-

Posts

5,790 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Steve Netwriter

-

-

It's all relative isn't it.

It is lol

But measuring anything against a varying/flexible metric is bound to make things tricky and is liable to be unreliable and give a false picture

A good metric doesn't have to be gold, it could be a basket of commodities, time averaged to remove short term market variability.

I like to watch the price of tins of pineapples lol

99c, then $1.39, then $1.49, now back to $1.39, all in the last few years in Countdown

Likewise cheese, was $5, got to about $12.99, now back at around $9.99.

So prices have doubled in the past 6 years?!

Or more accurately, the purchasing power of the NZ$ has halved?!

If the doubling time is 6 years, 70/6 gives 12% per year. Seems a little higher than the official CPI increases lol

If "gold has gone up by 23% per year", that's a purchasing power increase of more like 11% per year.

Not very much during such a turbulent and dangerous economic period.

Methinks there's a lot of catching up to do

-

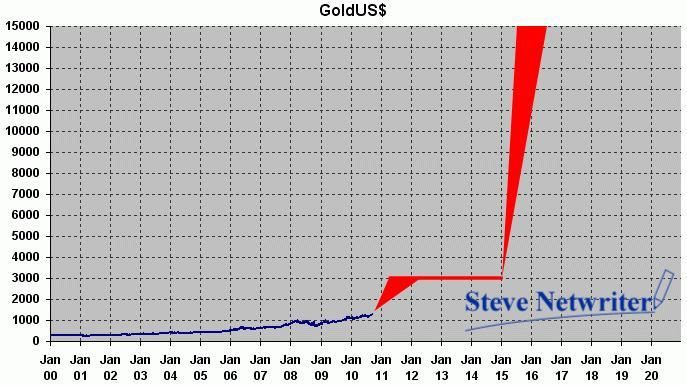

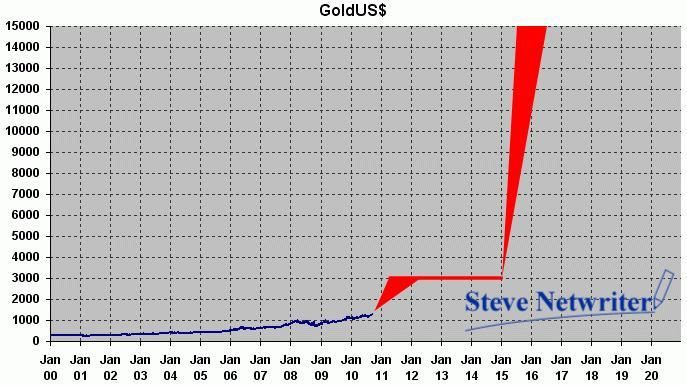

A bit out of date, but my Gold Index, showing how the basket of major currencies have fallen against gold since 2000:

I look forward to updating this when a catastrophic change occurs (as in catastrophe theory)

I still think this is quite likely

-

Hi Steve, good to see you post again. 'Goldbugs' left? On the next spike up there's a good chance a few will be back.... thats' volatility for you.

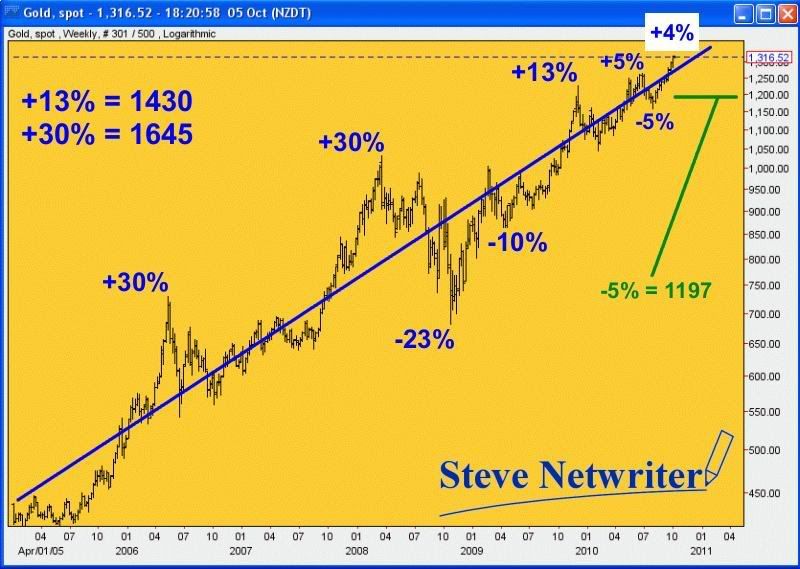

So, what do you think of the long term log chart? Convinced yet about gold appreciating 20% year on year?

