-

Posts

1,917 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Van

-

-

What is of far more interest to me & JD I suspect is what a 20% downpayment in gold today will get you.

-

re: House price : Gold

d'oh. It doesn't matter which index you use, so long as you use the same one for historical analysis. Surely that just be obvious.

Clearly, the market has lost it's 1st-half momentum and is now in for a few soft months - behaviour entirely consistent with the strong-H1, weak-H2 pattern that I've predicted.

Price will begin to pick up again at the start of next year.

As we see the current turmoil in the stock market the only thing that will be guaranteed is that interest rates will stay low and many small-time investors will continue to put their money into property instead of shares.

-

JD, I've never seen you present an argument outside of:

- Britain is a small island, land - they aren't making any more of it.

- Immigration will continue to boost demand

- Housing benefit keeps rents high and underpins capital values.

- Money Printing/ bank bailouts.

- We're a nation of house buyers/ Pent up FTBers and investors

- UK housing provides a yield the only thing left in the UK that has value.

These arguments have been done to death in various fora over the years. Most have been should to be false when fully analysed yet you continue to select any evidence that superficially supports any of the above, included the Laguarde speach. Your sound like a broken record and deserve to be mocked. The availability of credit is what drives the market. Low interest rates means vendors are not under duress to sell. The rest really is irrelevant, it would be easier to just admit it.

Howabout:

+ Lower real interest rates

+ Increasing life expectancy and longer working life

+ Increasingly firm rents (this encapulates all the misargument about supply/land etc etc)

-

The rate of increase in population is INCREASING (apart from 2008-9). That is very telling.

In 2002 the population increased by 0.345%

In 2010 the population increased by 0.755%

by a combination of an increase in the natural change and net migration.

You have to say that with these pressures on demographic, supply of housing is certainly an issue and unless we have a catch up in the housebuilding programme similar to the post-war era then Britain is likely to remain an expensive for housing costs.

-

Yes, very good find, tallim.

In recession I agree the average household size will increase as people try to rent out any spare household space. However the ageing population is likely to be a long term driver of decreasing household size - young 20-something are usually happy to houseshare with 3, 4, or 5 other people; but as you get older you want your own space.

-

Showing your credentials as an ex-EA by misintepreting statistic again JD. The rise in NET immigration is almost entirely attributable to a fall in emmigration, i.e, fewer people are leaving - this number is normally subtracted from the number arriving to give a net figure. Due to other economies battening down the hatches and refusing to take disaffected Brits. All the more fuel for the next set of riots.

I don't see how JD is misrepresenting anything. Net migration has risen, that means a larger population and more greater housing needs, whichever way you cut it.

This is helping to support rents. Buying is now cheaper than renting in most cases and can continue to be so even with a few IR hikes - which the property bears seem to have conveniently forgotten.

-

WE just came off a year which included a "bounce" in prices, so it does not look so bad.

In fact, I good "selling opportunity" was provided to those quick enough to catch it.

But we are likely to be headed into something far more negative

Negative, yes... eventually. "Far more" negative - I dispute. YoY figures are just about to turn back YoY positive as the largish drops around Q3 last year fall out of the index. The economy is weak, yes, and the public sector job cuts will keep unemployment high too. But on the supportive side it is clear the the BoE will maintain ZIRP almost for as long as it wants, which could easily be another 2-3 years now, and it is clear that commodity price inflation has peaked, and this will eventually lead to a fall in RPI. What's left of this bubble needs very slow deflating over at least another 5 years. Too much too soon will nothing except crash the economy - everyone knows it. That won't be good for anyone. No good houses being cheaper if you don't have a job.

-

Yep, me too. I really thought we would be seeing 1% per month drop in UK house prices in Sterling. It's not, it's glacial. It just isn't happening were I am. Decent family homes within reach of well paid jobs are still holding up. So, to get to G0ldfinger's sub 100 oz average house price, gold alone will need to make the moves as Sterling prices stagnate. And this is happening before our eyes. The Government's plan is panning out nicely. Add in future wage inflation, which I think is inevitable if necessities keep rising, then house prices will slowly loose their bubble status. Could take a decade or more. And HPC may as well close down their web site.

What effect on the real economy ? More of the same. Savers being screwed over to bail out borrowers. Higher taxation and those with property are sitting targets.

That's how I see it playing out, too.

