nicejim

-

Posts

1,577 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by nicejim

-

-

Maybe the October thread will be more focused.

-

BTW, I would be interested to know what the generally accepted definition of a S hitting TF scenario might be?

There are many outcomes which qualify. I'd include a family intervention by skilled, military-trained nation-builders.

http://cloudfront.mediamatters.org/static/...-perry_coup.pdf

-

I often hear companies advertising on US radio that they can help you get away without paying the full amount you owe on credit cards, loans etc.

That happens here too. I was told that there's nothing in these solicitors' claims, except for a nice big fee from the gullible. But at least one case has paid off. I just hope the solicitors got paid in advance - this woman might try to find another loophole!

http://news.bbc.co.uk/1/hi/business/8282264.stm

A related story - Bankruptcy Tourism. Foreigners can earn £150,000 per year on minimum wage!

http://uk.news.yahoo.com/5/20090925/tuk-br...po-45dbed5.html

-

British coins worked successfully as coins for many years and people will take to them very easily IMO. A lot of the older people I know often say, "Shilling", "10 Bob", "That's £5 in new money...."

If silver becomes a currency then we'll have to work out how much things should cost in pre-1920 coinage, post-1920 coinage and a combination of both. I don't think this will be easy or convenient.

-

So many pictures, so few rockets. And gold at $

10081009.1! -

This hour on the 4th Plinth is someone talking about Gnostics or something. Their Age of Iron ended in 1974 and their Age of Gold began! I hope he can tell us when it ends.

-

It is said that a picture is worth a thousand words. But it depends on the picture. And on the words.

-

Gold $1000+ again.

Deja vu all over again

-

Not at all.

If you are looking for a store of wealth... come what may... spend half on gold.

With the other half keep in "fiat" and then only buy silver on the dip.

Fiat is not quite toilet paper yet, amazingly, it looks likely to have the ability to buy more silver tomorrow than it can today.

These comparisons of fiat money and toilet paper are offensive to toilet paper. If inflation starts going hyper, toilet paper will be one of the first things off the shelves!

Just watch: celebrities boycotting real gold and wearing the fake stuff.Then a market for "ethical gold" will emerge.

I had those Girls Aloud round my gaff last night. In the morning I noticed green circles on the insides of my thighs and wondered what it could be. Then I realised: Fake Gold Earrings

Legal disclaimer: the above is a joke

-

Excellent nj. Thanks a lot! I guess a few hours researching the types of coins, dates and equiv in troy ounces will be my sunday morning. It seems only really worthwhile picking up pre 1920 coins, unless you become a serious collector (which I am trying to resist). I bet they are well worn and when in good condition are expensive. Roll on sunday.

A list of British monarchs and dates is also handy. One of the auction links posted above is for George V (1910-1936) and VI (1936-1952) silver coins, which may have no silver content. Even on the optimistic assumption that all the coins are pre-1920, the bids have gone to spot+~12%! I don't buy old coins so don't know the premium they usually go for but this seems high to me. Where I can make out a date they are in the 30s.

http://cgi.ebay.co.uk/100-Silver-Threepenc...id=p3286.c0.m14

A guinea is one pound and one shilling. 21 shillings.

http://www.woodlands-junior.kent.sch.uk/cu...ns/moneyold.htm

Have they stopped using guineas completely in the UK? Several years ago I believe that some auction houses still quoted guineas and maybe in horse-racing?

I recognise that site! I always get it when I google bank holidays

They're ahead of direct.gov.uk!

-

A note on Ebay to help value British coins' silver content

http://reviews.ebay.com/British-coins-silv...000000001664130

-

Mr-Silver.co.uk goes TU?

I wouldn't trust a trader who can't spell "trade".

From the homepage...

"Mr Silver Traiding as (White Van Man)"

GM and BV still up. Phew!

-

Awful quiet here in the Silver Saloon.

Eye of the storm?

-

Did he not hear the adverts about getting cash for old and broken gold? How does this not fit that description? What a muppet!