Hi Romans

I see you're in the same time zone

A few points from me

1. I don't see "gold as an investment". To me, "an investment" is something you go into in order to try and "make money".

I see gold, and to some extent silver, as a way to "not invest", ie to avoid all the speculative investments, whether paper "money", stocks, etc.

2. The Gold charts seem to be following the general trend since 2001. It's rather boring. One day that trend will be broken, and the paper currencies will drop much faster than they have been.

3. I don't see gold appreciating at all. I do see the paper currencies continuing to fall.

I haven't created any new charts for rather a long time now lol.

Wow doesn't time fly when you're busy on other things!

Looks a bit outdated now doesn't it lol

It looks like I thought the GoldUS$ rate of change was 23% per year:

-

Please scream away, Scotty.

Beam us up !

It's LONELY at the bottom, don't you think ?

What do they say, "buy when all else are selling" lol

It looks to me like we've been through a long enough period of boredom and depression for those who think lines up should be straight

I do remember commenting on Jim Sinclair's 1650, and how the GoldUS$ rate went straight through it, but now looking at the chart, maybe he did pick an important level.

Onwards and upwards

-

Those charts again

Weekly ... update

Daily ... update

Gold-in-A$

Pictures of NZ, tales of a Roman Holiday, and apparently the "Goldbugs" have left?

I haven't been following the charts much recently, I just check occasionally.

Am I the only one who thinks those charts are screaming one thing?

If this was Star Trek, Scotty would be screaming "the pressure is too great Capt'n, she's gunna blow" lol

-

I'll be interested to see how this works out.

On my site people register as normal but have to fill in a reason field. I don't get that many, but I get an amazing variety of reasons written, from "FFFIUGYTD" to short essays, many of which demonstrate a real knowledge out there.

I doubt you'll get many emails from spambots, or spammers, so it may well work well, because only those who want to join will bother.

-

Gold pushing new highs signals inflation right?

No, it signals loss of faith in the currencies.

Gold is not an inflation hedge. If it was, you would have seen gold rise from 1980.

-

Article updated with a few extra charts, including this one:

-

Explanation:

A Quick Summary of my Learning & Progress Along the 2008 Gold Prediction

http://www.neuralnetwriter.cylo42.com/node/3605

-

The fall of the US$ also surprised me:

Laura, wanderer posted a VERY large rocket going up. I'm not sure why

-

Yay, it's an audio and I can get it here in NZ

Thanks, going to record it for my personal listening pleasure

-

I didn't read any reason for GoldUS$=200.

Maybe it's just a number picked out of the air, or maybe it's just mimicking the large fall callers.

Or maybe there's an assumption that some people/traders will still think paper gold has some value.

It's not an aspect of the article I particularly made note of.

-

As Steve Netwriter keeps saying ,' You got to change your paradigm'.

Well actually I would say "there are other paradigms, and maybe better ones than your current one".

The problem I see is looking at the "gold price". It makes it look as if gold is rising. It looks LIKE a bubble.

Invert the chart, showing the currencies falling, which most people KNOW they are, and things look a little different.

Saying "will the gold price peak and fall back" is like saying "will the currencies drop and bounce?".

Yes, possible, but by how much? And they may not bounce. They could hit zero and disappear.

Could the US$ fall to GoldUS$=2000. Yes, very very likely.

Could it get to 5000? Yes, very very likely.

Could it get to 10,000. Yes, very likely.

Could it get to 50,000. Yes. That is one solution to the US debt problem. The only solution I know of!

-

Not to mention houses are assets, and gold is

money...currency... the most powerful symbol of money.**I know, it's a mouthful.... but it does help to avoid the metaphysical disputes.

Well I used to say "gold is money", but FOFOA has educated me a little more recently, so it seems to be "a really good store of wealth"

-

"Gold, unlike many other commodities is not consumed, and therefore the traditional models and theories of supply and demand simply do not apply!"

Ditto houses!

nicejim,

House deteriorate and also get destroyed, as I've recently experienced. They also get created.

The market is also elastic, supply and demand varying with price in the elastic market way.

Maybe this would help in understanding the gold market:

Gold Supply and Demand Dynamics. Does the supply fall when the "price" rises? by Steve Netwriter

http://neuralnetwriter.cylo42.com/node/3552

-

Oh dear, I see the same old arguments.

Maybe some facts would add to this thread.