Perhaps though that is the "least painful" way forward for UK PLC. I've been thinking about this, and realistically what are the alternative? A return to lax lending would restoke the bubble. I don't believe anyone except the BTL landlords want to see that. Even existing homeowners now recognise that high house prices simply make it more difficult to trade up. Conversely a rise in interest rates any time soon would send house prices down further and probably plunge the UK back into a *deep* consumer recession, and unemployment would rocket again. So it looks like we'll continue to run negative real interest rates for several years until inflation fades and then wages can begin to catch up. In the meantime the UK will remain a high-debt, low growth economy.

-

Yesterday's DLCG figures show:

+0.6% for June; the nsa raw figure was actually +1.1.

However, the medium term picture remains one of stagnation:

J/ 206,099

F/ 202,583

M/ 205,178

A/ 204,414

M/ 202,767

J/ 204,981

http://www.communities.gov.uk/documents/statistics/pdf/1966772.pdf

-

Let's remember what the Rightmove represents - new sellers' expectations. Therefore it only ever tells us half of the story, as it completely disregards buyers' ability to buy.

It's very common for it to be all over the place and suspectible to big seasonal swings as delusional sellers shift their expectation on short term mood swings. Rightmove is the least useful index out of all of them, but at least it is still somewhat useful as a gauge of sellers' sentiment.

-

Sizeable -2.1% slide in Rightmove index. The delusion gap is clearly coming down as H1 optimism gives way to H2 realism.

-

http://www.bloomberg...trics-says.html

Acadametrics report out. One of the most reliable as based on Land Reg.

Accurate maybe, but at the expense of being hopelessly behind the real state of the market (as with Land Reg). Especially in these times, I think there is a 6-9 month lag in these figures to where the real state of the market is at.

As I have seen it, we have a bounce (2009 to mid 2010), a further decline, (mid 2010 - end 2010), and a smaller bounce since the start of 2011 - ie if you were to chart it it would be a flag formation. Even if we decline slightly from here into the end of the year there's a good chance 2011 will finish higher than it started.

-

This isn't how it played out/is still playing out in Japan.

What's this about 'improving job market'-are you talking the UK?

I see more unemployment, less and less growth, inflation in food and energy, deflation or flatlining of nominal house prices, continued falls if measured in gold, etc etc.

The US in particular gave Japan a lot of stick over the years in managing the 'recession' here. Actually the Japs have managed it remarkably well, so far, so much so that the Yanks and the Brits and all and sundry want to follow the ZIRP and walk the problem down over the next decade or so.

That may or may not be possible. I don't know. But I think unlikely with the DEBTS on the table and being beholden to the bond vigilantes. At least the Japs owe their countrymen-and they are getting less and less thanks to Fukushima and years of deflation taking its toll on the population (lack of new members-no marriages-no real jobs). They also had loads of lolly in the kitty which has been a soft cushion. US/UK/ EU has sweet FA.

I imagine the UK property scene going into a long slide anytime now.

Stagflation then.

This isn't Japan, and I don't think the either the UK economy or housing market will play out in the same way. The job market *is* improving, both in the UK and in the US. The steady stream of employment figures show us that.

Inflation will peak soon with falling commodity prices (see my other thread http://www.greenenergyinvestors.com/index.php?showtopic=15097), and this will allow real wages to start growing again.

I agree that it's going to be a relatively long period of slow and anemic growth, but at least it will be "real" growth rather than NuLab's debt fuel comsumption binge.

-

So it now looks like we have a green light for ZIRP to be held into 2013:

http://www.bbc.co.uk...siness-14472741

ZIRP + Improving job market = no further meaningful nominal falls imo.

-

I know quite a few UK-based property investors (who doesn't these days?), none of whom AFAIK have gold, & I wouldn't describe any of them as dispassionate.

Fair enough but I can wholeheartedly say the same about Gold investors.

-

US house prices in gold -- story from Forbes magazine

An American friend sent me this

written by Adrian Ash

I've started saying this too now. US houses are positively cheap as chips. The gold/house ratio suggests that offloading their Gold and buying real estate is getting a bargain.

I know there are good reasons why the Gold bull market should run further, but I see Gold is regularly making the front pages of the BBC now - surely signs than the market is overheating.

Even cheaper when you consider...

