-

Posts

5,790 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Steve Netwriter

-

-

You might prefer something like this then, ....

Yes, I saw that. Spot on

-

Gold, as priced by the market, has just as much to do with perceptions of the fundamentals as it has to do with the fundamentals themselves. In this sense, Roubini's opinion is significant because people listen to him.

The Price of Gold is Arbitrary

http://neuralnetwriter.cylo42.com/node/3409

"Roubini's opinion is significant because people listen to him." On that, I agree.

-

Roubini:

The price of gold has risen 14 percent this year and traded at $1,252.25 an ounce as of 9:06 a.m. in London.This rules him out instantly for me as a credible source of opinion.

-

-

It's now September 2010, and GoldUS$ did not go below 1,157

http://neuralnetwriter.cylo42.com/node/3389

-

People are simply people, and not reducible to something else [everything is what it is and not another thing]. Reducing a person to something else is dehumanizing.

Oh, and finally...

:lol:

:lol:  :lol:

:lol: There are so many words that are appropriate as an answer to that, and not one of them is possible without me deserving being banned.

Let's just say, I'm laughing my socks off. The ignorance of the Human race never ceases to amuse me.

I'm going to add that reply to my list of quotes. When I want a good laugh, I'll be able to find it straight away.

-

Consider that faith in computation is what lead to the financial mess we are in today.

Faith in the ability to create a good enough system. And the mistake of ignoring chaos theory.

First we had the economists assuming people were rational calculators.Did they? I didn't know that. Is it true?

Then we had the quants and mathematic experts claiming to be able to manage risk by reducing it to mathematic formulae.Yes.

Finally, traditional regulatory concerns were swept aside and seen as quaint "fluffy thinking" which stood in the way of progress and prosperity.Yes.

The primary error was not so much that the computations were wrong, but that people came to believe in the very idea that everything could be reduced to [and controlled by] computation.Why can't they be reduced to computation?

People are not computers.You will need to define "computer".

It might be simpler if you simply say what you think people are.

With my interpretation of your statement, which of course might be wrong, but is the common meaning of that statement, I would say "that is incorrect", and that that statement reminds me of this statement: "The greatest shortcoming of the human race is our inability to understand the exponential function."

In this case it would be rewritten something like this:

The greatest shortcoming of the human race is our inability to understand how our own brain works.

-

For me, something that always bugs me about philosophers is how unwilling they are to recognise and account for irrationality. For instance while reading your rant I was interested in the part about patterns - it's always seemed to me that a lot of what the human brain does is to look for patterns and narratives in the objective world. It is indeed good at doing this, but also many cases of irrationality arise from projecting patterns that aren't genuine (for instance numerology, if you think of the way it affected medieval thought in particular) and from clinging to previously observed patterns and narratives and then interpreting new facts in the light of them (for instance when you get two opposing religious/national narratives you find the two sides of the argument interpret all facts in the light of their previous assumptions).

Philosophers tend to think they are extremely rational and that all problems have an ultrarational solution so they are uncomfortable with irrational thought.

That also leads me to question your last paragraph. Does knowing how the brain works necessarily teach us how to prevent silly ideas and myths? Perhaps it just explains why we are prone to such irrational behaviour?

I agree entirely

I knew I'd worded that last bit poorly. What I really meant was "knowing how the brain works would reduce the tendency of people to make up ideas about how we think, are creative etc".

I agree about being irrational, knowing we are, and why, might help, but I think most people will still be irrational. Positive/negative drawings are a simple example. You can see two different images in one drawing. Which is right? Both. It just depends what you see at the time.

What we see is what we interpret.

The thing about going down to the network level is that it becomes more like computation, and thus avoids the more generalised fluffy thinking, IMO.

-

Hi Steve,

As a (longtimeago) philosophy graduate I feel vaguely compelled to defend philosophy. I read the link and did enjoy it, and you're right that philosophers can be a bit too detached from scientific inputs - though there is some value in that also as science is subject to its own myths and prejudices and occasionally a philosophical perspective can be valuable.

