HPCsoYESTERDAY

-

Posts

1,200 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by HPCsoYESTERDAY

-

-

-

Thanks for that explanation.

i have posted this a few times but it sums up why pd > pt imho:

Clearly it is not an exact science as to how much platinum goes to one use or another. However, jewellery manufacturing is going to be the major platinum user in China. Primarily this is because the Chinese automotive industry tends to make gasoline-powered cars, and so the split between platinum (normally found in diesel-engine autocatalysts) and palladium is heavily in favour of the cheaper metal.http://www.commodityonline.com/news/Precio...-24102-3-1.html

+ here's a bullish writers view:

http://www.marketoracle.co.uk/Article17368.html

and finally..... here is something i prepared earlier

http://www.greenenergyinvestors.com/index....st&p=186793

This could move quickly now......... a log graph (not shown) suggests current support at $450

Good Luck!

-

From:

From:

-

i hope you're right GF, so does my wife

-

It does seem clear that silver is set to strengthen further though after breaking out of it's holding pattern.

-pic-

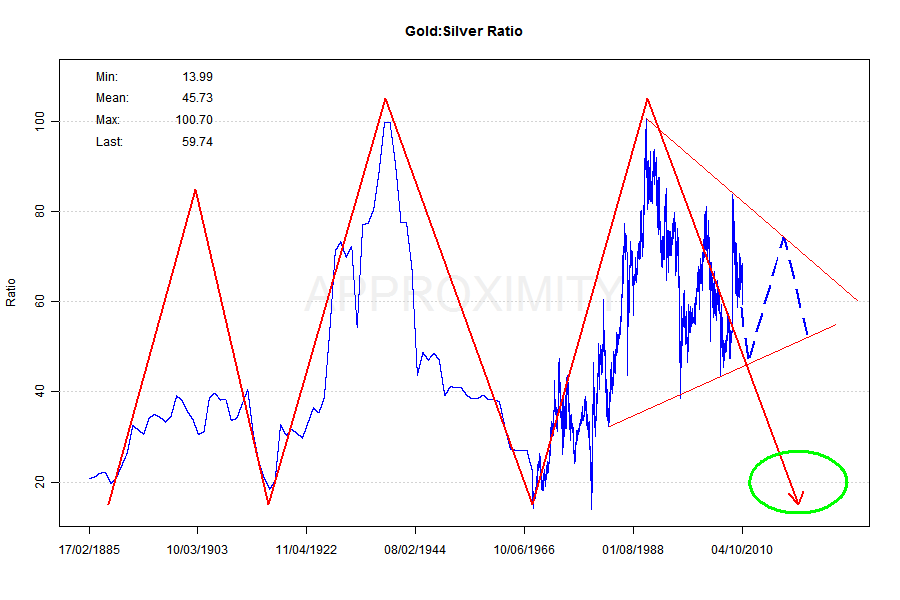

i agree with this, however, i think its a case of short-term vs longer term; on your shorter term chart the current setup in the GSR has been broken to the downside and is now looking for something resembling support - and here we move to GF's longer term cycle chart, where the GSR has clearly broken through the suggested downward trendline. Whilst it is indeed now moving to the downside, is it not reasonable to assume that the broken trendline may act as a support and present and 'bouncing' point for the GSR to move up again. Of course, it could be that the GSR never bounces too high and just moves down 'on the outside' of the trendline bouncing all the way. However, as it has clearly broken through the trendline GF suggests, this will be most interesting aspect of where the GSR heads next (after presumably hitting the support)

-

At the PM fixing g:s was below 60:1.

or?

which would coincide with a pm spike this March and pull-back thereafter, who knows? but i struggle to see the cycle your graph portrays tbh

-

-

-

1 oz Gold Britannia's on CID are Purity: 917 / 1000 compared to other coins.

Does this bother anyone ? Will these sell in other countries for less ?

tis still an ounce of gold

Kruggers have copper in them (as well as gold, lol)

-

here we go:

(credit pix for capturing this at the time)

-

another link on that 'glitch'

http://www.infowars.com/investors-spooked-...s-gold-to-3400/

any of you 'day traders' ever seen a glitch like this before?

reminds me of the day in 2008 when silver 'glitched' down to $6 on the comex - though i have to say this never materialized (yet

)

) -

very surprised that no-one has post this yet as it is VERY important.

paper gold (ETF).

:o

:o http://www.ft.com/cms/s/0/b9859c7e-c99b-11...html?ftcamp=rss

Europe’s central banks halt gold sales

By Jack Farchy in Berlin

Published: September 26 2010 22:08 | Last updated: September 26 2010 22:08

Europe’s central banks have all but halted sales of their gold reserves, ending a run of large disposals each year for more than a decade.

The central banks of the eurozone plus Sweden and Switzerland are bound by the Central Bank Gold Agreement, which caps their collective sales.

The lack of heavy selling is important for gold prices both because a significant source of supply has been withdrawn from the market, and because it has given psychological support to the gold price. On Friday, bullion hit a record of $1,300 an ounce.

“Clearly now it’s a different world; the mentality is completely different,” said Jonathan Spall, director of precious metals sales at Barclays Capital.

European central banks are unlikely to sell much more gold in the new CBGA year, according to a survey by the Financial Times.

so you won't be able to buy physical in large amounts anywhere soon imo.

You cash in your paper gold, it sits in sterling/dollars/euros.....but you can't buy any physical......uh oh...

Hmm, i wonder if the etf purchasers will get grumpy about this or just shrug it off

-

afaics, the only way gold will stay permanently high in fiat terms is if we reach a new gold standard as the end point

But, what happens when lots of people switch from gold to dow if this ratio <2? This assumes that the new gold standard will be in place by then, otherwise gold will surely fall in fiat currency

-

The Shoeshine Boy - from FOFOA

http://www.zerohedge.com/article/guest-post-shoeshine-boy

My bet, when the shoeshine boy tells you to buy gold he'll be talking about small gold coins only. GLD probably won't even exist anymore. And in this unique historical case, the shoeshine boy will not be the bad omen of a bubble top mania phase, but he will instead be the amazing bell-ringer of a new era. One in which even shoeshine boys can save their surplus wealth in gold. One I like to call Freegold. Because a physical-only gold market can actually handle everyone PLUS the shoeshine boy, unlike any other market.

To recap, a rising gold price is evidence of increasing investment demand, which confirms the belief of those that already invested in gold that it was a good investment. And because investment demand is over and above the relatively stable industrial supply and demand dynamic, any new investment dollars must bid gold away from its current owners. And because saving in gold is a Nash Equilibrium, the price will rise very high. And because gold is THE monetary metal with the highest monetary to industrial use ratio, it will have no reason to fall back when it reaches its top.this begs the question: why did this not happen in 1980 then?

and then i remember jim sinclair on kwn, who talks of how close the $ came to capitulating, but didn't

therefore, i think to myself, beware of bubbles and how people may justify them (no matter how high they go - granted this one may go a lot higher)

-

one of my favourite pieces of piano music

From:

a modern take on Dies Irae

From:

-

I've never seen it.

Should track it down at some point.

hmmmmm..... not very easy to find it seems

just to say - i would add that it is very likely that both yourself and harvi have seen apocalypse now, but if you have not, boy are you in for a treat!

-

Hey ladies, what are going to do with your precious? hahhahaha

I have 10,000 acres which I bought cash! I sold 20,000 to the Koreans hhahahaha.

I live in QLD, my father an Irishman(Dublin- Galway), my mother a great woman!-German) Maybe

Dr Bub? mr goldfinger ako isipin ang iyong mga sobra-pagpintog teorya ay walang kahalagahan Herr Goldfinger Ich denke, Ihre Hyperinflation Theorie ist kein Verdienst

is there some sort of on-line guide available for understanding your posts?

-

From the June Gold thread when gold was at 1256:

http://www.cnbc.com/id/15840232?video=1525161532&play=1

1289.... tick-tock... only 17 dollars to go

are "these markets perverse" yet?

Bobby hoye recently admitted he got it wrong so i hear

-

On Simon Mayo, radio 2 today, about 5.33pm theres talk about Gold. They have interview with Adrian Ash from BV.

http://www.bbc.co.uk/iplayer/console/b00ts...time_21_09_2010

About 29 mins in...

Hmm, phase 3?

-

Felt the same until a nosey postman asked me what was in all the packages

Told him computer chips, but decided enough is enough from that supply route.

Told him computer chips, but decided enough is enough from that supply route.Incidentally don't know whether others have had this experience but one dealer rang on the latest spike to try and say the price had gone up in 24 hours despite me fixing the purchase price and having it confirmed in an email. Will not name and shame, but poor show on their part.

i would quite like to know who that was - just to be sure i clarify with them in the future re. price if i use them

can you imagine it going the other way if the price fell, i can't!

go on name 'em! :-)

-

Crazy prices I have seen similar and more for the older Australian and lunar coins upto £40 an ounce! On a brighter note I picked up 5.96 oz silver in pre 1947 coins for £11.90 an ounce.

yep - i agree with what you're saying but interestingly the older lunars have become very collectable, esp. the 2000 dragon which rarely sells under £50. Also the silver - gold embossed lunars are quite collectable.

I regularly trawl through the scrap silver jewellery / antique mixed lots now to hunt for bargains, it's getting harder though!

-

-

.../..

Karl Bartos also co-wrote a number of tracks on Electronic's 2nd album 'Raise the Pressure'

From:

that was a great album and very different from the first

-

The Best of Youtube - Music

in Gold, FX, Stocks / Diaries & Blogs

Posted

From: http://www.youtube.com/watch?v=_4GDtlTzdkU