-

Posts

1,917 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Van

-

-

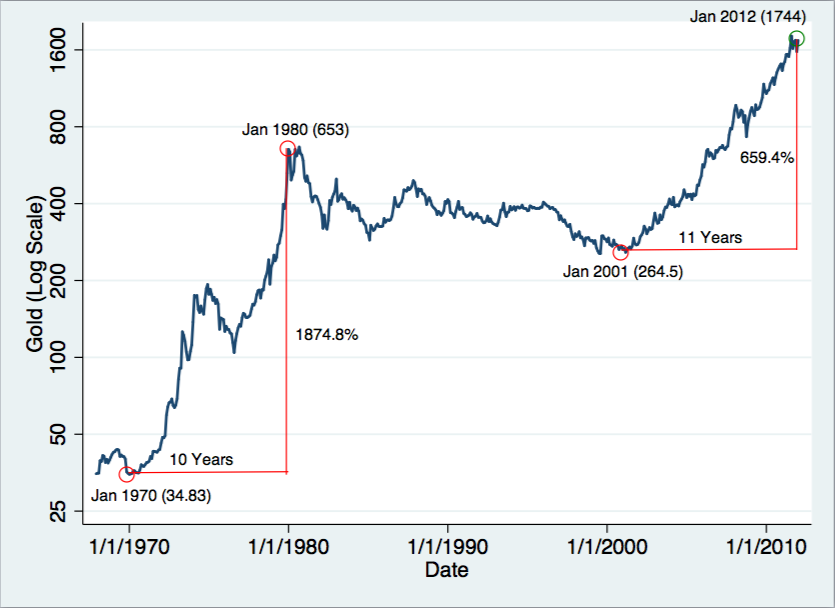

'Tis quite possible. In 1980 who would have thought that bonds would embark on a 30 year+ bull market. In there are no limits on the the amount of paper money they can print there is no limit to what the price of gold can go to.

-

In terms of CPI-deflated real prices, houses are at a new low of 68.26% of their peak:

Month SA Price Annual avg inflation SA Inflation Adjusted Aug-07 199,612 100.00% Sep-07 198,533 4.7 99.08% Oct-07 197,698 4.7 98.29% Nov-07 195,092 4.7 96.62% Dec-07 197,074 4.7 97.23% Jan-08 196,244 4.7 96.45% Feb-08 194,953 4.7 95.45% Mar-08 190,900 4.7 93.11% Apr-08 187,980 4.7 91.33% May-08 183,694 4.7 88.91% Jun-08 180,320 4.7 86.94% Jul-08 177,164 4.7 85.10% Aug-08 174,241 4.7 83.37% Sep-08 171,857 1.6 82.12% Oct-08 168,112 1.6 80.23% Nov-08 164,646 1.6 78.47% Dec-08 160,070 1.6 76.19% Jan-09 163,945 1.6 77.93% Feb-09 160,104 1.6 76.00% Mar-09 157,622 1.6 74.72% Apr-09 154,663 1.6 73.22% May-09 159,111 1.6 75.23% Jun-09 158,445 1.6 74.82% Jul-09 159,749 1.6 75.33% Aug-09 160,947 1.6 75.80% Sep-09 163,294 3.1 76.71% Oct-09 164,990 3.1 77.31% Nov-09 167,032 3.1 78.07% Dec-09 168,176 3.1 78.40% Jan-10 168,390 3.1 78.30% Feb-10 166,928 3.1 77.42% Mar-10 168,435 3.1 77.92% Apr-10 168,593 3.1 77.80% May-10 167,207 3.1 76.96% Jun-10 165,686 3.1 76.07% Jul-10 167,497 3.1 76.71% Aug-10 168,388 3.1 76.92% Sep-10 162,307 4.5 73.87% Oct-10 164,320 4.5 74.51% Nov-10 164,269 4.5 74.21% Dec-10 163,665 4.5 73.67% Jan-11 163,609 4.5 73.38% Feb-11 162,715 4.5 72.71% Mar-11 162,712 4.5 72.44% Apr-11 160,393 4.5 71.15% May-11 161,039 4.5 71.17% Jun-11 163,430 4.5 71.96% Jul-11 163,765 4.5 71.85% Aug-11 161,926 4.5 70.78% Sep-11 161,368 3.6 70.33% Oct-11 163,227 3.6 70.93% Nov-11 161,556 3.6 70.00% Dec-11 159,888 3.6 69.07% Jan-12 160,925 3.6 69.31% Feb-12 160,118 3.6 68.76% Mar-12 163,796 3.6 70.14% Apr-12 159,883 3.6 68.26%

-

2.4% DROP on the MoM Halifax figures! (Although, not so impressive when you consider the 2.2% rise they reported last month).