But my main feeling reading your views was that you aren't really attacking modern philosophy, but a dated version of what it consists of - very few philosophers bother to ask "what is the meaning of life" or "where did we come from". Whereas there is a lot of discussion of how neural networks relate to thought and whether the sensation of free will arises from (chaotic or deterministic) brain processes. You have recent schools of thought like functionalism and neural darwinism and the work of Dennett which has a lot of interesting stuff to say on these topics. Your answers to the questions are fine and would probably be all a scientist needs to bother with, but one can see potential problems in them and it is in those problems that a lot of modern philosophy resides.

Hi magpie,

I'm glad you enjoyed my vent

I'll tell you what annoys the hell out of me. I watched so many programmes in which philosophers/thinkers/experts are talking about the thought processes etc.

And NOT ONCE did they mention neural networks, or explain the basics of how the brain actually works. They just talked in generalities. It gives the majority who don't bother to research that the thinking is some mystical magical process, when in fact, it's the way the brain manages to do it that's amazing. They consistently miss the main point, and fail to pass on to people the real wonder of what biology has managed.

I think most people should at least have a reasonable grasp of how their own brain actually works!!!!!

Don't you? It would for example help them to understand how their kids are developing. And it would prevent stupid myths and silly ideas from being accepted.

Yes, there are people doing some real sensible and exciting work, although I'm a little behind on recent research

-

I've just been checking out this Tom O'Brien guy after his latest apparent call failure.

I found this:

LOL..This guy called a top in Gold @ 1039.5 in October of last year, right before it surged to over $1200. People who took his advice are still waiting to get in below 1039.5, as it hasn't fallen to those levels since.The truth is none of us are prophets. Short term trading calls are very difficult to make, which is why I don't even try. Long term, gold is bullish.

http://neuralnetwriter.cylo42.com/node/3339#comment-4971

He based his prediction on the link between the US$ and GoldUS$, and got it wrong.

-

When you see the demand for physical gold/silver go up, and the price go down, you know something "odd" is going on.

Buy physical, and forget the paper price and all this trading nonsense.

-

Not much argument from me with the above.

Perhaps you missed the "Weimar, could it really happen here" thread.

I had no time to follow most threads.

-

Following on from the June thread: "The WORLDS No1 gold trading timer" Tom O'Brien sold ALL his gold at 1236 USD and went short saying we would be visiting 1056USD. This guy is apparently the WORLDS best and he seems to have gone a little stray on this one. Those who followed him may have made a bit money going short ASSUMING they have now closed their positions BUT will still hold NO gold! If they want their position back they will have to give up a good chunk of their profits if they want actual physical back.

That's why I keep pounding the table about averaging in. The WORLDS best can't seem to get the exact timing right!

8 more trading days left till the end of the month.... lets see where we are then.

The latest King World News interview with James Turk is a good listen. Are they referring to O'Brien by any chance?

http://www.kingworldnews.com/kingworldnews...James_Turk.html

It's looking increasingly unlikely that GoldUS$ will get down to 1100 in August:

I think people like Tom O'Brien are, how can I put this nicely,..... unwise

When I saw what he'd said, I laughed.

I guess his account will judge him LOL.

-

How is it wrong? Where is the disagreement?

I think Goldfinger's replies cover it pretty well.

My position is that the dollar can become significantly cheaper when buying with gold while at the same time the dollar can become more expensive against other currencies. It's all relative; the other currencies will become cheaper against the dollar, and very cheap against gold.First, I applaud your wording: "cheaper when buying with gold".

I think the purchasing power of the US$ will decline drastically. Picking the currency that falls least seems like a bit of a futile exercise.

I suggest you re-evaluate the hyper-inflation theory. Our positions are after all theoretical.... fallible. I'm fully prepared to jump ship if my working hypothesis ceases to work, but it's worked for me just fine so far [a theory is a good one if it is fruitful].Hyper-inflation is not a theory. It's the name given to a known and recorded process. ie there are examples of it.

Maybe a clear definition is required, and agreed upon.

Inflation

Can be defined as:

1. An increase in the amount of currency in the system - the correct definition.

2. An increase in prices - this is wrong.

3. A process in which the economy grows, wages rise, borrowing increases, and prices rise. - This has some merit, but is also wrong.

It is better to stick to descriptions of the component parts, because no word can accurately define any process which involves many factors. eg during an inflationary process wages might not rise. Is it still an inflationary process?

