-

Posts

1,802 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by azazel

-

-

I am looking for some better coin boxes to protect my gold coins. I currently have these plastic tubes that can hold 10 coins but I have lots of naps folded in paper. What do you use guys use and where can I purchase them?

thanks.

I wrap my silver coins in cling film and store them in MDF boxes I made myself.

-

Is his track record of market calls any better than his appalling taste in ties?

All ties are rediculous IMO and one day will finally be unfashionable and then people will look back and see how stupid they look. Its like wearing a hangmans noose round your neck under threat as if you are a slave! Maybe thats why its compulsary to wear one in many workplaces.

-

-

Just had a look. Nice to see spot silver on the chart.

Months back somebody mentioned September as a possible start month.

They have a new photo on the site, I suppose when they got the Queen's award:

I was told by BV that they had a september target to start silver.

-

Sub-$500 gold ?

Get a grip !

Get a grip !Who was that GEI poster calling $400 a few months back ? Produced all sorts of weird and wonderful charts to support his waffle.

That would have been Ker who last posted 3 May 2009. Extradry Martini bet on a huge drop in price as did Realist bear over on HPC.

bigtbigt is holding out for sub £500 GBP gold.

-

BigT,bigT, what will you do if there is no dip in gold? I know you are up because of cable, but will you get back in atr $1050 or what?

-

Silver to fail first!

Your homework for tonight...

I've been told to watch all 5.

I'm just into 1.. very good so far!

Please can you explain what they are about as Im on a dongle in the hills. Thx

-

Id rather have £22,000 worth of gold bullion and a cheap phone thanks!

-

You don’t mention any exempt items when you fill in a Self Assessment.

Gold Sovereigns & Britannia are exempt because of TCGA92/S21 (1)(B )

TCGA92/S21 (1)(B ) says all Sterling Currency is exempt from CGT. The Silver Britannia (£2) is Sterling currency – like the Gold Britannia (£100)

Thanks.

-

I see CID have some more five 9s maples back in stock. Id recomend getting one of these as they are a much better looking coin that a standard maple and come in a display card with COA.

I doubt you will get red spots on one of these

-

How do you go about declaring that you made a capital gain but that its exempt due to it being sovs or brits? Does the exemption apply to silver brits?

-

Some of the most entertaining threads and posts I have read were cgnao. A great one was when he posted "I have just heard something from a reliable source about an unprecedented event that I cant tell you about" The thread was frenzied for hours!! This was when HPC had a great buzz durring the start of the collapse, before the rift with the gold bugs. Top quality poster IMO, and I like his posting style.

-

Im ready! Fully stocked in gold and silver. Nice to see you again dude.

-

got me some catching up to do....

anyone heard from Pluto lately ?? is he still posting ?

I havent seen pluto for ages, or cgnao. They will be back once the eye of the storm passes, I think.

I have just moved house too grumps. Sold 2007, rented a relatives holiday home for 2 years and now renting a fab place in the country for a bargain price. I may live here for many years and buy a place one day just to rent out and help me pay my rent.

-

42, thats old. Im 40

Gerald Celente on gold.

http://www.youtube.com/watch?v=QhnZHSECa5Q...feature=related

-

Im pleasantly suprised how well gold is holding up durring these summer months. I have been away for some time due to moving house and I lost my internet connection, so I have not been able to keep up with things. I hope everyone is OK.

-

Thats strange. Ive had little bars of silver in those polybags and no problems. I have my philli coins wraped in cling film, so I better check they are ok. Perhaps its what you stored them near that has effected them but you would think the polybags are airtight.

-

Now that's a seriously interesting idea!

Are we allowed to buy/sell gold between ourselves? I don't see why not. We could reduce costs/fees dramatically, and when the real gold is in Switzerland it brings added safety.

I'm not ready to buy in yet (expecting further downside in GBP PoG), but would be keen to discuss buying from some of you guys when I get to that point.

I can also point you to (help you with) cheap ways to buy and store in Switzerland.

I might be interested in offering to sale some coins or bars of gold and silver in the future. How do you think the best way of arranging the trade is?

I could show my ebay account as a reference and then accept a cleared cheque or bank transfer before posting, or cash on collection.

Id rather sell to a member here than sell to ATS or on ebay and let ebay and paypal take a huge slice! Like war pig Im not selling yet either but I might sell a kilo of silver or something.

-

All that Head & Shoulders talk looks like it was a load of old toot now. I wish I'd got out in March - can't believe I couldn't see the wood for the trees. If this looks like going any further down in GBP I am going to seriously consider pulling out and taking my (now quite small pile of...) profits with me.

