-

Posts

3,274 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by frizzers

-

-

Anyone would think Mr Sun has been reading Frizzers in Moneyweek!

-

From J. Turk,

I question the accuracy of the latest entries. A negative interest rate means that central banks (the biggest lenders of gold) are willing to pay someone to borrow gold from them, which although possible in theory is not likely in practice. Short-term interest rates for gold though are near zero as few people are willing to borrow gold in a bull market and thereby incur a gold liability. Also, the near-zero interest rates to borrow gold are the result of falling demand for borrowed gold as US dollar interest rates have declined, as this event has considerably reduced the size of the margin on gold carry trades.

-

Theodore Butler is a very well respected by some writer on silver and the silver markets. He has long believed that the Silver Comex is one of if not the most manipulated market and that the short position is verging on the illegal. He has long been saying that sooner or later there will be a supply squeeze.

His critics say he is too extreme and has never been proved right.

I enjoy his writing and his observations very much. He seems to know what he's talking about. I wouldn't attempt short-term trades based on his analysis, but I would buy physical. Indeed one of his views, I believe, is that if everyone actually took delivery of physical the silver price would rocket. At the moment it is held done by paper contracts.

-

Butler's latest:

As I have written recently, there are unusual patterns that strongly suggest that the silver shortage may be at hand. The delays of silver deliveries into the big silver ETF, SLV and the inability of the US Mint to keep up the sudden and persistent demand for Silver Eagles are two important and visible clues. Currently, there are many reports of widespread tightness in many wholesale and retail silver outfits.

-

BTW that gold to oil ratio looks GIP -ish

-

The thing to note is that juniors have been trading with financial stocks, not like gold.

If we get Martin Armstrong's turn this weekend, then hopefully the bottom is in for juniors.

However, if gold and silver continue to sell off the juniors will get further hammered. It's kind of heads you lose, tails you lose.

In The Privateer Newsletter, Bill Buckler wrote:

When Buying Becomes Cheap:

As can already be seen from coast to coast inside the US, housing is falling in price. Supply is enormous

and still climbing. The same situation, in principle, applies to all areas of a credit money system economy

as credit contracts. The economic areas where prices will be falling are the areas which earlier were the

greatest recipients of credit during the upswing. Since the business cycle is always a follower of the

credit cycle, it follows that the business cycle will here too follow the present downswing of the US credit

cycle. That is why a steep US economic recession is now unavoidable, regardless of any and all

“facilities” the Bernanke Fed will try to roll forward. The real issue is CAPITAL.

Juniors have been a just such beneficiary of all this credit.

The chart below shows the CDNX vs the DJ Financials vs GOLD - you can see the CDNX peaked in Feb 2007 (Armstrong's last turn date) at exactly the same time as the financials (yellow line).

The CDNX performed best during the period when gold and the financials were rising in tandem - in the lead up to May 2006. Let us hope we get such an occurrence again.

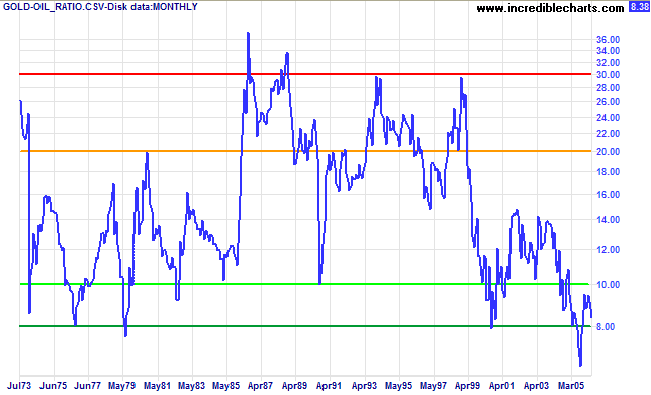

With regard to the producers and late stage development plays, we need to look at the gold to oil ratio, with oil as a proxy for mining costs. Though gold has gone up, oil has gone up by more. When gold starts out performing oil the HUI should outperform the metal:

Here is a long-term gold-oil chart.

The received wisdom is:

* Buying opportunities (for gold) when the gold-oil ratio turns up at/below 10 barrels/ounce; and

* Selling opportunities when the gold-oil ratio turns down at/above 20 barrels/ounce.

