-

Posts

5,790 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Steve Netwriter

-

-

There are some very immature insecure annoying boorish posters here that are just a waste of bandwidth. Grow up.

Nice graphic

-

COME ON STEVE NETWRITER WHERE IS YOUR CAVEAT EMPTOR ON THIS

Not needed when others are doing it

But, paying in advance is not unknown. But, personally, I would ONLY do it if the company had a good reputation, and if I thought the chance of them going bust etc before delivery was very small.

For a new company, with no reputation, they might need to offer a secure payment system which allowed you the return of your money if anything went wrong.

-

Does anyone know where I can get historic yearly dividend return figures for the dow?, historic dividend return figures for ftse indexes as well would be brilliant.

What springs to mind is the Shiller income chart.

Irrational Exuberance - loads of data from Robert Shiller book

http://www.irrationalexuberance.com/

Including PE of S&P500, which is also available here: http://www.multpl.com/

Is that what you mean?

-

Breaking: Gold & silver crashing.

Oh wait....my monitor is upside down

:lol:

:lol: -

So, you think places like e.g. Argentina didn't first have asset deflation and some even CPI-deflation(!) , and only then went hyper?

Think twice!

Similar thing in Weimar Germany, by the way.

Don't get confused by flawed Keynesian demand thinking. Supply matters just as much, as Steve Netwriter pointed out. On top of that, the plunging demand for the currency might matter more than the demand for goods at the time.

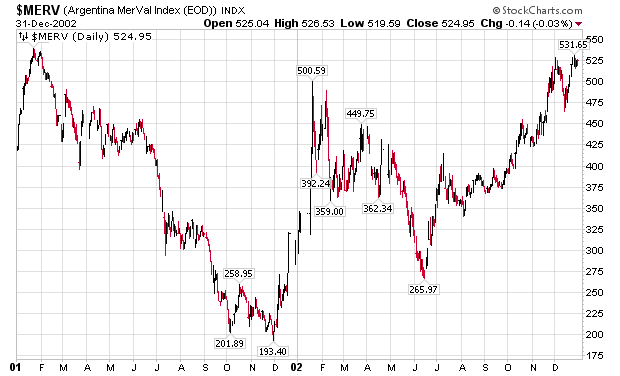

Argentinian CPI:

.gif)

Argentinian stocks:

Nice charts

I think that's an important point.

-

Isn't there a vicious circle here? Demand destruction leads to supply destruction [over-supply/ over-capacity]. The economy is then locked in an ongoing contraction as there will be less of both demand and supply.

Yes, exactly. Every lost job reduces demand, but also reduces supply.

My point is that demand destruction may not necessarily be greater than supply destruction.

In one case you'd expect prices to fall, but in the other they would rise.

Certainly demand destruction is not the whole picture

A very good debate between Mish and Daniel, which I've only heard 3 times so far. I think it requires quite careful analysis.

The bit I found funny was when Jim said "inflation leads to inflation". A classic example of how that word gets people confused

And I think they'd have been able to debate better if they'd had that word banned in the whole debate.

-

Ok, so many are now agreeing that financial assets are set to keep deflating. But bracket your aversion to fiat for a moment and think of the logic of this.

What do you think will be the effect of people seeing their wealth destroyed will be? They will most get very defensive and stop spending. We have seen this behaviour already. Less spending leads to demand destruction which is a downwards pressure on prices in consumables. Why would prices rise if the velocity of money doesn't?

Currencies are relative. You might as well say they are all rising together as sinking together as consumers come to value money more [save it and not spend it], and unless we see large rises in prices that is what they will be doing. Some currencies I imagine will rise more than others; gold could quadruple in value against assets while the dollar could conceivably double in value against those assets. The same may also be true of goods.

Why is it that everyone seems to talk about demand destruction and not supply destruction ?!

I make this point every time I see "demand destruction".

-

Wow, I wake up on Saturday morning, and gold has been really whacked down to......to......

oh $1006.

Still ABOVE 1000

:lol:

:lol:

4 digit US$ gold is starting to be a habit

Eric makes an interesting point about the net long % of open interest:

http://jsmineset.com/2009/09/18/cot-gold-comparison/

If you can't read his chart, I've blown it up here:

http://www.neuralnetwriter.cylo42.com/node/1882

I feel sorry for the Chinese, caught as they are with so many US Dollars, so I did a quick calculation to help them out.

How many of their $2 trillion should they convert to gold so that the rise of gold price offsets the devaluing US$?

I've assumed a US$ devaluation of 50% and GoldUS$ going to 10,000.

The simplistic answer is they just need to buy $200 Billion of gold or at today's price 100 million oz (3,100 tonnes).

Although they will obviously diversify into other commodities, they have more gold buying to do

-

I think the new government are going to support a strong Yen and the Japanese consumer. More bad news for exporters.

Just about hitting the 89 handle now.

Yes, and that could be quite significant.

Does it mean the Japanese are now willing to let the US$ fall without trying to keep the Yen following it into 'valuelessness' !

Could be yet another nail in the US$ coffin.

Hmm, wouldn't it be fun if they also started buying gold

-

Go on Steve, do it do it do it!

Do what?

whistles quietly while walking away

-

Got to be in it to win it.

Or as someone reminded me elsewhere just now....to avoid being dragged down a very big hole!

1017.02

-

Great graph Steve, but is the text describing your swap strategy right or am I reading it wrong?

Hi Nick,

It's really describing my view on the long-term way gold moves. So when gold looks initially "overbought" would coincide with the sort of time I'd be looking at going more into gold than silver.

