-

Posts

1,917 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Van

-

-

Not sure I would be ecstatic about living next door to my inlaws....

-

Silver looking very good here technically to break out to new 6 week high @ 33.20

Above that we have another target @ 35.40 set it early October, and above that 37.50 set back in February.

The rising mid term moving averages are very supportive of this move.

-

If the price of their homes is anything like the price of their sushi, you can count me out.

Yo Home / see previous, or: http://yo.co.uk

Hmm. Seems great, so long as:

+ You do not need a change of clothes

+ You don't have a suitcase

+ You don't own a book, or want to store 1-2 weeks of different foods

+ The counter-weight systems never break down or require maintenance

What it I don't drink wine, and want to store a bicycle instead

It looks enormously impractical to me

It is like a Hong Kong show flat: No one can actually LIVE in one of those

-

Welcome to Crony Capitalism, aka Fascism.

-

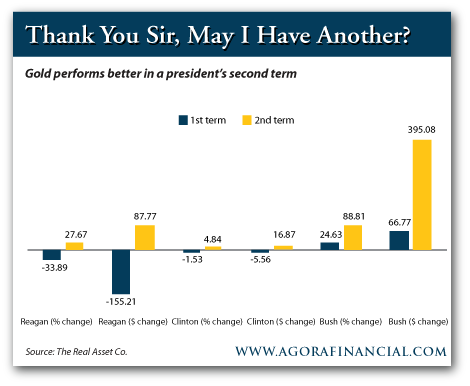

Hold onto your hats. It's going to go ballistic in Obama gets back in.

http://dailyreckonin...election-thing/

-

Halifax -0.7% for Oct 2012.

-1.7% YoY

£158,426.

http://www.lloydsban...ax/0611_HPI.asp

That is the 3rd lowest ever number from Halifax, only Mar-Apr 2009 were lower.

I think we are looking at 150k nominal bottom maybe in 2014.

-

It's austerity doncha know.

-

Nationwide has been remarkably consistent in the last 12 months, really:

165,798

Dec-11 -0.3 0.2 1.0 163,822

Jan-12 -0.3 0.1 0.6 162,228

Feb-12 0.4 -0.2 0.9 162,712

Mar-12 -0.9 -0.5 -0.9 163,327

Apr-12 -0.3 -0.6 -0.9 164,134

May-12 0.2 -0.9 -0.7 166,022

Jun-12 -0.6 -0.8 -1.5 165,738

Jul-12 -0.8 -0.9 -2.6 164,389

Aug-12 1.3 -0.6 -0.7 164,729

Sep-12 -0.4 -0.4 -1.4 163,964

Oct-12 0.6 0.5 -0.9 164,153

Max 166,022

Min 162,228

So +/- 2.3%.

BTW, someone should really tell them to put their charts on a log graph. That long term trend chart is looking more and more rediculous.

-

Boy, why is this trotted out over and over again? The purchasing power of the pound, in house buying/inflation terms, is only relevant to house prices.

"Wow, my electricity bill has gone up again. The purchasing power of my pound has been eroded. I now need £50 a month instead of £40 a month to pay for the electricity I use. The house I want to buy is the same price is it was, yet, somehow, miraculously, it's now cheaper for me to buy the house because it's more expensive for me to buy electricity! It's a miracle!"

I agree that disposable income is what really matters, but that is just a function of nominal prices vs income.

If nominal prices didn't matter then would be happy if your income fell 30% but the price of your gas bills fell 35% and the house stayed the same price? Of course not.

-

We could have just completed a $1700 double bottom.

-

Who said this about Gold:

"In the absence of the gold standard, there is no way to protect

savings from confiscation through inflation. ... This is the shabby

secret of the welfare statists' tirades against gold. Deficit spending

is simply a scheme for the confiscation of wealth. Gold stands in the

way of this insidious process. It stands as a protector of property

rights. If one grasps this, one has no difficulty in understanding the

statists' antagonism toward the gold standard."

Answer:

Alan Greenspan... in 1966.

-

Well, it's all relative.

Greece has austerity.

Portugal has austerity.

Eire has austerity.