We are around a buy-point for gold stocks according to this strategy, though the ratio has not turned up.

Though gold may not be rising so dramatically in dollar terms - it may even fall - we need to see it rise against other commodities.

-

This hs to be one of the best articles I have read on gold and yesterday's interest rate cuts I have read in a long time:

http://www.moneyweek.com/file/44016/why-th...s-for-gold.html

But then I would think that ...

-

OK I'm not sure whether this should go into one of the other threads, but here goes:

It's pretty clear to me now that fiat is slipping badly and that the pound in particular is vulnerable (after the dollar). Everyone here does not need convincing re: the merits of PM as a hedge against weakening fiat value (which is why presumably we're not all raving about forex as a way of hedging positions.) My motivation is not holding value when paper becomes worthless a la weimar, but in protecting my paper purchasing power in the coming bernanke stagflation (I still think it's possible that we could deflate after this period). Hence I use ETFs and spreadbetting rather than buying physical (although I do have a small physical position, and hold PM equities in ML GandG). I've been following PM movements for 2 years now and wish I'd had the courage of my convictions sooner than this.

I've been making reasonable sums from spreadbetting, mainly to get the practice - starting from a very small position I've quadrupled my money, but have 'lost' a good few £ on downswings in the process. I'm now considering taking a large position (for me) in silver at £25 per point (1 point = 0.5c, i.e. I make £5K if silver goes up by a dollar). Clearly with such a large position I need to be mindful of stops, not wanting to stop out too soon. It also seems futile to chase stop losses around the price given that silver can easily swing around 50-80c + per day. I'm thinking of a stop at just over $18 dollars and placing a stop sell order at $18 to cover myself in the event of catastrophe in POS. I'm 'happy' to risk £5-£10K on this play as I'm so concerned about the value of my savings (I hold no assets other than cash at the moment). I can't see a major downside to this position, other than possibly losing £10K of paper if I hit my stop and silver then stalls, which I'd 'lose' through inflation anyway over the next 12 months and the upside is obvious ('profit' of £45K paper if silver hits $30).

You guys have finer minds than me, so at risk of presumption I'd be grateful for opinion on this strategy. I'm aware of the process risks around spreadbetting per se, but my experience with the company I use is that they always trigger stops and orders when I want, and their customer service is very good.

Of course, if f***ing interest rates were set responsibly, I wouldn't even be thinking about this play

Silver is very hard to spreadbet I find. The most effective strategy imo is to take a much smaller position, so you're under less pressure, and treat it as physical riding out whatever comes your way. Then when you're not expecting it the silver chart will suddenly spike, as it has done since December - that is when you should think about taking some profit. I hope I'm wrong as I own shedloads of physical, but I'm not sure silver is a buy just now, unless your just nicking 50c gains here and there. It's quite a long way above its 200 dma.

-

-

The above from Sinclair's site is an excellent post and I recommend re-reading it.

It also shows a very simple way of valuing mining companies, for those that have trouble doing so.

-

From Sinclair's webite.

Hi Jim,

As a young tad, I worked in several Canadian hard rock PM mines from jackleg drilling to drill core interpretation. I know the B from the BS regarding proven reserves and factors governing the viability of a start-up, but these juniors have me stumped. My modest portfolio is exclusively precious metal juniors with more than adequate proven reserves, and a mine in operation or close to it. I’ve been diligent in making sure that none of them are hedged yet still they are greatly underperforming in relation to the price of gold.

Does Jesse’s advice to “sit tight” apply to juniors with good credentials, and if so, what will be some signs of these juniors unhooking from the general market decline in the future? You and Dan are the major reason I have not and will not cut and run in the insanity of the present market.

Sincere gratitude;

CIGA Hardrock GH

Dear CIGA Hardrock GH,

The hedge funds are long the Barricks of the world and short ALL the juniors. The hedge funds have over-priced the big guys and under-priced the juniors.

Here is the question that needs to be answered:

With gold headed to $1650 what do you think your junior with 1,000,000 ounces of 43-101 compliant reserves and a deposit strike length of at least 4 kilometers would be worth? Here's a back-of-the-envelope estimate:

1,000,000 times $1650 minus a $300 total production cost per ounce.