Hyper-inflation

1. Is NOT high inflation.

2. Is caused by a lowering faith in the currency, in which the currency is treated like a hot potato.

3. Is a very poor term to use.

For a more complete description: http://neuralnetwriter.cylo42.com/node/3337

[also, is it too much to ask to keep the conversation civil.... navel-gazing would have sufficed.I picked what I thought was the most apt analogy. I will explain. I view philosophy like this:

1. There are inputs, and with philosophers those inputs are limited, as most philosophers are scientifically ignorant. It seems to me that philosophers tend to reduce the inputs to just their own thoughts, and those of other philosophers.

2. There is the philosophical process. Again limited to philosophical type thinkers.

3. The result, is often rubbish, best treated with care, and discarded carefully.

I hope you can see the merit of the analogy, and why "navel-gazing" is less appropriate.

You can if you wish see my views on philosophy, and my answers to all the common questions like "what is the meaning of life?", here:

http://neuralnetwriter.cylo42.com/node/3335

Don't you think the term "judgement day" was a bit dogmatic/ moralistic?I meant it in two ways:

1. The market will judge your decisions.

2. In the way history judges people. For example, how does history judge Hitler? What you do and say, specially in public, is likely to be seen in context, at a later time. If for example you drive and don't put your seatbelt on, then crash, and hurt yourself, people will judge your actions. I suggest they will have less compassion.

I'd add that an awareness of philosophy encourages a healthy scepticism and tolerance towards other's views while discouraging dogmatic conclusions]I'll give you that

-

Indeed, the dollar could end up outperforming all currencies bar gold.... and perhaps Yen.

I suggest that conclusion is wrong.

As such, I suggest you re-evaluation your position, and find one which allows for the US$ to become significantly cheaper when buying with gold.

I think you are greatly under-estimating the change that is coming.

I'm going to avoid getting into the philosophy discussion, as for me it's like looking up your own anus. Not very fruitful.

And can also lead to equally stupid conclusions.

-

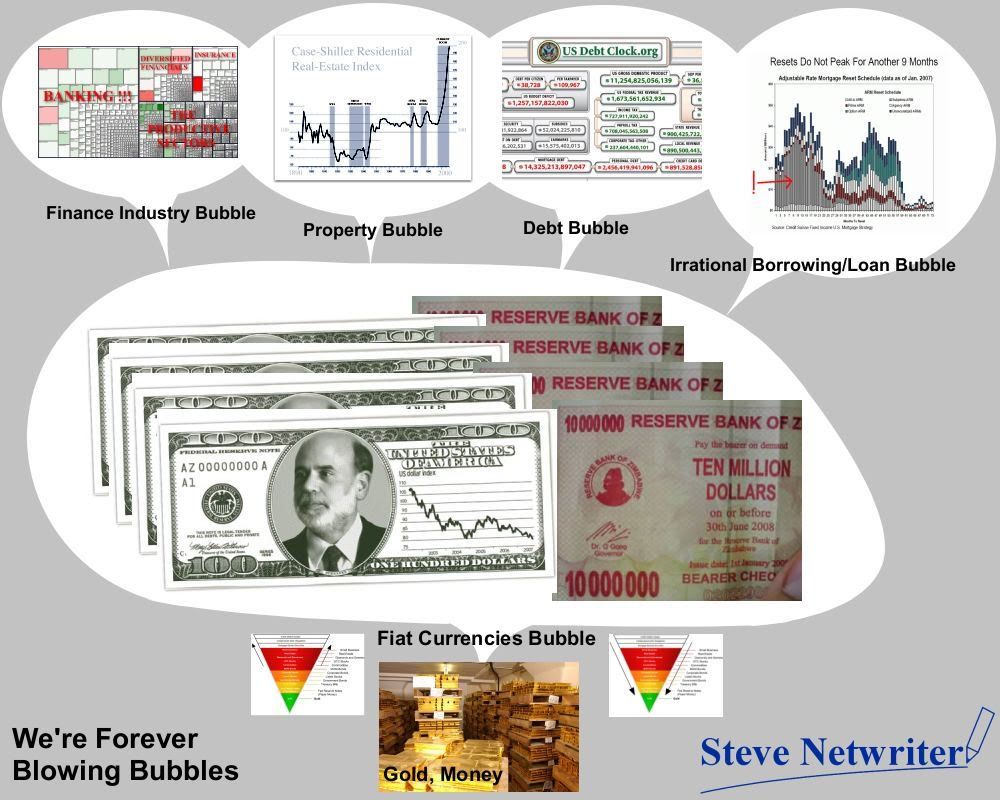

I think the new GEI header is relevant to this thread:

I have little time for EW.