-

All this talk of deflation over the last month is doing wonders for the price of gold, keep it up

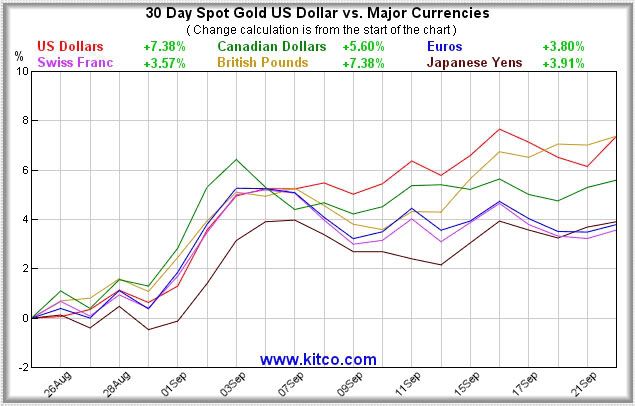

British Pounds out in front with USD. See, we can still lead the world in some things!

-

* A gold dealer told me last week that goldman sachs dealers were comming in and buying kg. bars, but the general public selling small items and scrap

That's a big one. Where are they - what currency?

warnign GOM anecdotal alert:

--

edited - to keep on topic

my victoria sovs arrived today, all the same bar one, which has a different design on the back. They are a nice looking coin aren't they ?

my victoria sovs arrived today, all the same bar one, which has a different design on the back. They are a nice looking coin aren't they ?edit 2 - on closer inspection (as I type) there appear to be 2 types of queens head on them, but the same design on the back. (a sword clasping soldier on a horse). But 1 coin is completely different to all the rest, with a coat of arms on the back

Is £7million net or does he forget about the leverage?

I take it you mean the shield design. I have a few halfs like that, they'll be the last to be sold. The soldier is St George, slaying a dragon.

Bootiful...

http://www.westminstercollection.com/pc_K744.htm

My halfs have a fancy border to the shield instead of the laurel.

-

Another whitewash...

:angry:

:angry:

If it's unsustainable then it will blow up eventually. Translate this whole thing as "Sale extended".

-

So the governments have given the banks the peoples money, then they give it back to us via their miscalculated speculation.

And we give it back in CGT.

-

Breaking: Gold & silver crashing.

Oh wait....my monitor is upside down

:lol:

:lol:You're in New Zealand. Everything is upside down!

-

So, people who know the value of money have decided that the going rate for a decent flat is too expensive for any flat whereas the people who are yet to discover the value of money think they're too good to slum it with the hoi polloi. Furthermore, those who know the value of money have their rental budget cut because they have to repay the debts they incurred when they didn't know its value.

The sort of flat a profession might actually want to live in will have to come down to the level they can actually afford.

-

As a girl in Wales once said to me ,"Oh boy... this is gonna hurt!"

She couldn't bear the disappointment?

Are we allowed pictures of Pocket Rockets?

Speaking of which, what the hell happened to the POG and USD? As Mark Twain didn't say, "news of the dollar's short term recovery have been greatly exaggerated."

Global recovery combined with G20 seeking reduction in global trade imbalances

http://www.bloomberg.com/apps/news?pid=206...id=aWtNXDQyBLJk

And the US knows it can't bully its way out any more

http://www.ft.com/cms/s/0/bb368bfa-a6ec-11...144feabdc0.html

-

Sold all my Goldmoney silver today so, using my dismal record of market timing as a contrarian indicator, I'd say it'll have doubled at the very least by Chrimbo!

This explains the relative strength today and the ro...you-know-what for the last hour

-

...

The simplistic answer is they just need to buy $200 Billion of gold or at today's price 100 million oz (3,100 tonnes).

Although they will obviously diversify into other commodities, they have more gold buying to do

And 400 tonnes has already been orgasnised. Is the IMF audited so we'll know the price they got?

-

It is striking that GOLD IS NOT RISING AT ALL THESE LAST 6 MONTHS in most currencies.

http://www.kitco.com/gold_currency/charts.htm?USD (click 'Hard Currencies' and '5 years')

So all we are seeing this year is a steady devaluation of GBP and USD - the two places where QE is in full force

Thanks for the link. I used to check this chart quite a bit but I got a new computer and haven't been able to get the javascript link on their homepage to work since.

It's amazing how the truth is revealed when you compare prices to gold, whether it's oil, stock indexes, currencies or whatever. This raises the question of whether there is a dollar carry trade or was Thursday's low the bottom. http://www.bloomberg.com/apps/news?pid=206...id=apUH.Ybqzwh8

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

I save my pre-1992 coins but they're only worth slightly more than face value. Given the weight and volume of a few pounds' worth of copper I doubt it has a part to play in a SHTF scenario or otherwise.

http://copper2009.com/