-

Posts

628 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Carlton

-

-

The first feature is that the rally has moved above the upper edge of the trading channel near $1,720. The second feature is that the price has also moved above the value of the downtrend line, which also has a value near $1,720.

This breakout above two important resistance features is very bullish. The first upside target is near $1,800. This is the peak of the November 2011 rally and it is a weak resistance level.

The width of the trading channel is calculated and this value is projected upwards to provide the second breakout target. This is near $1,860 but there is a high probability the price will use the previous resistance level near $1,880 as a target level.

The long established pattern of trend development inside the trading channel suggests that any breakout towards $1,800 and $1,880 will have the characteristics of a rally rather than a sustainable trend.

Darryl Guppy

-

First, I would familiarise myself with the Tax policies.

Regarding taxes, trading futures seems to be more advantageous than the GLD, at least for Americans. I'm somewhat surprised that you don't talk about futures trading.

-

"This particular house is $50 right now."

"Not too many people want to buy homes in Detroit now. At this point, the median price of a home in Detroit is just $6000."

Capitulation.

Detroit will regain its luster. Access to water, an international frontier, and good transport links, especially for an oil-scarce world.

-

About a year ago I (profitably) traded calls on these guys. The stock has since sunken far further than I ever expected.

It certainly looks undervalued and like the shares should appreciate from here, with help from the broad indicies and from Au. But I wouldn't hold my breath for a takeover. With a mkt cap of $11 bln it's going to take serious resources to take over this company. ABX could do it, but others like NEM would be strained. I think the shares can appreciate on their own merit.

-

^^ Bullish or bearish? That is the question.

-

Go/stay long London RE?

From 2007, but I find this interesting:

Richest cities and urban areas in 2020

Rank

City/Urban area

Country

Est GDP in 2020 in US$bn

Est annual growth 2005-2020

1

Tokyo Japan

1602

2.0%

2

New York USA

1561

2.2%

3

Los Angeles USA

886

2.2%

4

London UK

708

3.0%

5

Chicago USA

645

2.3%

6

Paris France

611

1.9%

7

Mexico City Mexico

608

4.5%

8

Philadelphia USA

440

2.3%

9

Osaka/Kobe Japan

430

1.6%

10

Washington DC USA

426

2.4%

11

Buenos Aires Argentina

416

3.6%

12

Boston USA

413

2.4%

13

Sao Paulo Brazil

411

4.1%

14

Hong Kong China

407

3.5%

15

Dallas/Fort Worth USA

384

2.4%

16

Shanghai China

360

6.5%

17

Seoul South Korea

349

3.2%

18

Atlanta USA

347

2.6%

19

San Francisco/Oakland USA

346

2.4%

20

Houston USA

339

2.5%

http://www.citymayors.com/statistics/richest-cities-2020.html

-

Actually you answered your own question and yes I can spend US Dollars almost anywhere as there are always plenty of takers for it. Gold on the other hand will be much harder to sell, since the spot price now seems to trending south.

Gold is always and everywhere salable. Anyone who has difficulty selling gold is doing something wrong. There is a reason Brit fighter pilots carry sovereigns (and not certs for shares of Unilever) with them into battle.

-

Silver isn't doing the job of safe haven that was predicted as inevitable in the mass turmoil currently taking place, it just gets sold off generally as a risky asset on any new piece of

Sure it is. Silver is one of the few things that has approximated gold's performance of the past 10 years. Of course silver is more volatile. But owning silver has more than protected your purchasing power, it has increased it. What more do you want?

-

Your first (deleted) thoughts were better Carlton. Numerology has as much validity as astrology

You're right; I thought I might have gone too far.

-

.............

-

Buy, buy, buy! ???

-

i don't see that hedging has anything to do with it. the miners are producing it and bringing it to market constantly - regardless of what price they already agreed to sell it for, it is new supply brought to market all the time.

Miner production is relatively constant and predictable. Hence, selling by miners isn't going to move the market significantly unless they engage in significant hedging. If the miners were willing to sell forward a few year's worth of production in a couple days that would move markets, but most of them don't engage in long-term hedging. Thus, miner selling is an inadequate answer.

-

mentioning no names, but I am somewhat surprised to hear industry professionals in the metals sector declare that they do not know who the sellers are, other than hedge funds

er, the miners maybe?

duh.