Spain is getting it, whilst we are just cutting down on the odd latte etc and letting inflation do the rest. Hey ho

I don't consider anyone who is still running a budget deficit to be truely running an austerity programme. They may be a little more austere than before, but they are still living above their means.

And if anyone says that the austerity is resulting in the fall in GDP so it's a downward spiral, well that just should how much of these economies were made up of unnecessary governmental departments. They'll continue on this downward spiral until what's left is actually of productive value.

-

Now can we please all agree that Rightmove is the worst of all the indices?

That's not news, mate.

Another jump in the delusion index, still what did you expect when the Olympics have given everyone a sense of invicibility?

-

Halifax -0.4% last month, now below the 160k barrier:

http://www.bbc.co.uk...siness-19821613

This latest fall means that the average UK house now costs £159,486, which is 1.2% lower than at the same point a year ago.

I see from the press release that Halifax/ASHE ratio is now down at 4.25, not too far from the long term average of 4, which is.. interesting.

-

Prices fell by 1.4% in the year to the end of September, the Nationwide said.

A 0.4% drop compared to August left the average UK home valued at £163,964, the lender said.

5 more years of real term glacial real falls. Guaranteed.

Intervention is turning what should have been a 5 year bear market into a 10 year one.

The last one took 7 years to bottom. Why did we think this one would ever be any quicker?

-

Is a pension not an investment?

JD, you have not considered tax efficiencies here. It will drastically alter your calculations.

£10k into your pension is not the same as £10k into a BTL. The pension contribution is from your gross pay, the BTL is from your already post tax income, then furthermore any income you draw from the property rental will be taxable and any profit from sale will be also be taxable.

Now, if you consider that if your employer runs a pension schemes on a matched contribution basis, you could be looking at giving up £32k or so of pension contribution to put £10k into a BTL.

-

Agree, without nominal rises

I think you've been a bull for a while, right. That said you make a reasonable point, but only as far as a PPR is concerned not because property has suddenly become a good opportunity, in fact it is still a very bad bet as an investment. Buying somewhere to live for you and family is a different matter entirely.

Agree, without nominal rises houses are a mediocre investment at best. As a PPR there is an argument to be made.

Has anyone checked the mortgage market? This move by the Fed was the worst kept secret in history and has been front run by the market since May. Bonds FELL on the fed announcement.

-

Yeah looks like you might well be closer than my "up to" -5%. (Yes I did say "up to", however, you did give an exact figure, so you get the prize if it comes in at -2.5%

).

).PS where are all the original forecasts, on this thread or another?

On the other thread.. search on 2012 house price predictions.

I don't expect any change in base rates until there is a USD and/or GBP crisis, and no one knows when that will be, but I also wouldn't put my money on us making it through another election cycle without there being a major currency crisis.

The housing market won't collapse until there is a spike in interest rates, and can't rise when people are getting poorer through the effects of QE, so it is drifting in the twilight zone, like a vast expanse of no man's land.

If I were buying now I'd fix for 5 years. When I remortgage next year I'm going to fix for 5 years (I expect to have almost paid it off by the end of this).

-

-

Aug-07 1 Sep-07 0.990795067 Oct-07 0.982858918 Nov-07 0.966198023 Dec-07 0.972285461 Jan-08 0.964491987 Feb-08 0.95448682 Mar-08 0.931072968 Apr-08 0.913328924 May-08 0.889095299 Jun-08 0.869430793 Jul-08 0.850950647 Aug-08 0.833713871 Sep-08 0.821219821 Oct-08 0.802262395 Nov-08 0.784683335 Dec-08 0.761866214 Jan-09 0.779278097 Feb-09 0.760014715 Mar-09 0.747243552 Apr-09 0.732246487 May-09 0.752309588 Jun-09 0.748170283 Jul-09 0.753330565 Aug-09 0.757976691 Sep-09 0.767075838 Oct-09 0.773073541 Nov-09 0.780652903 Dec-09 0.784002465 Jan-10 0.783005509 Feb-10 0.774235039 Mar-10 0.779239724 Apr-10 0.777988886 May-10 0.769632538 Jun-10 0.760693823 Jul-10 0.767054498 Aug-10 0.769175492 Sep-10 0.738683716 Oct-10 0.745107057 Nov-10 0.742148544 Dec-10 0.736712463 Jan-11 0.733763945 Feb-11 0.727082588 Mar-11 0.723409858 Apr-11 0.713207063 May-11 0.713053023 Jun-11 0.71686238 Jul-11 0.715996975 Aug-11 0.707806581 Sep-11 0.70363212 Oct-11 0.709987119 Nov-11 0.700989954 Dec-11 0.692045747 Jan-12 0.694820595 Feb-12 0.69053989 Mar-12 0.703741106 Apr-12 0.686053435 May-12 0.687392542 Jun-12 0.691343769 Jul-12 0.684780231 Aug-12 0.680103614

