notanewmember

-

Posts

2,639 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by notanewmember

-

-

Excellent podcast.

Have a copy of it with you, the next time you are on Edge TV?

No. 42, as well. The solution to the universe's problems could be solved with the right money system.

-

I don't know if anyone else has done this

Larger http://3.bp.blogspot.com/_szcRIfzGg8U/Sk63...1600-h/blow.jpg

We could be at the start of a parabolic rise, right now...

-

No bubble. If one checks the Relative Strength Indicator (RSI), the green line, we'd be coming close to the top of the 1980's, then yes I would agree, it's a bubble. But not currently. If the momentum can continue, gold would be well past $2000/oz, if a 1980 event happened.

-

I keep a beedy eye on the silver market in the UK.

If anyone remembers I said about a year ago, silver is hard to get hold of, and in the mania, that may come we'll just have to do with out.

It appears some entrepreneurs have sunk some money into the sector and have found a niche in the market. [Whether they are making money, I do not know].

There are have been some new sites since - I will only stick to Bairds, Coinsinvest, Cookson, Airelondale and Weightons though as they have been around longer.

www.sarniasilver.com - looks like they stock First Majestic, Pan American, Northwest territorial mint bars. A rarity in the UK. NO SHOP ADDRESS, BEWARE

www.mr-silver.co.uk - NWT mint, Umicore bars, NO SHOP ADDRESS, BEWARE

www.bullionuk.com - Silver eagle monster boxes [500 oz], Maple Monster boxes. Only a P.O BOX address. BEWARE

www.bullionbypost.co.uk - Umicore bars - This has a shop address in Birmingham

-

There maybe contaminants in those bags from the manufacturing process which could be the cause.

-

Britannia silver I believe is part silver part copper. 95% Silver, 5% Copper. But the Britannia is made up so it contains 1 troy ounce of silver.

The green residue is characteristic of copper oxidation.

---

Eagles are nearly 100% pure silver hence no green residue.

-

Perhaps JP Morgan and HSBC have tonnes of silver in heir vaults, and the short positions are just to hedge any falls.

Perhaps when they decide to end the short positions, silver will rise, and then they will offload the physical to the public.

-

'Terre Sacrée' is a non-profit making french association which defends the lives and causes affected by our technological civilization. It informs about the state of health of the planet on a daily basis.

-

what were the first two?

terbium and hafnium - not the easiest metals to purchase.

http://terresacree.org/argentanglais.htm - follow the link - each element is explained.

-

Silveris a chemical elementof symbol Ag — from the Latin Argentum — and atomic number47.

This metal is the third non-renewable resource set to disappear thanks to intensive exploitation by mankind.

Remaining workable deposits are estimated at between 270,000 and 383,000 tonnes.

June 2008: at current rates of production, 20,500 tonnes per year, deposits will last 13 years.

Extractable deposits of this metal will therefore disappear for good in 2021.

Note that the figures cited in our study are contested by a source claiming that silver reserves will last another 15 to 20 years and that this element will therefore be exhausted between 2023 and 2028. Another source refers to reserves of 29 years, which would see us through to 2037.

Links: http://news.silverseek.com/and http://environment.newscientist.com

Silver is used in jewellery, mintage, silver-ware and photography (59%). It is also used in industry (in electrical and electronic applications and in brazing, welding and other alloys: 41%)

However problems arising from its disappearance will start to make themselves felt well before any of these fateful dates. Other deposits are less concentrated, or smaller, or extraction of the metal from the ore is harder.

This precious metal was created when a star exploded and the Sun and the Earth were formed from the debris, over five billion years ago.

You cannot produce it artificially and there is no substitute. The Moon and the asteroids do not contain the metal in an extractable form. And just imagine the energy it would take to bring some back from Mars or Venus!

There will still be recycling but demand, which will keep growing exponentially with the development of the emerging economies, will far outstrip supply.

Poland has 20% of current known reserves, Mexico 14% and Peru 13%.

To learn more about silver, see: http://en.wikipedia.org/wiki/Silver

-

They are lucky in the US where precious metal coins can be found in circulation. The bank staff appear to be oblivious when they can themselves make some easy money with zero risk. They must have thought he was an old fool collecting old coins for their dates.

-

Silver mania building...

There appears to be a growing number of Youtube videos being uploaded in the last three months with people showing off their silver coin and bar collection.

Just try a search for

"Silver collection"

or

"Silver Bar Collection"

E.g. This chap has 5000 ounces here http://www.youtube.com/watch?v=XPey77JqPSE...feature=related

-

Well, its amove in the right direction for the physical holdings. A failed move means I have some expensive paper weights for a longer period of time.

-

Yes, perhaps a nice quick move to $17/oz would be good.

-

Atlantic Coal - Cheap energy source for the Great Depression.