Bit choppy to say the least

Flawed data collection/interpretation model, or a sign of low transactions and reducing market share?

It's is very obvious that the end of the stamp duty holiday had a big positive effect on the previous month that has been unwound this month.

-

This is painful, no doubt about it.

I swapped some of my gold for silver, but everything is getting sold off today.

HUI could test 400 today.

-

-

All EAs have stepped up their letting business.

It is no coincidence that they are trying to encourage a faster turnover in the letting market. Many renting friends I know have had to move out in recent years. The new letting process is all part of the gravy chain for them. I'm very glad I don't have to put up with that sh1t any longer.

-

Over the last several days volatility in the gold market has collapsed forming what is known as a coil.

http://smartmoneytracker.blogspot.co.uk/2012/04/b-wave-bottom.html

-

Because there are very few "motivated sellers" thanks to ZIRP. This has led to a pattern of sellers kite-flying in the hope they can bag top dollar, and if they can't sell then they just withdraw from the market and try again 6 months later.

Also from what I am seeing rents are still grinding upwards in most London areas - probably 3-5% higher than 12 months ago.

-

Depends where you live. Where I lived at the time - in Berkshire - the housing market was well and truly inflated at the time. In fact I sold to rent in the end of 2003 because, to me, it seemed exactly like 1988 all over again. The market had been inflated by the post 9/11 low interest rates of 3.5%

Throughout 2004/2005 my local market slowed right down and prices started to slide. This, clearly, rattled the powers that be and, in August 2005 rates were cut by 0.25%. This, it seemed, was enough to convince people that the increases througout 2004/5 were at an end and, in January 2006, it was as if someone had taken the cork off a bottle of lemonade. The market went mad. Houses that had been on the market for 18 months sold overnight. The whole backlog of stock was moved within 3 months and prices went back up again.

The fact is - house prices in Berkshire and Surrey (where I now live) and most of the Home Counties and much of the rest of the South and the West Country are about the same now as they were in 2003.

While we were experiencing a slow down and falling prices in the bottom half of the country, in Wales and the top half of the country, the bubble continued to inflate as investors moved away from the over priced market in the South to find higher yields further North.

Er, well yes.. unless I misunderstand, all you're saying is that the market in Berks was already inflated in 2003-05 and then went even higher up to '07.

What we see now is a market where the dross and the less salubrious areas have fallen considerably, but where the large houses and "desireable" areas have held up pretty well. That's a sign that there is still plenty of air left in the bubble. Current policy is just about a best-case scenario for most homeowners as ZIRP has kept their biggest cost of living down.

-

Gold Moves Sharply Higher For No Particular Reason Yet Seen - Remarkable Divergence The Same Reason It's Gone Up Since 2001

There, fixed it for you.

-

Gold still has further to run:

http://seekingalpha.com/article/396211-dow-gold-ratio-too-early-to-buy-equities

With the current dow/gold ratio at 8, we are nowhere near a bottom yet. Gold could still quadruple from here.

The rise of the last decade has been nowhere near as explosive as the rise preceeding the 1980 top.

-

There was a bigger relative rise in rates earlier in the decade (3.5 to 4.75 from Oct 03 to Aug 04), didn't cause a crash though (although it did slow HPI).

Indeed, it is abundantley clear that it was the collapse in the supply of credit that caused the 2007 - 2009 crash.

Do you ever stop?

The bubble was not as inflated back in 03-04, so the market and indeed the economy was not as geared and dependent on low rates as it become only a few years later.

Pinning the cause or the collapse on credit supply or any other single factor is to misunderstand or oversimplify the nature of a financial asset bubble where many things happen simultaneously which causes the rise to be unsustainable and therefore must ultimately be corrected.

-

As I said last month, other lenders will follow Halifax and RBS and raise their SVRs too:

http://www.telegraph...rest-rates.html

The Co-op Bank said it will lift its standard variable mortgage rate by 0.5% to 4.74% from May 1, meaning payments will typically go up by around £15 a month, or £180 a year.

...

And the Bank of Ireland also announced that it is increasing its SVR, affecting 100,000 UK customers. It will raise the SVR on its mortgages to 4.49% from 2.99% in two stages.

-

What? No mention of the Halifax data today? YoY ~ flat

Crash cruise speed delayed once more.

Maybe next month.

Looks like the spring bounce was rolled up into 1 month this time around.