-

"The supply of scrap gold...has remained surprisingly slow"

http://www.ft.com/cms/s/0/16f72c6c-c73d-11...144feab49a.html

http://spot-gold-price.org/gold-supply-and-demand/

Hence as prices rise, so does supply coming onto the market. If we add these two effects together then the market price is the point at which the two graphs meet and is where the level of demand will meet the level of supply, as shown in the chart alongside. So does the same model apply to the price of gold when you are trading spot futures or indeed trading in the physical commodity itself. The answer is categorically and emphatically NO, and the reason for this is very simple and very logical.Gold, unlike many other commodities is not consumed, and therefore the traditional models and theories of supply and demand simply do not apply!

-

The topic of "what is money?" seems to crop up a lot.

After recent discussions with FOFOA, I realise it's really quite complicated.

One aspect I've learned is that maybe it's best to start by defining "money", or maybe better still, to talk in terms of the separate functions of money.

So first it's possible to say money performs the functions of:

1. Medium of exchange

2. Store of wealth

3. Unit of account

For any particular "money", we can then discuss the merits of it by looking at how well it performs each function.

For example, the GBP is legal tender in the UK, so it performs the function of medium of exchange, and seems to do it well.

But, in another country that function may well be rather limited.

It doesn't seem to perform the function of "store of wealth" very well.

Gold in the UK does not currently perform the function of medium of exchange very well. It's mainly necessary to convert it into the local currency first.

But, as a store of value, it has performed very well since 2000.

If I understand FOFOA correctly, he sees gold in a "freegold" situation performing the "store of wealth" function in parallel with a currency performing the "medium of exchange" function.

Thus the inflation of the currency does not devalue savings, and the freely floating gold store of wealth allows the free market to keep a check on the currency.

It's a complicated subject, this is the discussion, I hope I've represented it fairly:

Bill Buckler Discusses The Last Price Standing Of "True Money", Answers The Only Question Relevant To Gold Bugs

-

I keep banging away at the paradigm, but it seems to persist.

It doesn't take MORE currency to cause the "gold price" to rise. It only needs a loss of faith in the currency, for the currency to DECLINE.

If you break free of the false currency based paradigm, things become very simple and clear.

The "gold price" to $5000? Really? You think the US$ will only DECLINE to 5000 for an oz of gold.

I think that is highly implausible.

If they pull it off, they will really deserve medals. It will be achieving the impossible. I will salute Ben Bernanke and kiss his shoes.

-

Which of these two questions is easier to answer?

1. What is the maximum possible price of gold in US$?

2. What is the lowest possible price of the US$ in gold?

-

Big Tommy O'Brien still holding out for 1075 USD gold

http://www.cnbc.com/id/15840232?video=1588378975&play=1

3mins 20

Gold getting competition from dollar and real estate. Buy a place for 100k, mortgage of 500 dollars per month rent it out for 600.

- Good luck finding solvent and reliable tennants Tommy! Also make sure you don't incur 1000k in fees and repairs or you are at zero!

4mins 20

Host: "so people should beware and understand that this [gold] is a commodity"

Tom: "absolutely"... "gold is not a safe haven its correlated with the market"

Jeezus - the WORLDS number one gold timer doesn't understand that gold is money

Thanks for that

IMO the problem is that there are two basic paradigms, one paper currency based, the other gold based. It depends on what you choose as your reference. If you think the US$ is money, and measure everything with it, IMO you are blind to certain realities.

Having switched paradigm I now think I see things more clearly, and people like Tom O'Brien appear blinkered and ignorant.

A lot of time and currency has gone into promoting the paperbug paradigm, so it's hardly surprising so many have been sold on it.

-

The reason is quite simple. Gold dealers know gold prices are driven by supply and demand. Unlike securities and most other investments, supply and demand for gold is only based on hype; fear, panic and greed, along with market manipulation of course.

In contrast, supply and demand for securities is based on valuation, which is assessed by comparing business risk versus cash dividends, cash flows and earnings growth.

:lol:

:lol:  :lol:

:lol:

Tremendous, thanks for that, it gave me a really good laugh.

:lol:

:lol:

-

The problem is the incommensurability of "paradigms".

You've outdone yourself on that one!

Maybe you should switch to German so you can get in some REALLY long words

-

Looking at the above graph, the price mentioned (6000 0r 7000 or 10000) should be the current price. Because once inflation catches up, the price could be many multiples of the mentioned price.

Yes, the US$ has a long way to fall to reflect pre-existing inflation. Then further to fall, to reflect future inflation or increase in velocity due to a loss in faith in the currency.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Hi All

I thought I'd pop in and see if everyone was jumping off tall buildings lol

A bit disapponted by the lack of suicidal tendancies lol

Maybe not a very representative group here, too intelligent and knowledgeable.

Funnily enough I've not been watching the price of fiat currencies much recently. I guess this is a temporary spike before a massive drop