Seeing that header "you can't prepare for both", I now have even less time for it.

Oh, in case I'm not being clear. Yes you can. Gold.

-

Price is in the eye of the beholder

Schaublin said:

http://www.greenenergyinvestors.com/index....st&p=179701

I agree with this but the problem is; the purchasing power of an ounce of gold fluctuates - say within a month, it may purchase 5 percent more or less than the nominal dollar price of an item. Within this short time frame, a loaf of bread or gallon of fuel will be the same or possibly a bit higher priced in dollars - so some get locked into thinking the Sun orbits the Earth! IMO, only when prices are rising visibly, monthly, will people (some) begin to use an ounce of gold as the reference point.Even more confusingly, when very high inflation starts, the purchasing power of gold will increase faster than the decline of the fiat currency due to gold's universal store of wealth attributes being more valued.

Some refreshing insights on your blog BTW.

First, thanks

This is a great point, I'd like to write and think about as I write. I'm going to write from my point of view as someone living in NZ, and hopefully make an interesting story from it.

I walk into Countdown, the NZ version of Tesco in England, only on an NZ scale, much smaller. I buy some cheese. It used to be about NZ$5 a kg (4 years ago), but now it's more like NZ$10 to NZ$12. I pay with cash, NZ Dollars, or I use a piece of plastic which takes NZ Dollars out of my account and puts it into the shop's account.

So yes, the main currency of New Zealand is the NZ Dollar, no surprise there.

And like everyone living here, I naturally use and think in terms of those NZ Dollars. Everything gets priced in NZ Dollars.

But, unusually I suspect, I don't have my cash in an NZ$ account!

I keep my cash in a JPY account, and transfer what I need for the next week or three into NZ$.

This is because I expect a downward trend in the NZ$ versus the JPY, and interest rates are low, and I think the JPY will offer a better short-term store of wealth and cash for day to day spending.

Now, I know that is probably very unusual, but there it is.

So, should I think in terms of NZ Dollars, or in Japanese Yen?

I should really think in terms of JPY, but I don't, I still think in terms of NZ Dollars. Being originally from England, I sometimes even convert back to Pounds!! But, if I want to buy something little more expensive than usual, I do take the exchange rate into consideration. I think "that camera will be cheaper if the exchange rate is lower".

This shows that we have a local currency, the NZ Dollar, which tends to influence everyone's thinking here in NZ.

Even me.

Sure, a local economy will have local prices in the local currency, which tend to vary as local products and services do. The main influences will be wages, petrol prices, supply and demand etc. The price of local apples will go up and down, but wages will change more slowly.

Now, suppose there is someone in England who wants to migrate here. And they want to buy a house here when they arrive. So they get on the internet and look at the property websites. They see prices in NZ Dollars. But, what do they think in? I bet they convert NZ$ back to GBP, and think in terms of that.

So they don't see NZ$ house prices, they see GBP priced houses. And that price varies with local NZ prices and the exchange rate. Now, the exchange rate between the currencies becomes significant, and can vary the price they see far more quickly and dramatically than the local variations.

The exchange rate variation moves the price around, and changes the demand from migrants.

With our current monetary system, inflation (the increase in the amount of currency), is the norm. In fact it's openly stated as desirable. Deflation is dreaded.

This means that long-term the amount of currency increases, and usually more quickly than the economy grows, leading to long-term price rises. So locally, here in NZ, we see prices rising from year to year. That's the normal thing.

The problem is, by only using that metric, we don't see what people in other countries can see, like the price of NZ houses priced in GBP, and nobody in the world, each with their own local currency, can see what is happening to their currencies. They just see prices rising.

Each possible method of pricing will have advantages and disadvantages, and will be influenced by a different set of factors.