In ground value: $1,650,000,000 (not including recoveries)

Cost of extraction: $ 300,000,000

Amortization of plant and equipment over say a 10 year mine life: $200,000,000

Value:

Value of the asset $1,150,000,000.

Now let's say the deposit goes to 5,000,000 ounces contained. In this case five times $1,150,000,000 is the value - all things being equal.

Does the enterprise plan to produce or will they sell the asset when it matures, say two to four years past initial production?

If they plan to produce for their own account, then the value is a combination of discounted present value times cash flow.

If they plan to sell the property, it is asset value. If the last sale of such an asset was at "x" euros times ounces contained, then the starting negotiation would be a premium above "x" euros times ounces contained plus a value for gold contained within other resource categories.

The hedge funds can play all the games they want but they will fail on valuations as gold goes to and through $1650. My personal money is wagered on my words.

So those that are demoralized should sell and stop the pain.

I am significantly committed and intend to continue my commitment with every cent I have, no margin.

Regards,

Jim

THEN

Dear Jim,

Looks like we are going to have a repeat of the 70’s with some gold shares. They won’t move until they do!

Alex

This is the chart for Hecla in the 70s (It's somewhere around $10 now BTW)

Dear Alex,

This is what few of the present gold share holders and hedge fund operators understand.

From 1970 to 1979 on balance the entire junior gold and silver category lagged gold and silver themselves until it was obvious that both metals were going ballistic. The junior precious metals then outperformed gold and the major gold shares.

As each Angel is taken out we draw closer and closer to the same action of the junior gold shares as was true in February of 1979.

The hedge fund operators are long the gold share majors and gold ETFs and short every junior under the assumption that the gold share leaders and gold itself will outperform the gold juniors.

Soon they will experience February 1979 and screw up their spread badly.

The more emotional and disillusioned emails I get the nearer we are to that point of a significant, immediate and violent up move.

I am a man of patience, but also an elephant hunter.

Study the chart of Hecla below, as it was almost the same action with every gold and silver junior from 1970 to 1979.

Regards,

Jim

-

A lot of eyes at HPC were on yesterday's Allsop auction of residential property a lot of which is in London.

We didn't get the falls a lot of people were looking for. In fact in many cases the opposite.

http://www.housepricecrash.co.uk/forum/ind...showtopic=68226

-

And EVENTUALLY, we will see the bull move of a generation, which they may disbelieve

You really think so?

-

More good news and the stock traded down it.

I really like this company. It is my largest single position and I treat each share as though it were a physical piece of metal. So there.

Gold Resource Corporation's El Aguila Project Returns 1m of 34.3 g/t Gold Within 9m of 1.4 oz/t Gold Equivalent at La Arista; 10m of 0.55 oz/t Gold Equivalent at El Aire

Monday February 11, 1:07 pm ET

DENVER, CO--(MARKET WIRE)--Feb 11, 2008 -- Gold Resource Corporation (GRC) (OTC BB:GORO.OB - News) (Frankfurt:GIH.F - News) reports 1 meter of 34.3 g/t gold within 9 meters of 1.4 oz/tonne gold equivalent (AuEq) at its La Arista deposit and 10 meters of 0.55 oz/tonne AuEq at its El Aire deposit. The La Arista and El Aire vein deposits are part of GRC's El Aguila Project in the southern state of Oaxaca, Mexico. The El Aguila Project is targeting gold production the second half of 2008 subject to timely obtaining the remaining required permits, regulatory approvals and equipment delivery schedules.