Given that many miners have committed to strictly limit their hedging that is not such an obvious (duh) answer.

-

Or does anyone suggest we are not going to see $1900 ever again in the future??

Only if the policy-makers decided to permit a years-long debt-deflation and all of the attendant problems: economic contraction, bankruptcies, unemployment, crime, riots, falling government revenue, and perpetual electoral losses for political incumbents.

-

^^ OMG. Onion News Network??

-

I know this is slightly off topic but I'd like to ask a question about a gold backed currency. If say the Euro was backed by Gold and also the Pound.....I suppose the Pound wouldn't have been able to devalue against other currencies so easily? So, when a country is experiencing economic problems, they cannot devalue when they have a gold backed currency to increase exports and even encourage companies to set up in their particular area? I'd be grateful is somebody could answer this for me.

A country on a gold standard can still devalue by changing the ratio of banknotes to gold. The US did this in 1933 changing the ratio from $20 per ounce to $35 per ounce. There were some European countries that also devalued during the WW1/interwar period.

It is less easy under the gold standard, however, because it requires an explicit policy decision from the government, as opposed to allowing loose monetary policy to gradually depress the value of a fiat currency. That explicit policy decision may be difficult with respect to domestic and international politics.

-

^^ Wise words, G0ldfinger.

-

Interpretations?

