-

Posts

8,549 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by romans holiday

-

-

Fair enough.

Then a key price you want to watch is: Land-in-Gold-oz (or maybe Land-in-Silver-oz)

Land/ gold is the one as most core buy and hold bullion is in gold.

With the US dollar hedge that's been maintained, I may manage to pull of the dollar/ silver trade I've had my eye on for a while. If that "trade of the century" eventuated, I may not need to dip into core bullion at all. The trade would pay for the land, and most probably put an end to concerns about [increasing] sordid money altogether. In that case, I'd then diversify the extra liquidity I had into various currencies.... or start donating to my favorite charities.

-

Holding all your silver "forever" seems much less sensible to me.

(If not "forever", then what's your exit trigger ?)

Surely, only the most miserable of misers would hold on to all of their silver forever [or for that matter, money].

What's my "exit trigger" for the bulk of my core bullion? Has to be when that bullion can be used for the purchase of a nice few green productive acres. 1/4 acre isn't quite enough for me.... though by only buyingless than I can afford, I've managed to keep most of my powder dry.

Even once I buy another property, I'd be loath to become completely illiquid. It would feel a bit like being naked in the current economic climate.

So to what end will you put your own massing of cash towards?

-

I vote for option 3], leave it as it is.

Sure, but then the same old pointless squabbles between traders and investors/ savers will continue. By having distinct threads for distinct purposes and aims, there will be less of those squabbles where people are effectively just talking past each-other. Anyway, just a thought. A more congenial site will attract more posters.

-

What other traders speak of these long term MA's that I use ?

== ==

Another leg down in Silver? - It is possible

SLV / Silver etf ... update : 1-year : 6mos-wo-610d

SLV is now testing the 377d, just below $30.

If that breaks it may rattle down to $25-26, where the 610d MA would lend possible support.

I'll be a buyer/ trader of silver in the high 20s.

Of course, still happy with the core silver bars bought and held since 2008. Its purchase price would have doubled.... even with silver back down to 26.

At a slightly later date, I moved most of my other core bullion [in paper/ goldmoney] out of silver into gold... as I perceived gold to be more stable and "safer" in volatile markets. Also, raised a reasonable dollar position here "the hedge".

Also at that time, I retained a small token trading position in silver, and exited this into dollars being uncertain of the silver market.

I guess the "difficulty" with this thread is whether it should be treated akin to the gold thread... with its rightful bias towards buy and hold, or not. Silver has shown herself a lot more volatile than gold as a few predicted; there's a good chance that instead of "leveraging" the rise of gold, silver may just rise at a similiar rate though being way more volatile to the upside and down. These criticisms of silver often irritated the silver bulls who tended to subscribe to the simple view of silver as a leverage on gold [not to mention mining stocks].

Possible options to make this site a more congenial one to all users could be:

1] Keep this thread with a buy and hold emphasis, and open another thread on silver with a trading emphasis. Problem then may be that there come to be too many threads.

2] Open up this thread more to ideas on trading silver, and move the buy and hold emphasis on bullion solely to the gold thread. That way, those only interested in buy and hold would treat silver and gold similarly on the gold thread.

A mistake I made early on was discussing the trading of silver /the hedging of gold etc on this thread. This only led to misunderstanding... as if I was not also interested in buy and hold, and as if my trading position, high-lighted here, had anything to do with my core bullion positions elsewhere. Opening up my own "Trading Volatility/ Silver" thread helped to avoid further confusion.