Pricing everything in terms of gold will have the following advantages:

1. It will include the devaluation of the currencies.

2. Over the very long-term, prices of things in gold stay roughly the same if no other factors change.

Pricing everything in terms of gold will have the following disadvantages:

1. Short-term, fluctuations in the price of currencies will cause prices of local goods and services to vary, when in terms of the local currency they have not. Just like pricing NZ houses in GBP will vary.

As I hope to show in the coming days, when you make that paradigm switch, and price everything in terms of gold, things become clearer, and it's possible to chart price changes more easily. The results are more clear.

And most importantly, it's easy to compare prices which before were less obvious. For example the price of houses in NZ and England, because they are both priced in the same way, in oz of gold.

The price that matters to someone will differ from the price that matters to someone else, like the NZ$ price of a house will matter to someone living here, and wanting to sell and buy things in NZ$, but the price in GBP will matter to someone in England wanting to buy an NZ house. The value of something matters to you if you have it or want it, and the price depends on what you're swapping it with.

But, for a clear picture of worldwide prices, and in order to escape the blinkers of the fiat currencies, price everything in oz of gold.

-

But you've just derided [by implication] non-Brights here with; "the superstitious, who bind themselves with their own imaginary creations"

Not at all. Some people like to be "bound" by rules or conventions. Many find religion makes them feel better, makes their inevitable death less scary. I have no problem with that, nor do I deride them for it. It's understandable.

I simply contend that it's a man-made system, and limits thought to those concepts that fit within that system.

I do find it fun watching people tie themselves in knots over a self-invented/created system though.

It's almost like "what a tangled web we weave"...

-

This caught my eye when reading FOFOA's latest article:

Now, on the other hand, this "modern day middle of the spectrum"! Well, they have read why we need gold, but they have never "Experienced" the need for gold! Until that day, when they gain "Experience", most of them will make "A Gamble That They Never Intended To Take". Yes, they do invest in all forms of paper and or leveraged gold and all the while, expounding from the roof tops the coming currency crashes and stock market declines. Even looking for bank closures and bank runs, as they cling dearly to comex options and gold stocks!Anyone, from the outside looking in can clearly see that "westerners" do lack "experience".

As I said before, judgement day is approaching, pick your side.

http://fofoa.blogspot.com/2010/08/two.html

-

Let me guess, brights don't believe in free will either, and think reality has vanished in a puff of logic/ mathematics.

What's the opposite of a "bright"? I'd prefer the label of dark to dull.

I think Brights have more free will than the superstitious, who bind themselves with their own imaginary creations.

The name "Brights" was chosen with care. It is supposed to be positive. For that reason I won't deride non-Brights by suggesting any label.

-

It's a little disappointing seeing people on here still thinking/talking in terms of "the gold price".

If you stick in the modern misleading paradigm where all is based around fiat currencies, you'll also be stuck in a misleading thought process, IMO.

Announcing the Steve Netwriter Gold Currency Index Version 1 (SNGCI v1) 19th Aug 2010

http://neuralnetwriter.cylo42.com/node/3303

(ID5, I've finally done it

)

)Those who say "that gold price prediction is ridiculous" are really saying "that prediction of how far the US$ etc can fall is ridiculous".

I don't think so.

Let's stop this "how far or fast gold is going up" discussion, and instead talk about "how far/fast the US$ etc are going to fall".

By the way, did anyone spot this news:

Singapore Mercantile Exchange (SMX) will start trading gold futures with physical gold delivery on 31th Aug 2010

http://neuralnetwriter.cylo42.com/node/3298

Sounds significant to me.

-

All a bit too... Manichean for me.

That's pretty funny (and shows a misunderstanding) considering I'm a Bright:

Think about your own worldview to decide if it is free of supernatural or mystical deities, forces, and entities. If you decide that you fit the description above, then you are, by definition, a bright! -

Question, how much money would you tie up in Gold?

Or, how much money (gold) would you tie up in currencies?

16th Aug 2010, GoldUS$=1,217. Time is running out if the US$ is going to get up to 1,100 in August.

-

I don't see it in such black and white terms as that. What's with "judged"?

Judgement day is approaching, pick your side

http://neuralnetwriter.cylo42.com/node/3280

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

I'll reword that for you

US$ looking WEAK to take out the all time LOW. The price looks fairly WEAK here after having had a period of time to consolidate at these levels