Recent drill highlights include:

La Arista Hole # 7089 (-45 deg

Vein # 1

-- 1 meter of 34.30 g/t gold, 1375 g/t silver, 1.57% copper, 5.99% lead,

6.97% zinc, (or a gold equivalent* value of 86.67 g/t

(2.79 oz/tonne)) and,

-- 1 meter of 15.00 g/t gold, 1040 g/t silver, 0.71% copper, 1.61% lead,

6.10% zinc, (or a gold equivalent* value of 49.80 g/t

(1.60 oz/tonne)) within,

-- 9 meters of 6.90 g/t gold, 894 g/t silver, 1.26% copper, 3.88%

lead, 6.08% zinc, (or a gold equivalent* value of 43.65 g/t

(1.40 oz/tonne))

Vein # 2

-- 1 meter of 10.95 g/t gold, 1605 g/t silver, 0.54% copper, 0.63%

lead, 1.14% zinc, (or a gold equivalent* value of 49.65 g/t

(1.60 oz/tonne)) within,

-- 2 meters of 8.69 g/t gold, 1788 g/t silver, 0.61% copper, 0.47%

lead, 0.91% zinc, (or a gold equivalent* value of 50.99 g/t

(1.64 oz/tonne))

El Aire Hole # 7292 (-61 deg)

-- 10 meters of 2.16 g/t gold, 288 g/t silver, 0.43% copper, 1.49%

lead, 3.93% zinc, (or a gold equivalent* value of 16.94 g/t

(0.55 oz/tonne))

The present drilling focus of GRC is to define the La Arista deposit's three parallel veins, each with significant underground mining widths. Currently, Vein # 1 is 8-10 meters wide, Vein # 2 is 5-6 meters wide and Vein # 3 is 2-4 meters wide. As previously stated, current drilling has shown ore grade mineralization over 300 meters of vertical extent but with all veins open in strike and depth.

Recent La Arista and El Aire drill results include:

AuEq*

Hole Angle From Interval Au Ag Cu Pb Zn AuEq* oz/

# (deg) Meters Meters g/t g/t % % % g/t tonne

--------- ----- ------ -------- ----- ---- ---- ----- ----- ----- -----

La Arista

7089 -45 142 1 10.95 1605 0.54 0.63 1.14 49.65 1.60

7089 -45 143 1 6.42 1970 0.67 0.31 0.67 52.34 1.68

Average 2 8.69 1788 0.61 0.47 0.91 50.99 1.64

7089 -45 235 1 2.45 1895 1.27 1.56 2.78 53.22 1.71

7089 -45 236 1 3.36 2370 4.30 2.41 4.56 77.75 2.50

7089 -45 237 1 1.70 234 0.70 10.90 14.75 43.74 1.41

7089 -45 238 1 0.43 126 0.46 4.73 5.32 18.33 0.59

7089 -45 239 1 1.33 330 1.25 2.54 5.37 23.04 0.74

7089 -45 240 1 1.02 121 0.30 2.07 4.48 13.30 0.43

7089 -45 241 1 2.48 558 0.75 3.12 4.36 27.04 0.87

7089 -45 242 1 34.30 1375 1.57 5.99 6.97 86.67 2.79

7089 -45 243 1 15.00 1040 0.71 1.61 6.10 49.80 1.60

Average 9 6.90 894 1.26 3.88 6.08 43.65 1.40

El Aire

7292 -61 225.5 9 2.12 286 0.42 0.99 3.93 16.07 0.52

7292 -61 234.6 1 2.53 304 0.55 5.58 3.97 24.10 0.77

Average 10 2.16 288 0.43 1.49 3.93 16.94 0.55

--------- ----- ------ -------- ----- ---- ---- ----- ----- ----- -----

*(Gold Equivalent (AuEq*) in chart using gold at $650/oz, silver at $14/oz, copper at $3.10/lb, lead at $1.40/lb, zinc at $1.20/lb) Assays by ALS Chemex, Vancouver, BC Canada

Gold Resource Corporation's President William W. Reid stated, "The La Arista deposit was discovered less than 7 months ago and since then drilling continues to intercept impressive high-grade gold and silver values. The 1 meter intercept of 34.3 g/t gold (with 1375 g/t silver) is the highest gold intercept to date at La Arista. The La Arista deposit alone, with the gold and silver grades we are intercepting, has the potential to provide us the ability to produce 100,000 to 120,000 ounces, or more, of gold and/or gold equivalent per year. Once La Arista production begins (targeted to begin in the second year), GRC's gold equivalent (AuEq) production numbers will only include precious metals (gold and silver) with silver values converted to the equivalent gold ounces. First year production is targeted from the El Aguila Project's high-grade, shallow El Aguila open pit."