The end of that phase (as in "this is it"), would be the sort of time I'd be going more into silver.

Obviously if you can pick the best dip of the consolidation phase then that would be THE best time to move more into silver.

I'd have done that in Nov, when most people seemed rather upset at the falls, but I'd already picked an earlier dip

Often it's the first dip, but last time it wasn't

-

I guess it depends how much you think silver has moved from a consumed commodity towards being a monetary commodity.

It's always going to be a bit of a gamble with silver. IMO the only way to play it is make your decision and hang on tight. If you are convinced of your decision long-term.

My bet is that the Chinese general public investment effect will limit any dips from now on.

Good luck with your decision.

-

WOW !!!!

Japan incoming finmin Fujii: strong yen has merits

TOKYO, Sept 16 (Reuters) - Incoming Finance Minister Hirohisa Fujii said on Wednesday a strong yen has merits for Japan's economy, saying current forex moves are not rapid.He also said he opposed intervention in the currency market if rates moves were gradual.

To put it mildly, that's a change of policy !!!!

-

Come on guys wake up

I can hear the "control room" now.

Controller: Fred, you've pressed the wrong bl**dy button again. You should have pressed the DOWN button.

Fred: But I haven't pressed a button Sir !

Controller: Oh hell, it must be those bl**dy Chinese.

:lol:

:lol:

I should add: Ooooohhh, that's fun. The Yen just suddenly started up REALLY fast against NZ$, EUR, US$ and GBP.

This is looking like so much fun right now.

In a "watching a nuclear explosion knowing many people are being killed" type of way

Edited to add:

This is bizarre. I've just checked google news to see what just hit the fan, and they all suggest everything is great and the Yen should fall

So why is it shooting up ?!

-

My view is that now is about the best time to be heavier into silver.

Yes there could be dips short-term, but it does look very much like the end of a long consolidation phase.

I think in terms of 6 months not weeks.

-

Ahhhhh...ooooooooohhhh !

1014.40 !

That's quite a jump up !

-

Well, I've had one of those feelings today.

Just waiting to see whether I was right.

1010.10

Rising

-

right I am obviously not completely understanding the gold:silver ratio then. I though you would wait for silver to be a lot higher in price terms first, or does this just depend on what you bought in at & what your silver:gold split is ?

so when the silver ratio is at its lowest, that's the best time to sell your silver ? am I understanding this chart below correctly ?

so that huge spike in '79 was when the pos shot through the roof for a short time ? then you would either buy another hard asset with the currency of your choice, or buy back into gold then ?

edited - I know GF has been talking a lot about this lately.

I still don't use the ratio. Sorry to you guys who do

Remember this thread:

Gold versus Silver, Volatility & Swapping

http://www.greenenergyinvestors.com/index.php?showtopic=3127

This is how I look at it:

I watch the gold price. If gold looks like it's reaching a "top" (ie if it's risen a lot and will probably consolidate for a year or two), then I would swap silver for gold.

If on the other hand I think the gold price is reaching the end of a consolidation phase, and could well rise for 6 months or more, than I;d swap gold for silver.

So this is the sort of chart I look at:

If I don't get the timing quite right I tend to stick with it and wait for the next likely turn.

I don't wobble rapidly backwards and forwards

-

Please vote

Poll: What sort of gold purchaser are you?

A Poll to see if there is any correlation

http://www.greenenergyinvestors.com/index.php?showtopic=7686

-

With friends like GFMS, gold doesn't need enemies!

I cannot imagine a more grudging perspective on gold. It's as if they are trying to get retail holders to sell their gold before it hits the 900 they suggest the correction will take it to.

I would be inclined to lump Barrick, GFMS, and the World Gold Council into what I would call the Anti-Gold.

Gosh you managed to be more polite than I would have

Maybe it's worth noting that the GFMS failed to make note of the gold bought by China. A slight mistake !

This gold fiddling is tricky

-

This duplicates the sort of thing I've been reading:

Ed Steer on Korelin:

http://www.kereport.com/audio/0912-03.mp3

"Sooner or later it's going to bust free, I just don't know whether it's going to be this second".

Personally I don't care. I'm in for the long-term. And I am pretty confident on the long-term

-

IMO this isn't receiving the attention it deserves. If this doesn't qualify as proof the gold/silver markets are manipulated then I don't know what does...

Maybe not on here or in the mainstream.

From my reading this could be a rather complex issue. Those that manipulate and connive sometimes act like spies, with spies, double agents, and triple agents. It's difficult to know sometimes which bit is truth and which is not.

Certainly YET another success for GATA.

-

Interesting to see the usual jokey comments like "bury it in your garden/under your mattress" along with the other predictable phrases such as tinfoil hatters, shot guns and beans, mad max etc... You could almost make a game of anti gold-bug bingo.

The phrase 'goldbug' is a label and like all labels, it allows the person labeling to make out that differences are fundamentally at odds with those from the majority, a process called Antilocution or 'othering' as in other than us, not the same, different, abnormal, weirdo, nutjob, to be avoided.

"First they ignore you, then they laugh at you, then they fight you, then you win " M.K Gandhi

They can't ignore us anymore, though I think in general we are still in the laughing phase at the moment, with just a few very vocal critics up for a fight.

Those posts get to go on the notable posts thread.

Excellent stuff

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

With respect, the other charts that have been posted, I do believe all rely on the official CPI numbers, which I believe to be significantly wrong.

This IMO is more accurate:

Created in April 2009.

See this thread for other charts:

http://www.greenenergyinvestors.com/index.php?showtopic=7906