----

If anyone is interested, "ATC" on the AIM London Stock Exchange is worth a look at 0.8p

Anthracite home heating clean coal mine in Pennsylvania is about to ramp upto full production in August 2009.

Anthracite http://en.wikipedia.org/wiki/Anthracite

Anthracite forum http://nepacrossroads.com/

Brokers note http://www.atlanticcoal.com/admin/LatestNe...age21.01.09.pdf

---

Management have invested alot of their own money in re-organsing a railway track on the mine land, and built a £1m+ washing plant that cleans and sorts the coal. They have just secured funds recently and bought a giant excavator.

The mine has a 4 million ton resource already staked out and are open to acquiring more sites.

---

Do your own research of course!

-

-

makes one wonder if we have learned anything over the last two years, doesn't it?

Learned what?

I'll offer 4 cows, 2 arces of land, a house for one gold ETF please!!!!

-

www.airedalecoins.co.uk

Looks like new stock has arrived. But bullion coins are now £18. [Maples/Eagle]

£14 now looks cheap, if you can get hold of some. And those £16 Britannias seemed expensive, now look cheap in todays price increases.

-

GOLD - The Original and Best Bubble.

For all those people that think that Gold's value will collapse, please think about this.

Gold has infinite demand. Everyone wants to be rich and have lot's of money. Everyone wants to be powerful. Gold is money. In the days before 1971 this was gold's function. Fiat on the otherhand was born from a lie.

Those who had no gold, had to work hard for a living.

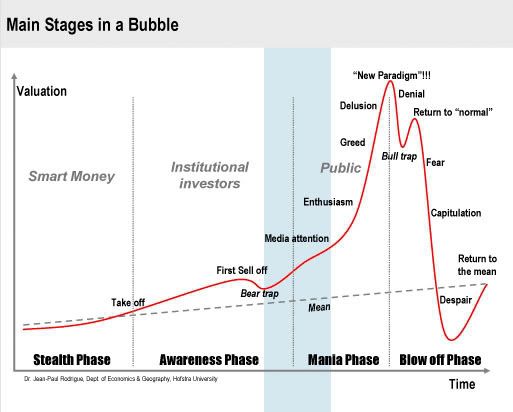

Now don't think of Gold as something that follows the earlier posted chart of the different phases of an asset class. Rather, think that Gold is the CONSTANT that everything else is measured against. That new iPhone is very nice. It will go through all those phases over it's lifetime. Apple know this and will develop a newer model in time, with more features. Old one dies, new one booms. If Apple get the timing wrong, new competitors will appear. This is the free market in action.

In the same way you can think of 'fiat' money. 'Fiat' has had it's New Paradigm moment and the only way is down folks.

Now let's think about that major liar 'Sir' Fred Goodwin. He knows the score. He knows he has lots of 'fiat' paper. Why do you think he milked RBS? Why won't he give back his pension? Because he knows that when we go 'The Way of Zimbabwe' he will need every penny he can get.

People need to see the Credit Crunch as the SOLUTION and NOT THE PROBLEM.

Now, don't think that getting rid of fiat will be easy. It will not be suddenly toppled from it's throne. Every country in the world has a vested interest in keeping their 'fiat' going.

The only thing I would like you to contemplate is that deceit and lies create very good liars. Honest money will create a more just and fair society. From the truth you get truthful people. Is honesty 'really' the best policy in today's society?

I m sure Fred will be buying gold and tin foil hats. He knew how to ride the bubble to the top - I'm sure he knows whats coming next.

-

I have made about 4-5 trades in gold in 4 years. They were all buys. Back to sleep.

-

Not really - where would one put the funds?

-

Anyone see the bit about gold on Friday's Tonight with Martin Lewis?....... had that awful property ramping bitch Rosie Millard on which was quite hilarious as she looks really desperate now. Martin Lewis went to Baird & Co. and spoke to Tony Baird who has talked about golds impressive performance these last few years. Hope the link works ok:

http://www.itv.com/ITVPlayer/Video/default...mp;Filter=35336

So there you go - gold is now mainstream and the general public in the UK are now going to pile in at the top and push it even higher

Thanks - I ve only realised what this post is about. Normally I skip anything to do with MSE and Martin Lewis doh.

-

Do you know Lauri personally? What will he do when he runs out?

i don't know Lauri - he has a good shop that I have used several times and he hasn't raised his prices. He does not appear to be restocking or reinvesting the profits. [we'll maybe because its hard to get stock]

Have to keep an eye on it.

-

airedale coins have very little stock left, just noticed.

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

Internet dealers with no addresses - just saying to beware for new investors.

I would never place a large order over the internet unless they have an address, one can visit if there is any problem. I will also verify their address also using another source of information.

Good luck silver bugs.