The significance of the La Arista intercepts can be illustrated by relating them to the potential annual production of the proposed El Aguila mill. The 300,000 tonne per year mill with an average head grade of only 11 grams per tonne gold produces 100,000 ounces of gold per year. Equally, a silver grade of 500 grams per tonne through the mill would yield 5.3 million ounces of silver which equates to a gold equivalent (AuEq) 100,000 ounces. A head-grade through the mill containing a combination of both gold and silver values, such as those shown by the intercepts in this and previous press releases for the La Arista deposit, are capable of producing 100,000 to 120,000 ounces, or more, per year gold and/or AuEq. The La Arista deposit has many intercepts exceeding these threshold values.

Gold Resource Corporation is very fortunate to have a polymetallic deposit at La Arista. The benefit of polymetallic ore (polymetallic being gold, silver, copper, lead, and zinc) is while recovering gold and silver, valuable base metals (copper, lead, and zinc) are also recovered. Any base metal revenues are in addition to the gold and silver revenues and are applied against production costs of gold and silver. The net effect of La Arista's impressive polymetallic ore is that yearly production of 100,000 ounces or more, of gold / AuEq (gold and silver) will result in very low cost, or possibly even negative cost, of production. This is in line with industry practice as evidenced by Agnico Eagle, Goldcorp and others who use base metal production to lower gold production costs.

The rapidly expanding La Arista deposit will continue to evolve as to its average estimated grade but with this recent high of 34 g/t gold and the previously reported high of 5,000 g/t silver, La Arista's grade appears to be trending higher, especially in precious metals. The high-grade La Arista deposit is scheduled to commence processing during the second year of El Aguila mill operation.

Though GRC's main focus continues on the La Arista area, a recent step out hole (# 7292) at the El Aire deposit, which has not been drilled for several months, extends the El Aire vein mineralization south by 70 meters. El Aire vein mineralization is open in both strike and depth. The El Aguila Project continues to grow in the El Aire/La Arista areas where mineralization now extends 700 meters along strike.

Mr. Reid continued, "We are very pleased with the progress of the El Aguila Project. Our aggressive exploration program continues to reward with exciting high-grade gold intercepts. We recently began construction at the El Aguila Project with the mine and mill road. Mill equipment procurement is progressing well and we are expecting the mill/tailings permit shortly. Gold Resource Corporation is moving forward on all fronts as an emerging low cost gold producer and, as of now, is on course to begin production the second half of 2008."

-

No, they rose in parts of London at an equivalent annualized rate of 27-28%.

I'll try and dig up the source.

-

I knew you were going to say that. I can't remember the source but I read it on HPC. Either Halifax, Nationwide or Rightmove.

-

According to latest data, Ken and Chelsea continues to rise at an annualized rate of 27%.

Rises also for Hammersmith and Fulham and Westminster.

This 'crash' hasn't reached prime Central London yet.

-

Gold:Silver ratio has broken out. (The wrong ay for silver bugs).

-

If gold goes back to 850 (I can't believe I'm sayingback to 850!) and even beyond, the juniors will get even more horrible.

Where do you see gold going from here, Dr?

-

-

COMPLETELY!

On virtually every junior.

Walk - would you mind starting a thread on some of the NatGas jnrs you're following?

I'm bullish on Nat Gas but I don't know that many companies.

-

-

Sorry edit - mine is TSX:CN Condor - a different company altogether.

Apologies.

-

Yes, I own some Condor from about 50c last year. I sold a lot of mine at around $1, but I still have a few shares. It is one of the few juniors that has bucked the recent nasty trends. The reason? In my opinion, lack of dilution.

I really like it - and if you bought last Monday you'd be sitting on a near 50% profit already!

Central LONDON Property: Databank & Charts

in Monitoring: Data, Bellwethers, Forecasts

Posted

Mortgage Drought as Economy Faces Plunge into Recession

QUOTE

Cheltenham & Gloucester, part of Lloyds TSB, has instructed brokers that borrowers who work in the City and whose income depends on bonuses are not to be trusted. If they have bonuses of more than £100,000, they should be referred to underwriters and must provide their bonus history for the past two years and details of any anticipated bonuses.