Halifax has hit a new inflation adjusted low, 32% down now (based on CPI deflator).

-

Well, it's been 5 years now, and thanks to TPTB I reckon we're still no more than half way through this glacial bear market.

Halifax index is now down almost exactly by a third in real terms since the Q3-2007 peak.

I think that the market is probably going to take a further little lurch downwards over the next 5-6 months, thanks to usual seasonal weakness and post-Olympic reality. Still reckon my forecast for -2.5% 2012 is looking dead on.

Halifax House Price Index - August 2012 There was little change in underlying house price growth in the UK over first eight months of 2012, according to the latest Halifax House Price Index.Commenting, Martin Ellis, housing economist, said:"Nationally, house prices continue to tread water, as measured by the underlying trend. Prices in the three months to August were fractionally lower (-0.3%) compared with the previous three months. House prices fell by 0.4% in August with the declines in the past two months largely offsetting the gains in the preceding two months."Overall, there has been little change in house prices so far this year with the UK average price in August at a very similar level to the end of 2011. A gradual upward trend in spending power, aided by lower inflation, should help to support housing demand in the coming months. Nonetheless, house prices are likely to remain flat over the remainder of 2012 and into next year."Key facts

There was little change in underlying house price growth in the UK over first eight months of 2012, according to the latest Halifax House Price Index.Commenting, Martin Ellis, housing economist, said:"Nationally, house prices continue to tread water, as measured by the underlying trend. Prices in the three months to August were fractionally lower (-0.3%) compared with the previous three months. House prices fell by 0.4% in August with the declines in the past two months largely offsetting the gains in the preceding two months."Overall, there has been little change in house prices so far this year with the UK average price in August at a very similar level to the end of 2011. A gradual upward trend in spending power, aided by lower inflation, should help to support housing demand in the coming months. Nonetheless, house prices are likely to remain flat over the remainder of 2012 and into next year."Key facts-

House prices in the three months to August were 0.3% lower than in the preceding three months. This was slightly worse than in July when there was a 0.1% decline in prices on a three monthly basis.

-

House prices declined by 0.4% in August. This was the second successive monthly fall, with these two decreases largely cancelling out the rises recorded in May and June.

-

Little overall change in prices over the first eight months of 2012. The average UK house price in August 2012 was 0.2% higher than in December 2011. House prices nationally are at a very similar level to three years' ago, at £160,256.

/more: -

House prices in the three months to August were 0.3% lower than in the preceding three months. This was slightly worse than in July when there was a 0.1% decline in prices on a three monthly basis.

-

Hmm... this setup was so obvious that everyone seems to have missed it!

--

http://postimage.org/image/g66jyb3nx/

Good ol' Stan Weinstein would say that we've just moved froma stage 1 into stage 2...

-

-

Increasing mortgage costs are a very significant headwind for the UK housing market.

Santander are rasing their SVRs:

http://www.dailymail...es-SVR-0-5.html

More than 400,000 Santander customers paying the standard variable rate (SVR), which homeowners move to at the end of a fixed or tracker deal, will be affected by the change.

Halifax, Royal Bank of Scotland, the Co-operative, the Bank of Ireland and the Clydesdale and Yorkshire banks have all already raised mortgage rates for customers on standard rates this year.

The bank is Britain's second biggest mortgage lender with 17 per cent of the market, according to Council of Mortgage Lender figures for 2011.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

The is a worrying "lack of a bounce" after a 2% selloff...