"US housing’s previous low came during the deflation of the Great Depression. Never mind that the average US home doubled in size in between, or swelled another 40% since"

-

Could be, the YTD NSA is 4% up!

Indeed, and the YoY will go +ve too as H2-2010 was all -ve, so unless that is matched this year then we'll go +ve for sure. However, I still think that this market is essentially flat (in case anyone accuses me of being a bull), within the confines of seasonality, with punters basically optimistic for the first half of the year, and then falling back in the 2nd half.

Builder shareprices essentially foretells this, with minor peaks and troughs ahead of the HPI indices by several months.

-

July Nationwide +0.2%,

YoY -0.4%

Stagnation for 5 years? Don't rule it out.

-

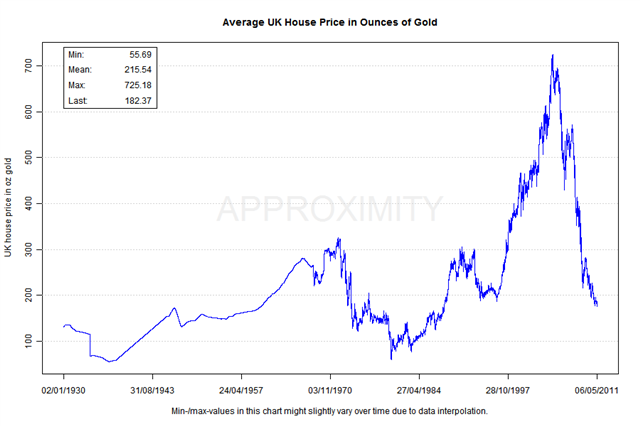

GF's graph lines... If houseprices in gold go the way of your GS ratio lines all it would take is a doubling of gold here, regardless of nominal prices.

My own feeling is for a slight move down-at least-in nominal and continued move up with gold. Target of 80-120 oz for the average UK house. With gold at about GBP 1000/per oz, at least the calculation is easy!

that is my thinking too. With gold just about £1000/oz now, the we may only have 20%-30% left before we reach extreme (ie >3 standard deviations) bottom-type levels, in a market that is already up 600-700%. I know there are good reasons for gold to still be going up, but frankly I wonder how much is left, and if gold is already at the same stage as houses circa 2005 or techstocks circa 1998. I know also that gold/dow ratios still say gold is cheap, but franky I do *not* expect a return to bottom-forming levels - much more sensible to draw a long term average through the ratio and then see how far we have deviated from that.

-

Halifax +1.2% in June.

The 3m YoY figure has moderated to -3.5%.

The actual 1m YoY figure is now just -1.6%.

Now.. what was that I was saying about a nominal low being close?

-

interesting

This chart says to me that it is very nearly time to sell gold and buy houses..

-

The inflation argument is nonsense. If anything inflation will decrease prices further. There are two kinds of inflation, cost push and demand pull. We're seeing cost push. Demand pull is where rising wages drive price increases; this is what is needed to make the mortgage more debt affordable are we're not seeing it. Cost push is where prices rise because of rising costs to foreign manufacturers or home currency devaluation. This does not decrease the relative debt levels measured in the home currency. It simply reduces even further the amount of income that can be expended on debt repayment and interest.

The demand-pull period will come after a few years of cost-push as workers demand better wages when the economy is recovered enough for them to be able to, without fear of losing their jobs (or being able to find better jobs). Wages will catch up- eventually.

-

Halifax is now down 20% since mid-2007 peak, and general inflation accounts for another 12-13% since, so we can now accurately say that UK Property has had a third of its value wiped off in real terms since peak. We knew that real prices would have to fall by 50% to for them to revert to trend, and this now looks bang on target.

I still don't think that we'll get big nominal drops, however. More a long slow grind down over the next 3-4 years with inflation doing the rest.

-

Looking at the LR report and the London data, the most striking thing to me is total collapse in volumes of the sub-200k FTB sector.

http://www.landreg.g..._11_x1p5cst.pdf

page 13.

100k - 150k -44%

150k - 200k -54%

UK House prices: News & Views

in NEWS Commentary, 2021 & Beyond

Posted

Mortgage rates have fallen in the last month.

2/3/5 year fixed and tracker mortgages are all cheaper - all lenders have cut these deals between 0.25 - 0.5%.

The housing market maybe experiencing headwinds, but costly borrowing is not one of them.