-

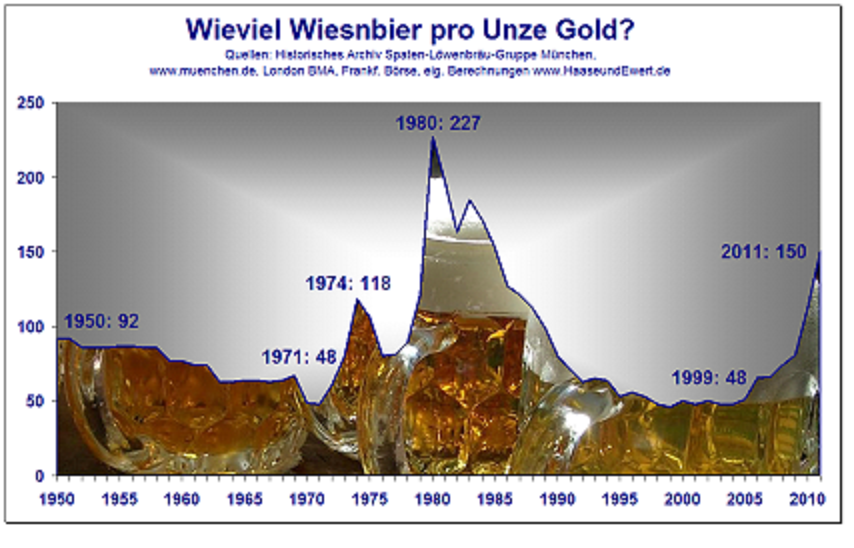

Appeared in this article (in German): CLICK

Very nice graph here (courtesy of Daniel Haase (Haase & Ewert)! It shows the gold price in units of Munich Oktoberfest beers.

I would say gold is definitely not cheap anymore but it's still some distance away from the 1980 top. As of today (€1240 per tr.oz. / €9 per Mass beer) we sit at a ratio of 138.

With giold it's all relative. A couple of years ago 1000 seemed expensive, was a difficult buy for many... and 1600 looked a bit fantastical. Presently, with gold already having spiked to 1900, 1600 looks relatively cheap. With the long term trend in mind {"TA"; trend analsis] it's very likely that gold will spike through 2000 next year with new support around 1800/ 1900.

-

The recent action in gold is starting to make this recent post of mine a little more interesting;

The long term trend line on the log chart puts support at around 1600. It could of course go a little lower before heading up again.

Thought silver would be lower today with gold having come off a bit.

-

But then, some people enjoy just this.

The problem I think with money is it has an "addictive" element. To be free of it, you have to first have enough... and then realize you have enough. One is then freed up to pursue the more important ends in life. The probelm with today is means has become confused with ends.... so the bulk of people now pursue money as an end in itself.

-

Monthly income from work, for example. On the other hand, if you bought gold sub-$1,000 then just don't worry anyway and just hold on to it if you can't buy any additional. No need to panic-trade all the time. It's going to go up on average.

Don't get monthly income from work at the moment. And don't really need it..... as I replied to an Aunty who enquired about my work prospects; "My bullion investment have been acting as a well-paying job".

More to life than work right? Heavily investing long term in gold has allowed me to become a man of leisure. Any leisure worth the meaning of the word has to also involve being free of the monetary sphere altogether. Keeping an eye on markets 24/7 would no doubt be hard work, involve some stress and a "price" in terms of leisure, freedom and time..... which is fine I guess, for those that choose it.

-

The uptrend angles are getting more acute, implying weakness. I'm glad I don't hold silver anymore, it might just get crushed (again).

I have a [wilfully] "split personality" towards silver. On the one hand, having bought and held silver bullion since 2008/ 2009 that has continued to do well...as far as the long term trend is concerned [akin to gold]. On the other hand, I'll attempt to trade the volatility in silver in order to hedge over-weight long term core bullion [silver, but more gold]. The high 20s look a good point to buy if you pull up a long term log chart [am unable to post charts these days].

There's a good chance that silver will have a third explosive move up to 100 odd......though it may take a couple of years. Being a trade, I'll no doubt have to exercise the firmest discipline in order to sell back to dollars..... not being a hyper-inflationist and all.

Most core "buy and hold" bullion is in gold because of the perceived volatility in silver.

50s Quiff's chart above is good for considering an entry point.... though personally prfer the dollar chart.

-

"Central bank gold buying at 40-year high"

Whoops! The dumb money is flooding in, now that Paulsen is selling.

You can not be serious!

Doesn't "dumb money" usually refer to the mass of investors in the stock market and all those "get rich quick" funds?