I'm in a similar situation to you I guess. Im optimistic that gold will make a move this winter. Its easy to say you wished you got out in march. I wish I had picked last weeks lotto numbers and the week befores! I will seriously consider getting out of gold when its at a high, not a low.

-

I just got a pile of Eagles for £11 each as a private deal from an ebay seller. Otherwise I would be stocking up on some Philli's.

Im staying out of houses hoping for further falls this winter, and renting a fab place in the country in a few weeks. Im optimistic that gold and silver will make some moves upwards after the summer.

-

http://arabianmoney.net/2009/06/27/chinese...-a-price-spike/

Chinese gold moves setting the market up for a price spike

Price spike imminent?

However, by monetizing gold in this fashion international investors will surely appreciate that a floor is being put under the gold price, with the prospect of upwards only price revision.

It is exactly this kind of impossible-to-loose investment scenario that produces price spikes, and if you look at the longer-term technical chart for gold it does look remarkably similar to the Nasdaq in the late 90s before it really took off.

-

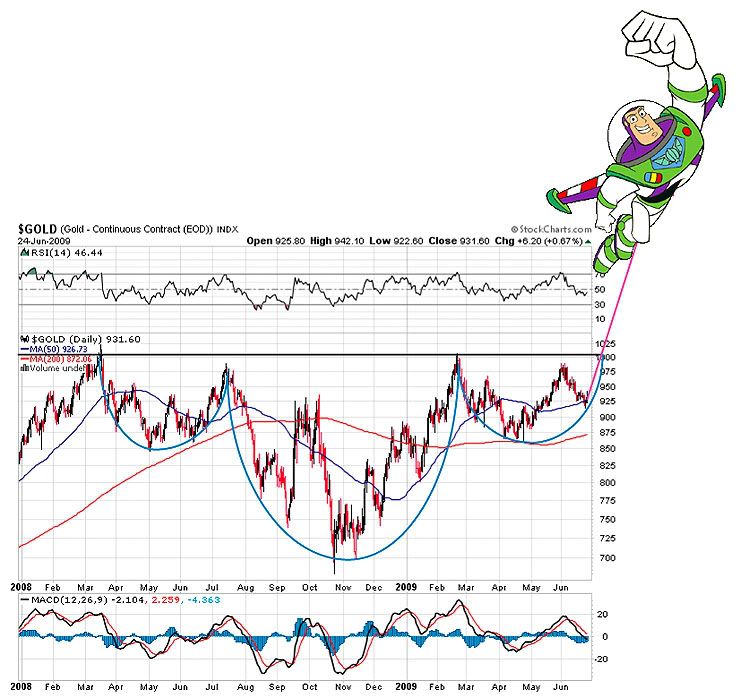

Will let my pictures do my talking

Are you suggesting Gold will fly?

"Thats not flying, thats..... falling, in style" said Woody when Buzz attempted to prove he could fly.

Lets hope thats not what happens to gold!!

-

POG we all know can still be murdered at will (& I just don't get this 'mid-summer take off' talk). Whereas 'strong dollar - weak stocks' would seem to suit a few very powerful manipulative interests.

I'd better not ask 'what have I missed?', it would not be fair on you guys!

I have a gut feeling you are right but why would Paulson buy his gold in the first quater if he could have got it cheaper in the summer? Everyone knows gold falls in the summer, but not always.

http://arabianmoney.net/2009/06/13/paulson...ment-portfolio/

-

This debate has been raging in my mind for some time now. The proceeds from the sale of my house went in to a 1 year fixed rate bond at 7.05% and is due to mature in August. In retrospect it would have been a better move to just buy gold. Looks like we are getting a second chance here though with gold back down at £570 and could even see it nudge very slightly lower.

This is a little self-centered (so feel free to ignore or delete if this is bad form) but I would also be interested to know what others would do with my imminent cash pile if they were in my shoes. Im 33, married, first child due September, both working in what appear to be stable and reasonable paying jobs, no outstanding debts and the following holdings:

Gold: 10oz

Silver: 600oz

2000USD

2000CAD

78000GBP

Need to keep some cash to fund paternity leave.

My goal is to have as small a mortgage as possible but in no rush to buy. Selling at start 2008 and holding off the purchase of a new place is still probably the biggest step towards this but would love to get your ideas on what could be done with pounds sterling cash in the meantime.

Thanks all. This site is true gem!

Sterling might get stronger against the dollar and gold may get cheaper over the summer. Buy BV gold ready for a possible big move up in the winter and spring.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Hmmm, strange they are both yellow....there must be a reason.