-

Posts

2,764 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Jake

-

-

These look amazing. I am year of the snake. Can I order these from Switzerland.

He paid USD 802 per coin for 54 coins!!. Currently USD 667 per coin! Better to average in, surely??

-

It's just like 2008 all over again and being down in the bunker when Hitler got his margin call. http://www.youtube.com/watch?v=eVB-SSkkLnY

Very funny, especially the reference to Gartman and Nadler...

-

If it is a question of "them" "whacking" gold, then how far can gold be whacked?

I notice Prechter's recent gloating about his recent charts, without telling about his failures since 2001. Are we going to see his 200 call?? And silver in single digits any time soon??

-

Perhaps noone wants to invest in an "artificial" bull market-or sees the risk as too large for an illiquid asset whose props could easily fall away?

I see rising house prices as a desperate system failure, not success.

-

Shameful manipulation!

Will Hongkongers get it too? (he wonders)

Not looking for 'benefits' are you Dr Bubb?

What's in a name? that which we call a rose

By any other name would smell as sweet...

-

Jeremy Paxman wasn't too keen on gold was he. I don't remember debates on prime time TV when gold was topping...

Hilarious! It's interesting to see Jeremy Paxman unusually as clueless as your averge Tom, Dick or Harry on what gold is. He and his team obviously haven't done any research about gold whatsoever.

Max Keiser tries to do a good job but his approach is not a good advert for the uneducated. As for that other public school prat, he probably has a nice big London mortgage and is going to go down with it when it goes. Still I bet Daddy has a few bricks stuffed away in Geneva..lol.

Thanks for posting.

-

Yep, good post JD. And now that the wise UK government, comprised of philosopher kings, financial genii and brilliant students of human nature

is offering government backed sub-prime mortgages, it would seem highly probable that there are going to be further increases.

is offering government backed sub-prime mortgages, it would seem highly probable that there are going to be further increases.People who have put thousands of posts on the internet about how prices were going to collapse should have the humility to admit they were wrong.

So present policies may well mean house prices go up. Governments offering sub prime government backed guarantees to implode on the watch of the next government may seem like a good idea or an act of folly.

Ditto freshly printed reams of QE to boost the stock market and pull everyone into the quagmire, might seem like a genius ruse. For now.

Those who have 'put thousands of posts on the internet about how prices were going to collapse' may well yet be proved right. Jut not immediately. That is no fault of their own analysis. Rather on account of those desperate to not let it happen and save the bad news for something far worse later.

John Rubino,

''...we should now be deep in a 1930’s style, capital “D” depression... That we're not in a depression today is due to the fact that the world’s governments are, for the first time in history, armed with unlimited fiat currency printing presses and are using them to dump huge amounts of liquidity into the banking system. This is buying time, at the cost of ever-increasing debt.''

-

Shopping basket time?

-

Also includes silver, platinum and palladium.

At least those clients don't have to worry about confiscation anymore!

If they kept their cash in the bank they could have a haircut though. Mmmm "Cash for Gold".

I see the bank is offering the "current market rate"... and this is the biggest bank in the Ned.

-

-

Support the house prices AT ALL COSTS. When it goes down the whole UK edifice will implode.

-

Support the house prices AT ALL COSTS. When it goes down the whole UK edifice will implode.

-

To confiscate bullion, people would first have to own some. Most don't (maybe they did not listen enough to the Pied Piper...).

Also, so much easier to give a haircut to electronic bank accounts. Much easier as well to heavily tax property (can't be moved, you recently explained, that's also why it's called an "Immobilie" in German). Gold is possibly too elusive nowadays. And silver will stay under the radar anyway.

Call me Silverfinger.

Also much easier to close out ETF's, convert into fiat. I wonder how hard it would be to confiscate BV or GM? For eg the US vs Swiss banks was a piece of cake?

-

The market can stay irrational for longer than you can stay solvent.

-

Does anyone think we should move THIS THREAD to the Trader's Section?

BTW, have you seen this thread in the Private section ?:

I'd be very much obliged if it was kept here. Why should it get moved??

-

If we do go into the Green circle, it might also take a little longer than show - as the last time did

So, about 2016-18?

-

Thanks GF, nice to have your input around here from time to time. I wonder how long before we enter that green circle? Let's hope as fast as you can say 'gold silver ratio'? That chart and forecast simply was a knockout..as was the bounce back to 52.

-

Timely charts, Brother Dominic! Incredible disparity within the UK, N/S divide etc. Looking at the UK Longterm chart there it would suggest that house prices are sure to slide... Eventually...all the way to 50-60K...which would be just about the same as GF's chart forecast. NE and NW even look cheap at first sight. Still, that's forgetting that the whole area-save a few pockets- is rather undesireable.

Uk has proven to be a hard nut to crack but I think we'll see that little chestnut crack as time ticks on. (Paper house prices; a farce-inspired by reams of continuous paper printing)

Best to just keep chipping away month in month out with gold and silver.

(I'd like to see the London charts esp back to the early 80's or 70's).

-

1615! Buying opportunity coming up?

-

That's a fine looking roof! And a witty article on the Leaf. I'm sure the solar and the Leaf/electric cars will play a part in the transition stage ( ie for 30-50 years or so).

-

I don't think there's a big difference with electrics and not when it comes to car. Cars powered by electricity is also using coal because in order to create the electricity or power that we are using everyday most companies are using coal so there's no difference in that. It's still the same so better to just get a hybrid rather than cars that are powered by electricity. In hybrid we can guarantee that it is environment friendly and is saving gas.

Well, they should sell the Nissan Leaf, for example, as a 'set' with enough solar panels for your garage/house to charge it. That way we save on using coal and its electric other than for the cost of the car and the panels plus installation.

-

(it's been a long day)

-

http://www.bbc.co.uk...d-asia-21055206

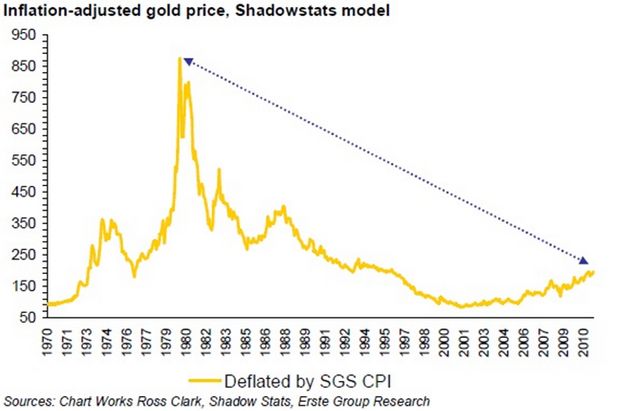

Funny old world. At first I thought this looked like a duck. But then I realized that if you lay it on its flat edge it looks just like the inflation adjusted gold chart from the late 70's to present day.

-

or 'Buy Gold and Keep Calm'

?

I think I did mean that. But it could also go 'Buy Calm and Keep Gold' or how about, Calmly Carry On Buying Gold or Keep Buying Gold and Calmly Carry On. The latter would be my favorite and closest to the original of 'Keep Calm and Carry On'.

For international travellers you could have 'Dont Leave Gold in your Carry -On'.

For international travellers you could have 'Dont Leave Gold in your Carry -On'.This could run and run.

UK House prices: News & Views

in NEWS Commentary, 2021 & Beyond

Posted

I make it around 190 oz. I think it got to 147 oz at one point.