-

Posts

1,802 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by azazel

-

-

It seems the reason you cant understand me is something to do with your bias, and habit of being pedantic over things which are irrelevant

Even Jim rogers will tell you that gold is prone to bubbles because there is low fundamental demand for gold as something useful compared to the all ready mined supply of gold. But you want to come up with 'the world is not awash with surplus gold; it is being quietly accumulated in physical form whilst vast amounts of paper gold are played with on margin.' as if you have some great knowledge that nobody else has.

I note from wiki that Barrick mined 7,700,000 oz gold in 2008 at a cash cost of 443 US dollars an ounze, and i wonder why people know that India bought 200 tonnes of gold at about 1045? Oh the IMF told you about it. It must be true i suppose.

And i see the Chinese say they prefer US debt

But hey you are the expert researcher

Wheres goldfinger when you need some culling........?

-

This thread is for watching silver only. No discussion except for the occasional Ooh and Aah as the charts surprise and confound us.

Silver Ooh, Gold Aah.....

-

Thank you for your reply.

So of your liquid assets you are totally committed to PM.?

If so what % of your gross yearly income is in PM?

I think that is an important factor to gauge your commitment?

Regards

ML.

Im all in with my savings at the moment, all my income gets spent on cost of living so I doubt I will be buying any more PMs.

-

Chris -CT

"About 70% Gold, 30% Silver. Missed the palladium boat! This amounts to >1.5 years' gross salary for me

Go to the top of the pageReport Post"

+

This is a really helpfull post for people who are a little late for the start of the party, and encourages me to join in.

Cheers Chris,

Would anybody else like to add the current position.

Mine of liquid assets is :- 10% gold 2% silver 88% sterling.

My liquid savings are 3.5 times my income stream.

Regards

ML

80% gold, 20% silver.

-

Did anyone notice that gold had broken out of it's falling wedge pattern last week?.... the next move up is underway.

RH - there is a dollar thread and it needs repinning as we are already at the beginning of a major trend change in equities/gold/dollar.

Its what we have been expecting (pix lines). Where do you think it will peak in dollars on this move up?

-

I think Im right in saying that gold has just made a record high as of 10pm tonight at £737. I assume this is due to the falling pound.

-

Nice - how about some Chic?.... love the funky guitar sound!

From: http://www.youtube.com/watch?v=OHfvfM_N8Ww

2 of my favourite uplifting tunes - enjoy!

From:

From:

Wow, a great Saturday night in at the GEI disco with some wiskey....

-

What a complete and utter fool that man is - jumping from one declining currency to another - and even then managing to get it wrong. I remember him years ago on HPC telling all and any that gold was overbought at 600 USD - I pity anyone who listened to his advice.

Because he sounds so smart, his dopey advice sounds smart too. Im just a fool and sound like one too but my advice and decisions have proved very profitable thanks too those who said gold was the place to be in this crisis.

-

Even with a dollar rally all the way up to 90 odd, gold should not decline much below 1000 if the previous pattern is anything to go by:

I think golds going to $1350 in the next two months.

-

Pounds going for a plunge. $1.55. I bet Soros isnt buy pounds at the moment.

-

Maybe he thinks it's a potential bubble. Investors have bubble vision these days. Bubbles are everywhere. Many are investing in China while consciously aware it is becoming a bubble. The idea is to speculate and ride the bubble up, not to invest. This has to make for one incredibly unstable and easily spooked market... unless of course they all suddenly decide it's not a bubble, but good solid growth after all. Ship of fools.

ftr, I don't think gold can get in a bubble today, not when currencies are coming unstuck, and money is remonetizing gold. Only assets can become bubbles... and you got to ask yourself; is gold just an asset today.... or morphing into a currency which itself prices assets.

Perhaps he sees gold as the ultimate asset in much the same way as John Exeter did with the inverse pyramid.

-

we always knew he was a crafty sod.... He obviously wants more.

Soros More Than Doubled Gold ETF Stake in 4th Quarter (Update1)

http://www.telegraph.co.uk/finance/finance...ate-bubble.html

Davos 2010: George Soros warns gold is now the 'ultimate bubble'

The telegraph took what Soros said out of context IMO.

What did Soros mean by "The ultimate asset bubble is gold"?

-

What I find interested about those prices is that the buy price for Maples and Nuggets is the same as for Kruggrands. However the fineness for Maples and Nuggets is 999.9 but 916.6 for Krugerrands. In Hong Kong, the prices are not the same with the Kruggerand selling/buying for around US$50 less.