Central banks are nothing like this. When they "buy" gold, they are not investing, they are diversifying their reserves.... and buying gold as an alternative form of liquidity/ liquid capital.

In the case of central banks buying gold, it ought to be thought of as a currency exchange.

-

Did anyone else laugh when they saw this report?

The case for Gold is bullish." - says Bloomberg,

and as evidence they mention that "smart stock pickers" like John Paulsen have a Big Position.

What Idiocy ! Who do they speak such crap too ???

GOLD IS WEAK today, coming out of the Blue.

And the volume has been sluggish in recent days, despite a news environment that favors it.

Why?

I reckon their "smart investor" Paulsen may be selling, because he is getting hit with big

redemptions, and will need some cash to cover them. Does he have any choice but to sell GLD?

He will need to make an announcement regarding his fund within a few days.

Where are the distinctions? Sure, in the immediate short term gold could easily consolidate to its long term trend, which would be around 1650-1700. But that doesn't mean gold is "bearish", it means gold is indeed bullish. Keep in mind that this thread is mainly for the "buy and hold" type [or those thinking of buying] not the short term trader, and it seems very odd to state that gold is not bullish. Of course it wouldn't be odd if that was stated on a trading thread.

-

ARE YOU A BAHAI ?

Well, I think we are in basic agreement.

My main point is:

+ Buy & Hold is (probably) Dead in the stock market

+ Buy & Hold is alive and well in the Gold market, because must who B&H think it is GUARANTEED that gold is going up in the long run.

My view is: that is very possible, even likely, but NOT guaranteed gold will go on rising for sometime more... for a long list of reasons.

If you wanted to call yourself a Buy-And-Hold-And-Hedge-Sometimes (BAHAHS) investor in Gold, I would agree that is a smarter way to play it, if you have some useful timing tools, than pure Buy-And-Hold-Only (BAHO)* which I reckon will someday "run off a cliff", but maybe not until Gold-$3000, Gold-$5000, or some higher figure.

BAHO's will go Boo-Hoo someday IMHO. Road Runners hedge and trade around a core Long position, but are not doctrinaire: "Mee-Beep !".

*alternatively: Buy-And-Hold-All-In (BAHAI), not to be confused with Bob Hoye ("Ba-Hoi" in chinese)

Some good options to choose from there.

The best one has to be: "Buy-And-Hold-All-In (BAHAI), not to be confused with Bob Hoye ("Ba-Hoi" in chinese)".

... because you have here the "all in" element. Also, the bahai "faith" comes to mind. But then that has to be just a euphemism for another term, right?

-

Yeah.

I get your point.

But here's the logic that I think is dangerous:

"Gold is only going to rise in the long term. I am a long term INVESTOR in gold.

Therefore, I will be fine in the long term, no matter when I buy gold. And no matter what I pay."

Well, that's not my logic. Nor is it the logic of most "buy and holders". I think it may instead be the logic of the "all in buy and holders".... the 100% certain, and 100% in crowd. Don't you agree? And if so, why not use that distinguishing term..."all in" rather than simply paint all "buy and holders" with the same brush?

I mostly agree that gold will rise from here. But it is dangerous thinking.People who bought gold at $800 in 1980 could have said that too.

And they would have been "right" so far, but with a rather huge drawdown to $252 along the way.

Yes, there are no certainties, which is why hedges are a good idea.

It wasn't long ago that firms like Merrill Lynch were out pushing the idea that it was fine to INVEST in stocks for the long term, and that people could build a safe pension fund investing in blue chip stocks. That notion may have died in 2008Yes, which is why investors may increasingly sell assets and become increasingly liquid on the sidelines. Gold buying deflationists are open to considering gold as a form of liquidity as opposed to the conventional idea of it being just an investment. This would make the above irrelevant.

To repeat, why not use that distiguishing term..."all in" rather than simply paint all "buy and holders" with the same brush. It starts to look a bit silly when you criticize, without distinctions, those who have bought and held gold when obviously that has shown to be, on the face of it, a good option. I mean, you wouldn't want to discourage the average Joe from buying a bit of gold would you?

-

You are on potentially dangerous ground here.

?

How so? Surely you're not lumping me in with the "all in buy and hold 100% certain" crowd?? Me, a deflationist, a hedger.

You are taking for granted that New Higher Highs on Gold are ahead, and so it is safe to be an "investor" rather than a "Trader." I believe so too, but I take NOTHING for granted - long experience has taught me so.

You are taking for granted that New Higher Highs on Gold are ahead, and so it is safe to be an "investor" rather than a "Trader." I believe so too, but I take NOTHING for granted - long experience has taught me so.For this reason, I am happy to replace some of my longs with: Cash-plus-in-the-money-Calls.

This is not because I am a "Trader", but rather because I want some protection from Price Risk at such times. In fact, this policy allows me to stay with the long term trend, and remain safe, if it surprises me and breaks down.

Instead of knocking it, try understanding the strategy. It may save your wealth someday

I'm not knocking anything. My point was that nobody should be knocking anyone. OK, so there are a few gold purists that do knock others.... who also tend to be in 100% because they are 100% certain. But these are only a small minority, and then why identify "B&H" with that minority?

Most "buy and holders" have a lesser percentage of their wealth in gold, even though that percentage might be well above the conventional 5-10%. These have done extremely well to have bought and held.... no denying that.

If you want to trade gold, fine. If you want to buy and hold, fine. If you want to buy and hold, hedge, and trade, fine also. I think it's only the "all in buy and hold" minority you have an argument with who also tend to be anti-trading.

Instead of knocking it, try understanding the strategy. It may save your wealth one dayMy own strategy has suited me very well thankyou, having a few years back bought and held gold with 50% of my liquid worth. This is well hedged. I may even get a good trade in. So there are different ways to skin a cat. Also, there are more important things than wealth. Your strategy involves a large sacrifice of time to increase or maintain your wealth. Fine for you, but surely you recognize that yours is quite an exceptional activity and not for everyone. It might suit most to just buy a bit of gold and be done with it.

-

How about: Food..., Energy..., Guns

"If you really need Gold, you will need Lead more."

Gold should be considered an alternative currency.... no more, no less.... no drama required.

I have to ask: Who has called the Gold and Silver markets well this year? I think the perma-bulls have mixed returns. I would be interested to see how they would do with a B&H or Beating B&H portfolio.Have to say, you're continuing to compare apples and oranges here. Trading gold and investing in gold [or disinvesting] are two very distinct activities. It's not a competition. Don't let the few anti-trading purists color your view of "B&H". Live and let live.

-

A near or there 100% gain in 2 months ?

Seeming extremely unlikely I would say.

Silver isn't doing the job of safe haven that was predicted as inevitable in the mass turmoil currently taking place, it just gets sold off generally as a risky asset on any new piece of catastrophic news. Sure it is a big head scratcher for the bulls when we have an environment in which they would have anticipated a far far higher price for silver.

If then we are awaiting the industrial side to kick in ( read that it could be supposedly 70% of demand in the future), then surely a massively bankrupt western world and slowing growth elsewhere isn't exactly bullish.

Also factor in the inevitable margin hikes etc. that occur as soon as any sign of steep inclines in price occur in the PM's, do you think a rise of 100% would happen with no interference ?

The problem is that there was too great an expectation put on silver which owed to a simplistic reading of money figures, QE, and the way money was supposed to behave etc.

A more realistic reading of silver is that it won't "leverage" the rise in gold but instead reflect it..... appreciating on average around 22% annually. And this rise will be more volatile to both sides due to golds higher status as a monetary asset, and a safe haven when volatile markets sell off.

There is scope within this scenario to hedge core gold/ silver by trading silver volatility against the dollar.

-

My argument is that you need to put a roof over your head, and so far, buying has been much much cheaper than renting. With rents going up and no signs of interest hikes I know I am much better off. The money I have saved in rent has more than offset the lost opportunity of investing my original 5% + stamp dury and fees in pm's!

Yes, buying property isn't just a purely economic calculation. There are real world circumstances trumping mere monetary considerations.... chief amongst which has to be the basic need of shelter, and the limitation of time.

I just cashed in some bullion to buy property.... probably to prove to myself I was no miser.

That said, I'd feel a bit exposed if what remained liquid didn't well and truly counter-balance property owned. Needless to say, the property is rather humble.

That said, I'd feel a bit exposed if what remained liquid didn't well and truly counter-balance property owned. Needless to say, the property is rather humble.

-

yes. but not quite as painful as thinking you own something worth nearly $50 and then suddenly it being worth only $30

the point of my 'trading' as you put it, was to avoid catastrophic loss (which $50 to $30 certainly is) and, by consequence to avoid holding the thing once it has completed its bull market. it is all well to talk about buy and hold, but one day the bull market will end and you will have to make the same sort of decision traders make on a daily basis. the difference is that you will not have acquired any practise!

Yes, the diffculty is finding that balance between holding enough bullion, and also holding enough of a hedge, where no anxiety is held in whatever outcome. I guess this will differ for every individual. For myself, I feel comfortable with the amount of core gold and silver I hold already, so that if I'm unable to buy further silver with the hedge, in order to increase the hedge, I can easily live with the consequences. I can live with not buying again, even though I think there may be a good chance of doing so. That said, I could also live with seeing bullion crash again. early days.

-

Maybe the lows have been in now, and we go towards $50 here? I wouldn't bet against it.

One more more downdraft, and another month might do it. I wouldn't bet on it but.

-

You're being wildly optimistic if you think this crisis can last another 10 years before imploding.

It may seem wildly optimistic.... from a wildly pessimistic perspective. I bracket all assumptions, and extrapolate the current trend into the future.

-

...using this example, at $10,000 an ounce

Brodsky on Gold - http://www.ritholtz.com/blog/2010/11/brodsky-on-gold/

We think we know what to expect: ultimately the Fed will formally devalue the dollar to gold and then it will conduct monetary policy on the much higher dollar/gold exchange rate, just as it has conducted credit policy with interest rates over the last generation.

First, give it some time.... "informally" in the market.

Gold appreciates against the dollar at 20% odd a year; in 10 years gold will quietly go through 10,000.

At this point, central banks can step in and formalize the price, fixing it in a new standard at around 10,000. They may be forced to do this in order to stop capital increasingly flying into it, and out of economies.

Edited.

-

http://www.reuters.com/article/2011/10/17/us-markets-precious-idUSTRE78M11C20111017

Gold up 22% a year, and silver 30% odd. Looks a good a time as any to buy gold with the long term trend around that. A good chance silver will over-correct as it moves back to the long trend.

This chart showing the rate of appreciation from a while back:

-

General ideas do not have the articles before them. So I guess your example would be corrected by something of the following:

A vehicle Transportation itself is an idea. Many things can be used as [function as] transportation.

[such as a vehicle]

-

Gold is not a symbol of money: gold is money.

Money itself is an idea. Many things can be used as [function as] money. These are the forms we call currencies. The question today should be which currency is the strongest. Gold is the strongest because it best symbolizes, in our culture, the idea of money.

SILVER

in Gold, FX, Stocks / Diaries & Blogs

Posted

Ah yes, but then in that case there needs be a third category besides traders, and speculators who think they are investors/ savers.... i.e; savers [with the liquidity preference] who think they are savers [not all savers/ investors are delusional]

I'd say the average "buy and holder" of gold has put a wedge of their worth into gold because they simply see it as a way to be on the sidelines, in an alternative currency, as all else deflates in value. This can be thought of as saving... though not sure about conventional "investing"... more like "dis-investment" [getting liquid]. It's all a matter of differing perspectives arising from different motivations, aims, purposes etc. No point squabbling over which is the "right" one, which would just be another form of purism. Better to give each its own dues, which is why we have separate threads, each with their own perspective.

Obviously, you can be short term bearish while being long term bullish, yet a lot of the storms in tea-cups arise from mixing completely different time frames in the same thread.