appreciated.

0.925 hallmarked silver can be scraped for around 80% of spot price at Hatton Garden Metals

-

http://www.telegraph.co.uk/finance/persona...age-scheme.html

Some of the biggest high street banking names have refused to take part in the Government's scheme to help distressed home owners avoid repossession.Barclays, HSBC, Nationwide and Santander – including Abbey and Alliance & Leicester – have opted out of the Homeowners Mortgage Support Scheme.

…

The Conservatives suggested that the major lenders which have refused to take part covered 55 per cent of the mortgage market.

…

Lenders that have signed up to the scheme include Lloyds Bank Group, Northern Rock, the Royal Bank of Scotland, Bradford and Bingley, Cumberland Building Society, and the National Australia Bank Group.

…

I’m surprised that National Australia Bank Group (Clysdale + Yorkshire Banks) have joined the scheme. They appear to be the only non-nationalised bank taking part.

-

The Gordon Brown Gold Rally Indicator flashes buy signal: http://www.usagold.com/amk/abcs-gold-rally-indicator.html

The look on Gordon Browns face when he was talking about the IMF selling gold (after the G20) convinced me to convert my Sterling cash ISA in to Sovs.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Did anyone get any?

I bought 3.

They've sold out now.