Biggest One-Day Declines by PercentDate Close 1-day $ Move 1-day % Move

3/17/1980 17.4 -13.35 -43.41%

3/26/1980 15.8 -4.4 -21.78%

9/23/2011 30.10 -6.477 -17.71%

2/28/1983 10.3 -2.2 -17.60%

1/18/1980 40.5 -7.9 -16.32%

4/20/2006 12.525 -1.997 -13.75%

6/13/2006 9.625 -1.44 -13.01%

3/13/1980 25.5 -3.8 -12.97%

10/2/2008 11.12 -1.65 -12.92%

10/20/1987 7.285 -0.995 -12.02%

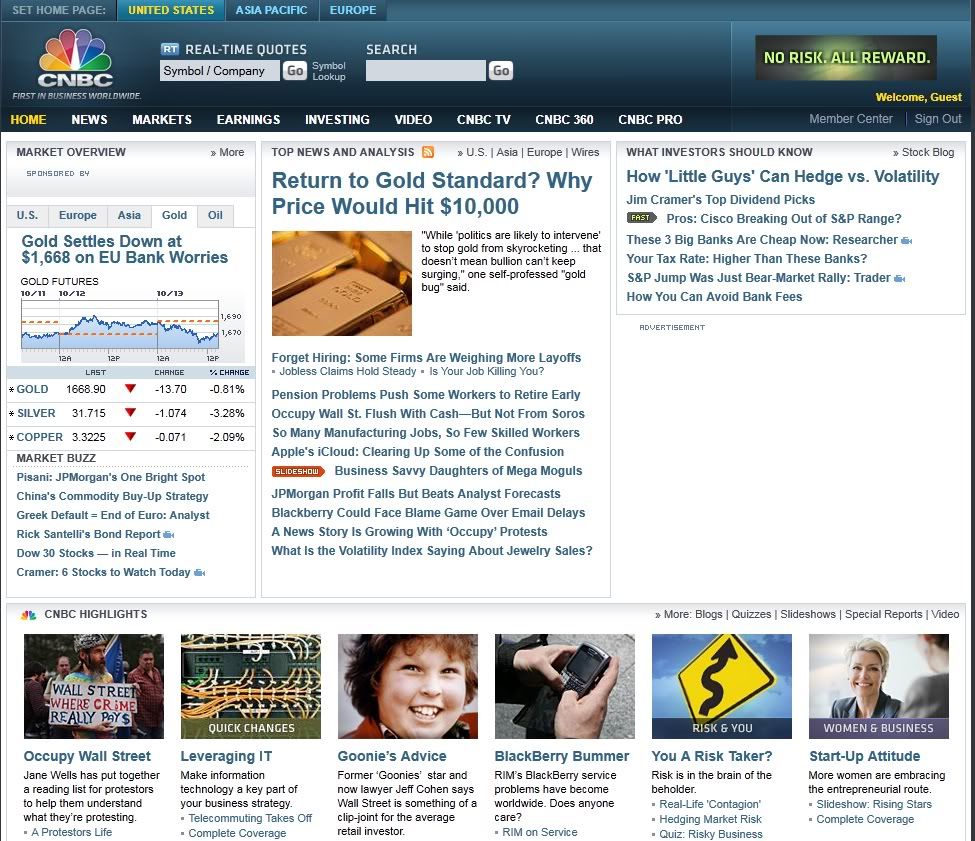

From http://www.cnbc.com/id/44647369

The only two bigger losses than today were in 1980, which was not a great year for silver.

-

“As soon as China closes trading each day, that is when the selling starts in the paper markets. These raids on the price are designed to get weaker players flushed out of the futures markets so they (commercials) can cover some of their short positions."

It was an interesting article; however the "London Trader" says that central bank gold is physically going to the East. This is contrary to what Rickards has explained - that the central banks maintain possession of their leased gold and that it will be the commercial banks who are left naked short on gold when the CBs terminate the leases.

-

-

Stewart Thomson is at it again:

“If only I had done this, if only I had done that, I’d be so much further ahead now”. Yes, let’s talk about “now”. Click here now to view the monthly meditation chart for GDX. When you meditate, you can’t have thoughts in your mind. So, annotations are useless when it comes time to meditate on a chart. Just look at that chart. GDX has risen about tenfold since the great dollar bear market began. Meditate, and then ask yourself, realistically, if you called all those small rises and falls, on the road from $6.46 to $66.Gold and gold stocks gyrate. If you have no short positions in play, you book no profits when price declines. When price falls, all you think about is how much you are losing on your long positions, and how much of your position you should have sold at the latest minor top, to have avoided being “where you are now”. You understand the rewards of flip trading, but do you really understand the risk side of the equation? In this crisis, flip trading could put you on a real breadline, alongside Elmer Fudd Public Investor.

The Sheriff. There’s a new sheriff in town, and his name is Mr. Unleveraged Physical Gold. This period in time can’t be 2008 again because the physical gold players are beginning to act aggressively.

-

He added, “This bull trend will end all the other major bull markets,” and singled out debt capital as an asset class for which demand and prices would decline.

...In addition, Gmuer said silver is set for an even greater upward run than gold, with the market due to correct a distortion in its pricing of silver in relation to gold.

Gold and silver currently price at a ratio of around 45:1. However, Gmuer said declining silver output over the last 60 years—as a result of inventory depletion and mine closures—meant silver supplies currently outnumber gold by a ratio of less than 10:1, thus indicating a market correction is due.

Once this occurs, Gmuer said that silver prices would settle at 10 percent to 15 percent of gold. This implies that if gold reaches $6,200 per ounce, silver will peak at between $620 and $930 per ounce.

-

In recent remarks during an official visit to Japan, Vice President Joe Biden said that China became the world's second largest economy only because of US troop presence in Asia.

This line of reasoning only makes sense to a politician: China's growth has nothing to do with its huge population, massive accumulation of savings, burgeoning technology, or culture of productivity... and everything to do with US military installations in South Korea, Japan, and Okinawa.

To be fair, the US and the US military have contributed disproportionally to world peace and freedom of the seas, conditions that have made globalization, the expansion of trade, and investment in place like China possible and attractive.

Moreover, if the US had opposed GATT/WTO China and other developing countries would be much poorer, with less savings, and less technology.

-

I may as well add this here:

Moreover, gold can be expected to respond to increases in base money. "Inflation is always and everywhere a monetary phenomenon..."

In 1985 the monetary base was $200 billion, today it's $2700 billion, an increase of 1250%. A proportional increase in gold takes gold from $350 to $4725.

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

This seems to suggest that we will have an unsuccessful run at the $48 high 9-18 months from that high, meaning roughly between now and Oct. 2012.

Moreover, we will have a breakout to new highs 1 1/2 to 2 1/2 years following the $48 high, meaning roughly between Oct. 2012 and Oct. 2013.

IMO, the price action will closer to the shorter end of those time ranges due to the deep global recession and silver correction that occurred in 2008. In other words, the time frames will be more like 2004/5 and 2007/8.