-

Seems the UK housing stock as a whole is worth (on paper) £5.5Trillion and has a LTV of only 20%

Even if all the properties have been 100% over valued, that still gives a national LTV of only 40%, capable of getting all the best deals

Not quite as bad as some try to make out, is it?

http://www.guardian....perty-hotspots#

Seems the UK could cope with a significant fall in prices after all. As a whole

.

.You *have* noticed the date, haven't you?

-

Nationwide down 1% MoM.

Wow, perhaps people really did try and beat the stamp duty cut off. Should have just waited and got a couple of % off later

Or maybe not, if you care to just look at the figures:

Jan-12 £162,228

Feb-12: £162,712

March-12: £163,327

Fall = ALL seasonal adjustment.

-

Looking for a great investment? Overpay your mortgage

By Phil Oakley Mar 15, 2012

I've always said this.

Most importantly it will give you a cushion of a smaller mortgage and more equity when interest rates go back up.

-

On the road I live on out of 8 houses 6 are debt free ok we are all getting on a little bit most have lived here 20years plus, nobody cares about house prices it only matters if you want to move!

That's a bit of a narrow-minded biew.

What happens when these families' children want to buy their own homes and start their own families? They won't be able to afford a home, or if they do it'll likely be a 1br shoebox that they'll be tied to for years.

High house prices prevents all sorts of social mobility. The NINJAs become trapped and stay at home into their 30s and beyond. It's a crap state of affairs that impoverishes the young.

-

"That's consistent with the idea that rising house prices caused bigger mortgages - not the other way around. According to Broadbent, there isn't even much evidence that "mortgage withdrawal" - loans taken out on the basis of rising property values, were used to fund extra consumption."

Sorry, I can't take this article seriously with stupid statements like that. Broadbent obviously lives in a macro-economic Keynesian model and rather than in the real world.

-

The answer why the "recovery" is slow is simple yet unpleasant because nobody wants to hear it:

As in 1992 and 2001, the recession of 2008-09 was not allowed to run its full course. Therefore the massive and unsustainable imbalances in the economy are still present, still being propped up, and they are preventing efficient allocation of resources. The global economy will continue along a path of long term wealth destruction as long as the short term pain is continually avoided by monetary and fiscal policies.

-

-

I think I may be the longest HPC-follower here - my interest in the topic started back in 2002 when HPC didn't yet exist and it was still a forum on the FT.com website.

In hindsight I would not have STR but would have found some other way to hedge myself; shorting housebuilders using strict TA would have been one of the trades of the decade when the broke long trend support.

Unfortunately HPC as it is now serves no useful purpose and resembles a bad advfn board.

IMO we are 2/3 of the way through the UK housing crash in terms of real falls, however no more than 1/2 way through it in terms of time. The last 1/3 of the falls will be a long and drawn out affair as the economy is kept on ZIRP life support for many years yet. Lost decade? You betcha.

-

from my journal thread:

This indicator has provided an excellent entry point for long gold trades over the last 3 years, and further back too. The indicator currently says "BUY LIKE A M**F***".

-

Couldn't agree more, it IS crime and my old sig "you can't beat the system" was actually meant to reflect this (and the lengths that TPTB will go to in order to keep their lavish lifestyles).

Some took it the wrong way*, so I changed it.

Rant time.

I've said here many times that I think we've been witness to the biggest financial rip off in human history, and we are utterly powerless to do anything about it. Moral hazard has been eliminated for those at the top, and those beneath are left with the all the risk, and all the cost.

I would say that it's endemic throughout the UK's whole political and financial system, top to bottom, not just at the top.

At the bottom you have an overly generous benefits system that subsidizes lazy scroungers

In the middle you have the hopelessly overborrowed middle classes who continue to benefit from ZIRP and QE, and if they are still in trouble then they can just declare themselves bankrupt and have their record purged after a few years.

At the top you have the million-pound bonus City boys whose employer was saved by the government bailouts

Financial wreckleness and immorality knows no class or income divide.

In all cases the ones who pay will be the current and the unborn generations of this country. What a future our children have to look forward to.

UK House prices: News & Views

in NEWS Commentary, 2021 & Beyond

Posted

Mortgage rates creeping up:

http://www.thisismoney.co.uk/money/mortgageshome/article-2145665/Mortgage-rates-set-rise-euro-crisis-pushes-banks-borrowing-costs.html?ito=feeds-newsxml

Experts said cheap deals are being replaced every day by more expensive options.

Last Friday, Yorkshire Building Society raised its two-year fixed rate loan from 3.24 per cent to 3.54 per cent. Tomorrow ING Direct will raise its two-year fixed from 3.29 per cent to 3.49 per cent.