Why would someone buy Kruggers (with less gold content) than maples/nuggets if they are selling at the same price or conversely why would someone sell them at the same price?

They all have the same gold content, 1 troy ounce or 31.1grams. Its just that the krugerrand has some copper in it as well which makes it larger and slightly heavier than 31.1g.

-

Gold:silver has breached the red line recently. Is it meaningful?

Yer, it means your red line is in the wrong place my yellow friend

-

I might not be smart enough to add much to the purpose of this website but I would like to think my posts do not have a damaging effect. Its a shame some others do not feel the same way. Its a good job Im not a moderator as id ban them all. If you dont like it the **** ***

Thanks to those who add some great content to this site.

-

I find it a pain in the @$$ that I regularly have to fund BV or sell gold to pay for the account fees.

? I have held gold in BV for two years and sold gold, withdrawn cash without paying any fees yet, although I owe them some money. They dont seem to be bothered about it.

-

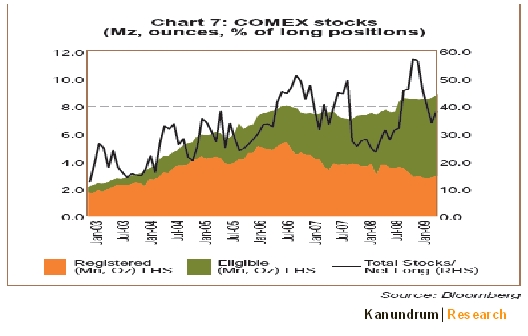

Also, In Apr'09, the World Gold Council released this plot:

(from Page 5 here: http://www.gold.org/assets/file/rs_archive...April_2009.pdf)

showing that even in Jan09, including all Registered AND Eligible stocks, they only had 30% of the total long contract available in their warehouses.

Conveniently, they seem to have stopped producing that chart....But in any case the green band will be at about 8M Oz, and the eggshell one at about 1.7M Oz. Total long contracts anyone? - In any case, the Registered/Eligible proportions have reached historic lows.

In answer to CJ, I think 'eligible' means either segregated for clients / themselves or simply not yet proved good for delivery. Whatever, 'eligible' seems to be growing and 'registered' shrinking.

Its just a matter of time before a parabolic rise IMO but it could be a few years yet though. Thanks for the encouraging charts Chris. Silver is still very cheap if it is really a precious metal.

-

I find the whole concept of "grassing-up" reprehensible, and when the government offers money to those prepared to inform on their neighbours, I am reminded of the GDR and other totalitarian states.

Surely, the better thing to do is to approach the man who is cheating and confront him - is it not?

I am always irked by those who park in disabled parking bays without any need. I know they are located nice and close to the shop entrance but it is not that which makes them essential to me when I take my disabled daughter shopping. It is the extra width which allows one to manipulate a non-standing, non-walking person from car seat to wheel-chair that I need - and in a normal-sized parking bay, this is simply not available. Therefore, when I see the underserving parking in disabled bays, I am very vocal in my questioning of them!! What I refuse to do is "grass them up". That way lies an informer society where the only winner is the state and no-one is able to trust his neighbour - divide and conquer - we all become slaves of the state rather than the state serving us.

If there was five empty disabled bays, and you only needed one but someone undeserving had parked in a disabled bay as it was conveinient, as it was raining or late at night, would you still be vocal in questioning them or think of the bigger picture?

-

BullionVault now offer silver as of today.

-

I guess this disqualifies me as a gold bug as I'm not "all in".

would only go "all in" on a big dip

Ah, so one day you will be qualified to be a gold bug.

-

My sympathy!

Indeed. Why he is so keen to sell, I do not know. I guess he just got impatient. One of the mebers here and myself got a fair bit for £12.50 a coin which is now cheaper than spot+VAT. (£12.96)

-

My freinds silver all sold now.

-

Does anyone want to buy some silver? My mate has eagles, maples, mexican libertads, (all new from CID in tubes) a few kilo argor bars (nicest bars imo), an old 20 ounce coin and other bits and bobs if I remember correctly. He has 300 ounces total. I would buy it all but Im busy with a building project at the moment so spending more than im saving.

-

I must admit my new two year plan isn't much different than my old two year plan. I do plan to ditch much of my sterling as I feel inflation will start to pick up after Q2.

I know this has been done to death but how are other people diversifying? Anyone doing anything different this year?

Much like wren, im planning to sell some gold late winter early spring but I will wait till summer and buy back in hopefully increasing the ounces. I will still hold my core position and silver.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted